The Fed cautiously approaches the end of monetary tightening

Link

- Today, the Fed will give its verdict on the position to be taken by monetary policy in a context of contrasting economic conditions. Indeed, despite signs of a slowdown in the PMIs, the resilience of the job market still seems capable of sustaining growth. At the same time, inflation continues to decelerate, thanks largely to favorable base effects, notably the year-on-year fall in energy prices. Our scenario is still for a final increase of 25 basis points (bp). The risk, however, remains that the Fed will have to do more, but in a sequence of interest rate hikes more spread out over time. Most likely, monetary policy will remain restrictive. The prospect of continued monetary stringency does not seem to be altering risk appetite. In particular, technology stocks continue to lead the way. The recent surge in valuations does not seem to be a cause for concern. As far as we are concerned, while avoiding taking extremely negative positions, we continue to maintain a rather cautious stance on risky assets.

- The ECB will follow tomorrow. A 25bp hike is almost certain, given the comments made by members of the Governing Council since the last monetary policy meeting. Nevertheless, it is the direction of future decisions that should occupy the market. Despite inflation remaining far too high, the ECB should surely take note of the faster-than-anticipated deceleration in economic activity in the Zone, and moderate its tone on further tightening. Also, given the evolution of credit conditions, which remain restrictive, as shown by the latest survey of banks in the zone, the ECB must be satisfied to see that the transmission of monetary tightening is being well transmitted to the real economy. We believe that we will see the last rate hike as economic conditions deteriorate more rapidly.

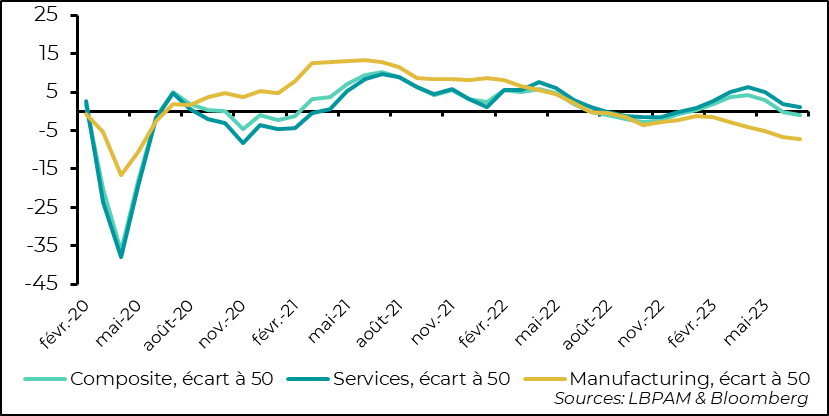

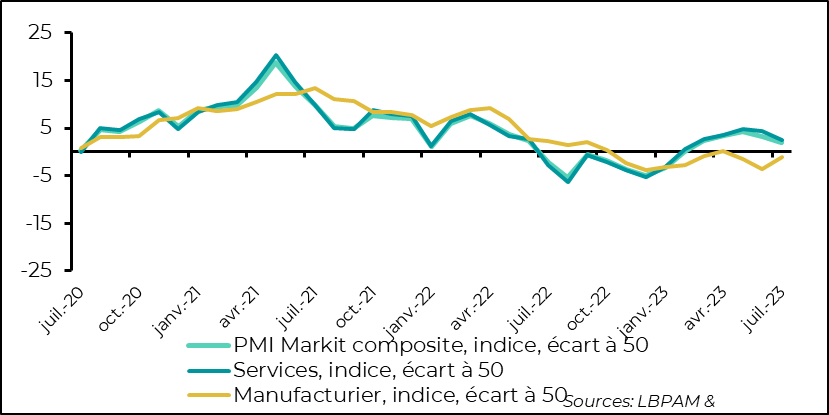

- Indeed, the PMI survey results for July in the Eurozone were disappointing for both manufacturing and services, as was the IFO survey for Germany. Growth conditions appear to have deteriorated further than anticipated. The composite PMI index fell further, remaining slightly in the contraction zone at 48.9. The situation has deteriorated mainly in France and Germany, while peripheral countries seem to be holding up better. Our projection is still for very weak growth over the coming quarters, but the risks of a more mediocre scenario seem to be increasing. In the US, activity also seems to have deteriorated, especially in the service sector, which nevertheless remains in expansion territory. In manufacturing, although activity is still contracting, the sector seems to have improved slightly in July. Nevertheless, the composite PMI index remains in expansion territory, at 52.

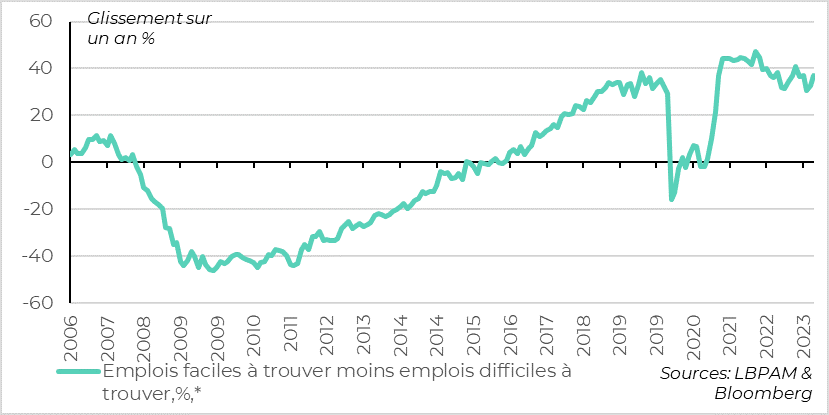

- Also in the United States, the Conference Board's household confidence survey came out better than expected. As expected, the resilience of the job market and decelerating inflation, while wages are still rising at a brisk pace, appear to be supporting consumers. The vast majority of households still find it easy to find a job. This resilience in consumption may force the Fed to do more to slow the economy in order to converge towards its 2% inflation target.

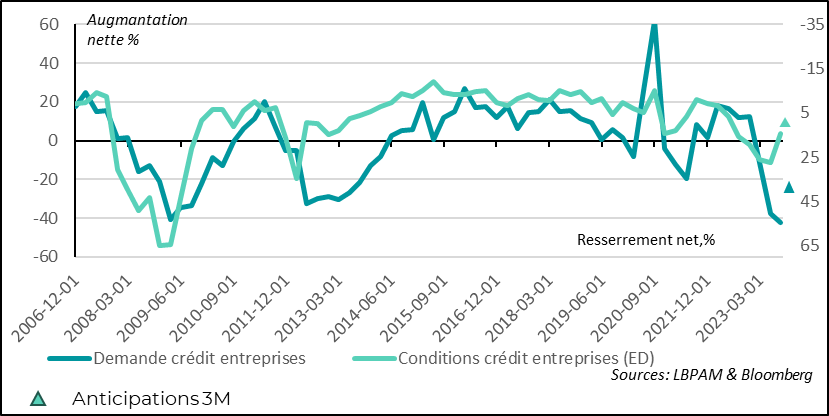

In the Eurozone, the bank survey for 2Q23 clearly shows that monetary tightening is being transmitted to the economy, and should reassure the ECB. Indeed, Bloomberg's synthetic indicator of credit conditions remains in very negative territory, even though it is no longer deteriorating.

In detail, on the corporate side, demand for credit continues to fall, while bank lending conditions remain difficult, although not as tight as in the previous quarter. Expectations seem a little more favorable, but this was already the case in the previous quarter, and reality does not seem to have followed expectations.

Fig.1 Eurozone: Corporate demand for credit continues to fall and credit conditions are still tighter but a little less so

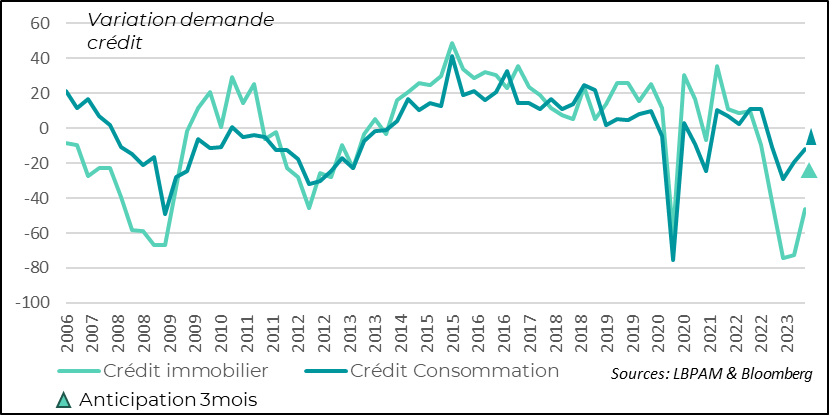

On the household side, the situation is much the same. Given the rise in interest rates, demand for credit (real estate and consumer credit) has weakened. The only consolation is that the decline in 2Q23 was smaller than in the previous quarter.

Fig.2 Eurozone: Household credit demand (consumption and real estate) continues to fall, but to a lesser extent than in the previous quarter

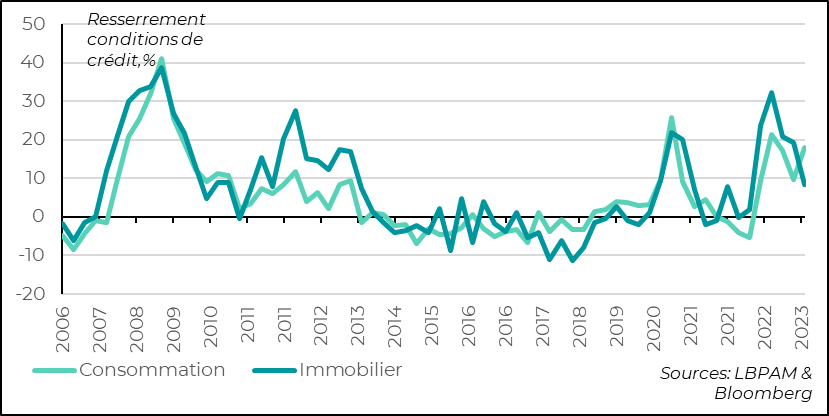

Given the rise in interest rates and the worsening economic situation, banks are more cautious, so lending conditions remain unfavorable, even if the tightening in the real estate market seems to have eased somewhat.

Fig.3 Eurozone: Consumer and real estate credit conditions remain restrictive.

All in all, for the ECB, the survey shows that the credit transmission belt of its restrictive policy is working well. Nevertheless, given that the economic downturn seems to be stronger than anticipated, which should help to accelerate the fall in inflation, central bankers should be a little more cautious in their monetary tightening. That's why we think we'll see the last rate hike of this cycle. Nevertheless, given the uncertainties surrounding inflation, the risk of further tightening remains.

On the economic front, S&P's preliminary PMI survey for July reveals that the business situation has deteriorated, particularly in the Eurozone. The composite PMI for the zone fell to 48.9, a further decline on the previous month. The situation is deteriorating in both the services and manufacturing sectors. It is especially in France and Germany that the loss of momentum seems most pronounced. Indeed, the IFO survey for Germany gave a similar message. On the other hand, peripheral countries, notably Italy, still seem to be holding up better.

Fig.4 Eurozone: S&P PMI declines and remains in contraction territory

In the United States, the economic situation remains better than in the Eurozone. Although activity is deteriorating, notably due to a loss of momentum in services, the composite index is still in expansion territory. Even the manufacturing sector saw a slight improvement over the month, although it remains in expansion territory.

Fig.5 United States : Activity still growing with PMI in expansion territory, but services activity weakening

Nevertheless, it's important to remember that activity is indeed slowing down, which is important for the Fed in calibrating its monetary policy. US GDP figures for 2Q23 should confirm this loss of momentum (we expect annualized growth of around 1.3%, compared with 2% in 1Q23), even if the US economy continues to surprise on account of its resilience.

To a large extent, this resilience is based on consumption. Behind its robustness lies the resilience of employment to the slowdown in activity. Admittedly, the labor market is a lagging variable in the economic cycle, but the strength of the job market remains a surprise.

This was further underlined by the Conference Board's Household Confidence Survey, which showed that confidence rebounded in July, corroborating the result of the University of Michigan survey. Behind this result, of course, lies the employment situation. U.S. households continue to see the job market as extremely buoyant, where it remains very easy to find a job.

Fig.6 United States : US households continue to find the labor market very buoyant.

This very favorable labor market situation, which maintains pressure on wages, even if it moderates, is likely to continue to push the Fed to maintain a restrictive policy.