The pivot is near, but we’re not there yet

Link

- As expected, the Fed, like the Bank of England (BoE), raised its rates by 0.25% this week (and the Swiss National Bank, by 50bp). They also stuck to their plan to shrink their bond portfolios (i.e., quantitative easing) while drawing a clear distinction between this monetary policy-driven withdrawal of liquidities and the temporary liquidity injections being made in support of banks. They nonetheless acknowledged that current banking stress could very well lead to stiffer credit conditions and hence weigh on the economic outlook, although it is too early to tell by how much. They seem to be flagging that the tightening cycle is not completely over but is approaching an end.

- Despite recently emerging uncertainties, we have made little change to our baseline scenario, which is rather similar to the one the central banks have recently presented. We continue to forecast weak growth (and even a slight recession in the US), due to the tightening of financing conditions that will be necessary to cool off demand and reduce inflation. But our baseline scenario does not assume a financial crisis or a severe recession. It does assume that Fed could raise its rates once more, to 5.1% in Q2 and that it will keep its rates high at least until 2024, i.e., until inflation converges sustainably forwards its target.

- The biggest newsflow impact this week came from Treasury Secretary Janet Yellen (yes, the former Fed chairperson), who told Congress that the US government had neither considered nor discussed a blanket guarantee for US bank deposits, in contrast to what she had suggested previously. A blanket guarantee would require Congressional approval and therefore has little chance of being adopted pre-emptively. While we believe that the financial authorities’ reaction has thus far been adequate to prevent global systemic financial risk, the risk of further banking stress cannot be ruled out after Yellen’s statements. Let’s hope for no bombshells from a major financial player, as that could revive the crisis of confidence.

- Interest rates remain very low, even as risk appetite has stabilised and central bank have raised their rates. No only are terminal key rate expectations below our forecasts, they are pricing in a return of expectations of key rate cuts beginning in mid-year. We believe they are too low. Our baseline scenario assumes that central banks will not lower their rates until next year. Rates could be reduced in the second half of the year if stress in the financial system continues to rise and lasts long, as that could trigger a severe recession by yearend. But this is not our baseline scenario and, assuming an adverse scenario, it is hard to explain the resilience of non-financial shares. We believe the equity markets are pricing in the scenario of lower interest rates (which would drive equity valuations up) but without pricing in what would justify such a scenario (i.e., a recession and a severe contraction in profits). That’s why we remain cautious on the whole in our asset allocation, although it is true that recent days’ volatility has offered some localised opportunities.

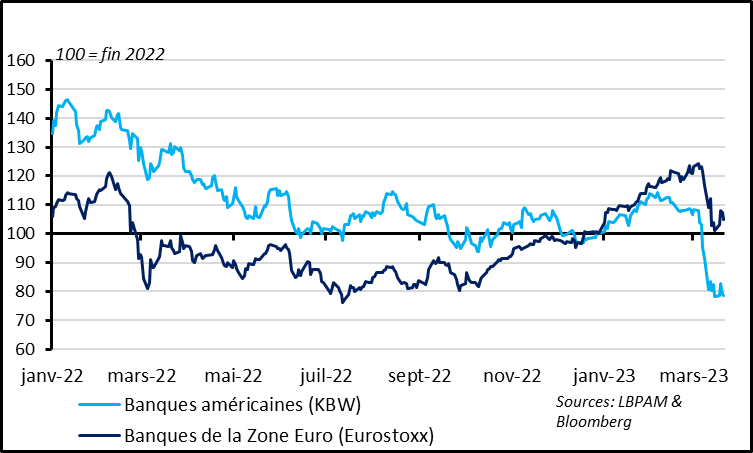

Fig. 1 – Markets: stress on banks is stabilising but not receding

100 = end 2022

US banks (KBW)

Euro zone banks (EuroStoxx)

Banking shares have stopped dropping since Monday, while failing rally on further central bank rate hikes and, more to the point, the statements of Treasury Secretary Janet Yellen, who told Congress that the US government had neither considered nor discussed a blanket guarantee for US bank deposits. We believe that the financial authorities’ reaction has thus far been (and will be) adequate to prevent global systemic financial risk and that bank stress should therefore stabilise. But stress is unlikely to completely vanish, given the reduction in liquidity, and the risk of further bank stress cannot be ruled out after Yellen’s statements.

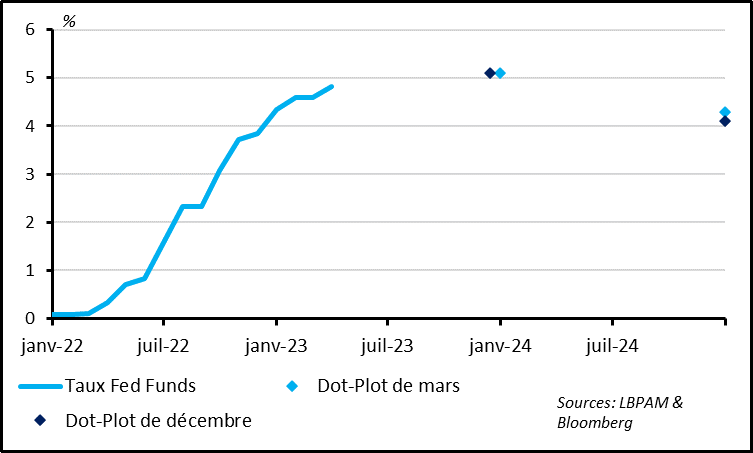

Fig. 2 – United States: The Fed raised its rates further this week but is coming to the end of its tightening cycle

Fed funds rate

March dot plot

December dot plot

The Fed raised its key rate by 25bp to 4.9% and flagged that its tightening cycle is nearing its end but is probably not completely over. In its communiqué, the Fed said that its members expect “some additional policy firming may be appropriate". So, it declined to announce the end of rate hikes, but its language is far more cautious than in February, when it said that “ongoing increases in the target range will be appropriate”. Meanwhile, a majority of Fed members expect the Fed’s terminal rate to be 5.1% in 2023, or 25bp above the current rate. This forecast is unchanged from the December one, whereas Jerome Powell told Congress in early March that “the terminal interest rate level will probably be higher than expected”, due to positive economic surprises and inflation in early 2023.

Banking tensions are adding uncertainty and downside risks to the economy and to the inflation outlook, but it is too early to tell by how much. While the Fed described the US banking system as “solid and resilient”, it acknowledged that current stress would create less favourable credit conditions, something that will weigh on economic activity, employment and inflation. But the Fed acknowledged that “the extent of these effects is uncertain”. Powell summed up the situation well during his press conference in saying “we simply don’t know”. For the moment, Fed members have only slightly lowered their growth forecasts for 2023, from +0.5% to +0.4%, and for 2024, from 1.6% to 1.2%. But as economic activity was surprisingly strong in early 2023, that nonetheless suggests that Fed members forecast a slight recession in the coming quarters (about -0.5% per quarter until yearend). This is more in line with our scenario, which had already assumed a slight recession sometime this year.

Fig. 3 – United States: The Fed continues to shrink its bond portfolio, while separating that from its temporary liquidity injections to help banks

Bn of dollars

All Fed loans (liquidity for banks)

Securities portfolio (QE)

Total balance sheet

The Fed continues to suggest that it will stick to a restrictive monetary policy in the baseline scenario.

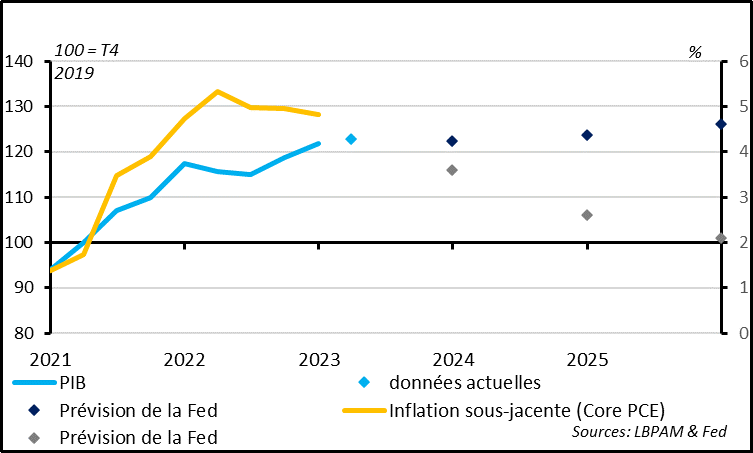

The Fed continues to keep a close eye on the inflationary risk. In its communiqué, it reiterated that “the Committee remains highly attentive to inflation risks”. And, despite the current banking stress, Fed members raised their inflation forecasts slightly for the next two years, with projected core inflation remaining well above the 2% target until 2025. What’s more, no Fed member expects a rate cut before yearend and only one member no longer sees any additional rate hikes. Lastly, the Fed confirmed that it would continue to shrinking its portfolio of government bonds and mortgage loans at the current pace (i.e., up to 95 billion dollars per month), despite bank liquidity stress. Like the ECB, it is drawing a clear distinction between monetary policy, which must be tightened to regain control over inflation, and its financial stability policy, which currently requires temporary liquidity injections into banks to stabilise their balance sheets. The

Fed loaned more than 150 billion dollars to banks this week, only slightly below the all-time record, set last week.

Fig. 4 – United States: The Fed forecasts a slower increase in inflation despite a stagnation of GDP this year, and that will require a long-lasting tightening policy

Q4 2019

GDP Current data

Fed forecast Core inflation (Core PCE)

Fig. 5 – United States: the market is once again pricing in several Fed rate cuts as early as the second half of the year

Fed dot plot

Fed funds rate

Market (OIS)

One month previously

Jan - July.

Market interest rates fell once again after the Fed key rate hike, sending the 2-year yield to under 4.0%, a low since September, and the 10-year yield under 3.5%. This reflects the market’s cautious take on further rate hikes, pricing in a likelihood of less than 50% that the Fed will raise its rates by another 25bp at its May meeting) and, above all, the return of anticipations of rate cuts for the second half of the year. Indeed,

the markets are now pricing in more than three rate cuts by yearend, vs. less than one cut prior to the SVB failure.

We believe this is overdone. In our baseline scenario, we forecast one last 25bp rate hike in Q2, raising the Fed’s rate above 5%, after which no change in this high rate until 2024. This is in line with Fed members’ expectations.

Fig. 6 – Markets: the equity markets are holding up very well to banking stress, in contrast to what might have been expected

Equity performance

Bank shares’ performance over the past month

Rate cuts as early as the second half of the year would be possible if stress in the financial system continued to rise and lasted a long time, but, if so, the equity markets should be taking a bigger hit than they have so far. A financial shock could very well trigger a significant recession before yearend. If so, inflationary pressures would recede drastically and the risk would once again be excessively low inflation, which would justify rate cuts at least as great as the markets are currently pricing in. But this is not our baseline scenario and, more to the point, assuming such an adverse scenario, it is hard to explain the resilience of non-financial shares. We believe the equity markets are pricing in the scenario of lower interest rates (which would drive equity valuations up) but without pricing in what would justify such a scenario (i.e., a recession and a severe contraction in profits). That’s why we remain cautious on the whole in our asset allocation, although it is true that recent days’ volatility has offered some localised opportunities.