Labor market and inflation expectations prompt Fed to exercise caution

Link

Read Sebastian Xavier Chapard's market analysis for February 10, 2025.

Summary

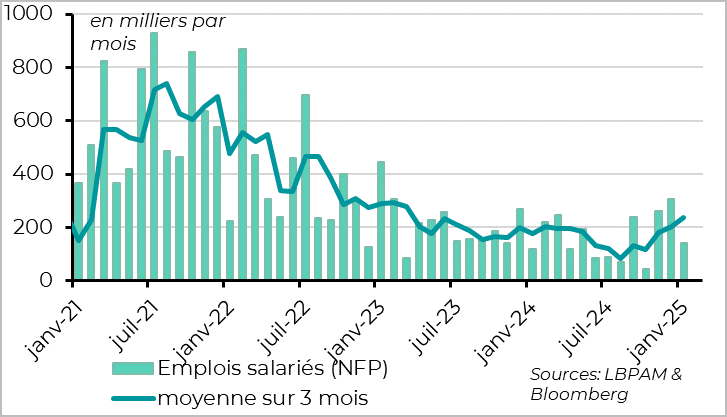

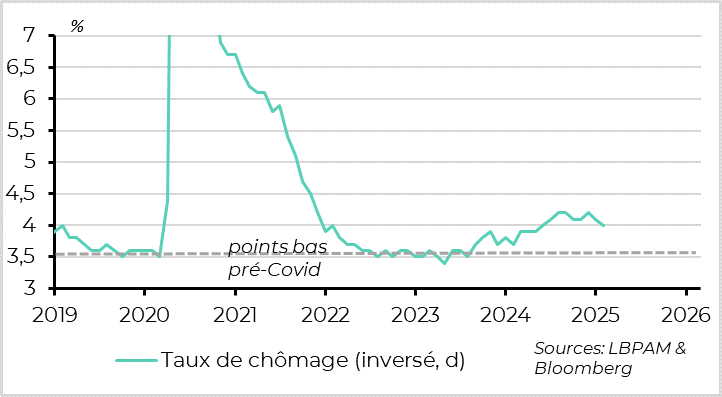

►Despite a slight slowdown in January, job creation in the USA is on a very solid trend. The economy created “only” 143,000 new jobs in January, but job creation figures for the previous two months have been revised sharply upwards. Overall, employment accelerated on average over the last three months to 237,000, the highest level for almost 2 years. The unemployment rate is also falling again and, at 4%, indicates that the economy is at full employment. Against this backdrop, there is no urgent need for the Fed to resume rate cuts.

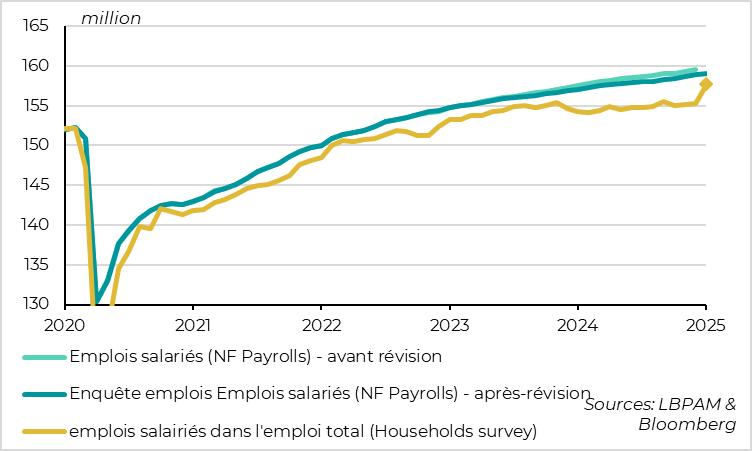

►This is all the more true given that the annual revisions to the jobs surveys show that job creation was higher and slowed less in 2024 than previous figures indicated. Fears of a sharp slowdown in the job market were the main reason why the Fed became much more accommodating last summer, and rapidly cut rates by 100bp.

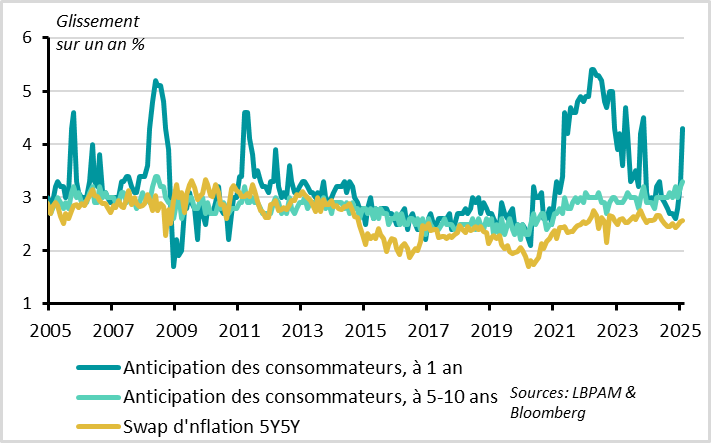

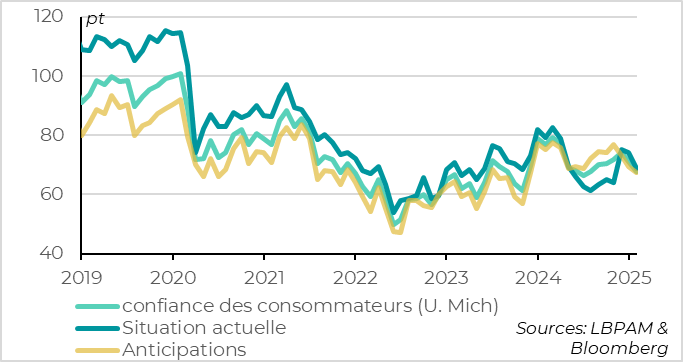

►Another element that could make the Fed more cautious is the rise in household inflation expectations, which continues into early February. Household confidence has fallen back below its pre-election level due to fears of tariffs, which are pushing up inflation expectations. While these expectations are not yet alarming, they do suggest that the risk of disengagement has increased.

►Will this push the administration to limit the trade war? Nothing is less certain after D. Trump's announcements over the weekend to impose 25% tariffs on steel and aluminum imports. The market is not overreacting this morning, believing that this is still a negotiating technique. The macro impact of these measures would be negative but limited, given the amounts involved, but it would affect certain sectors in Europe and Canada.

►In the Eurozone, ECB staff published their new neutral rate estimate of 1.75%-2.25% (as stated by C. Lagarde in Davos). Many members of the ECB came out in the media after the publication of the report to play down the role that the neutral rate played in the central bank's rate decisions. The fact remains that the current key rate, at 2.75%, is still in restrictive territory. It is no longer justified in a Eurozone context of sluggish growth, rapidly normalizing labor market pressures and inflation set to return to target within a year.

►For this reason, we expect the ECB to bring its key rate back towards 2% quickly, cutting rates by 25bp at each meeting between now and the summer. Given that the Fed is likely to hold rates steady until the summer and only cut rates twice this year, the rate differential between the US and Europe will widen further in the short term.

To go deeper

United States: Employment slows in January but remains on a solid trajectory

Despite a slowdown in January, job creation in the USA is on a very solid trend.

Job creation slowed slightly more than expected in January, to 143,000, which is not an abrupt slowdown either. This slowdown is fairly widespread in services, while employment remains stable in industry. And it cannot be explained by any easily identifiable temporary effect. In particular, public-sector employment continues to rise, while the DOGE's (i.e. E. Musk's) action on federal employment has barely begun. Also, the US statistical agency points out that the California wildfires had no impact on national employment statistics for January.

However, job creation figures for the previous two months were revised sharply upwards, by over 100,000. Beyond month-on-month volatility, which can be revised later, job creation is accelerating. Over the last 3 months, they have risen by an average of 237,000, their highest level for almost 2 years.

Although job creation figures for November and December certainly exaggerate the trend, as they benefited from the end of the impact of the hurricanes and strikes, it would appear that job demand is at least stable at the turn of the year, at a solid level (close to 200,000 per month), and even accelerating slightly.

United States: unemployment rate falls back to 4% after rising in 2024

At the same time, the unemployment rate unexpectedly fell to 4.0%, a level which indicates that the economy remains at full employment.

The fact that the unemployment rate fell in January should not be over-interpreted, as this is due to the impact of annual revisions to population estimates rather than an actual drop in the number of unemployed. This is because, unlike the business survey, the history of this survey remains unchanged.

But the level of the unemployment rate in January does indicate that the job market has stabilized at a more than satisfactory level. The unemployment rate remains slightly above its lows of 2022-2023 (3.5%), when the economy was clearly overheating. But it is now significantly below its highs of mid-2024, when it rose rapidly to 4.2%.

The unemployment rate is therefore at the lower end of the Fed members' equilibrium rate estimate band (between 3.9% and 4.3%), and could fall over the next few quarters if the economy doesn't slow down, while the number of new workers from immigration has slowed since last summer and is likely to slow further with the new administration.

United States: Wages surprise on the upside in January

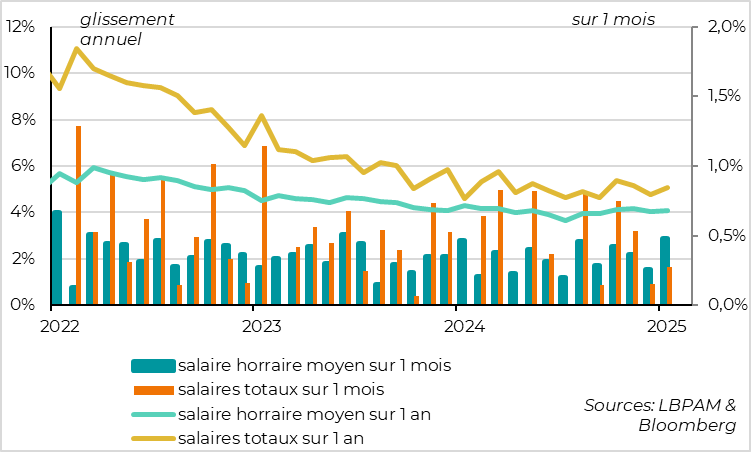

Wages remain somewhat high, enough to support household purchasing power, but not so high as to scare the Fed away from inflationary pressures.

Average hourly earnings accelerated in January, rising by 0.5% over the month after 0.3% in December. This keeps annual wage growth at 4.1%, well below the 2021-2022 wage increases, but still slightly above the level the Fed considers sustainable (~3.5%). But this acceleration is exaggerated by the fall in hours worked in January, which probably suffered from adverse weather conditions. So rather than an acceleration in wage pressures, these figures suggest that their normalization is still incomplete and will be slow.

United States: employment survey revisions confirm solid job situation

The revisions to the US employment surveys resolve a large part of the gap that had developed between the business survey and the household survey, in a favorable direction since they confirm that job creation has been high for 2 years and has slowed less than initially estimated in 2024.

Employment in the business survey (the “Payroll survey”), which had been very dynamic but had slowed markedly in 2024, was revised down by 600 thousand jobs for March 2024 at the annual revision in January. This is at the lower end of economists' revision expectations. This implies that job creation was actually a little lower than initially estimated in 2023 (216 thousand per month instead of 251), but more or less on target for 2024 (at 166 compared with 186 initially estimated). They therefore slowed down less abruptly than expected at the start of 2024, calling into question the main reason why the Fed had become much more accommodating last summer.

Above all, employment in the household survey, which was disappointing in 2024 and well below that indicated by the other survey, is in fact much stronger than previously indicated. Population revisions carried out by the US statistical agency lead to an estimate that total salaried employment was 2.4 million higher in January than estimated in December (+1 ;5%). This implies that job creations were 275 thousand per month according to this survey, instead of the 49 thousand estimated in December.

With the January figures, and after the annual revisions, the picture of the US job market is one of solidity, stabilized at full employment, and more likely to overheat again in the short term than to deteriorate abruptly.

In this context, there is no urgent need for the Fed to cut rates further. It should be comforted in its view that it can pause its rate-cutting cycle, given that the risks to employment are low, until inflation is again clearly on a downward trend and, if possible, until there is a little more certainty about the economic policies that are going to be implemented.

A Fed rate cut in March is therefore even less likely. We are maintaining our central scenario of two rate cuts this year, in June and December, but the risk of later or even more limited rate cuts is increasing.

All the more so as inflation expectations appear to be a little less well-anchored than hitherto.

United States: households fear a return to inflation

Household inflation expectations rose sharply again in early February, according to the University of Michigan's preliminary survey. Households' 1-year inflation expectations rose from 3.3% to 4.3%, the highest level since 2023 and unusual for a period when oil prices have tended to fall. Above all, 5-10 year inflation expectations, historically more stable, rise again from 3.2% to 3.3%. They are slightly above their historical fluctuation band, whereas they had remained within this band during the inflationary shock of recent years.

Note, however, that these expectations are difficult to read, given the extreme difference in expectations between households calling themselves Republicans, who see inflation falling sharply, and households calling themselves Democrats, who see inflation exploding. The market's inflation expectations remain reasonable for the long term, even if they have risen a little in the short term.

This is something the Fed needs to keep a close eye on to ensure that any short-term inflationary shocks (such as tariffs, for example) do not risk generating a lasting rise in inflation.

United States: risks of tariffs weigh on household confidence in early 2025

Moreover, fears of inflation linked to possible tariff hikes are weighing on US household confidence, which fell sharply again in early February, back below its pre-election level. While this fall is not alarming for the US economy as it stands, it is a reminder that tariff hikes are a tax on the consumer. Will this make the US administration think twice before imposing massive tariffs? We hope so, but nothing is certain.

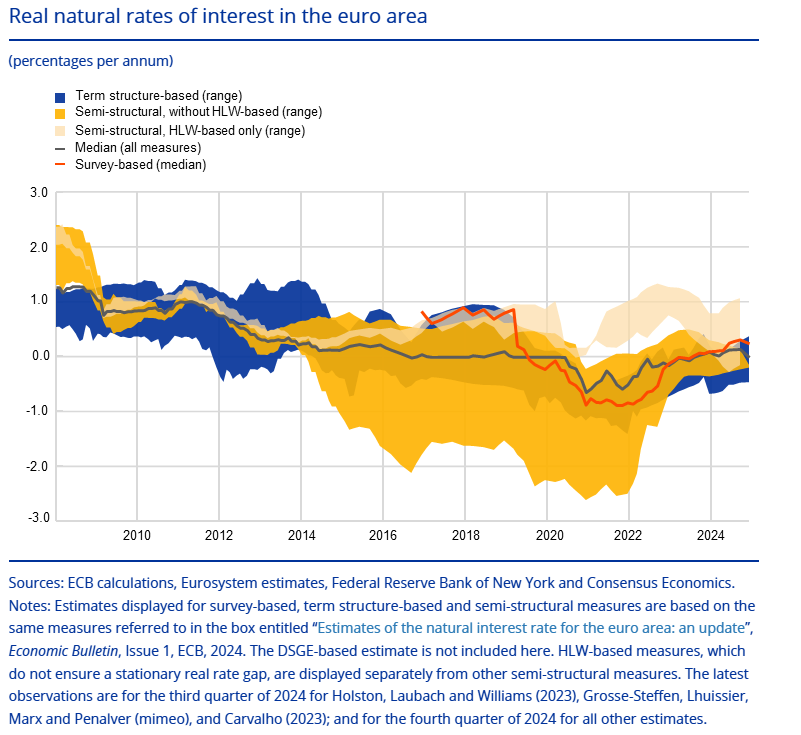

Euro zone: ECB estimates neutral rate at around 1.75%-2.25%

As announced by C. Lagarde during the press conference two weeks ago, ECB staff have published updated neutral rate estimates for the Eurozone. This estimate comes as no surprise, as the staff indicate a range of between 1.75% and 2.25%, which is in line with our and the market's estimate of around 2%. Indeed, the ECB's models indicate that the real rate that would stabilize the economy would be around -0.25%/0.25%, to which must be added the inflation target of 2%. He points out, however, that the uncertainty surrounding this estimate is very wide, making it impractical for calibrating monetary policy in practice.

Indeed, many ECB members came out in the media after the report's publication to play down the role the neutral rate played in the central bank's rate decisions. In particular, Chief Economist Lane warned that all the factors involved in calibrating the ECB's monetary policy “cannot be summed up by a single indicator such as comparing the current policy rate with a highly uncertain estimate of the so-called neutral rate”.

The fact remains that this estimate implies that the current key rate, at 2.75%, remains above the neutral rate and therefore in restrictive territory. This is no longer justified in a Eurozone context of sluggish growth, rapidly normalizing labor market pressures and inflation set to return to target within a year.

This is why we believe that the ECB will rapidly bring its key rate back towards 2%, cutting rates by 25bp at each meeting between now and the summer.

Xavier Chapard

Strategist