Is momentum in services beginning to slacken?

Link

- The markets are tentative in the run-up to the Fed and ECB meetings next week, especially after the Australian central bank once again raised its rates yesterday after having previously announced a pause. However, the end of the US debt-ceiling saga, the announcement of meetings between US and Chinese authorities, and initial economic support measures in China are providing some support for risk appetite.

- On the economic front, the first signs of a weakening in services could point to a continued lacklustre outlook for global growth, which is our scenario for the second half of the year. The resilience of global growth so far this year has been driven by strong trends in consumer services, due, in turn, to momentum in jobs, lower energy prices, and the shift in demand from goods to services. This has offset weakness in manufacturing, business investment and construction in most countries. And no wonder, given that demand for services is less sensitive to monetary tightening than other swaths of the economy. But we do feel this is a source of vulnerability for the economic cycle.

- That’s why the steep, unexpected drop in the US ISM services index from 51.9 in April to 50.9 pts in May, is a bad sign. It is still above the 50 pts threshold but is at a three-year low (excluding last December’s dip). Of course, let’s not overreact to a single figure, especially as jobs in services rose sharply again in May. But it’s still worth keeping an eye on.

- In the Eurozone, growth remained sluggish in April with stagnation in retail sales and a new decline in orders in Germany. Most importantly, the PMI services index fell for the first time in May, while remaining far into expansion territory. We forecast positive but limited growth in the Eurozone over the coming quarters.

- In China, private-sector PMIs rose in May, unlike official PMIs. Most importantly, the authorities announced the first support measures since Friday, albeit modest ones. This eases some of the fears over short-term slack in the recovery.

Initial second-quarter Eurozone economic activity figures are mixed, suggesting that the return to growth after the winter stagnation is modest and remains highly concentrated in consumer services. Retail sales levelled off in April after shrinking by 0.5% in March, thus beginning Q2 at 0.3% under their Q1 average and are now 4.5% below their pre-Covid trend. Unlike in the US, consumer goods have more than normalised after its post-Covid rebound. Meanwhile, manufacturing remained weak in April, with an unexpected drop in production in Spain and a further decline in durable goods orders in Germany (-0.4% after -10.9% in March). This suggests that foreign demand remains poor.

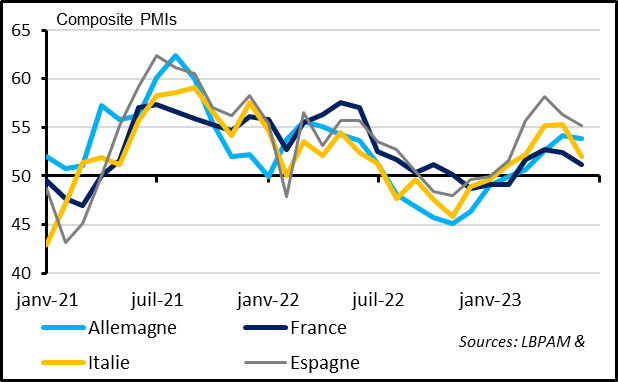

Fig. 1 – Eurozone: PMIs fell a bit in May, more so in Italy

Jan. July …

Germany France Italy Spain

The slippage in Eurozone services PMIs in May after their steep rebound over the past six months suggests that the rebound in services, driven by the energy countershock, is beginning to run out of steam, particularly in Italy. The final Eurozone PMI fell more than expected, from 54.1 in April to 52.8 pts in May. It is still at a satisfactory level but this was its first decline October. And while the decline in the PMI is rather broad-based, it was especially steep in Italy. The Italian PMI composite dropped from 55.3 to 52.0 pts, thus remaining in expansion territory but below the Eurozone PMI for the first time since October. In contrast, the Spanish PMI decreased less than the Eurozone PMI and is still high, at 55.2 pts.

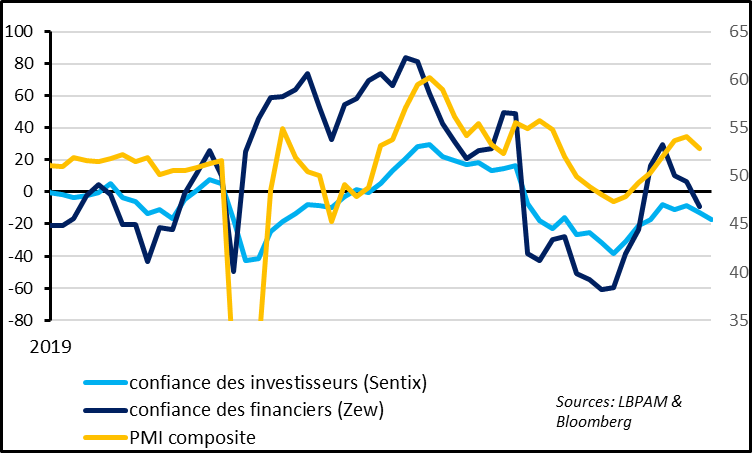

Fig. 2 – Eurozone: Investors pricing in a further drop in confidence in June

Investor confidence (Sentix) Financier confidence (ZEW) PMI composite

Investor confidence in the Eurozone fell further in June, based on the Sentix survey, suggesting that the May economic slowdown was not a one-off and that growth will remain weak this summer. While this indicator should be taken with a grain of salt, historically it has been a good indicator of cyclical downturns, and it did decline for the second consecutive month.

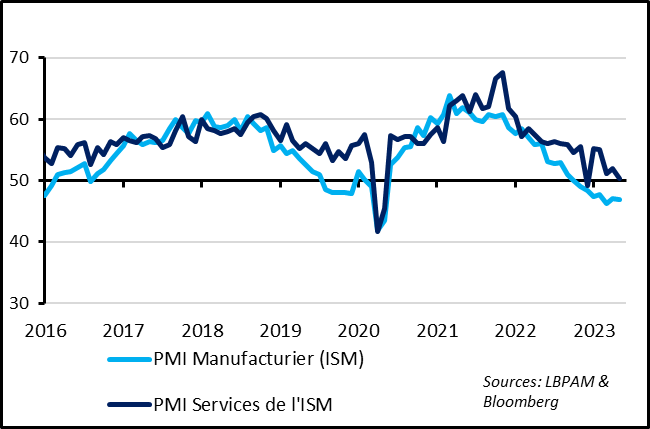

Fig. 3 – US: services confidence fell sharply in May, according to ISM

ISM manufacturing ISM services

The US ISM services fell unexpectedly, from 51.9 in April to 50.9 pts in May. It remains above the 50 pts threshold but is at a three-year low (excluding its December dip). Given that the ISM manufacturing index was down again in May, the ISM composite, which depicts strength in the economy as a whole, slipped below 50 pts for just the second time since the start of the post-Covid recovery. Most importantly, demand metrics have worsened considerably, including orders, inventories, etc., and employment is shrinking even as activity in services continues to increase. All in all, resilience of production and employment in May suggests that US growth is still holding up in Q2 but the decline in leading indicators supports our conviction that the economy will slow more in the coming months.

The good news, which is linked to the weaker demand for services, is that the price component of the ISM services survey is at a three-year low and is in line with its pre-Covid level. This backs our view that inflation in services should begin to recede very gradually in the coming months if economic activity slows, as we expect it to do.

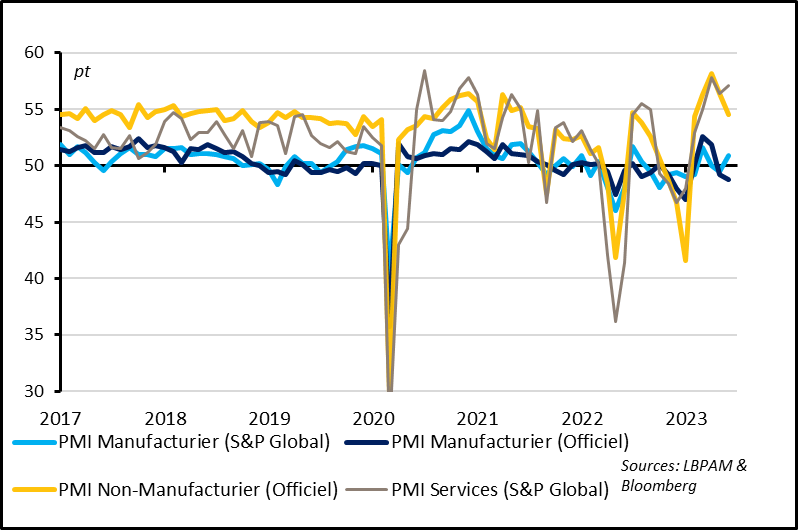

Fig. 4 – China: PMIs were mixed in May but on the whole point to a modest recovery

PMI manufacturing (S&P Global) PMI manufacturing (official)

PMI non-manufacturing (official) PMI services (S&P Global)

In contrast, the Caixin private-sector PMIs rose in both manufacturing and services, pushing the PMI composite to a more than two-year high, at 55.6 pts. This is more reassuring than the official PMIs, which fell again in May and are already back below their long-term average just five months after the reopening began. Unfortunately, official PMIs are probably better indicators of the general economic picture in China, since they cover more companies, bigger companies, and more sectors. The Caixin PMI services indices, however, may better capture momentum in household consumption. Meanwhile, foreign demand declined further in May, as seen in the further decline in exports (-7.5%). All in all, the recovery in China appears to be still on track, but only thanks to consumption and hence to a limited extent and strength.

This explains why Chinese authorities are beginning to raise their economic support slightly, but without the massive stimuli of the past. Since the end of last week, the authorities have announced an easing in rules on property purchases in some second-tier cities and have asked banks to lower the remuneration paid on household deposits. We expect the authorities to do the least amount possible to keep the economic recovery on track in the short term, although the medium-term outlook remains cloudy.