The US job market remains a pillar of resiliency

Link

- The markets remained risk-on, with equities gaining, but also some heavy sector rotations, while government bond yields gave up a little ground. Risk-taking was driven, in part, by expectations of a rather rapid shift in monetary policy by the major central banks, the US Federal Reserve in particular. However, we see little likelihood of these expectations panning out. The economy continues to show, but we don’t feel it is enough to allow an easing in monetary policy, the goal of which is to drive inflation back down towards 2%. A significant shift in the short term would be possible only if the US or European economy were to slip into a deep recession. Once again, we don’t see that happening.

- The release of the Fed’s February minutes caused no change in views of central banks’ language. The most common view still seems to be one more rate increase, or even additional hikes.. Bank stress has obviously added a note of caution, but at no time have monetary policy committee members flagged a rate cut before the end of 2023. Our scenario still assumes a continued restrictive policy. This diverges widely from the markets’ expectations and is the main reason for our market stance, i.e., the search for reasonably priced quality and yield.

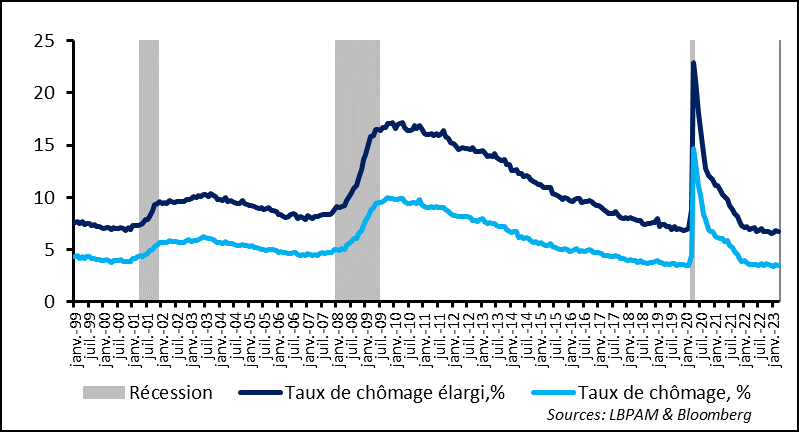

- The bond market’s reaction last week to receding job offers – which was interpreted as a rapid weakening in employment – was strident and overdone, even though job offers remained historically high.. The release of the March jobs report last Friday showed once again that the job market is still robust, despite some signs of easing. More than 230,000 jobs were created, and the unemployment rate fell back to a more than 50-year low, at 3.5%. Not only is hiring still on track, but the participation rate is also rising, albeit in uneven fashion. The pace of wage hikes was slightly slower, but at 4.2% year-on-year, it remains too strong to allow inflation to move towards the 2% target.

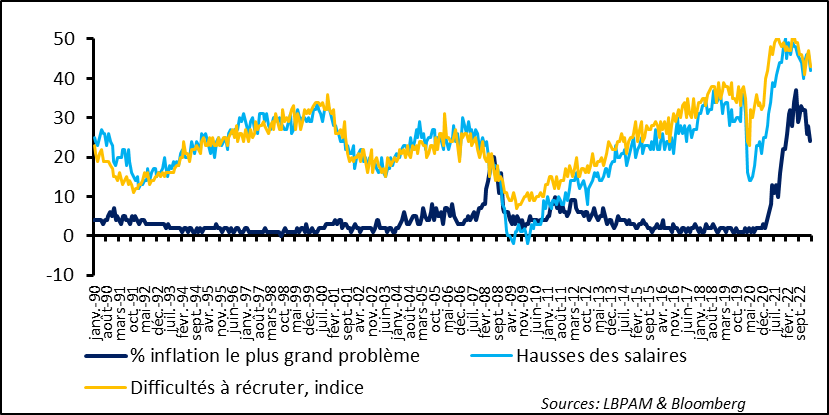

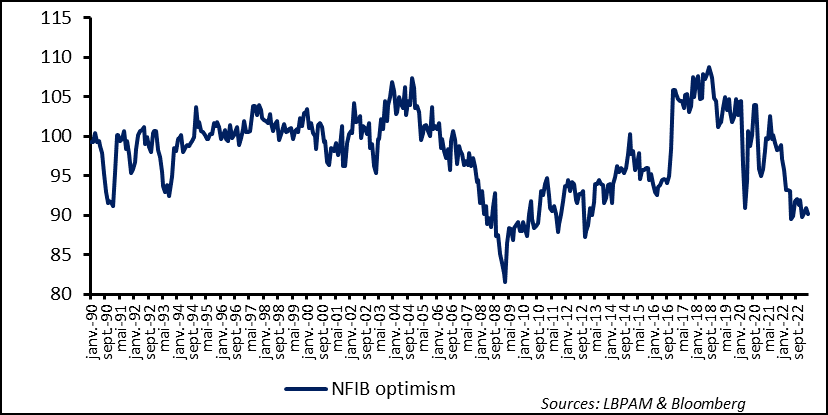

- Resiliency in the job market, which remains one of factors keeping growth from receding rapidly, was also reflected in the small business survey (NFIB), which is still pointing towards hiring difficulties and robust wage increases. Meanwhile, the general feeling is rather glum on economic activity. Things could very well worsen in the coming months if, as we expect, credit conditions become more restrictive.

- More broadly, the FMI released its new growth projections for global GDP in the coming two years, lowering them slightly, to 2.8% in 2023 and 3% in 2024. The FMI thus continues to see weak growth throughout this period of time. This is due mainly to ongoing restrictive monetary policies, which are meant to bring inflation down to central banks’ targets, particularly in the major countries. Meanwhile, in light of recent stress in banking systems in the United States and Europe, FMI experts stress that there are now greater risks of a harder-than-expected landing, citing the possibility of a tighter credit – an already safe assumption. On the whole, this scenario is similar to our own. Its release caused barely a ripple on the markets.

In the US, the March jobs report was more solid than expected, with more than 230,000 job creations, according to the survey of businesses. We had had several alerts in recent weeks on employment trends, suggesting that they had become less robust. Job claims figures had turned clearly upward, and activity surveys of businesses pointed to a lull in hiring. All in all, the survey shows that hiring continues, with still very strong momentum in services, catering in particular.

The household survey backed the business survey, showing a slight decline in the unemployment rate to a more than 50-year low of 3.5%

Fig. 1 – United States : Despite something of a slowdown in hiring, the job market is still tight, with an unemployment rate of 3.5%

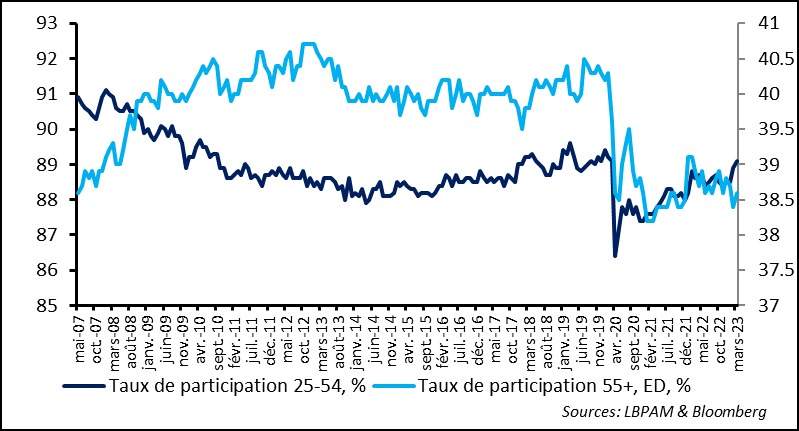

Continued robustness on the job market was reflected in particular in a further increase in the participation rate, which is now back to where it was prior to the pandemic in the most numerous category, the 25-55 age group. However, there seems to have been a real structural shift in the participation rate among older workers (55 and older), which remains sluggish. This may, in part, simply indicate a significant shift in the breakdown of the job market.

Fig. 2 – United States: The participation rate is rising but only in the broadest segment of the working population. Older workers are still not coming back

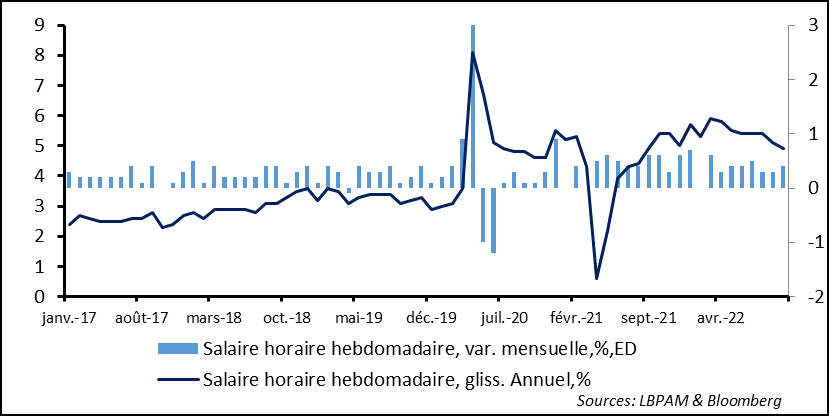

A very low unemployment rate echoes the stubborn wage pressures. Even so, increases in hourly wages continued to moderate, falling to 4.2% year-on-year from 4.6% the previous month. The 0.3% month-on-month figure continued to rise fast and even slightly faster than the previous month. Be that as it may, this increase is still incompatible with a convergence of inflation towards the 2% target.

Fig. 3 United States : Upward wage pressures appear to be easing in the business survey but are still increasing too much.

The small business (NFIB) indicator was also released for the month of March. Although it is not specific by nature and does not cover the entire US economy, in recent years it has been a bellwether of the tensions that have emerged in prices and on the job market.

The survey continues to paint an ugly picture for small businesses, with the confidence indicator remaining very low and close to historical periods of low growth or recession in the US.

Fig. 4 – United States : Small business confidence is near its lows, reflecting the slowdown in the economy

Although the outlook may look poor, it is worth noting that the problems that have dominated the sector are still with us, albeit slightly less so. Indeed, inflation remains one of the main issues affecting small businesses at a time of difficulty in hiring.

Fig. 5 United States : Inflation remains the main concern, albeit to a lesser degree. However, the job market is still tight.