Bond markets vs. the Fed : another round

Link

Fears over the banking sector did not truly recede at the end of last week. US regional banking stocks had only a moderate breather, while banks in Europe continued to take a hit, particularly those regarded as the weakest, such as Deutsche Bank. The markets remained on high alert despite further reassurances from authorities on both sides of the Atlantic. The German chancellor, no less, even came to the defence of Deutsche Bank, insisting that it was solid. It is hard to see how current fears will fade in the very short term, although, objectively, it is hard to see a trivial link between the failures of a few banks in the US and Credit Suisse in Europe and the level of anxiety that has taken over the markets. One thing is for certain – the bond markets have convinced themselves that monetary tightening has already gone too far and that its repercussions could cause even more stress in the banking sector, including systemic risks and/or that we could be seeing rather pronounced recessions rather soon. While remaining very cautious, given that we do see a slight recession in the US, we have a hard time agreeing with the current market expectations.

The bond markets expect key rate cuts from both the Fed and the ECB as early as 2023. In the Fed’s case, they would begin this summer and amount to almost 100 basis points (bp). As for the ECB, for the first time since its tightening cycle began, a reduction in its key rates is being priced in for this year. Naturally, fears have been stoked by the stress that has emerged in the banking system. But at this point, and based on the information we have on bank balance sheets and comments by banking supervisors, we don’t really see further bank failures, particularly among systemic banks, as the most likely scenario. However, we also believe that these episodes underline the fact that monetary tightening is not, and will not be, economically painless. In the United States, the shock to the banking system (through more stringent lending conditions) could be more costly than we had expected in terms of economic growth and could lead to a more rapid contraction. But we don’t see anything that could tip the US economy into a hard recession, a scenario that looks even less likely in the euro zone. But, once again, we prefer to remain cautious, given the risks of market overshooting that would undermine economies.

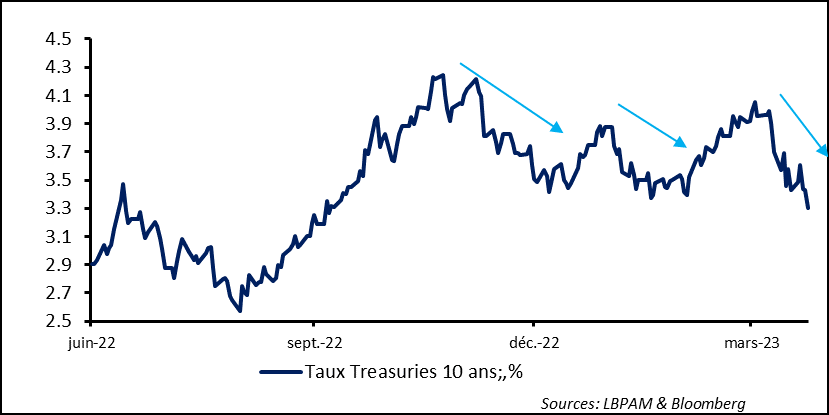

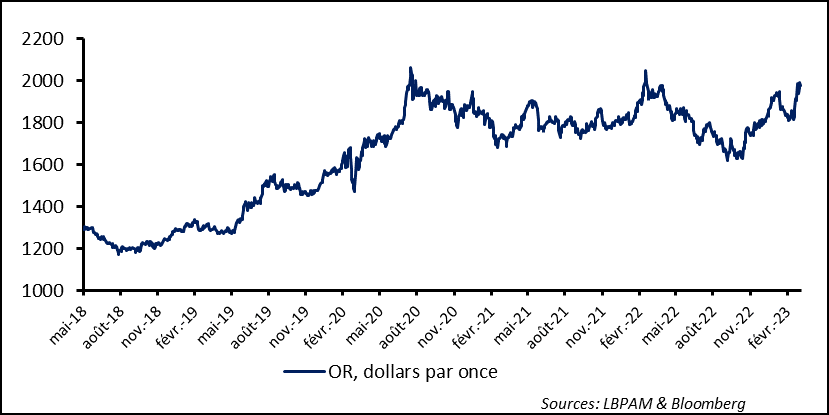

On both sides of the Atlantic, the bond markets seem to be pricing in a very dark picture for the economy, which would justify a switch very soon to accommodative monetary policies. Since the end of February, 10-year yields in both Europe and the US have fallen by 60 to 70 bp, with, obviously, a steep drop in real yields but also a receding in inflation expectations. Under this scenario, financial risks and weaker economic activity would lower inflation drastically. This is plausible, but, once again, it is not our baseline scenario at this point. In addition to government bonds, other safe havens have been in strong demand, driven by the extent of fears over a systemic crisis. These include gold, which recently approached the all-time highs it had set at the outbreak of the pandemic and, then, of the war in Ukraine. Paradoxically, non-banking equities have held up rather well. Long-duration and growth stocks have rallied with the very steep drop in long-term bond yields. Nasdaq, the flagship index of US tech stocks, gained more than 2% last week. It is hard to see how this could be happening if economies were at risk of heading towards a worst-case scenario. For, if that were to happen, earnings would take a hit, which would send equity prices down. All in all, we are in a dynamic that is similar to those that we have experienced since the tightening cycle began, with the markets at odds with central banks’ language and general views on the economy. Nevertheless, stress in the banking system is reason enough for caution, although inflation remains far too high.

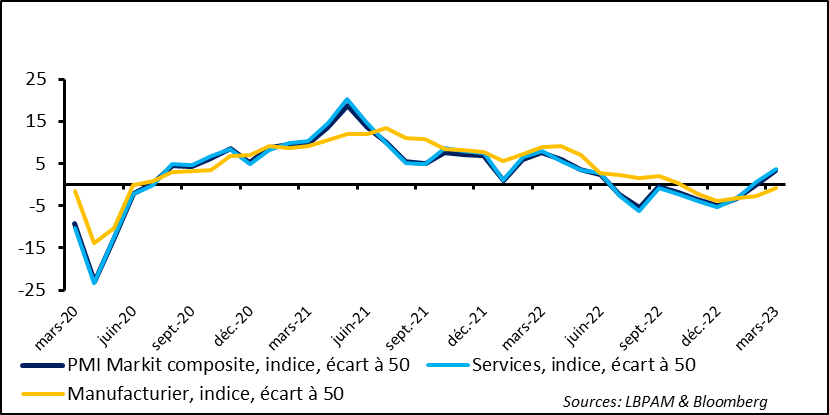

For the moment, the economic reality does not seem to reflect at all the markets’ fears over growth or inflation. Regarding growth, S&P’s flash PMI surveys for March have confirmed the trend of the past several months. The services sector in both Europe and the US is looking better, while manufacturing remains shaky, due to a still-weak global cycle. In the euro zone, the services PMI is not only still in expansion territory, it is also at a 10-month high. In the US, it has even surpassed its May 2022 level. Obviously, economic momentum could be hit hard, and fast, if financial constraints were to become too great, with an impact on lending in particular. This is not yet what we are seeing. In light of the prevailing uncertainty, we are sticking to our highly cautious view on the markets, keeping in mind that even in our scenario, which is more optimistic than that being priced in by the markets, we continue to forecast weak growth for the coming quarters.

For the moment, the authorities’ reassurances do not appear to have dissipated the markets’ fears regarding risks to the banking sector. Governments, like central banks, continue to insist on the banking system’s robustness, particularly those banks regarded as systemic. Even German Chancellor Olaf Scholz has waded into the discussion, voicing support for Deutsche Bank, which had come under attack on the markets, saying that it was solid and profitable, and therefore not in the same category as, say, Crédit Suisse. In the US, Treasury Secretary Janet Yellen stated once again that other support measures could be rolled out if American depositors were to lose confidence in their banks.

All this failed to truly reassure the bond markets, and it reflected on a large scale the prevailing anxiety. But, as has happened several times since the start of monetary tightening, it did cast doubt on the direction of monetary policy. For market participants, monetary policy must quickly change course, as seen in long bond yields, which have continued to fall. The 10-year US government bond yield, for example, has hit its lows for the year.

Fig. 1 – US : Once again, the market sees key rates falling rapidly… leading long bond yields lower

This time, the market’s anxiety is easy to understand, but we feel that fears seem to be driven more by panic than by objective criteria.

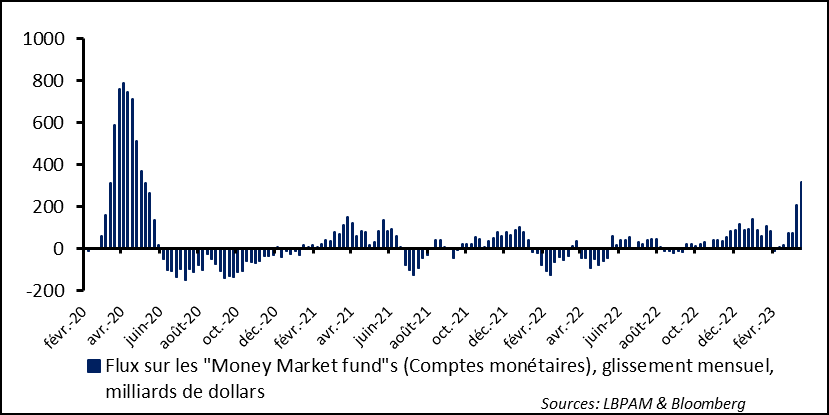

Among the factors driving fears are the risk that stress will persist on US regional bank deposits. For example, inflows into money-market funds have recently been heavy. We don’t really see a direct cause-and-effect link between outflows of deposits from certain banks and inflows into money-market funds. One likely reason for this movement could be the search for higher returns amidst very steep market volatility. Indeed, with short-term rates at levels not seen in more than 20 years, it’s easy to see the reason for the heavy inflows into money-market funds, which invest in highly liquid, high-quality, short-dated assets, such as government bonds.

Fig. 2 – United States : Given the current uncertainties and the high short-term yields, money-market funds are prospering

Meanwhile, it is worth noting that during the weekend, deposits and assets of Silicon Valley Bank (SVB), which was the first bank to fail, were acquired by First Citizens Bank & Trust. So, the resolution appears to have been quick and suggests that the banking system is more resilient than currently feared. Even so, we would stress that other small financial institutions could take a hit from the current adjustments being made in the US economy to reduce inflationary pressures. But these difficulties should be regarded as less systemic in nature than cyclical.

One thing is certain – investors are still worried and have rushed into safe havens, as seen in falling interest rates, but also in the “crisis asset” of gold. The gold price has headed back up, approaching its highs of its recent years, which were reached with the outbreak of the pandemic and then with start of the invasion of Ukraine by Russia.

Fig. 3 – Gold : Systemic fears, possible key rate cuts, and purchases by certain central banks (Russia and China?) are supporting gold

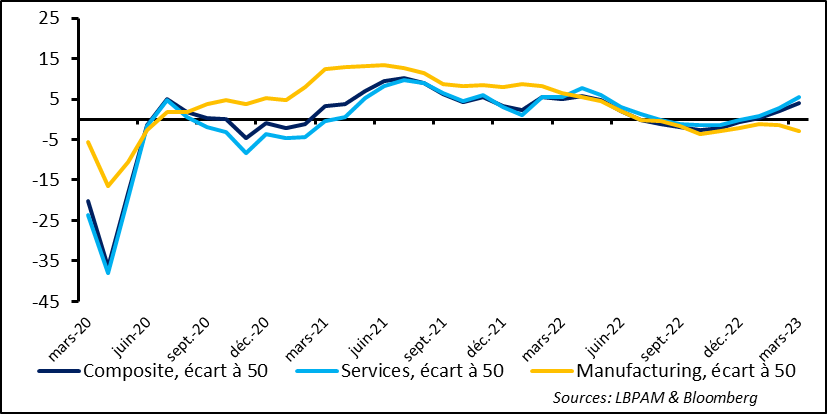

Despite market concerns, the economic reality remains surprisingly resilient. S&P’s Flash PMI for March provided further evidence of the trend we have seen since the start of the year, with services continuing to recover, whereas manufacturing activity remains weak in light of a less buoyant global economy.

The PMI survey suggests that activity in services rebounded strongly in March in the US. The PMI is not only in expansionary territory but has hit an 11-month high. This improvement can be put down to further declines in energy prices, driven by weaker-than-expected expectations on demand for energy products amidst rather lacklustre economic growth forecasts, especially since the emergence of stress in the banking sector. This boost to purchasing power at a time of continued robustness in the job market, could therefore be one explanation. Meanwhile, we continue to see an end-of-pandemic “reopening” impact, with the recovery of hard-hit sectors like tourism and catering.

However, manufacturing, which is more integrated into the global cycle, still seems to be lagging behind, although the survey does show a trend towards improvement.

It is also important to stress that the survey revealed, particularly in services, that inflationary pressures persist with price sub-indices resuming their upward climb.

Fig. 4 – United States : Activity in services remains buoyant with a PMI at an 11-month high, whereas manufacturing is lagging behind

In the euro zone, the message is rather similar, with activity accelerating in services, and the services PMI hitting a 10-month high. Things don’t look as good in manufacturing, with activity declining during the month.

Meanwhile, the survey seems to confirm that bottlenecks are clearing up fast, particularly in manufacturing and that lower energy costs are also providing some relief.

However, with consumer demand holding up well, company pricing power has improved once again. We will have to see whether this shows up again in March inflation figures.

Fig. 5 – Euro zone : Nothing is stopping services, whereas the manufacturing sector remains constrained by the global cycle

Obviously, we will have to pay close attention to the impact of the prevailing fears regarding the banking sector and which could result in weaker lending, which, in turn, would slow economies more than what we currently forecast.

Yours Sincerely,

Sebastian Paris Horvitz