Is inflation a different matter in the UK?

Link

-

After last week’s slight correction, the market environment was rather positive early this week, with a slight easing in long bond yields and a partial rally in equities. In addition to slightly more encouraging signs from the Chinese economy, US inflation figures due out this afternoon are likely to show that it receded considerably, from 4% in May to 3% in June. Core inflation, however, is expected to remain above 5%, due to sticky inflation in services, and we think that only a very negative surprise would keep the Fed from raising its rates further in late July.

-

UK job figures are not encouraging, and that is keeping pressure on the Bank of England, despite signs of a slowing in the economy. On the one hand, the job market has weakened rather considerably, with the unemployment rate rising from 3.8% to 4% in May, and salaried employment receding in June. On the other hand, wages are still rising and, at 7.3%, are far too high to hope for a normalisation in inflationary pressures anytime soon. Although we believe that the UK is something of a special case, these figures show that the main risk currently is still persistent wage and inflationary pressures. This is likely to push central banks to stay on high alert and to prefer the risk of doing too much rather than doing not enough. All in all, central banks’ ongoing hawkish policies are making us even more cautious in our asset allocation.

-

In the Euro Zone, initial surveys for July suggest that the economic outlook remains weak as summer begins but also that inflationary pressures are receding. The ZEW investor sentiment survey is back to its level of last December, and the Bank of France survey found that business confidence has receded since early July in all sectors. However, the Bank of France estimates that French GDP continued to expand slightly in Q2 (from 0.1% after 0.2% in Q1). Most of all, the survey shows that companies’ price increases are quickly moving back to normal, even in services. This suggests that the ECB’s hawkish policy is dragging down growth prospects but, at the same, time is helping to ease inflationary pressures. That’s why we believe the ECB could stop raising rates after July, in contrast with the market, which continues to price in two additional rate hikes.

-

In the United States, the NFIB survey of SMEs confirms that the economy has slowed only very gradually until now, allowing only a slight receding of pressures on the job market and on prices. We still believe that the monetary tightening already enacted will cause a further slowdown in the US economy between now and yearend, which will allow the Fed to be more patient after its July rate hike. But there is a risk that it will have to raise its rates more in the second half of the year if inflationary pressures continue to recede at the current slow pace.

-

In China, hopes are being revived a bit by the official decision to prolong support measures for real-estate developers and as lending has reaccelerated after the central bank’s mid-June rate cuts. This reflects a rebound in lending to households and, especially to businesses, which suggests that investment could at last turn back up a bit and play a role in the recovery. However, lending and real-estate indicators have continued to decline year-on-year after the severe Q2 slowdown, and the authorities will therefore have to do more to keep the recovery on track in the second half of the year.

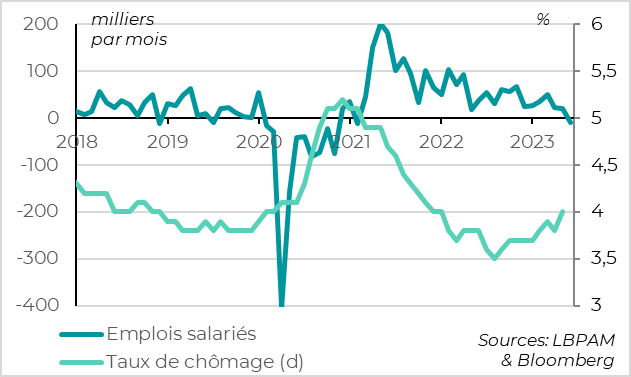

Fig. 1 – UK: the job market slowed more as summer approached

‘000 per month

Salaried jobs Unemployment rate (right scale)

Even more than in the US, the UK job market showed signs of weakening as summer approached, but that has not yet helped relieve upward pressures on wages.

The unemployment rate rebounded in May, from 3.8% to 4%. This is still low, but it has nonetheless risen by 0.5 pts since last summer and is now back above its pre-Covid level. Most importantly, applications for jobless claims resumed their upward trend in June, and salaried employment declined for the first time since early 2021, according to the flash estimate. This suggests that the job market is slowing significantly.

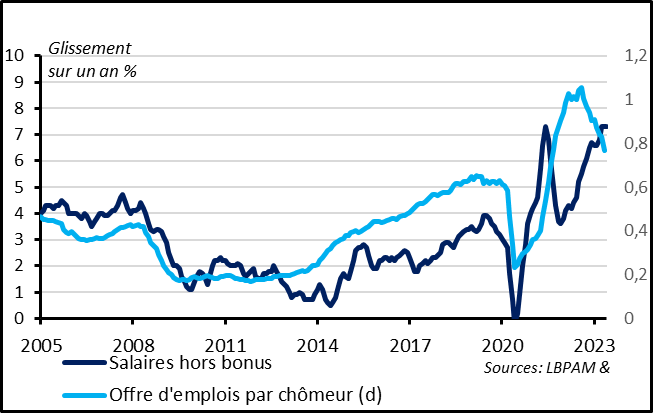

Fig. 2 – UK: This is helping to ease job market imbalances but still with no slowing in wage hikes

YoY % chg.

Wages excluding bonuses Job offers per unemployed person (right scale)

Accordingly, tensions have gradually eased between labour supply and labour demand. The increase in unemployment, combined with the steady decline of job offers over the past year has helped the number of job vacancies per jobless person return to normal, from 1.1 in mid-2022 to 0.76 in June. While this measure of job market pressures remains above its pre-Covid level, difficulties in hiring reported by companies have moved back below their pre-Covid level since the start of the year. This is encouraging, as it suggests that demand for labour is increasingly in line with the available workforce, which is a prerequisite for an easing in wage pressures and, ultimately, in prices.

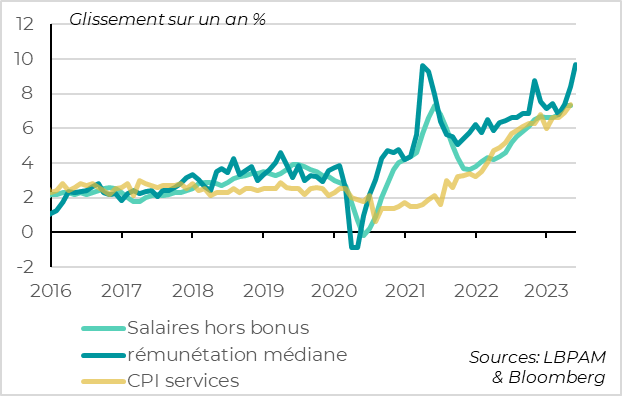

Fig. 3 – UK: Wages are still rising in mid-2023, which is keeping pressure on prices of services

YoY % chg.

Wages excluding bonuses median remuneration CPI services

However, wage growth is still not slowing and is even accelerating further. Average weekly wages, excluding bonuses, rose by 7.3% in May, a high since the 1990s. The median monthly wage accelerated even more in June to more than 9%. This is more than twice as fast as before Covid, when inflation was consistent with the 2% target. Against this backdrop, it is hard to imagine that inflation in domestic services can return to normal for a long time to come without wages slowing significantly.

We still believe that UK wages will slow in the coming months but only gradually and at the cost of a long-lasting hawkish monetary policy and long-lasting anaemic growth. And as long as such is not clear in the data, the risk is that even higher interest rates will be needed.

The UK is not in the same paradigm as the US and Euro Zone. It is a small, open economy where inflation expectations are less well anchored and where job market and productivity tensions have been exacerbated by Brexit. That’s why wage and inflationary pressures are not as extreme in the US and the Euro Zone and that they will probably require less hawkish rate hikes to bring them back under control.

However, the UK case does show the risk that wage and inflationary pressures will be more stubborn than expected, which would likely push the ECB and Fed to opt for the risk of doing too much rather than too little.

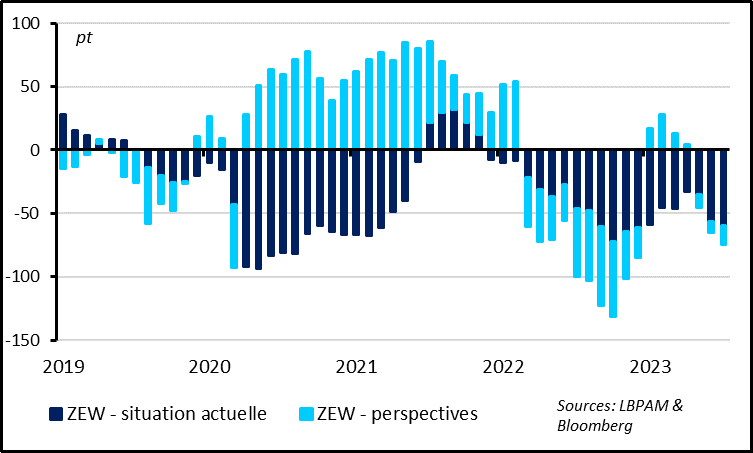

Fig. 4 – Germany: The ZEW once again fell considerably in July

Pts ZEW current conditions ZEW outlook

As for the economy, the first Euro Zone surveys for July suggest that the economic outlook is still rather weak as summer begins.

German financiers’ confidence in the economy fell again rather steeply in July after having stabilised in June, according to the ZEW survey. Their economic outlook has been in negative territory since May and is now back to its December level. Although the ZEW is not a very good indicator of the level of confidence, it is a good indicator of a shift in trend. The ongoing decline of July therefore suggests that the economy continued to weaken early in the summer after the 2nd-quarter rebound.

.

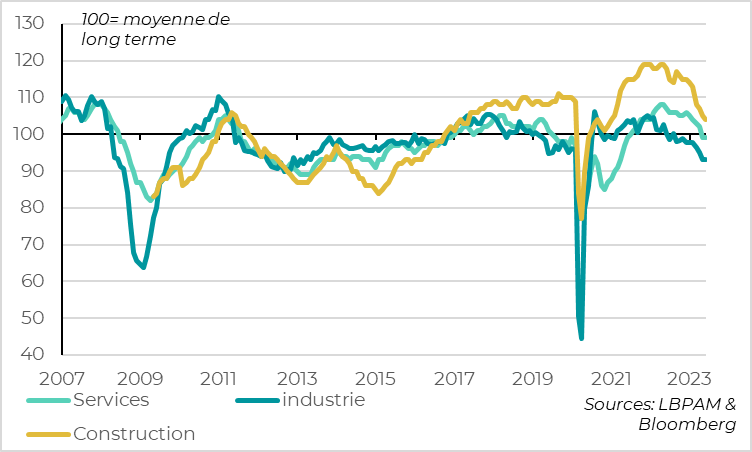

Fig. 5 – France: Business confidence receded in early July in all sectorss.

100= long-term average

Services Construction Manufacturing

The Bank of France survey of businesses confirmed the weakening of confidence in late June and early July in all sectors, albeit far less so than suggested in the PMIs (which hit a two-year low in June at 47.2). In fact, businesses reported a slight increase in activity in June, in reaction to which the Bank of France is forecasting 0.1% growth for the second quarter after 0.2% in Q1. However, leading indicators are not as strong, with inventories still too high, order backlogs back under their average, and cash levels low in both manufacturing and services.

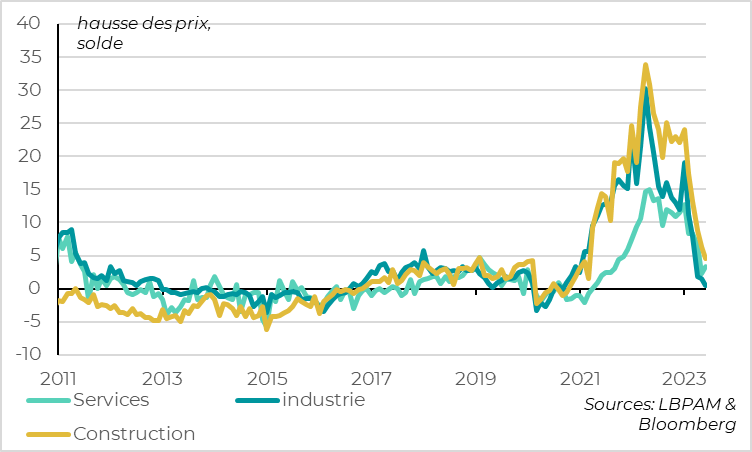

Fig. 6 – France: Businesses are also reporting a normalisation of price hikes in all sectors.

Higher prices, balance

Services Construction Manufacturing

There is also good news from the Bank of France survey. First of all, businesses are still expecting employment to hold up, despite the poor outlook for economic activity. This is lessening the risk of recession in the coming months. Most of all, companies are reporting that the pace of hikes in sale prices has at last returned to its pre-Covid level in all sectors, even in services. This is reassuring for the inflation outlook, as it suggests that monetary tightening, while it does restrict growth, is helping relieve inflationary pressures in France.

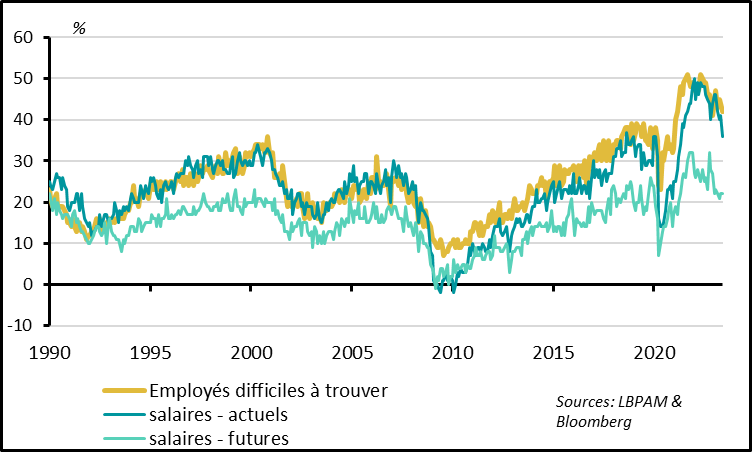

Fig. 7 – US: US SMEs confirm…

Jobs hard to find

Current wages Future wages

In the US, the NFIB survey of SMEs suggests that the job market is coming back into balance, and that inflationary pressures are receding, but only very slowly for the moment. The job market has become gradually looser since mid-2022 but remains far tighter than it was before Covid, which is consistent with the official data released last week. The share of companies raising wages is far lower than one year ago but remains higher than it was pre-Covid. Meanwhile, the share of companies raising their prices fell back below 30% in June for the first time since early 2021, but the share of companies expecting price rises in the next three months moved back above 30% for the first time on the year to date. All in all, the Fed should be reassured by the fact that disinflation does seem to have begun but it will have to remain on high alert as inflationary pressures are still far returning to its target.