The risk of recession seems to be gaining ground

Link

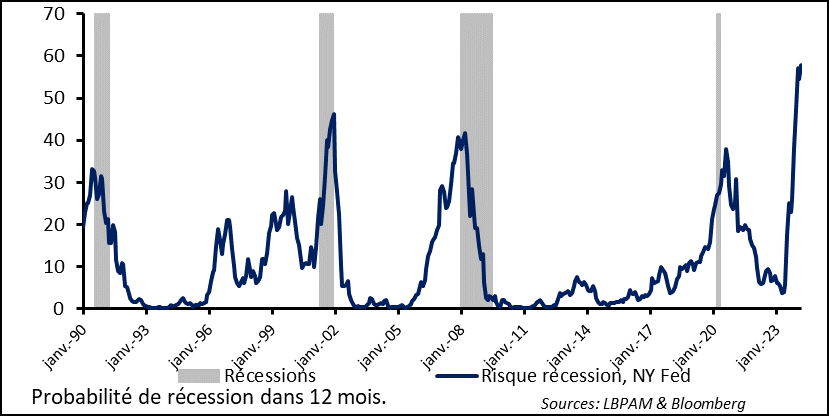

- While the risks of an imminent banking crisis have faded, fears over the pace of growth, particularly in the United States, have continued to gain ground, especially with the new surge in oil prices. At least, that’s the message being sent out by the bond market, which is still pricing in rather abrupt Fed key rate cuts for 2023, whereas long bond yields are still low. At 3.3%, the 10-year US yield is at a low since September 2022. Until now, equity markets have paradoxically resumed their upward march, while betting on better days, despite still-high valuations. Two possibilities: either the US economy soon slips into recession, requiring prompt action from the monetary authorities to counter an excessively severe impact on growth, or economic activity proves to be far more resilient, giving companies the capacity to maintain their profitability with margins that continue to hold up. We have long since assigned very low probability to this latter scenario. Meanwhile, we have reiterated that a recession looks inevitable, a recession that we are still forecasting for 2023, but that will be rather moderate. Our scenario assumes that monetary policy will remain restrictive, but without going further than the current levels of key rates, in order to move inflation towards the 2% target. Current dynamics still appear to be consistent with this forecast.

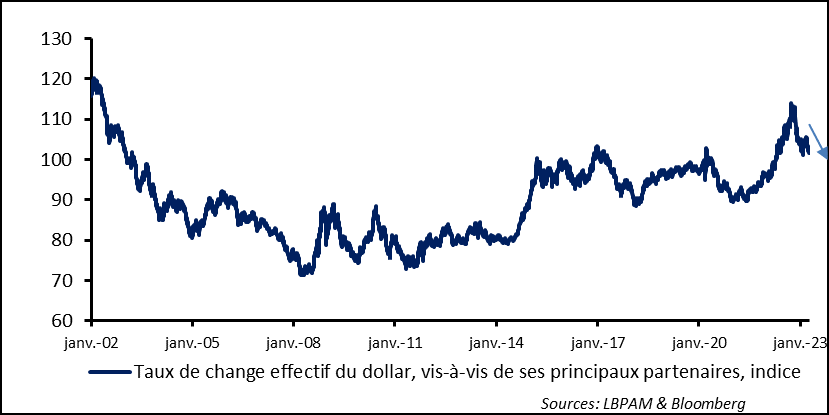

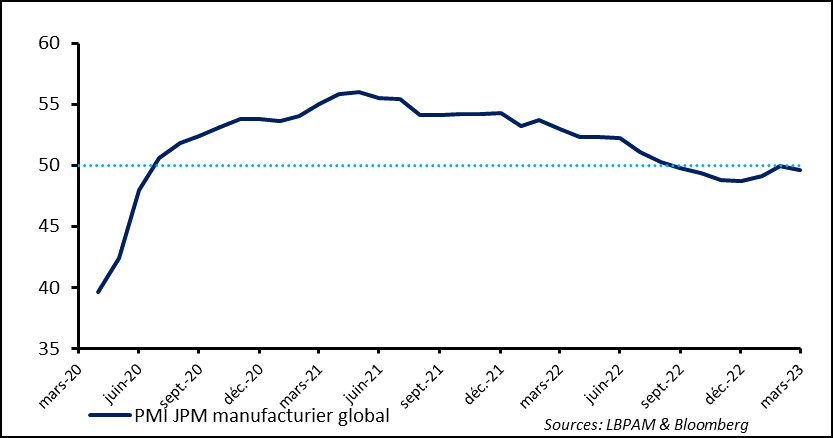

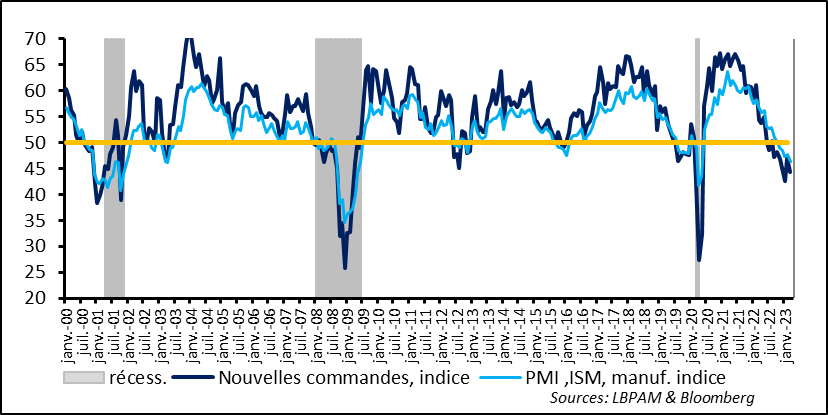

- Action by the major central banks has already had an impact on economic activity. Growth has been sluggish since last autumn in manufacturing, the sector that is most closely tied to the economic cycle. The latest global PMI surveys, compiled by JPMorgan, found that in March manufacturing had slowed its upward momentum of recent months, which was driven mainly by the recovery of activity in China, as well as a bottoming out in the major economic regions. This less buoyant trend has shown up particularly in the US, where the ISM manufacturing index hit an almost two-year low and is well into contraction territory. In the Euro Zone, the trend in March was also downward, with German industry remaining one of its weakest elements. Meanwhile, the restarting of Chinese manufacturing seems to be taking its time, with growth driven mainly by consumer services. We will see today whether activity in services, which has held up well almost worldwide over the past several months, continues to do so.

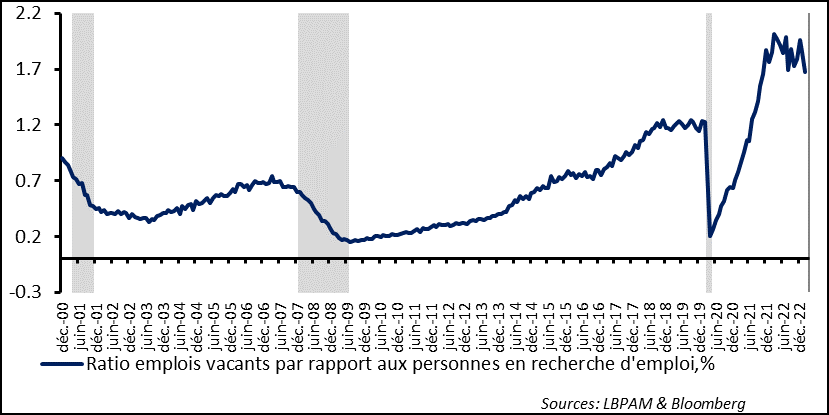

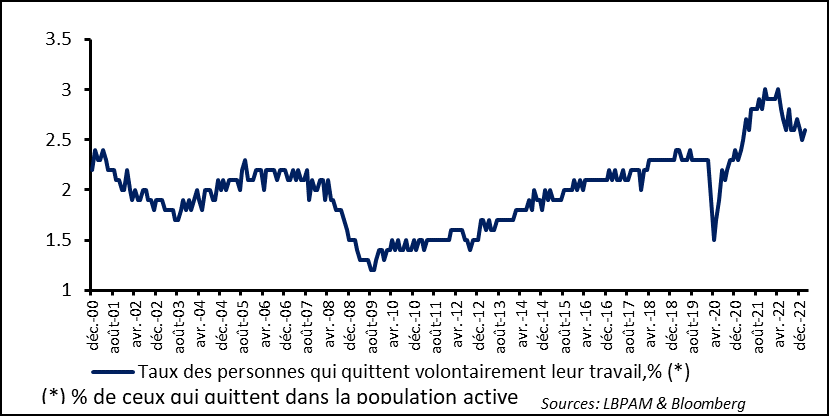

- The job market is still one of the key variables for assessing momentum in the US economy and for helping us calibrate how central banks should respond in order to ease inflationary pressures. Job offer figures for February fell rather steeply. In fact, this was their steepest decline since peaking one year ago, but they are still at a historic high. There are still 1.7 job offers for each person looking for a job, a very high figure, albeit lower than the 1.9 of the previous month. This indeed suggests, as might have been expected, that companies are beginning to roll back their job offers in reaction to slower economic activity. Meanwhile, from employees point of view, it is worth noting that the number of persons voluntarily quitting their job for a presumably higher-paying one, has rebounded. The most likely scenario is that job offers will continue to decline, but it’s hard to say how fast this will happen. This will surely ease tightness on the job market, but, once again, it is hard to say by how much. Meanwhile, some may believe that these statistics are a sign that the US job market is weakening rapidly. At this point, we don’t see much evidence of this occurring. Even so, the Fed will definitely be keeping a close eye on this statistic. We’ll see late this week what the jobs report tells us about the state of the job market. We are confident that it will weaken little by little, but, as we have seen in recent months, so far, surprises have been more on the upside than the downside.

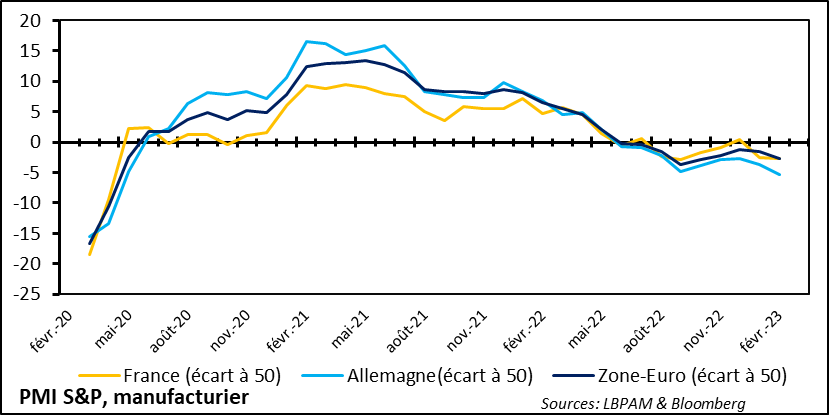

- Stress in the US banking sector has had a big impact on the market’s anticipations of monetary policy, with pronounced expectations of key rate cuts. These expectations are now being stoked by fears of recession. This rather radical shift in expectations in recent weeks has obviously sent the dollar down sharply. The dollar is, in fact, at an almost one-year low vs. the currencies of its main trading partners. We had expected a shift in the dollar’s strength, and this has indeed been the case since last autumn. If market expectations of steep cuts in US key rates were to fail to pan out, the dollar could very well regain some lost ground, but we do expect the greenback to continue adjusting downward slightly in the medium term, particularly vs. the euro.

Global industrial activity slackened in March, as revealed by the latest PMI surveys. This came on the heels of the slight rebound that we have seen since autumn and that accelerated a little with the reopening of the Chinese economy. The global PMI index compiled by JP Morgan thus moved back into contraction territory.

Fig. 1 – World : Global manufacturing activity is slowing, particularly in the United States

This slowdown has been especially marked in the US, where the ISM manufacturing PMI index hit an almost two-year low. The trend is not very promising, with new orders having also slackened on the month. The index is clearly in a zone that is consistent with a US recession.

Fig. 2 – United States : Industrial activity continues to slow in the US, with the ISM index well into recessionary territory

Nevertheless, as we all know, the current economic cycle has been severely disrupted by several shocks and for the moment is still being led by the recovery in services.

Today, we will have the yardstick for services. We will see whether activity is still holding up, keeping in mind that it had been quite buoyant in recent months. But last month’s concerns over the banking sector could very well have had an impact on activity in services.

Be that as it may, we still believe that we are headed for a recession in the US. We still expect it to come in 2023. But we also expect it to be moderate.

In the Euro Zone, industrial activity is still depressed and slowed its pace in March, based on the zone’s aggregate PMI indicator. Germany is still the Euro Zone’s weak link, even if activity is in contraction territory almost everywhere. Hopes of support from China’s reopening still look premature, but our scenario sees support from Chinese demand being more robust late in the year.

Fig. 3 – Euro Zone : Another slackening in the manufacturing sector

In this economic cycle, we are all looking to inflation and U.S. employment to try to gauge the direction of the Fed's monetary policy. For example, the latest job openings survey showed that job openings fell very sharply in February. Nevertheless, at 9.9 million, they remain historically high, with 1.7 job offers for every person looking for work.

Fig. 4 – United States : The year began with lower interest rates, which gave new life to real estate… but this is unlikely to

So, will this downward trend continue? The answer is certainly yes. However, it is harder to say how fast companies will withdraw their surplus job offers.

Likewise, it is just as hard to deduce from this that job market pressures will quickly ease. Indeed, almost surprisingly, the survey revealed that the number of persons who voluntarily quit their jobs for, presumably, better-paying jobs, rose once again in February. This suggests that the job market remains buoyant and that wage pressures remain stubborn.

Fig. 5 – United States : The labour market seems to be holding up well, with still a high percentage of persons voluntarily quitting their jobs

We will be looking at the jobs report due out this Friday to see whether the pace of job creations, which so far has been robust, slackens a little. The manufacturing sector is a weak link. All in all, forecasts are for 240,000 jobs created in March, still a very high figure.

Although the resilient job market is still offering the most protection to the US economy, we still expect activity to continue slowing and to lead us into a recession, which we are still placing in 2023. Some say 2024, but the real question is how deep that recession will be. Based on our expectation of a moderate contraction in activity, we are taking a cautious stance on the markets and, therefore, overweighting resilience, hence quality and the search for yield.

Obviously, if the economy were to worsen more than expected, we would need a far more conservative allocation strategy than our current one.

One thing that is certain is that the bond market’s message is unambiguous – we will be in a recession within a year. The hard part is saying how bad it will be.

Fig. 6 – United States : A high probability of recession in the coming 12 months… according to the bond market

In reaction to the potential risk of recession, which has been exacerbated in recent days by the run-up in oil prices, the market is sticking to its expectations of steep cuts in key rates by the Fed. This has already led to further declines in the dollar.

We believe that if our scenario pans out – i.e., if the Fed waits till 2024 to cut its rates – the dollar could recovery somewhat. Even so, we expect the dollar to depreciate in the medium term vs. the euro from the high levels that it has reached.

Fig. 7 – United States: The dollar weakens…as Fed rate cuts are priced in