Banking stress seems to be receding, but not inflationary risks

Link

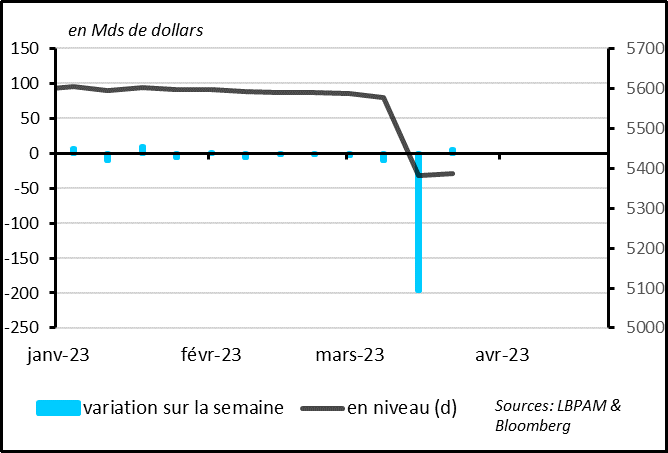

- Banking stress seems to be receding, with a slight rally by banking shares last week after three weeks of steep declines, and with the stabilisation of deposits in US regional banks since mid-March (+USD 5bn, according to the Fed two weeks ago after -USD 196bn the previous week). But as the week began, oil prices are what stoked volatility on the markets.

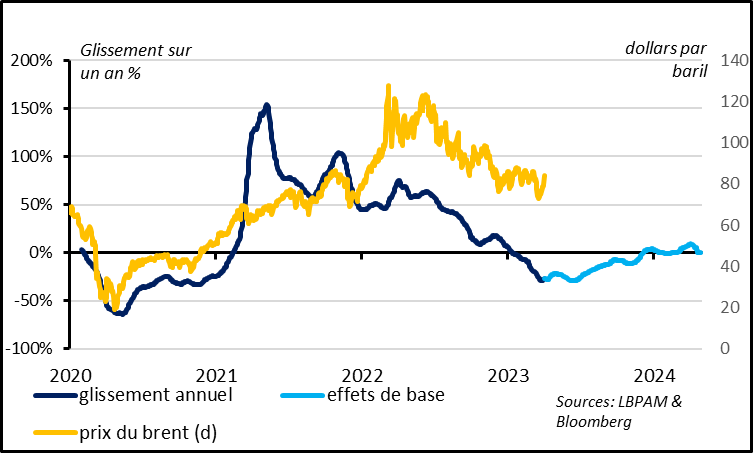

- OPEC+ this weekend announced a surprising reduction in production of more than 1 million bbl./d beginning in April. This comes on top of the 500,000 bbl./d cut announced by Russia in March, which is expected to last till yearend. This sent oil prices up by 5% this weekend, to USD 84/bbl. After their steep drop of recent months, we expect energy prices to recover slightly in the coming months. Despite the slowing global economy, China’s reopening should support demand, while Saudi Arabia is prepared to limit its output to support oil prices. If so, energy prices’ disinflationary impact is unlikely to be any stronger from now on and could even weaken considerably in the second half of the year. As a result, falling energy prices are likely to provide less support to household purchasing power and consumption.

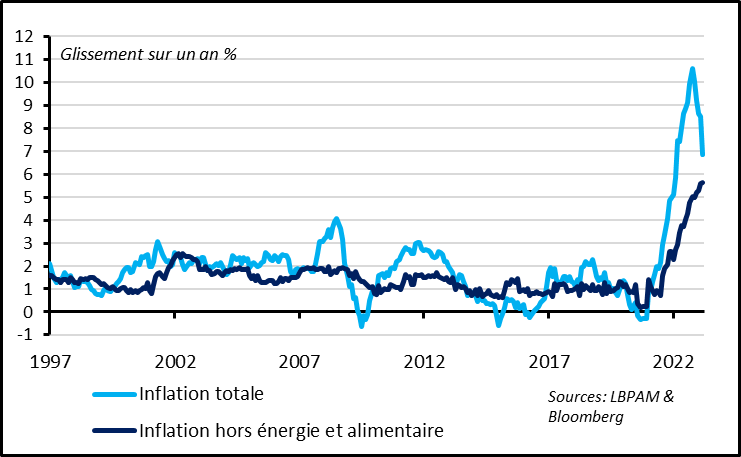

- Core inflation in the Euro Zone hit 5.7% for the first time in March. Total inflation is being driven down sharply by energy basis effects, but the ECB will have to remain alert to stubborn inflationary pressures, particularly in services. We believe that if banking stress recedes a little more, the ECB will probably raise its rates another two times this quarter, from 3.0% currently to 3.5%. This is what the market is pricing in.

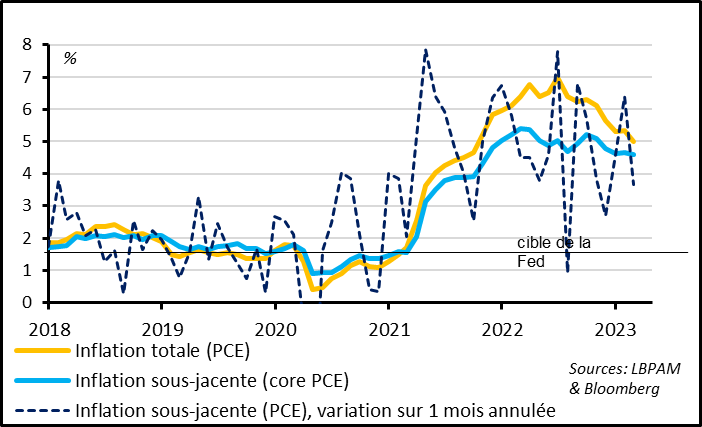

- US inflation slowed slightly in February, based on the Fed’s favourite yardstick, but remains too high. The consumer price deflator, ex energy and food, slowed by 0.5% month-on-month and by 4.7% year-on-year to, respectively, 0.3% and 4.6%.

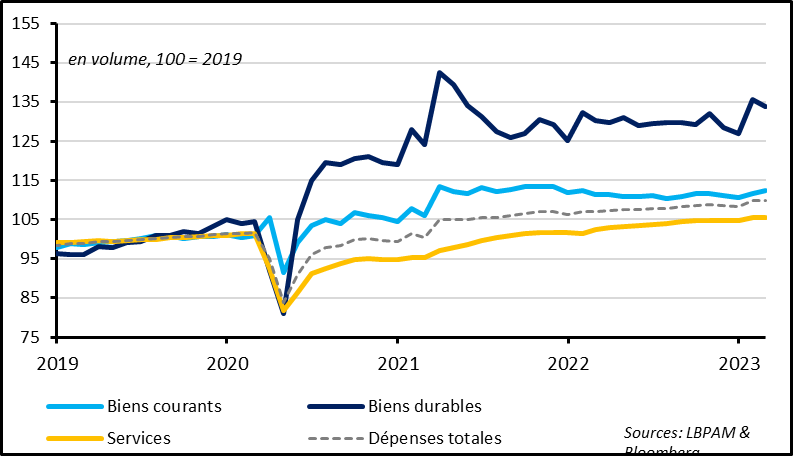

- US household consumption levelled off in February (-0.1% in volume) after spiking in January (+1.5%). Consumption is expected to continue driving growth in the first quarter but showed signs of slowing in the run-up to the second quarter, with an increase in the savings rate and a slightly weakening in confidence. In light of this, job market trends will be decisive in setting the tone for consumption. We should get a first idea of this with the release of March jobs reports on Friday.

- As for the rest of the world, we are keeping a close eye on March PMI surveys. The PMI manufacturing survey could point to a further weakness in the industrial cycle, as is the case for the Chinese manufacturing PMI, which was released this morning (and was down by 50pt). But the focus will be on services PMIs, which so far have been solide.

Fig. 1 – Banks: US regional bank deposits stabilised last week

Fig. 2 – Oil: prices rebounded after OPEC+’s announcement of production cuts

OPEC announced this weekend that its members would reduce their oil production target by 1.1 million bbl./d beginning in April, starting with Saudi Arabia, which has pledged to cut output by 500,000 bbl./d. Meanwhile, Russia announced that the 500,000 bbl./d cut in production that was already in the works for the second quarter, would be extended till yearend. OPEC’s production cut is expected to be less than the announced figure, as many of its members currently produce less than their target. Even so, oil supplies are expected to be about 1% lower in the second half than currently projected.

The OPEC news sent Brent up by 5% to USD 84/bbl. and back to its level prior to the US banking crisis. This does not look overdone, given that, historically, a reduction of this extent is consistent with a 10-15% price hike.

Fig. 3 – Euro Zone: total inflation is slowing drastically, but core inflation continued to rise in March

Total inflation in the Euro Zone slowed more than expected in March, from 8.5% to 6.9%, a one-year low. But this reflects only the steep drop in energy inflation, from 13.7% to -0.9%, thanks to further declines in energy prices in March and, most of all, favourable basis effects (oil and gas prices had soared in March 2022 after the invasion of Ukraine).

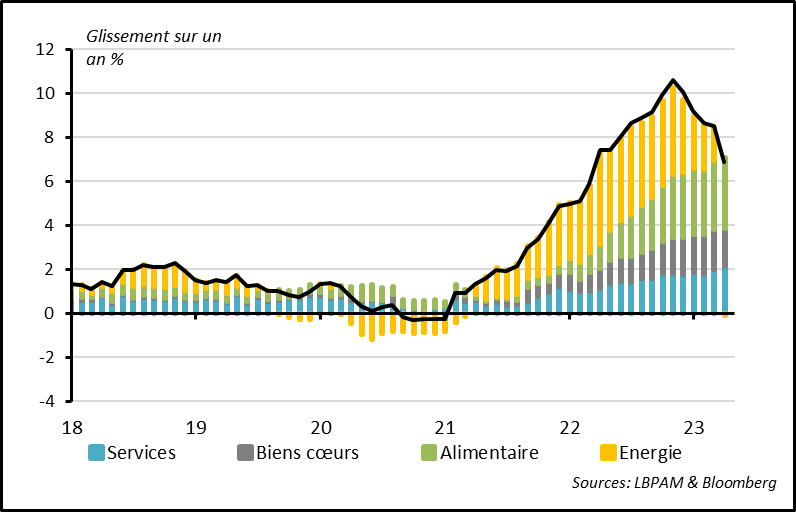

Fig. 4 – Euro Zone: inflation is slowing only because of energy, while it is still rising for food and services

When stripping out energy prices, Euro Zone inflation is still rising more than expected. Food inflation remained surprisingly strong in March and hit a new year-on-year high at 15.4%. Meanwhile, core inflation (i.e., ex energy and food) rose, as expected, from 5.6% to 5.7%, an unprecedented level in the Euro Zone.

By category, inflation in manufactured goods slowed very slightly for the first time since early 2022, from 6.8% to 6.7%. We expect prices of goods to slow, as global demand weakens and now that production lines have returned almost completely to normal. However, the slowing of goods prices in March was probably exaggerated by temporary factors, such as the lag in sales promotions in Italy. Most importantly, inflation in services accelerated again in March to 5.0%. And while prices of some services, which are driven by the reopening of economies, should begin to pull back, it is hard to see services inflation falling rapidly as long as the job market remains so tight (unemployment remained at a historic low of 6.6% in February and wages accelerated further in early 2023).

All in all, the slowdown in Euro Zone inflation is being driven solely by energy prices, while core inflation has not yet begun to recede. It is likely to remain very high until this summer before slowing to a greater extent but without returning to the 2% target for another two years. If so, the ECB will probably raise its rates further in Q2 and keep them high for several more quarters.

Fig. 5 – US: inflation is slowing very gradually

US inflation slowed slightly in February. The consumer price deflater slipped from 5.3% to 5.0%, and from 4.7% to 4.6% when excluding energy and food. The latter is at a low since October 2021. It’s reassuring to see that the Fed’s favourite inflation yardstick resumed its decline in February after its surprisingly very steep acceleration in January. On the month, core consumer prices slowed from 0.5% to 0.3%, and prices of services from 0.6% to 0.3%. Even so, US core inflation remains more than twice as high as the Fed target and is unlikely to converge towards it any time soon, as long as the job market remains as tight as it is now. All in all, these figures suggest that the Fed’s monetary tightening is beginning to pay off, but there is a long way to go before the situation stabilises. We believe that the Fed is not far from its pivot – we forecast a final rate hike in Q2, which would raise rates to just above 5% – but that it will keep its rates high until 2024 even if the economy slows considerably.

Fig. 6 – US: consumer spending remained stable in February after a steep rise in January

US household consumption stagnated in February (-0.1% in volume) after its steep rise of January (+1.5%). Consumption probably continued to drive growth in the first quarter, given that in January and February, it averaged 4.6% more than its Q4 year-on-year level, after rising by just 1% in Q4. But it showed signs of slowing down in the run-up to the second quarter, as the savings rate continued to rise in February and as consumer confidence fell slightly in March. This would be consistent with the receding impact of savings that were accumulated during Covid and the decline of energy prices in recent months, two factors that have so far boosted household purchasing power. Looking ahead, household spending is likely to be increasingly driven by the job market. We will get a first indication of this this week with the release of March jobs reports, which are likely to show a gradual slowdown in wage income.