Learning to live with political deadlocks and uncertainties

Link

What should we take away from market news on October 10, 2025? Answers with the analysis of Xavier Chapard.

Overview

► The US government shutdown, i.e. the suspension of many federal government services due to a lack of funding, has entered its second week, with no significant progress in political negotiations. That said, pressure on officials will intensify, with many civil servants no longer receiving their salaries as of today. We continue to believe that a solution should be found within two weeks and that, if so, the impact of the shutdown on the economy will remain marginal and temporary. We therefore remain confident about market developments. However, the risk of a prolonged deadlock or a reduction in civil servants' salaries cannot be ruled out at this stage, which could have a more significant impact on the US economy.

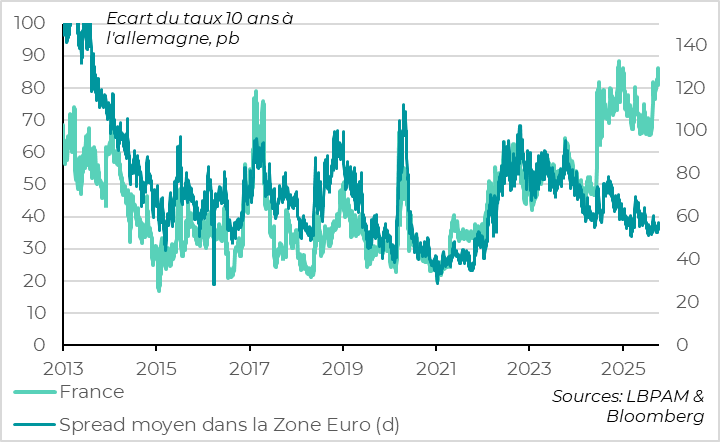

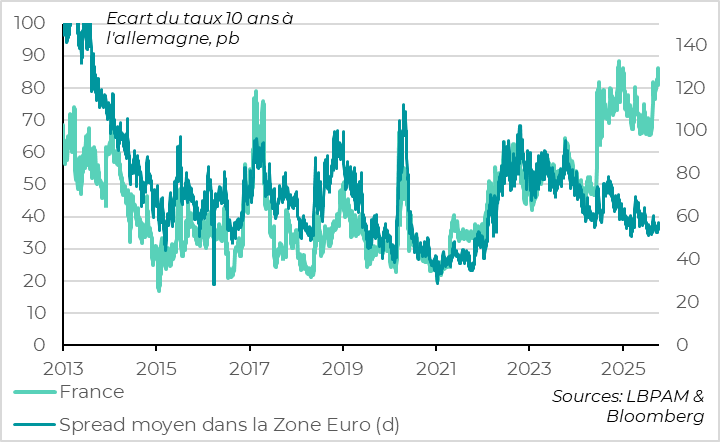

► In France, following inconclusive negotiations led by the outgoing Prime Minister, President Emmanuel Macron is expected to appoint a new head of government within the next few hours. However, uncertainty remains as to whether the future government will be able to remain in place long enough to pass a budget before the end of the year. The budget will necessarily have to include significant, and therefore costly, concessions. Despite an already high risk premium on French debt and a systemic crisis risk that we believe to be contained, we remain cautious on French assets in the short term. Political, budgetary and sovereign rating uncertainties are likely to persist. In our bond allocation, we continue to favour the debt of southern eurozone countries, which currently offer a better risk/return profile.

► The minutes of the Fed's September meeting confirm a consensus in favour of a further cut in key interest rates by the end of the year. However, the Federal Reserve remains cautious in the face of persistent inflation that is still above its target. Above all, these minutes point to differences of opinion within the Fed regarding the pace and extent of future rate cuts and the scale of the balance sheet reduction still required. This increases uncertainty, although we continue to believe that the market is anticipating too many rate cuts, given that inflation is likely to remain above target for some time. In this context, we remain cautious on US bonds and currently favour European bonds.

► The ECB minutes confirm that the institution is comfortable with maintaining its neutral interest rate (2%) for the time being. However, it remains cautious and is not ruling anything out for the future, given the high level of uncertainty. Yet the ECB itself anticipates inflation to remain below its target over the next two years. This is why we believe that another rate cut will occur before the end of the year. Its current stance is therefore conservative and suggests that, contrary to its official line, it fears above-target inflation more than below-target inflation, despite its projections. This would not be good news for medium-term growth, but would support long-term bonds.

Going Further

France: Political instability weighs on French assets

The federal government shutdown continues into its second week

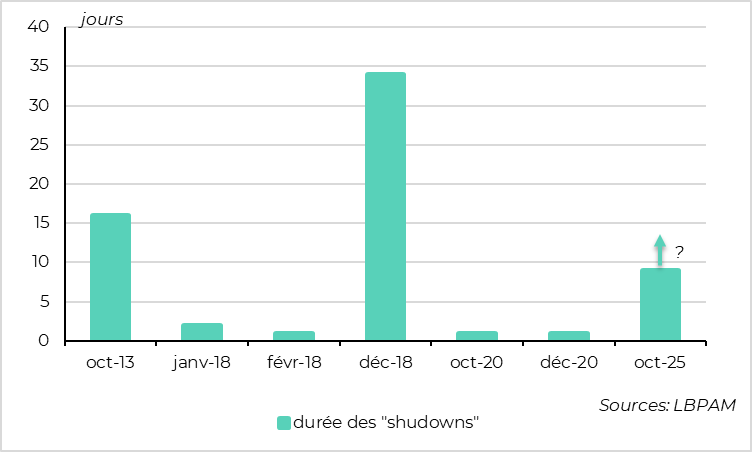

Republicans and Democrats have still not reached an agreement on signing the spending bill needed to fund many federal government activities. The shutdown has therefore entered its second week since last Wednesday. Unfortunately, there has been no significant progress in the negotiations so far. It is therefore likely that the situation will continue at least until next week.

That said, political pressure is likely to intensify in the coming days as many civil servants will not receive their pay today, and some military personnel will not receive theirs next Wednesday if the shutdown continues. In addition, key economic data, such as inflation and retail sales, may not be released next week if the shutdown continues. That is why we believe a solution should be found within two weeks.

In this case, the impact of the shutdown would remain marginal and temporary. Most estimates indicate that a week-long shutdown costs 0.1 percentage points of annualised quarterly growth. This cost tends to be quickly offset once the shutdown is lifted, particularly thanks to the payment of deferred salaries. Given that this shutdown is occurring at the beginning of the quarter, the recovery should take place before the end of the year, making its impact on fourth-quarter GDP virtually invisible.

That said, the cost could become more significant if the deadlock persists beyond the end of the month, or if certain salaries are not paid retroactively to a significant number of civil servants, as threatened by Donald Trump, or if certain civil servants currently on temporary layoff are permanently dismissed. This scenario, which we consider unlikely, could, however, have a more significant impact on the US economy.

Fed: More rate cuts on the way, but how big will they be?

Inflation slightly above 2% in September, mainly due to base effects

The minutes of the Fed's September meeting indicate that ‘most members believe that further policy easing is likely to be appropriate over the remainder of this year’ in response to the sharp slowdown in employment. This finding comes as no surprise, given that 12 of the 19 Fed members anticipate at least one additional rate cut by the end of the year. In fact, markets are already pricing in a 95% chance of a cut at the end-of-October meeting.

At the same time, Fed members insist on the need to maintain a balanced approach between their two mandates: employment and inflation. A majority of them identify upside risks to their inflation forecasts, while believing that the latest data do not reflect a sharp deterioration in the labour market.

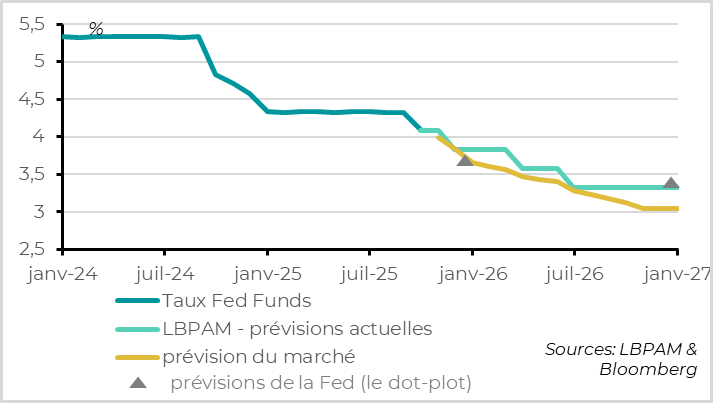

This confirms that the planned rate cuts do not represent a shift towards an accommodative policy, but rather an adjustment towards a less restrictive stance, aimed at limiting the risks of a more pronounced weakening of employment. This is why we continue to believe that the Fed will cut rates in the coming months, but probably to around 3.5%, rather than the 3% anticipated by the market.

Fed members remain divided over the trajectory of future rate cuts

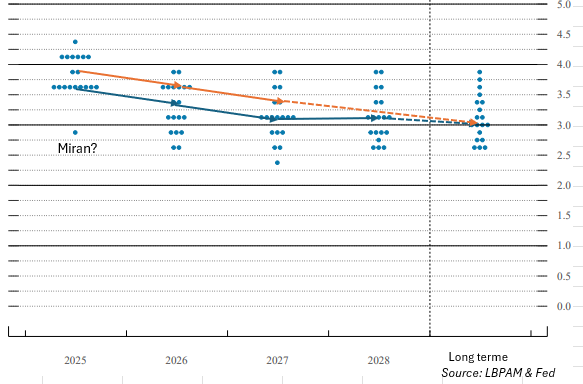

Beyond a relative consensus on limited insurance rate cuts, the minutes of the September meeting reveal deep divisions within the Fed, making its future trajectory more uncertain than usual.

Opinions are divided on the pace of future rate cuts: while some members, such as Miran, argued for a 50 basis point cut in September, others considered keeping rates unchanged, although they ultimately voted in favour of a cut. The dot plot also illustrates this divergence, with seven of the 19 members no longer forecasting any further cuts between now and the end of the year.

Financial conditions have already eased considerably

- There are also marked differences of opinion regarding the extent of future rate cuts. Jerome Powell has indicated that the current rate level, between 4.00% and 4.25%, remains moderately restrictive, leaving the door open for a few more cuts without monetary policy becoming accommodative.

- The September dot plot shows that the median Fed member still estimates the equilibrium rate at 3%, suggesting significant potential for cuts. However, the minutes reveal that some participants consider financial conditions to be already very favourable, which could indicate that monetary policy is not as restrictive as it appears. In this case, the scope for further cuts would be limited.

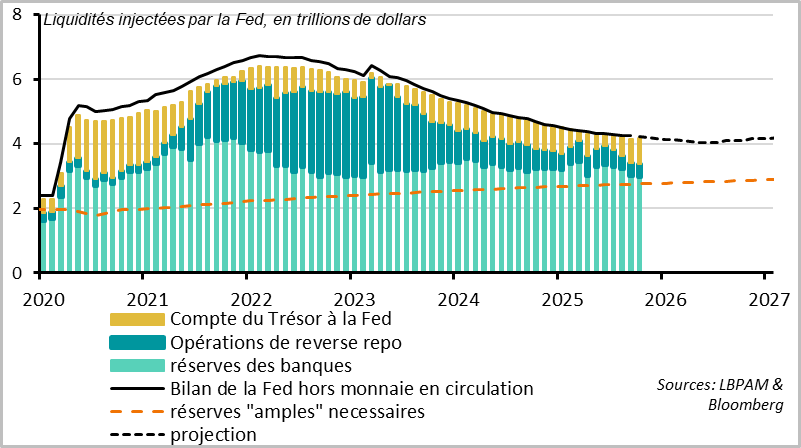

The Fed appears to be nearing the end of its balance sheet reduction process

More surprisingly, regarding the size of the balance sheet at which its reduction should be halted (i.e. ending quantitative tightening): as Jerome Powell indicated, the majority of participants believe that bank reserves are still abundant, but that they are approaching the level at which they would be just sufficient, which would mark the point at which the Fed should stop reducing its bond portfolio. We believe that the Fed should stop this reduction by the end of the first quarter of 2026 and announce it at one of its upcoming meetings. However, the minutes reveal that some members believe that the Fed should reduce its balance sheet as much as possible, suggesting that QT could be prolonged. In this case, a larger reduction in the government bond portfolio would increase pressure on long-term US rates. This is another reason for us to remain cautious on long-term US rates and to continue to favour European bonds.

More surprisingly, regarding the size of the balance sheet at which its reduction should be halted (i.e. ending quantitative tightening): as Jerome Powell indicated, the majority of participants believe that bank reserves are still abundant, but that they are approaching the level at which they would be just sufficient, which would mark the point at which the Fed should stop reducing its bond portfolio. We believe that the Fed should stop this reduction by the end of the first quarter of 2026 and announce it at one of its upcoming meetings. However, the minutes reveal that some members believe that the Fed should reduce its balance sheet as much as possible, suggesting that QT could be prolonged. In this case, a larger reduction in the government bond portfolio would increase pressure on long-term US rates. This is another reason for us to remain cautious on long-term US rates and to continue to favour European bonds.

Eurozone: ECB remains confident despite downside risks

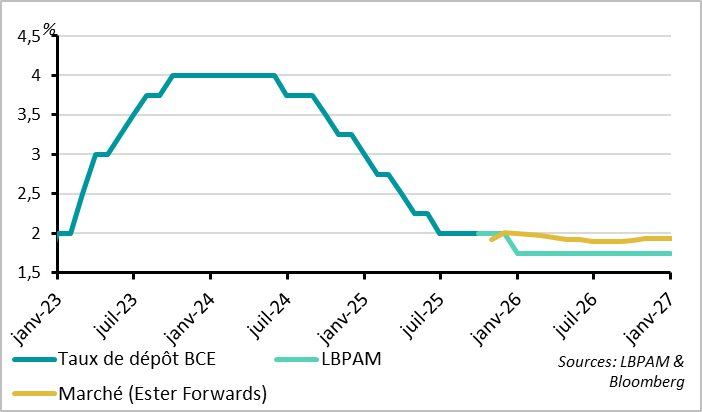

The stability of rates at 2% satisfies both the ECB and the markets

The ECB's decision to keep key interest rates unchanged in September was unanimous, according to the minutes of the meeting held on 10 and 11 September. After two consecutive pauses since June and speeches in favour of stable rates, these minutes confirm market expectations, which now see only a low probability of further cuts in this cycle.

According to the minutes, the members of the Governing Council considered that there was no ‘immediate pressure to change key interest rates’, as the inflation outlook was deemed stable, with balanced risks, as were the economic risks. Nevertheless, the ECB wishes to keep all options open in an economic and geopolitical environment that is ‘more uncertain than usual’. The message therefore remains one of caution, in a context where monetary policy has been brought back to a neutral level.

However, like us, the ECB believes that a further cut in interest rates in the coming months could better protect the inflation target, both in the baseline scenario and in adverse scenarios. Indeed, it forecasts core inflation to be below target in 2026 (1.9%) and 2027 (1.8%), despite the temporary inflationary impact of the new carbon market (ETS 2) in 2027. Furthermore, the inflationary risks linked to the trade war seem to be easing, as the EU has not retaliated against US tariffs.

This is why we continue to believe that the ECB could proceed with a final rate cut as part of its risk management strategy, as we believe the risks of inflation remaining below target for a prolonged period are higher than those of inflation being too high. The December meeting could be an opportunity, particularly if the first inflation forecast for 2028 remains below 2% and growth remains weak at the end of the year. Moreover, weak German industrial data for August (production, orders, exports) confirms a temporary slowdown linked to trade tensions.

However, the minutes specify that ‘the materialisation of upside risks [to inflation] would, on the contrary, justify maintaining the current level of key interest rates’. ‘Some members’ even consider that inflation risks are skewed to the upside in the medium term, due to the possible transmission of US inflation, tensions in global production chains, and expansionary fiscal policies. This more hawkish rhetoric reinforces our concern that the ECB has adopted an asymmetric view of inflation, preferring inflation slightly below 2% rather than slightly above, as was the case before 2020. If so, rate cuts may already be over.

Les tensions sur la dette française ne se propagent pas aux autres pays de la zone euro

Regarding tensions surrounding French debt, the ECB emphasises that ‘despite political uncertainty in France, sovereign bond spreads vis-à-vis German Bunds have remained at the lower end of the range for euro area countries’. Indeed, the average spread in the euro area relative to German rates remains close to its lowest level since autumn 2022, and has only been lower during the period of quantitative easing and negative rates.

The ECB is therefore reassured by the fact that ‘fragmentation in euro area sovereign bond markets has decreased, despite the ongoing reduction in the Eurosystem's balance sheet and higher short- and long-term interest rates’.

We believe that the ECB will not intervene in the sovereign debt market as long as the tensions surrounding French debt do not spread to banks or other eurozone countries. In reality, the mere fact that the ECB can intervene in the event of systemic stress is enough to contain the risk of crisis, unless of course there is a marked deterioration in the political and budgetary situation in France.

Xavier CHAPARD

Strategist