Markets on edge in the run-up to Fed and ECB meetings

Link

-

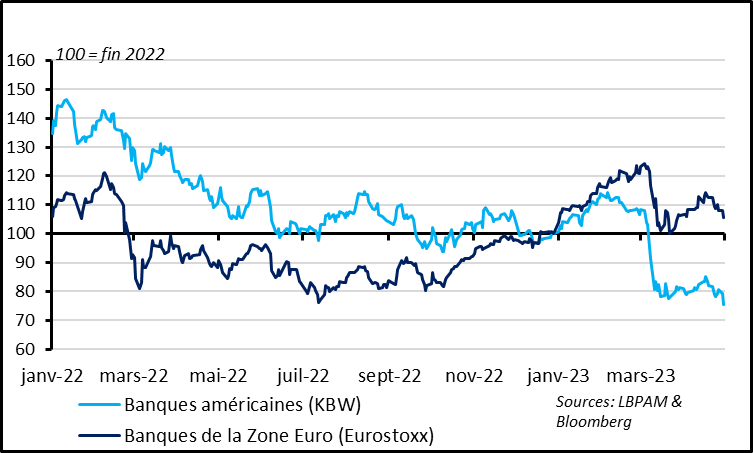

The markets are nervously eyeing the Fed’s decision this evening, after a resurgence in US regional bank stress and a steep drop in vacant jobs in March. US bank stocks fell by 4.5%, hitting a new low just one day after JPMorgan’s takeover of a First Republic Bank, a sign that financial stress remains high. Meanwhile, vacant jobs and resignations in March hit a more than two-year low, while remaining above their pre-Covid levels, which may suggest a more marked weakening in the job market. Even so, the Fed is likely to stick to its tough line after the unexpected 1st quarter increase in core inflation and wages (both close to 5%). We still expect the Fed to raise its rates by 25bp this evening to 5.25% and to flag that, while this could be its last rate hike for the moment, the risk on key rates remains on the upside. This could disappoint the markets, which continue to price in rate cuts as early as this summer.

- Tomorrow it will be the ECB’s turn. We expect it to raise its rates for its seventh consecutive meeting, but by a lesser extent (25bp instead of the 50bp of its latest three meetings). That said, a new 50bp hike remains possible and, most importantly, Christine Lagarde is likely to suggest that monetary tightening is probably not over.

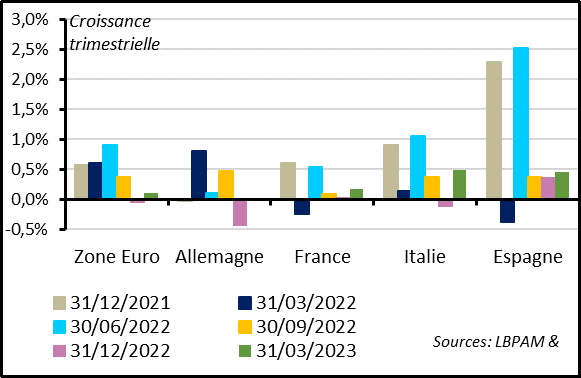

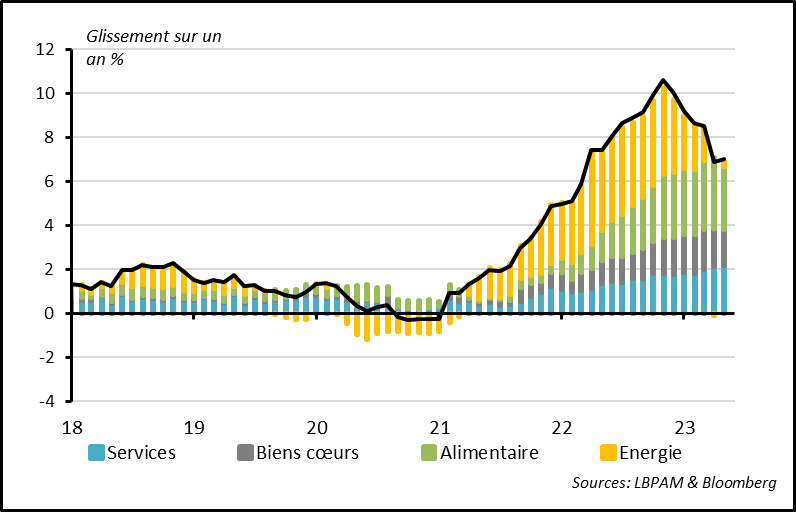

- Eurozone GDP expanded by 0.1% in the 1st quarter, driven by southern Europe, after having stagnated in late 2022. This confirms that the Eurozone managed to sidestep a recession this winter and is in line with the forecasts the ECB released in March. The gradual recovery in confidence indicators since early this year raises hopes that growth is nonetheless holding up, although it is likely to remain lacklustre. On the price front, inflation was stable in April in the Eurozone at levels that are still extremely high and above the ECB’s expectations (at 7% for total inflation and 5.6% for core inflation). The resilience of business activity and inflationary pressures point to a restrictive ECB.

-

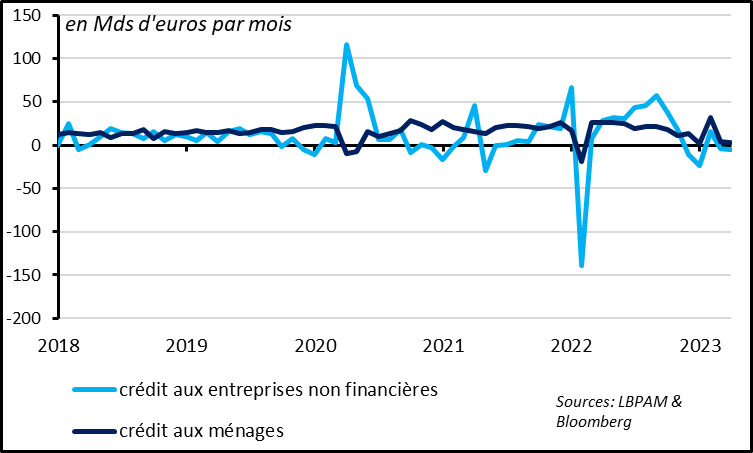

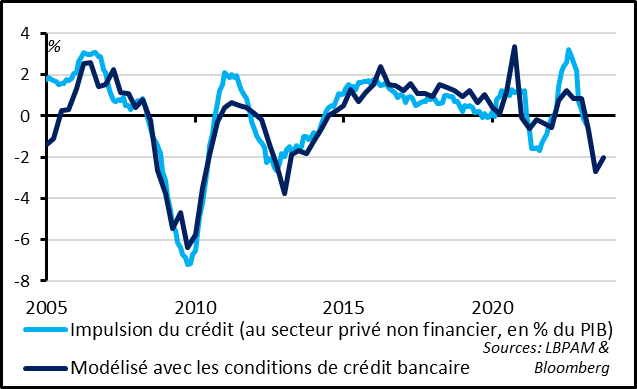

That said, Eurozone monetary data suggest that monetary tightening carried out already over the past year is beginning to have an appreciable impact on the real economy, which, in turn, suggests that the ECB will take a cautious stance. That’s why we expect the ECB to slow the pace of its rate hikes this week and to stabilise its key rate by this summer. Lending has slowed to households and especially to businesses since the end of last year, and banks report that both credit supply and demand got even worse in early 2023. Although banks are not reporting a heavy impact from the March episode of banking stress, this is consistent with a negative contribution by lending to growth beginning this quarter. Since February, sight deposits of both businesses and households have contracted for the first time since the creation of the Eurozone, something that should rein in private demand.

Fig. 1 – Markets : US bank shares have fallen further to their lows just before the Fed’s decision.

Fig. 2 – Eurozone : GDP up slightly in Q1, driven by southern Europe.

Eurozone growth moved slightly back into positive territory in Q1 to 0.1% after GDP had stagnated in Q4 2022. This confirms that the Eurozone avoided a recession this winter, in contrast to what might have been expected after last summer’s energy shock. This growth was slightly below consensus forecasts, but that was due solely to the steep drop in Irish GDP, which is notoriously volatile. When stripping out Ireland, Eurozone GDP expanded by 0.2% in Q1 after a 0.1% decline in Q4, which probably better reflects the Eurozone’s economy this winter.

By country, Germany’s GDP stabilised in Q1 after dropping in Q4 and it therefore continues to underperform the rest of the Eurozone. This is due to its greater exposure to Russian gas, eastern Europe, and the global manufacturing sector. That being said, we expect Germany to return to slight growth in the next few quarters, driven by an improvement in domestic conditions and China’s reopening.

France returned to slightly positive growth (+0.1%) after stagnating in late 2022, driven by foreign trade, public-sector demand and resilient business investment. However, household spending shrank, due to the hike in regulated energy prices early in the year and the decline in real-estate activity.

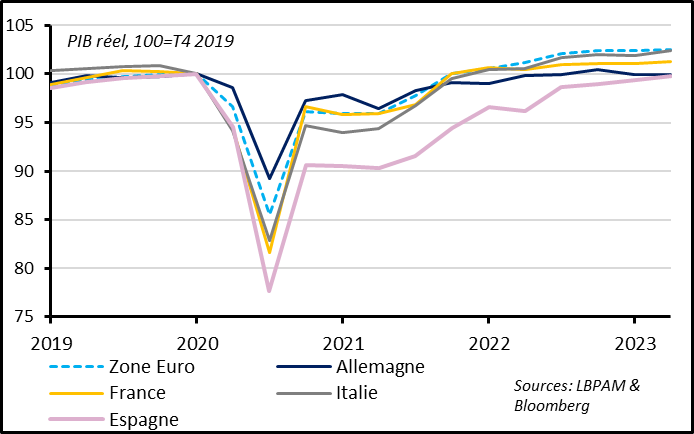

Fig. 3 – Eurozone : Spanish GDP still catching up; Italian GDP truly outperforming

Eurozone growth was driven in Q1 mainly by solid growth in southern Europe. Spanish and Italian GDP expanded by 0.5% in Q1 (and Portuguese GDP by 1.6%), thanks to the recovery of tourism and investment. While solid growth in Spain is mere catching up from a continued low base, in Italy it is a truly good surprise, especially given its heavy exposure to natural gas and the German economy. This suggests that European funds and the Draghi government’s reforms are paying off.

Fig. 4 – Eurozone : Inflation stable at a very high level in April

As expected, inflation rose slightly in the Eurozone in April, from 6.9% to 7.0%, due to less favourable base effects in energy this month. But inflation should begin to move back downward in the coming months, as energy prices had risen sharply from May to October last year. This is especially true, given that food inflation seems to have at last begun to slow in April for the first time in two years, while remaining high (at 13.6% after 15.5% in March).

In contrast, core inflation slipped lower for the first time in almost one year, from 5.7% to 5.6%. This is due to the slowdown in the price of manufactured goods for the second consecutive month. But inflation in services, which is historically more stubborn, has still not slowed and hit a new historic high of 5.2%.

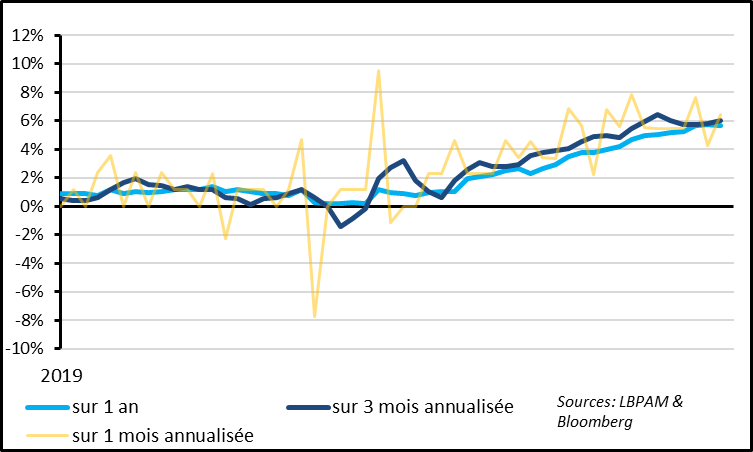

Fig. 5 – Eurozone : Core inflation still not slowing sequentially, which is not an encouraging sign for the ECB

While the ECB will probably appreciate the start of a slowdown in total inflation, food and goods, it is also likely to remain very concerned by stubborn inflation in services and by the fact that core inflation has shown no signs of relenting in recent months. In fact, core inflation is rising at an annualised pace that is faster over three months than over one year, suggesting that trend inflation has still not begun to slow.

Fig. 6 – Eurozone : slower growth in household lending and a decline in business lending since end-2022.

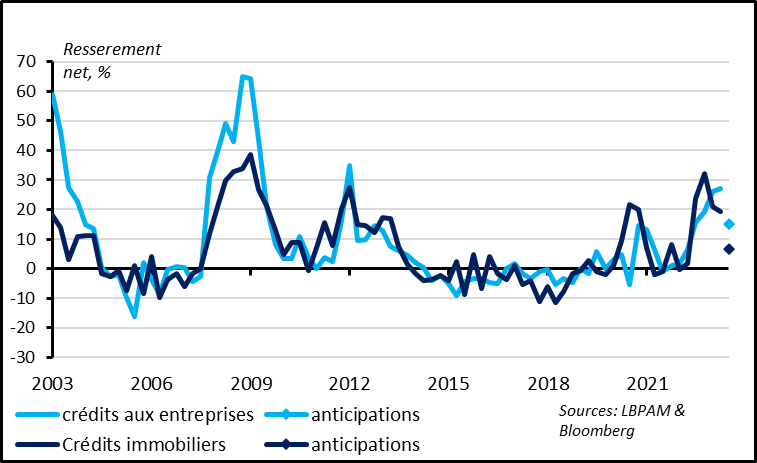

Fig. 7 – Eurozone : The banks report further tightening of their credit conditions but not more so since the mid-March episode of stress

The quarterly survey of banks on credit conditions published yesterday by the ECB was highly awaited after the March bout with banking stress, to see if it had had an impact on lending (the survey was conducted between 22 March and 6 April, i.e., after the failure of SVB). It revealed that Eurozone banks continued to toughen their credit conditions considerably, but no more so than in late 2022. This suggests that this tougher line is due more to the monetary tightening and to economic uncertainties rather than to financial fears. This is reassuring in that it reduces the risk of an abrupt rationing of lending. Even so, access to credit is becoming more difficult and will weigh on growth in the coming quarters.

Fig. 8 – Eurozone : tightening in credit conditions is just beginning to drag down Eurozone growth.

In addition to tightening of credit supply, Eurozone banks report that demand for credit slowed even more in early 2023, to an extent comparable to that of the financial crisis in the late 2000s for both households and companies.

Historically, tightening in credit supply and demand has led to slower growth of lending, which has, in turn, weighed on growth. According to our calculations, the impact of banking credit stimulus on Eurozone growth has been negative since February. And the tightening in current credit conditions is consistent with a contribution by lending of about -2 points of GDP to growth in the second half of the year. That’s why we believe that Eurozone growth will remain sluggish and that core inflation will begin to fall more steeply in the second half of the year.