Less synchronised monetary policies

Link

-

Expectations about the path of monetary policies remain at the centre of the market debate. However, it is now almost certain that the ECB will act before the Fed, cutting its key rates in June. For the Fed, the rate cut is likely to come later. We continue to expect two rate cuts this year. But recent comments from members of the Monetary Policy Committee have been very cautious. R. Bostic and C. Waller think that more time will be needed before any action is taken. The probability of less easing exists.

-

Our scenario is still based on our projection of a gradual slowdown in the US economy, converging towards its potential growth. The recent movement in the bond market partly reflects our forecast, with a sharper fall in real rates than in inflation expectations. The US 10-year real yield has fallen by 20 basis points (bp) since the end of April.

-

This slowdown is consistent with the latest US economic figures, which have been below expectations since the beginning of May, in contrast with the eurozone, which appears to be in a phase of gradual economic recovery, but still with relatively weak growth. This is why we believe, as does the market, that the ECB will indeed cut its key rates in June. This forecast was more or less confirmed yesterday by Mrs Lagarde, who also argued that inflation now seemed to be under control.

-

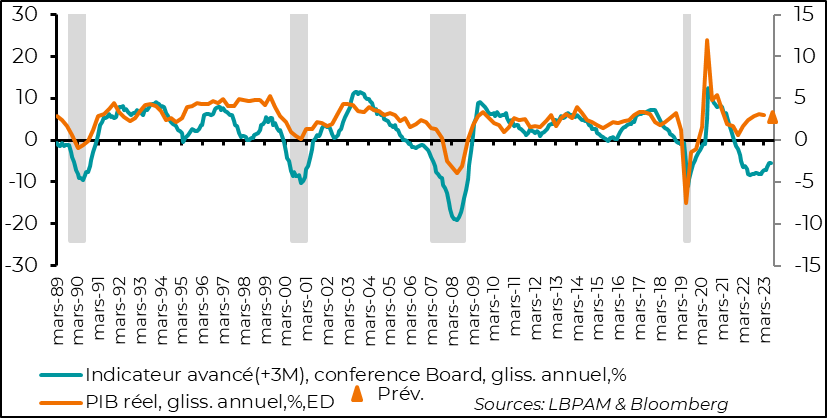

The Conference Board's leading indicator for April is still forecasting a slowdown. Admittedly, its signal has not been in line with the growth achieved by the US economy over the last two quarters, and the latest figure is less negative than it was six months ago. Nonetheless, its signal remains that a slowdown is on the way.

-

We continue to believe that a highly diversified asset allocation is justified, taking advantage of the carry offered by bonds, with a high degree of selectivity for the riskiest credit, and gaining exposure to equities by favouring companies with reasonable valuations that still have the capacity to preserve their margins.

-

Commodity prices continued to rise, especially metals. As we indicated in a previous note, there is a shortage of supply for some products, such as copper. Also contributing to the risk of higher end-product prices is the fact that the trend towards higher tariffs on Chinese products is continuing. Echoing the Americans, Latin American countries are also beginning to protect themselves against Chinese steel, for example.

-

Following the accidental death of Iranian President E. Raissi, the country's authorities announced that presidential elections would be held on 28 June. Given the tense situation in the region, some fear that uncertainty could escalate. Nevertheless, most experts see a status quo in Iran with someone close to the regime as the most likely successor. In other words, a president as conservative as E. Raissi. At this stage, the price of oil, down to $82 a barrel for Brent crude, does not appear to be incorporating an additional premium.

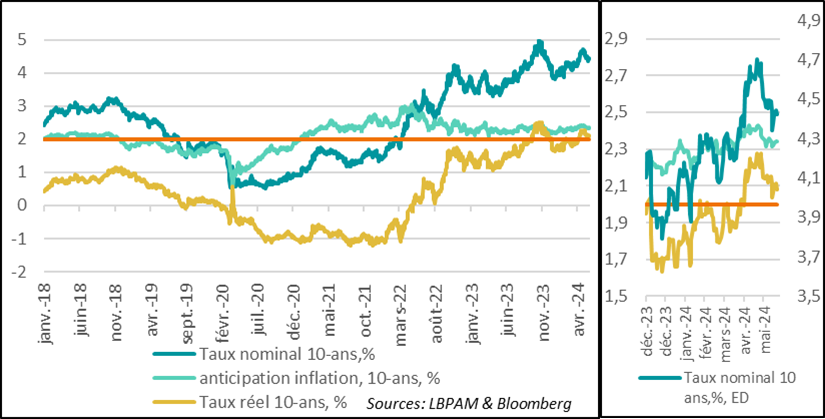

US long-term rates have adjusted to expectations of future rate cuts, but more recently also seem to be incorporating the possibility of a slowdown in growth. Indeed, despite expectations of much smaller cuts in key rates in 2024 than the very aggressive expectations at the start of the year, statements by central bankers indicating that they still expect rate cuts over the coming year have certainly contributed to the fall in nominal rates since the start of May. Nevertheless, this fall also seems to reflect a gradual downward adjustment in the growth outlook for the US economy.

So, if we break down the US 10-year yield into its inflation expectations component and its real component, we see that it is the real component that has made the biggest contribution to the recent adjustment in long-term yields.

Obviously, this breakdown is a little simplistic, as long rates also include a term premium, which should reflect the uncertainties associated with holding a bond over a long period. However, calculations of this premium show that it has returned to almost zero. This suggests that it is growth expectations that have adjusted downwards. This expectation should therefore reflect the equilibrium rate of the long-term neutral real rate.

Fig.1 US long-term rates: the latest fall in long-term rates was dominated by a fall in the real rate,

consistent with a trend towards economic deceleration.

- Nominal rate, 10 years, %.

- Inflation expectations, 10-years,% (%)

- Real rate 10-year,% (%)

- 10-year nominal rate,%, ED

Compared with the experience of the past 15-plus years, the current real rate, still above 2%, remains well above what we have seen. In our view, the real rate will remain higher than in the period following the financial crisis of 2008-2009, although it is still likely to adjust downwards.

However, in the very short term, given the very strong performance of the US economy, it is likely to remain higher until there are clearer signs of a slowdown in growth.

However, there are signs that the economy is cooling. We saw this in the ISM surveys (services and manufacturing) for April, and in the retail sales figures, which seemed to indicate a ‘pause’ in consumer appetite.

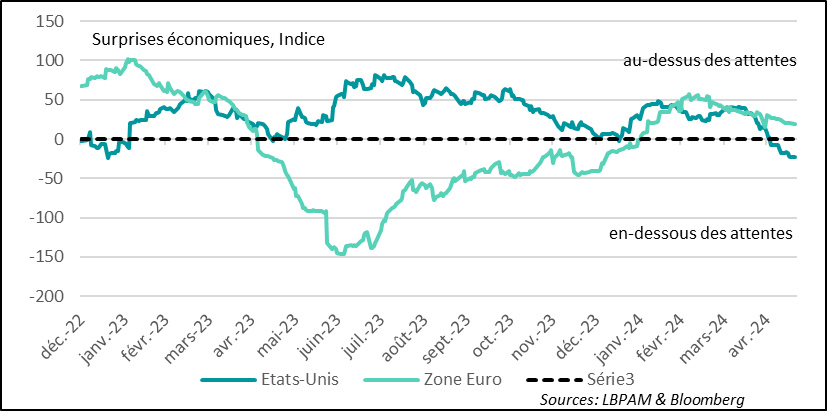

In fact, for the first time in over a year, economic figures across the Atlantic have been below expectations since May.

Of course, we have seen similar periods since the post-Covid recovery, with the economy bouncing back fairly quickly. But this time, some of the support from past years that could fuel a new rebound is dissipating. The savings accumulated by households and the strength of the fiscal stimulus do seem to be diminishing, even if not completely. The fact remains that, despite the maintenance of high key interest rates, financial conditions in the United States have eased considerably since the start of the year, which is supporting growth.

Fig.2 Economic surprises: economic data in the eurozone continue to be better than expected,

while in the United States they are more negative.

- United-States

- Euro Zone

- Series3

While it is still difficult to say whether the factors supporting growth or those pointing towards a slowdown will prevail, the fact that key interest rates are still high because of inflation, which will be slow to converge towards 2%, leads us to believe that a slowdown will indeed occur, all the more so if the contribution to growth of public spending is reduced as we expect.

Supporting the idea of a slowdown, we had the publication of the Conference Board's leading indicator for April. It fell more than expected over the month, but in year-on-year terms, the fall was slightly more moderate than in the previous month. Nevertheless, it is still in very negative territory, suggesting that growth is likely to slow.

Of course, some may think that this indicator has lost its relevance, as it was anticipating a recession in 2023, which never happened. Nonetheless, it seems to us that the very special period we experienced last year, with a surprise fiscal stimulus in particular, goes some way to explaining the fact that for the first time in several decades, this index's trend indication has been wrong.

We can still give it a ‘second’ chance. Especially as the variables that make up this leading indicator remain more than relevant.

Fig.3 United States: The Conference Board's leading indicator remains in very negative territory,

consistent with a gradual slowdown in the US economy.

- Leading indicator (+3M), Conference Board, year-on-year,%.

- Real GDP, year-on-year,%,ED

We continue to justify our forecast of two rate cuts by the fact that the US economy will slow from 2Q24. This will be consistent with the Fed's dual mandate, which is to maintain full employment while keeping inflation close to its target.

In our view, inflation will slowly converge towards the target, but will only do so if growth decelerates.