"Liberation Day" is approaching

Link

What is "Liberation Day" according to Donald Trump? Find out in the market analysis of March 24, 2025.

Summary

► Donald Trump is expected to announce on April 2nd the level of tariffs on countries with higher tariffs than the United States. However, whether it concerns goods or product lines, this remains unclear. The American president calls this day "Liberation Day." To reassure the markets, his team has repeatedly stated that the extent of these tariffs should be less than anticipated and more targeted. At this stage, it is difficult to make a definitive statement, especially since the president's advisors are counting on hundreds of billions of dollars in revenue for the state in the coming years.

► For the market, having more clarity will be very important given the volatility induced by the erratic measures taken by D. Trump. It could also be a day of liberation. However, considering the current government's track record, it is difficult to bet on this outcome with certainty. Nevertheless, if the level of tariffs is lower than we anticipated, the negative impact on American growth and the effects on the rest of the world would be less severe.

► A less negative anticipation of tariff measures may be the reason for the stabilization of American stock markets at the end of the week. Indeed, a more constructive scenario (a much lower impact of tariffs on growth) would allow for a resurgence of colors. Above all, this could halt the clear outperformance since the beginning of the year of value stocks (relatively inexpensive compared to their earnings) in relation to so-called "growth" stocks. However, given the vehemence of the American president's statements on the subject so far, it is still difficult to be overly optimistic.

► Furthermore, the acceleration of the punitive campaign led by the new government against its opponents of all kinds risks further weakening the climate of confidence in the country and harming growth. All these elements lead us to remain cautious about American risky assets.

In Europe, we expect this week the first indications from the March PMI on the potential impact that shock policies taken by the German government may have on businesses. At this stage, we should expect a rather moderate effect due to an uncertain economic situation, especially given the risks on American tariffs.

► In France, we already have the results of the INSEE survey of businesses on the business climate. It emerged that the general situation is improving slightly, even though the index across all sectors is still below its historical average. In the industry, unfortunately, the situation is deteriorating slightly compared to the previous month. Good news nonetheless: future production prospects are picking up.

To do deeper

On April 2nd, the tariffs that should apply to goods imported by the United States are expected to be announced. Indeed, on April 1st, President Trump will receive the conclusions of the Department of Commerce's analyses on the trade practices of its partners. The idea behind this initiative was to have a policy of "reciprocity," meaning, in simple terms, for each product, the level of tariffs between the United States and its trading partners should be the same. We know that such a policy is impractical. Above all, the basic idea behind this logic, that the United States has been the laughingstock in global trade, is false.

While until now, we could expect the worst, given the measures already taken against Mexico, Canada, or China, as well as on aluminum and steel, it seems that D. Trump's advisors have managed to reduce the extent of the new tariffs that would be imposed. At least, this is what these same advisors have been communicating to the market in recent days.

They emphasize that the decisions that will be made will be much more targeted than the market might think.

It is obviously difficult to take this information at face value given the president's aggressive messages over the past two months in office. Especially since some of his advisors continue to stress that the new tariff regime should bring hundreds of billions of dollars in new revenue to the American Treasury.

On the other hand, it is certain that a less aggressive American foreign trade policy than what has been displayed so far could change market expectations, and obviously ours, on global growth prospects.

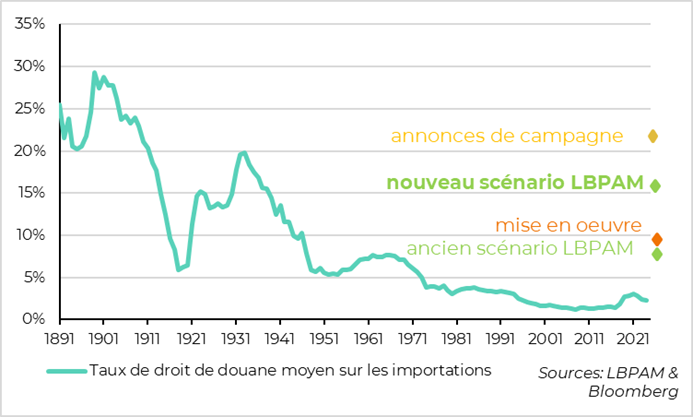

With the measures already taken and our assumptions on tariff increases on the European Union, we had increased the level of American tariffs by just over 12 percentage points, bringing them to 15%. This had led us to significantly change growth (less) and inflation (more) prospects in the United States, notably.

United States: on tariffs, our current scenario takes into account what has already been announced and our expectations on upcoming measures

A more moderate effect, due to lower tariffs, would have a positive impact on the markets.

We remain skeptical about the moderation of D. Trump's strategy. His negotiation strategy so far has been very political. It is therefore difficult to see a very strong moderation in it. Nevertheless, we must remain flexible and adapt in case of good news.

In particular, the American market has strongly outperformed since the beginning of the year, with a decline in major stock indices. The market has largely been affected by the risk of a negative shock to growth. Indeed, so far, most announcements have been rather anti-growth, the opposite of what was expected.

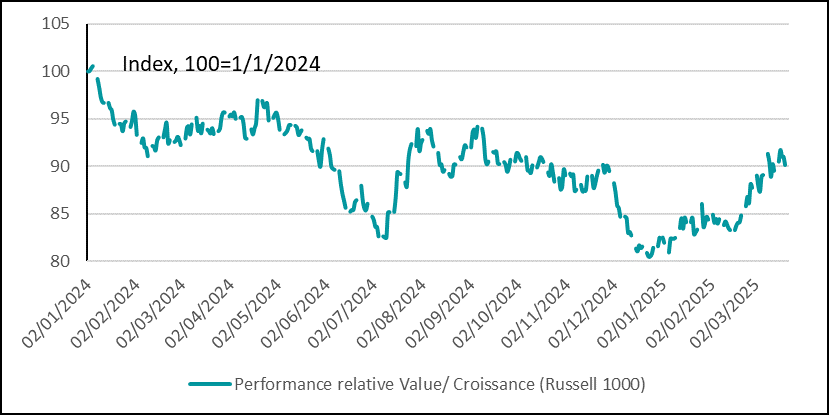

This can also be seen in the outperformance of so-called value stocks (i.e., relatively inexpensive compared to their earnings) against growth stocks. This dynamic is often observed when the market anticipates a slowdown in economic activity. This view on weakening growth prospects has also been reflected in the decline in long-term American interest rates and has been integrated into the new Fed forecasts.

United States: in the stock market, since early 2025, investors have favored relatively cheaper stocks (value), more resilient in an economic slowdown

We will see this week if communications intensify regarding the moderation of trade policy or not. Part of the market continues to strongly believe in the "Trump put," meaning his willingness to protect the market in case of a downturn. He did this repeatedly during his first term by attempting to support the market in his speeches, and especially through a significant reduction in corporate taxes. This time, it is less the case. It seems that the president's political objectives and considerations aimed primarily at protecting his supporters are more important.

The approach of D. Trump that we observe today seems to be fueled by an attitude that primarily aims to punish all his opponents, regardless of the consequences. It is difficult to predict what the economic consequences of this approach will be. So far, the only indications come from sentiment surveys that are deteriorating. It will take several months to see real impacts on the real economy.

We remain very cautious about American risky assets, even though we must stay agile in case of a potential reversal of the policies announced so far by D. Trump, particularly in terms of trade.

In the eurozone, we expect this week the PMI indicators for March to see if the historic decisions taken by the German government regarding budget spending already have a positive effect on businesses.

It is obviously premature to expect a radical change, as the situation in the industry remains quite precarious in the region, and anxiety is high regarding potential American tariffs. However, businesses could show a bit more optimism about the future.

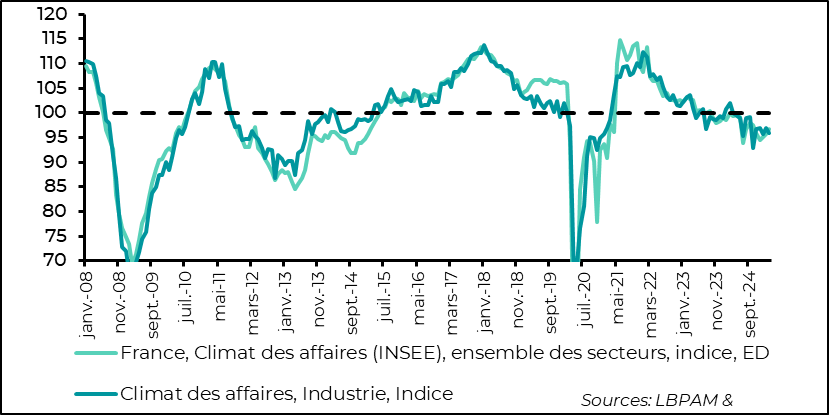

In this regard, we received the INSEE survey of French businesses for March on the business climate. The confidence index showed a slight increase compared to the previous month. This is its third consecutive rise. Nevertheless, it remains below its long-term average. This rise in confidence is also reflected in an improvement in the employment climate index.

However, in the industry, we observed a slight decline in the confidence index, notably affected by less promising new orders.

France: INSEE survey for March, according to businesses, the business climate is improving slightly but still deteriorating in the industry

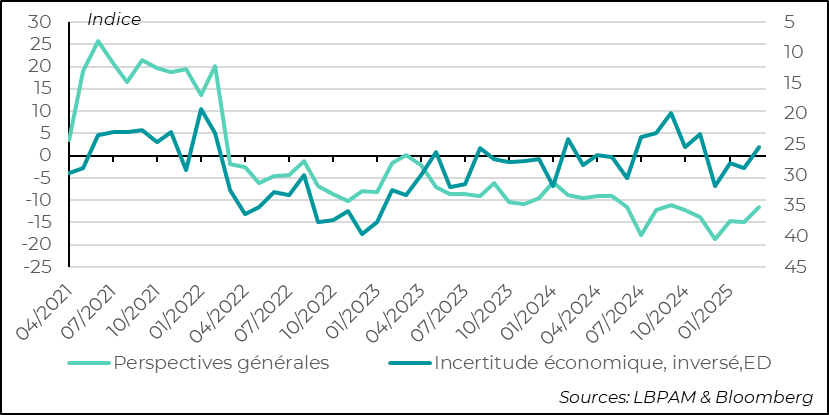

Despite the deterioration of confidence in the industry, it is worth noting that, at the level of general production prospects, the balance between positive and negative responses is improving. This can be partly attributed to a slightly more stable political situation, as indicated by the decline in the economic uncertainty indicator.

France: in the industry, despite a slight deterioration in the general climate, production prospects are improving, coinciding with a decrease in uncertainty

We continue to believe that the European recovery will be very gradual. Nevertheless, it is clear that the positive budgetary shock, notably from Germany, and the continued reduction in the ECB's key interest rates should help accelerate the recovery in the coming quarters. However, there remains significant uncertainty regarding American trade policy.

Sebastian PARIS HORVITZ

Head of Research