Market doubts

Link

- Over the past few days, a wave of doubt about the future has swept through the market, drowning out risk appetite. This has been fuelled by long-term interest rates which, on both sides of the Atlantic, have reached levels not seen for over 10 years. Doubt seems to have somewhat dented the prevailing scenario of a soft landing for the US economy, in particular, which would succeed in maintaining relatively solid growth, while inflation would gradually decline.

- Two alternative scenarios seem to have crept into investors' minds. On the one hand, the possibility of a more sustainable monetary tightening due to more persistent inflationary pressures resulting from relatively higher growth for longer. A permanently tighter monetary policy would clearly not be good news. On the other hand, the scenario we continue to advocate, that of a marked deceleration in growth, under the delayed effect of a very restrictive monetary policy. Given the surprises we've had since the start of the year, we're aware that it's still very difficult to predict with any certainty how the economic cycle will unfold. But we believe that our scenario of mediocre growth over the next 6-9 months, in both the Eurozone and the US, remains the most likely. This is why we remain very cautious in our asset allocations. We are maintaining our underweight in equities, albeit slightly, but with a bias towards quality, and a very selective exposure to bonds, while retaining a relatively large, well-interest-bearing cash cushion.

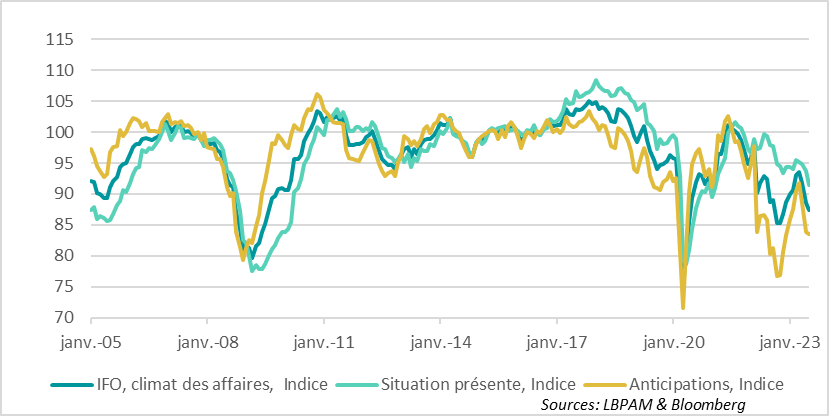

- Keeping up with growth momentum remains a priority. Thus, unfortunately unsurprisingly, the IFO survey for Germany in September confirmed the mediocre state of the economy, with the total index maintaining its downward trend. The IFO index remains well below its historical average. The present conditions sub-index continued to fall, while the outlook sub-index rose slightly. It remains to be seen whether the coming months will see a stabilization in activity, as the German services PMI seemed to indicate. Nevertheless, we believe it is difficult to envisage a short-term rebound in activity, all the more so in this context of high interest rates and, now, a rising oil price.

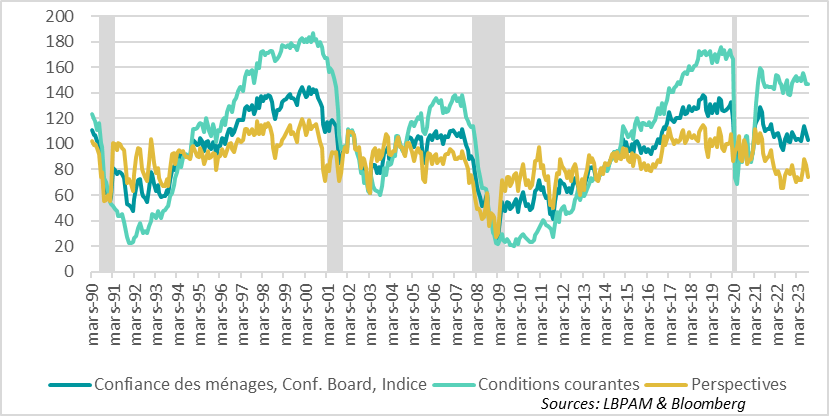

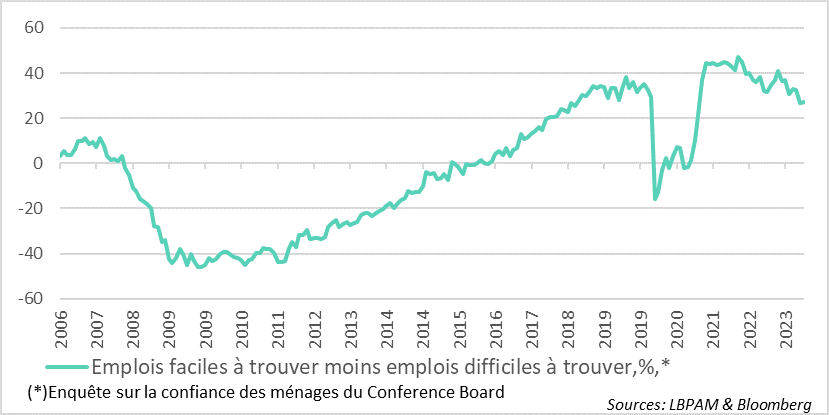

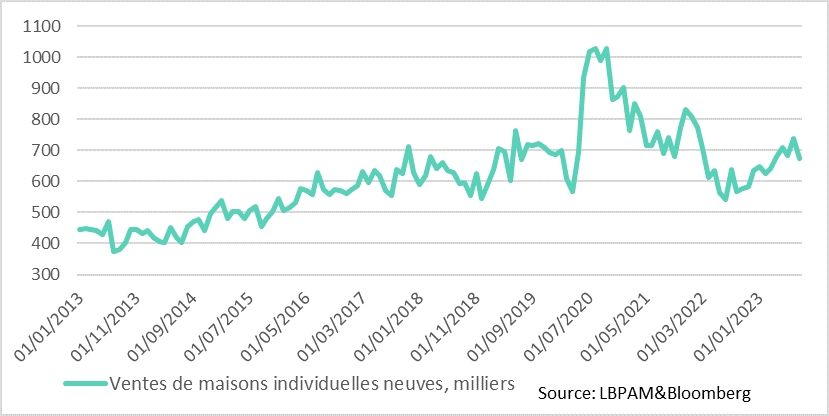

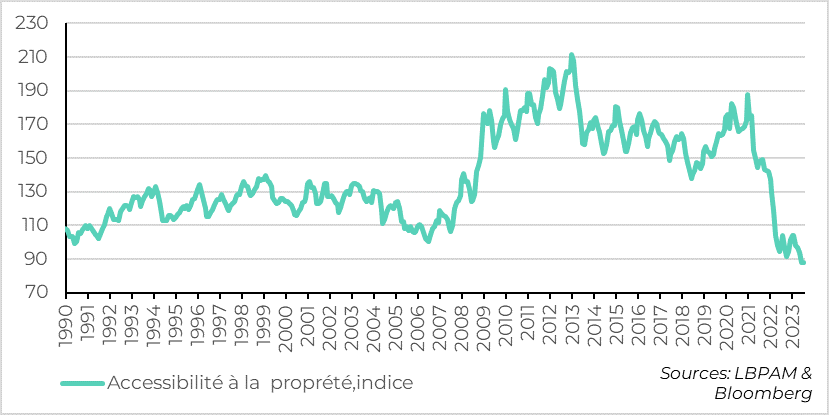

- In the United States, the Conference Board's household confidence survey showed a deterioration to its lowest level for three months. It would appear that concerns about the worsening economic situation have contributed to this deterioration, while the rise in gasoline prices is eroding purchasing power. At the same time, the labor market situation is still perceived as favorable, even if the gap between those who find it easy to find a job and those who find it more difficult has remained close to its lowest level since spring 2021. Confidence is also affected by the cost of credit, with mortgage rates approaching 8% (for a 30-year loan), the highest level since 2000. This seems to be breaking the upward momentum of the real estate market, as evidenced by the fall in new home sales.

- In China, despite some signs of stabilization in the industry, thanks in particular to public-sector infrastructure spending, the real estate sector remains in an extremely fragile state. The saga over the future of Chinese property developer Evergrande, the world's most indebted company, continued with new defaults on debt servicing. Private developers remain under pressure, and it is difficult to foresee a rapid exit from the slump, despite the demand stimulus measures recently put in place.

The rapid deterioration in activity in the Eurozone was one of the bad news stories of the summer. The big countries, France and Germany, saw the greatest deterioration. The IFO survey for September confirmed this weakening of the German economic situation. The overall index continued to fall, remaining well below its historical average. At the same time, the fact that the outlook indicator is stabilizing could indicate a slight stabilization of the economic situation over the coming months. Indeed, the gap between the outlook index and the current situation, which has become more favorable, is often an indicator of future improvement. Nevertheless, at this stage, against a backdrop of high interest rates and now rising oil prices, it is difficult to see a quick rebound. We are still expecting activity to stagnate for at least a few quarters.

Fig.1 Germany: Business conditions continue to deteriorate, as shown by the latest IFO survey.

In the United States, the Conference Board's consumer confidence survey for September showed a sharp drop of more than 5 points. Fears about the outlook for the economy largely explain this trend. Indeed, the consumer expectations indicator fell by almost 10 points over the month!

The recent rise in petrol prices, which is eroding purchasing power, is obviously no stranger to this deterioration in households' perception of the future, but more fundamentally it is the fear of a more marked deterioration in the economy in the future that seems to dominate household sentiment.

Fig.2 United States: household confidence, as measured by the Conference Board, worsens in September, mainly due to the outlook

At the same time, the job market situation remains an important support for consumers. In fact, the Conference Board survey shows that favorable perceptions of the labor market situation still far outweigh unfavorable ones. Nevertheless, although the latest statistic is up very slightly, the trend in the difference between those who find it easy to find a job and those for whom it is more difficult to find one, has indeed taken a downward trend and is below the pre-covid level. But, with the unemployment rate still very low (3.8%), it's hard to see households feeling negative about employment. The months ahead will be very important in determining whether or not employment remains a bulwark for US growth.

Fig.3 United States: The favourable employment situation remains a positive factor for households, even if it is gradually becoming less buoyant.

Nevertheless, there are signs of weakening in some sectors that had so far held up much better than expected, notably real estate. For example, the latest data on new home sales showed a sharp fall in August, of almost 9%. At the same time, if these statistics are seasonally adjusted, August is still a rather weak month in terms of sales. We'll have to wait and see if this trend continues in the coming months. Especially as house prices continue to rise.

Fig.4 United States: The real estate market seems to be suffering from the sharp rise in the cost of credit, as shown by the recent drop in new home sales.

Even so, the recent sharp rise in the cost of credit, the resumption of house price rises, and incomes in real terms that are holding up, but not exploding, should have a negative impact on real estate in the months ahead, in our view.

In this respect, it's worth noting that the US Association of Realtors' Housing Affordability Indicator (integrating house prices, incomes and the cost of credit) is at an all-time low.

Fig.5 United States: Home affordability at an all-time low

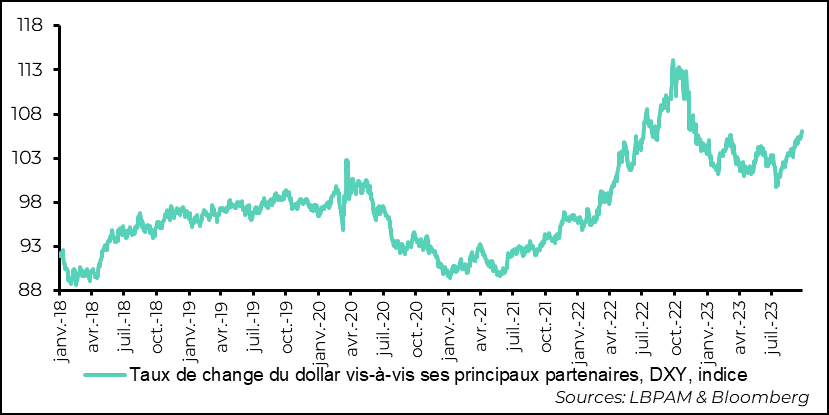

Amid market doubts, fuelled by fears that the Fed will raise rates again, as Minneapolis Fed President N. Kashkari indicated, the dollar is once again gaining ground, reaching its highest level of the year against the major currencies.

As we all know, a sharp rise in the dollar will only complicate central bank policy in many countries, particularly in the emerging world.

Fig.6 Dollar: strengthened sharply in view of the resilience of the US economy and the prospect of further tightening of monetary policy