Markets celebrate slowdown in US employment

Link

- U.S. yields continue to fall, as signs of a slowdown in the U.S. job market support expectations of rate cuts by the Fed. The US 10-year yield fell back below 4.2% for the first time since early September, allowing equities to approach their July highs. Market expectations for the Fed and the ECB - a first rate cut in Q1 and a total cut of over 125bp next year - now seem a little optimistic.

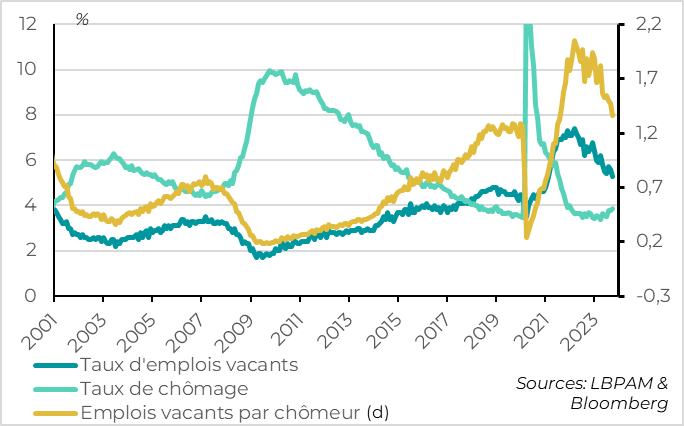

- The number of job vacancies in the USA fell sharply in October, to its lowest level since early 2021. Combined with the slight rise in unemployment, the ratio of vacancies per unemployed person eases markedly, from 1.5 to 1.3, although it remains slightly above its pre-Covid level.

- The slowdown in the US job market is good news for the Fed. It suggests that wage and inflationary pressures will continue to normalize if the rebalancing continues. For the business cycle, on the other hand, the risk of a more abrupt slowdown in the US economy is increasing. The moment of truth for the post-Covid landing scenario is approaching.

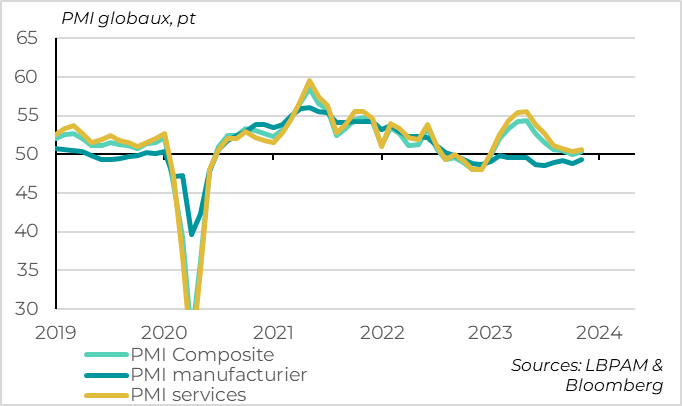

- The global composite PMI rose from 50.0 to 50.4pt in November. This is reassuring after 5 consecutive declines which had brought the index to the edge of the contraction zone. But the PMI remains at a low level, consistent with below-normal global growth.

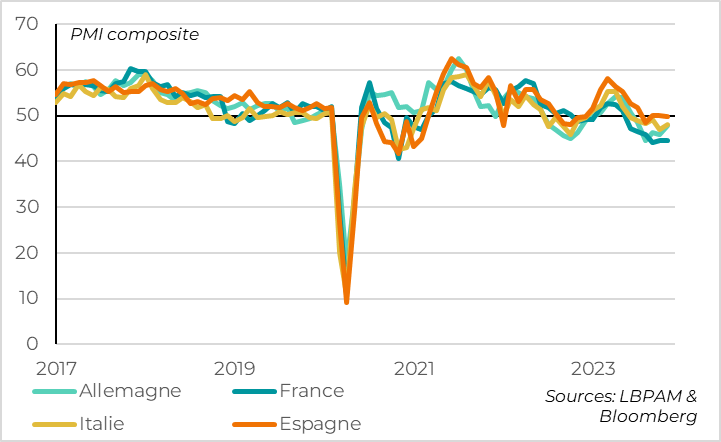

- The slight improvement in the global PMI is mainly due to the lesser contraction of activity in Europe, while the Chinese remain broadly stable just above the 50-point mark and the Japanese PMI falls back below 50pt for the first time since last year. In Europe, Spain and Italy continue to hold up well, while Germany seems to be starting to stabilize. But the French PMI remains very weak.

- The ISM US services index, one of the best coincident indicators of US growth in recent times, was also reassuring. It reversed part of its sharp decline in October, rebounding from 51.8 to 52.7pt. This suggests that the US slowdown will remain gradual until November. On the other hand, this indicator provides little information about activity in the months ahead.

- Chinese assets are suffering again this week, this time following the announcement by rating agency Moody's that it has lowered its outlook for China from neutral to negative. This reflects the growing long-term risks associated with local government indebtedness and property sector adjustment as potential growth declines. But this is no surprise, and China remains highly rated. We do not expect this decision to have any material impact.

Fig.1 USA: job market eases sharply in October, with a clear drop in job vacancies

The number of job vacancies in the USA fell sharply in October, from 9.35 million to 8.73 million. As a percentage of the labor force, the number of job vacancies fell from 5.6% to 5.3%, remaining above its pre-Covid level but at its lowest since early 2021.

Business demand for jobs is normalizing, while the number of jobseekers is rising, indicating a rebalancing of the labor market from an overheated post-Covid situation. Indeed, the unemployment rate climbed back to 3.9% in October, 0.5pt above its low point at the start of the year.

The fall in the vacancy rate and the rise in the unemployment rate led to a sharp drop in the number of vacancies per unemployed person, a measure often cited by the Fed to gauge tensions on the job market. In October, there were 1.3 unfilled jobs for every 1 unemployed person, compared with 1.5 in September. This is well below the 2 reached in 2022, although still slightly above the pre-Covid level of 1.2.

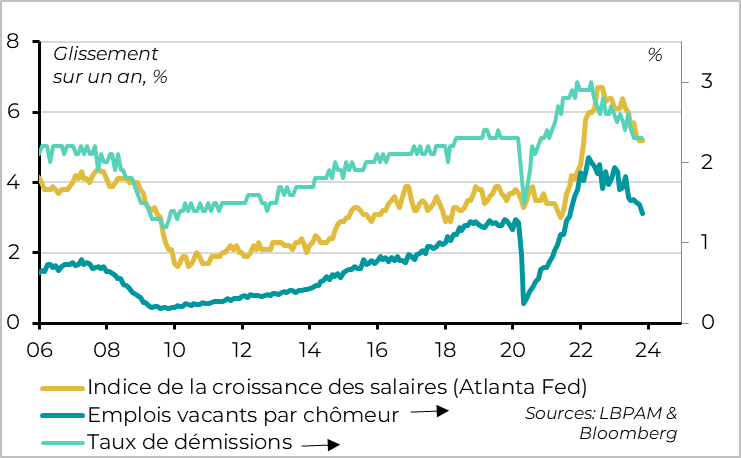

This is good news for the Fed, as it indicates that the rebalancing of the labor market is progressing, which should, if it continues, reduce pressure on wages and hence domestic inflationary pressures. Especially as, at the same time, the resignation rate has stabilized at its pre-Covid level of 2.3% for several months. These ratios are historically leading indicators of wages, and suggest that wage pressures should continue to ease gradually.

On the other hand, the slowdown in the job market increases the risk of an abrupt economic slowdown in the months ahead. The decline in job vacancies, while reducing inflationary pressures, reflects the fact that companies are becoming more cautious in their spending. This is also indicated by the fall in orders for capital goods since the summer, which suggests less demand for CAPEX.

The moment of truth is approaching. The Fed wants to slow corporate demand without causing a cycle reversal. So far, it's succeeding. But the evolution of corporate spending on employment and investment is what makes economic cycles, and when companies start to retrench, they rarely stop before the economy slows sharply. We'll see in the coming months whether the soft landing the Fed and the markets are dreaming of comes to pass, or whether the slowdown in the US economy is more abrupt, as we fear.

Fig.3 United States: US business resilient but with limited momentum

The U.S. ISM services index, one of the best coincident indicators of U.S. growth in recent times, is reassuring, reversing part of its sharp October decline in November. It does, however, indicate limited growth and provides little information about activity in the months ahead.

The ISM services index rebounded in November after its sharp fall in October, from 51.8 to 52.7pt. This remains well below its historical average (55pt) and, according to the ISM, compatible with growth of around 1%. This confirms the slowdown in growth compared with the over 5% achieved in Q3. But it remains clearly above 50pt, suggesting that growth remains positive in November.

Note, however, that the ISM services index is a volatile indicator, very good for gauging activity over the month, but not for anticipating the trend in activity over the coming months. So all we can say is that, so far, the US economy is holding up well.

Fig.4 World: PMIs improve slightly overall in November

Overall, the global composite PMI rose from 50.0 to 50.4pt in November. This is also reassuring after 5 consecutive declines, which had pushed this coincident indicator of global activity to the borderline between contraction and expansion in October. But it remains at a low level, consistent with below-normal global growth.

In terms of sectors, the slight improvement comes from both industry and services, although the industrial PMI continues to underperform and remains in contraction territory.

Fig.5 Eurozone: activity remains resilient in southern Europe

In geographical terms, the slight improvement is mainly due to the lesser contraction of activity in Europe, while the US and Chinese PMIs remain stable just above the 50-point mark, and the Japanese PMI falls back below 50pt for the first time since last year.

This is good news for Europe as the first activity data for October continued to fall slightly (car sales, industrial production in France and Spain, German exports). The good news in November's PMIs came from the stabilization of activity in the UK, whose PMI rose back above 50pt for the first time in 4 months, and the rebound of the German PMI from very depressed levels (to 47.8pt). Italian and Spanish PMIs are also reassuring, remaining close to 50pt thanks to the resilience of services. In contrast, the French PMI remains very depressed at just 44.6pt. All in all, these data support our scenario of long stagnation in the eurozone rather than recession at the turn of the year.

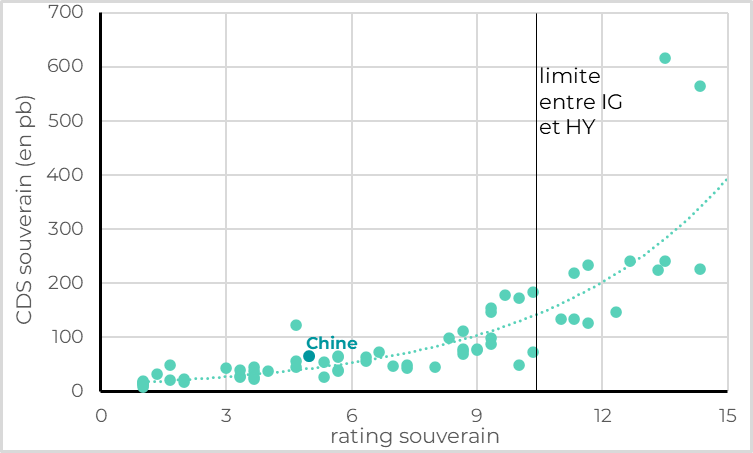

Fig.6 China: Moody's may downgrade China's sovereign debt rating, but it remains highly rated

LRating agency Moody's has lowered its outlook for China from neutral to negative, indicating that it could downgrade its rating from A1 in the coming quarters. The agency justifies this downgrade risk by the risk that the central government in Beijing will have to come to the aid of highly indebted local governments and absorb losses linked to the adjustment of the real estate sector. This is hardly a surprise. Indeed, while central government debt is stable at just 20% of GDP, public debt, including local governments, has risen by 15pt of GDP since 2019 to reach 76% of GDP by 2022. Moreover, China's credit market has always suffered from distortions linked to the central government's implicit guarantee in many sectors of the economy, which encourages the misallocation of resources.

This downgrade highlights China's structural difficulties, in particular the decline in potential growth and the explosion in credit over the past few years. But it is unlikely to have a significant impact. Rating sovereign countries that issue almost all their debt in their domestic currency makes little sense, as the risk of default is virtually nil. This has been shown by the downgrades of the USA and Japan over the years. The impact of a rating downgrade could be significant for a country at risk of changing category (i.e. from Investment Grade to High Yield), as some investors would be forced to sell these bonds. But China is rated 6 notches above this limit by Moody's, Fitch and S&P (A+ with a stable outlook).

In fact, investors continue to have confidence in Chinese public debt following this announcement, which only resulted in a 4bp spread in sovereign CDS, in line with its average level of 65bp over the past few years.

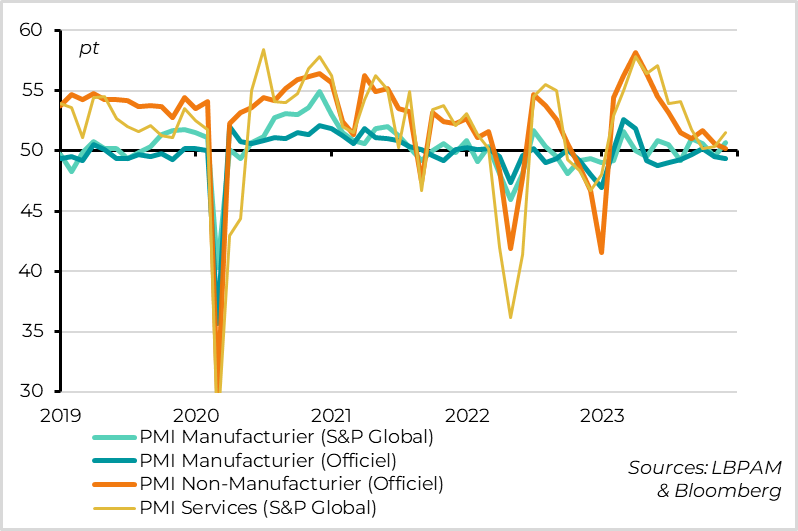

Fig.7 China: PMIs diverge in November but remain limited overall

On the economic front, Chinese PMIs were mixed in November, but overall indicated stable growth at a limited level.

Official PMIs fell sharply in November, with the manufacturing PMI staying below 50pt and the services PMI falling into contraction for the first time outside co-financing periods. By contrast, private PMIs (published by Caixin and S&P Global) rebounded in November for both industry and services, and are now in the expansion zone.

This complicates the reading of China's economic situation, especially as historically, none of the PMI sources is better than the other at forecasting activity. If we simply take the Chinese PMI rate average, it cancels out its decline of the previous month in November, but remains at a fairly low level of 50.5pt.