Markets reeling from tariff shock

Link

Find the market analysis of April 2, 2025, signed by Sebastian PARIS HORVITZ

Key Points

► The announcement by Donald Trump of a historic unilateral increase in American tariffs on nearly half of the countries around the globe devastated the markets at the end of last week, with investors seeking to reduce risks in their portfolios. However, finding a roadmap to navigate the uncertainty generated by American economic policy will remain extremely difficult, potentially leading to even harsher penalties for risky assets, especially those most sensitive to the economic cycle. We remain very cautious in our allocations.

►At this stage, we believe that the decision made by the American administration is an economic policy mistake. In this sense, it should have a detrimental impact on the economy, contrary to the sought-after prosperity objective. For the vast majority of economists, as it stands, the decision creates the risk of a global recession in 2025, starting with the United States. According to us, the probability of an American recession is currently around 50%. The tariff increase should be seen as a huge tax on consumers and businesses.

►Obviously, the effects of these tariffs will only be seen gradually, and the effects will be really strong around mid-2025. In the meantime, these tariffs may be negotiated and reduced. But nothing is certain, not knowing what D. Trump wants, except to reduce the American trade deficit to zero. Also, things could worsen with retaliatory measures, such as those taken by Chinese authorities to increase their tariffs to 34%, the level imposed by the United States. The European Union is also ready to act.

►The positive factor for the resilience of the global economy is that this shock occurs at a time when growth remains fairly solid. Even in the United States, we observed that job creation remained strong in March (+228 thousand). Also, in the eurozone, starting with Germany, growth should be supported by a significant increase in public spending (around 0.2-0.3 points of GDP). And Chinese authorities also seem inclined to do more to support the domestic economy. However, this resilience could falter in the event of a strong American contraction.

►In the United States, the Senate has just passed, with Republican votes, a budget bill different from that of the House of Representatives. With a considerably larger public deficit. Opening the door to more tax cuts and fewer budget cuts. It is not clear that this proposal will pass in the House of Representatives. In any case, these tax cuts will only apply in 2026, so they should not mitigate the recessionary effects of the tariffs in 2025.

►Of course, there is what central banks can do. J. Powell, the Fed chairman, said on Friday that the tariff increases could have lasting effects on prices, which will need to be taken into account in the central bank's decisions. But at this stage, "patience before any adjustment remains the order of the day," he said. We now think that the Fed will have to cut its key rates three times in 2025 to counter the risks to growth.

►According to us, if considering the short term is already complex, the medium term becomes even more difficult to read. Even if the major technological trends should not change, they may develop in a very uncertain regulatory context. Certainly disrupting investment decisions. President Trump has already profoundly changed the geopolitical framework and undermined the common rules that had been built over decades to manage world affairs. The American Secretary of Defense said a few days ago in Japan that America First did not mean alone. It seems that his opinion is different from that of the president.

To go further

The sharp decline in global stock markets clearly reflects the significant fears that D. Trump's protectionist policy will lead to a global recession. This fear is justified given the magnitude of the shock. However, the impact of the increases in American tariffs will only be felt gradually. Moreover, there is always a possibility that these tariffs could be renegotiated, thus mitigating the shock.

At the same time, at this stage, it is difficult to see what negotiation paths could be taken. Indeed, by focusing solely on the trade of goods with the sole objective of reducing the U.S. deficit to zero with the rest of the world, it is hard to see how other countries can respond to such a demand. However, the possibility of a change in U.S. strategy cannot be ruled out.

The Republican Party could be a driving force for change. But at this stage, it seems that the ability of Republican leaders to oppose the president is weak. The president's strategy of domination seems to prevail over everything.

Nevertheless, political leaders can only worry about the consequences of a shock that will significantly compromise the growth dynamics of the United States and the implications this could have for the mid-term elections at the end of next year.

A very negative shock to growth would especially break the still very favorable dynamics of the American economy today. The ruling party would be even more penalized.

Certainly, the first quarter of 2025 is expected to be marked by a significant slowdown (we anticipate growth close to zero), mainly due to a deceleration in consumption. However, we observe that the dynamics in services, in particular, remain relatively strong.

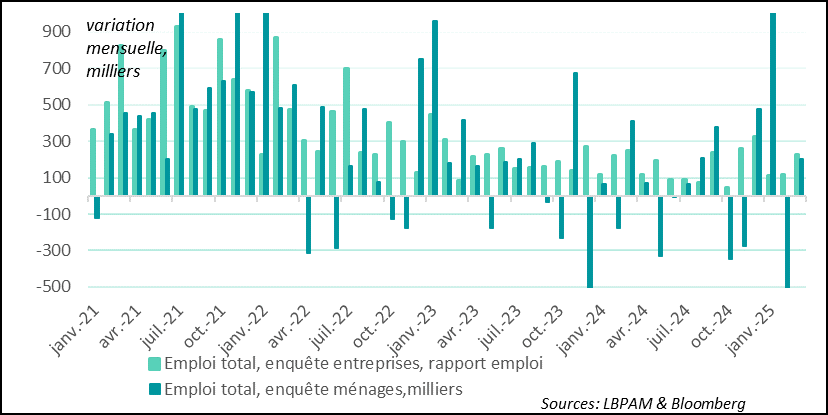

This is demonstrated by the latest employment report for March. Job creation in the American economy amounted to 228,000 new jobs, a figure much higher than anticipated. A rebound compared to an average of 114,000 in the previous two months.

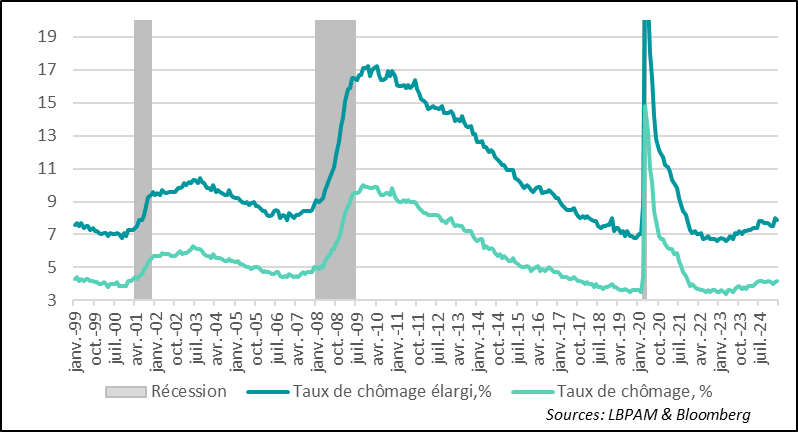

However, according to the household survey, the unemployment rate increased to 4.2% from 4.1%. But this essentially reflects rounding rather than a significant increase. In fact, more than 200,000 jobs were created in March, while 230,000 new people entered the labor market. This explains the slight increase in the unemployment rate.

United States: The labor market showed great robustness in March, even though the unemployment rate slightly increased to 4.2%, a historically low level

Last month, household and business surveys were almost perfectly aligned, highlighting the resilience of the labor market. In the business survey, it is observed, unsurprisingly, that the service sector remains the major contributor to job creation, with 197,000 new positions.

United States: In March, household and business surveys were aligned on job creation, with very dynamic services.

Once again, the health and leisure sectors (notably restaurants) are the most dynamic, accounting for nearly half of the job creation in March.

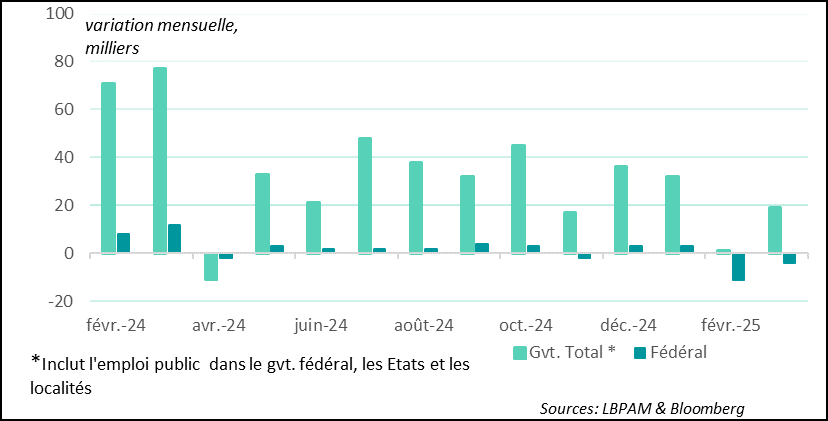

Furthermore, in the public sector, amid all the controversies over staff reductions caused by DOGE, the department led by E. Musk to reduce federal government staff, new reductions were observed in March following those in February. However, these remain very small compared to the total labor market. They are not really capable of changing the situation regarding state spending. Nevertheless, they can create significant disruptions in the functioning of the federal government apparatus in the future.

These job reductions could be more significant in the coming months with voluntary departures of beneficiaries of financial offers made by DOGE to leave the administration, and if certain court decisions are unlocked in favor of the government, following dismissals deemed illegal in certain services. Nevertheless, these staff reductions should remain limited and, once again, will not change the general budgetary situation.

United States: Federal staff reductions continued in March, but they remain weak. They could be more significant in the coming months

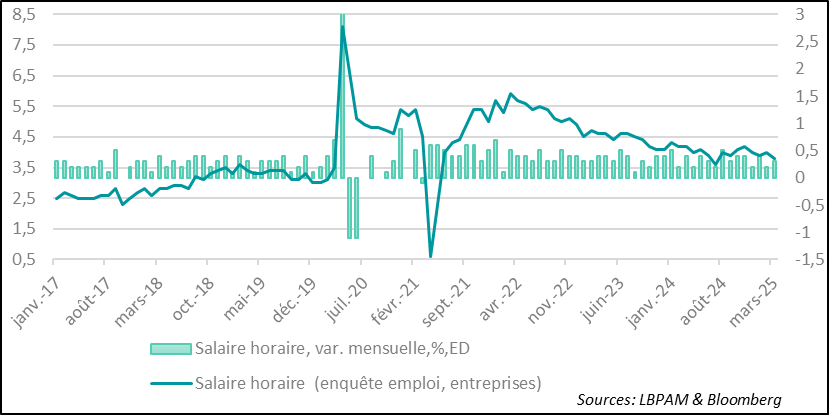

Regarding wages, despite a resilient labor market, we have not observed any acceleration. The monthly progression remained relatively dynamic, but on an annual basis, a deceleration was observed, rather welcome for the Fed, at 3.8%.

However, more reliable statistics will be needed in the coming weeks to see the true wage dynamics, correcting for composition biases in the employment report survey, such as the Atlanta Fed statistics and labor cost data for Q1 2025.

United States: Wages remained dynamic in March, increasing as expected by 0.3%, but on an annual basis, they decelerated.

Obviously, it is important to monitor the reaction of businesses in the coming months to the tariff shock. If businesses become quickly more cautious, the negative effects on employment will be felt just as quickly.

Sebastian PARIS HORVITZ

Head of Research