Markets remain well-oriented at the start of December

Link

Discover the market analysis for December 5, 2025, by Xavier Chapard, Strategist at LBP AM.

Overview

► Mixed U.S. data point to a slightly higher risk to employment than to inflation at year-end, reinforcing the case for a Fed rate cut next week. This cut is now priced in by more than 90% of the markets.

► Private employment fell in November in the U.S. by 43,000 according to ADP and by 20,000 according to Revelio Labs. In the absence of official data, this is enough to indicate downside risks; even other available data for November still do not show a reversal in the labor market. Meanwhile, U.S. business surveys remain stable at levels consistent with resilient growth. In particular, the ISM Services index rose by 0.2 points in November to 52.6, still modest but the highest since the start of the trade war..

►Beyond year-end, the resilience of U.S. growth limits employment risks, while inflation should remain above 3% in the first half of 2026. This should, in our view, limit Fed rate cuts next year. But that is a risk for the coming months.

► For now, Fed rate cuts combined with global economic resilience are supporting markets at the start of December, bringing global equities to within less than 1% of their late-October highs, despite rising long-term rates driven by Japanese yields at their highest in nearly 20 years (1.94%). We believe this favorable context can continue to support markets into the new year.

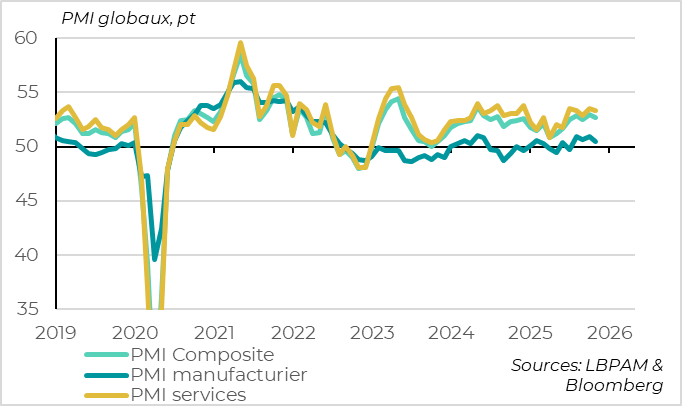

► The global composite PMI, the best coincident indicator of global conditions, eased slightly in November after its sharp October rise but remains at a reassuring 52.7. This is consistent with moderate but well-oriented global growth. The PMI even rose unexpectedly in the eurozone to 52.8 according to S&P Global’s final estimate, its highest since early 2023.

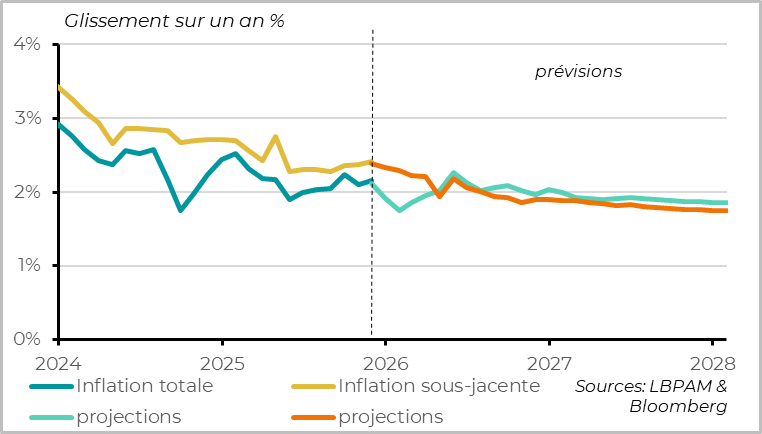

►Eurozone inflation remains slightly above target in November, at 2.2% for headline inflation and 2.4% for core inflation. This is above the ECB’s latest forecasts and should push it to avoid further rate cuts in the short term. However, November’s persistence mainly reflects unfavorable base effects, while sequential price increases are slowing sharply for both goods and services. We remain confident that inflation will return to target in the first half of 2026 and believe risks are mostly to the downside thereafter. Will this be enough for the ECB to cut rates again next year? It’s uncertain, but it remains our central scenario.

Going further

United States: Uncertainty on Employment but Resilient Activity

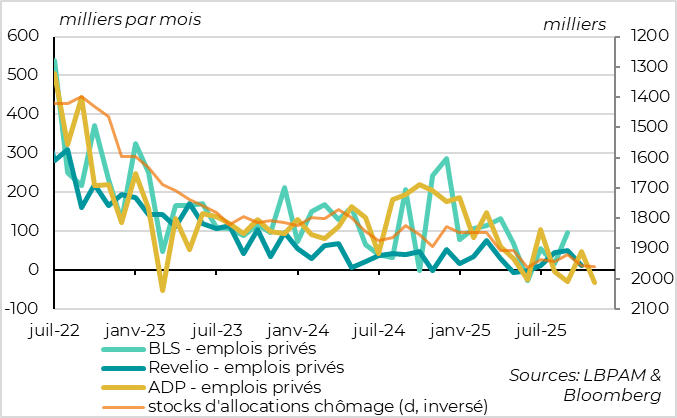

Employment Risks Are Tilted to the Downside for Year-End

Private U.S. employment fell by 32,000 jobs in November according to ADP, after a 47,000 increase in October—the sharpest drop in two and a half years. This decline is broad-based, affecting both goods and services producers, and does not account for the likely drop in public employment in October-November due to the delayed impact of departures organized by DOGE earlier this year.

Other recent indicators suggest the labor market remains stable, with few hires but also few layoffs. Challenger-reported layoffs returned to normal levels in November after an unexpected spike in October. Initial jobless claims fell sharply to near historic lows at the end of November (likely partly due to a Thanksgiving effect). Continuing claims remain slightly elevated but stable for six months.

These usually secondary data are more important this month since official employment figures will only be released on December 16—after the Fed meeting. If they do not show a sharp labor market reversal, they support the view that risks are to the downside at year-end, virtually confirming that the Fed will cut rates next week.

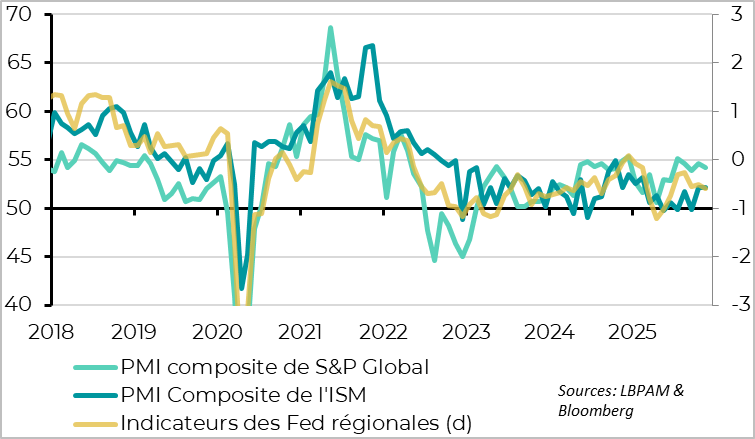

Business surveys remain positive in november

From a cyclical perspective, November surveys suggest stable growth at modest levels. This is reassuring after a month and a half of partial government shutdown, indicating that activity trends remain positive even if Q4 growth will be temporarily hit by the shutdown’s impact.

The S&P Global PMI remains solid at 54.2, though revised down from the initial estimate and slightly lower than October. The ISM Composite remains stable after its October rebound, gaining 0.1 point to 52.2. It converges toward regional Fed surveys at an average level, whereas it had signaled weaker activity since the start of the trade war. These indicators remain significantly below the S&P PMI, but the gap is narrowing.

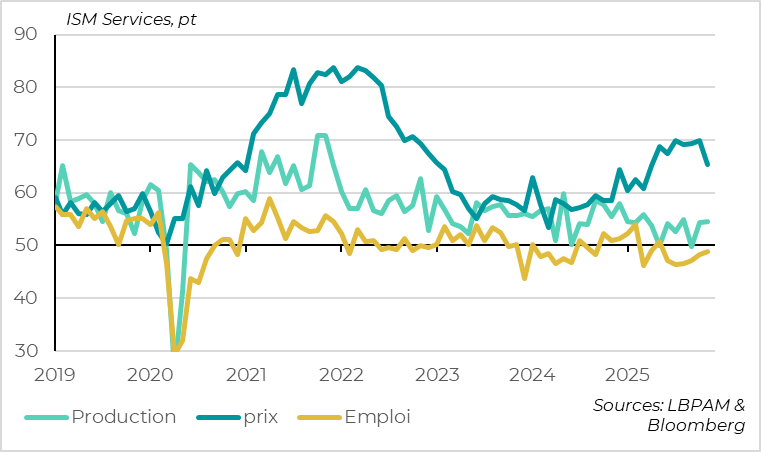

ISM services suggests tariff impact Is starting to ease

The slight rise in the ISM Composite in November comes from an unexpected increase in ISM Services after last month’s rebound. At 52.6, the index is at its highest since February, though still below its long-term average. This offsets a slight decline in ISM Manufacturing.

Component details are also reassuring, suggesting the stagflationary impact of tariffs remains significant but is starting to ease. On activity, the current production index remains solid at 54.5, orders stay positive after October’s rebound (52.9), and the employment index recovers to a six-month high, though still in contraction territory at 48.9. On prices, firms report cost increases slowing after hitting a high since 2022 last month, falling from 70 to 65.4—still historically elevated.

Global: Conditions still well-oriented at end-2025

Global PMI remains resilient in November

The global composite PMI eased slightly in November after its sharp October rise, from 53 to 52.7. It is back below its long-term average but remains firmly in expansion territory and above previous quarters’ levels. This is consistent with growth just below 3%, continuing to hold up well in Q4.

By sector, the industrial recovery is confirmed, though still limited. The global manufacturing PMI stays above 50 for the fourth consecutive month but dips slightly in November to 50.5. This suggests global production is stabilizing around 2% after slowing sharply mid-year due to trade tensions.

Services continue to drive global growth, with a nearly stable PMI in November at 53.3, both in developed and emerging markets.

Growth converges across regions—except China

By country, the U.S. S&P Global PMI continues to outperform (54.2), but the gap with other developed economies is narrowing thanks to slight PMI increases elsewhere.

In particular, the eurozone PMI was revised up for November, from 52.4 to 52.8. It rose again from October’s 52.5, reaching its highest level in two and a half years. This confirms a slight acceleration in year-end growth. The UK PMI was also revised up from the preliminary estimate, from 50.5 to 51.2. It remains down from October (52.2), but less sharply and in line with recent months’ averages, reducing risks of an abrupt slowdown. Japan’s PMI was confirmed at 52.0, its highest since last summer.

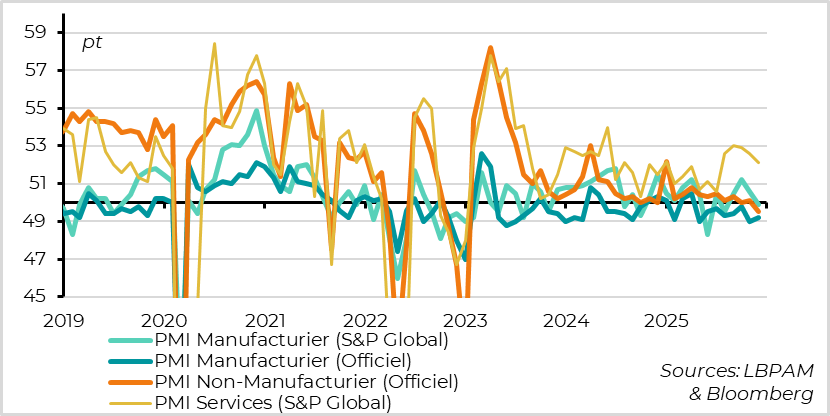

Chinese PMIs drop sharply again in November

The bad news comes again from China, where official and S&P Global PMIs fell sharply for the second consecutive month. They average their lowest since January and hover just above the 50-point threshold. This is disappointing, as the late-October Sino-American trade agreement reduces external demand risks. It confirms domestic demand remains weak and authorities need to act quickly to stabilize real estate and boost infrastructure investment (in addition to slightly supporting consumption). However, we remain confident in policymakers’ willingness and ability to prevent the late-2025 slowdown from becoming too severe or prolonged.

Eurozone: Behind persistent inflation, return to target still in sight

Inflation rises and stays above target in November

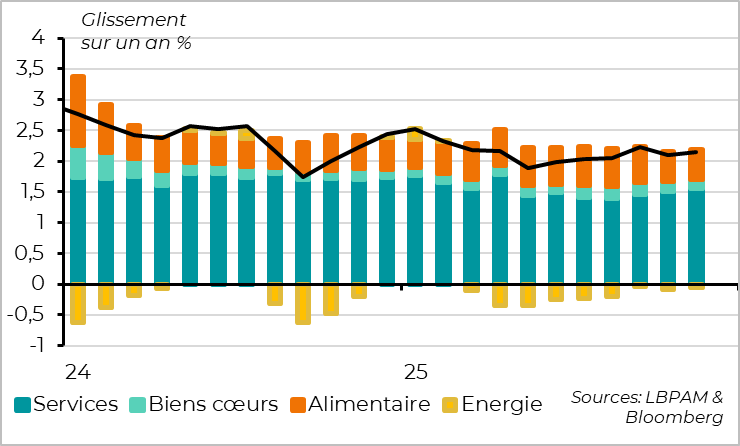

Eurozone inflation edged up in November by 0.1 point to 2.2% year-on-year, remaining slightly above the 2% target for the third consecutive month. This partly reflects energy price volatility in November, but also core inflation.

Eurozone inflation edged up in November by 0.1 point to 2.2% year-on-year, remaining slightly above the 2% target for the third consecutive month. This partly reflects energy price volatility in November, but also core inflation.

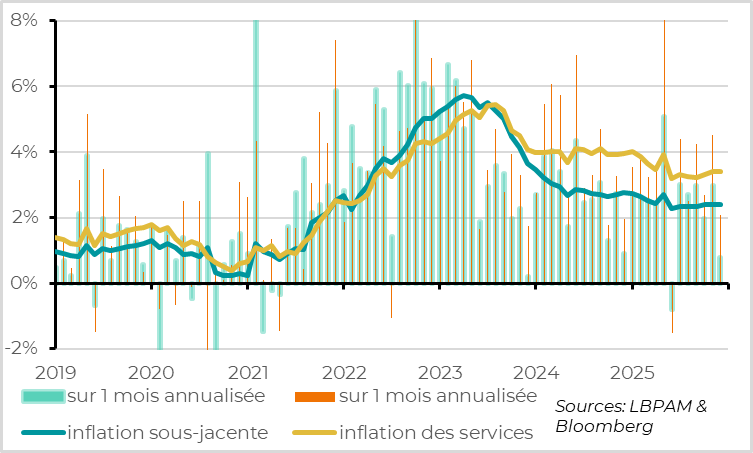

Core inflation remains unchanged at 2.4% for the third month in a row, meaning no progress toward the target for six months. It even rose slightly in November, from 2.37% to 2.41%, its highest in seven months. This slight acceleration in core inflation comes from services, where prices rose from 3.4% to 3.5%, while food inflation (2.5%) and manufactured goods inflation (0.6%) remained broadly stable.

As services inflation is the most persistent component, this raises questions about the speed of disinflation.

But price increases slow sequentially

However, the rise in services inflation stems from unfavorable base effects, as service prices barely increased last November. It is also likely exaggerated by volatile tourism prices.

In reality, price increases slowed sequentially in November, suggesting disinflation will resume in the coming months. Core prices rose only 0.1% in November—the smallest increase in six months—and recent trends are back in line with the 2% target. Specifically, industrial goods prices stagnated for the second month in a row, and service prices slowed to 0.17% for the month.

Return to target—or below—still expected in 2026

Overall, the slowdown in sequential price increases, combined with wage moderation, makes us confident that core inflation will converge toward the 2% target by mid-2026 and is more likely to undershoot than overshoot in subsequent quarters.

Overall, the slowdown in sequential price increases, combined with wage moderation, makes us confident that core inflation will converge toward the 2% target by mid-2026 and is more likely to undershoot than overshoot in subsequent quarters.

In the short term, persistent core inflation above target and positive signs for eurozone growth should lead the ECB to keep rates unchanged. However, we still believe it could cut rates one last time in the first half of next year due to risks that inflation becomes anchored below target in the coming years.

Xavier CHAPARD

Strategist