Markets unimpressed by an extended deadline that is "not 100% firm"

Link

Donald Trump has announced steep tariff hikes on several countries, but markets remain calm as these measures have not yet been implemented and could be renegotiated. The deadline has been pushed back to August 1, and major partners such as the EU are not affected. Uncertainty remains high, but markets remain optimistic in the short term.

Key Takeaways

► Ahead of the deadline (the end of the suspension of reciprocal tariffs scheduled for today) and in the absence of new trade agreements, D. Trump has announced unilateral tariff hikes with several countries, which are close to those he announced on Release Day in early April: 25% on Japan and Korea, 30% on South Africa, 32% on Indonesia. He also indicated that tariffs on copper would increase by 50% and those on pharmaceuticals could reach 200% (!). Taken at face value, and if applied to other countries as well, this would represent a much bigger trade shock than anticipated.

► Yet the market remains very calm, anticipating that these threats will not materialize, or at least will not be generalized to all countries. Indeed, the deadline for the new tariffs has been pushed back to August 1, a deadline that is “firm but not 100% firm”. What's more, Trump says he is still open to negotiating with the targeted countries. And these new tariff hikes do not apply to countries that account for over 70% of US imports (including the EU), with whom negotiations are continuing. It remains to be seen whether D. Trump's recent victories (on Iran, passage of the budget bill...) and the lack of reaction from the markets will push the President to go further in the trade war, but as things stand, the market isn't taking him very seriously.

►All in all, we are not changing our scenario as it stands, which still includes a few tariff hikes compared with the current situation (on certain small exporters and specific products), but not as massive as in the recent announcements. That said, US negotiating tactics are prolonging uncertainty, with new risks for August (in addition to the end of the truce with China).

►Against this backdrop, risk appetite could remain buoyant over the coming weeks. But it has already reached high levels, limiting the markets' upside potential in the short term, and August could be more complicated in our view. Especially if July data (published in August) start to show the impact of tariffs and uncertainty on US employment and inflation, as we expect.

► On the economic data front, the week was fairly quiet. For the USA, US small business confidence (NFIB) stabilizes at an average level in June after rebounding in May, still limited by high political uncertainty. But small businesses indicate that price pressures are gradually increasing, supporting our expectation of higher prices from the summer onwards.

► In the Eurozone, activity data for Q2 was rather weak, as expected, due to the backlash from advanced US demand in anticipation of tariffs and the impact of the confidence shock. However, investor confidence continued to rebound in early July, reaching its highest level since the start of the war in Ukraine. This remains consistent with our scenario of a delayed but unchallenged recovery this year.

To Go Further

United States: new, limited trade war threats

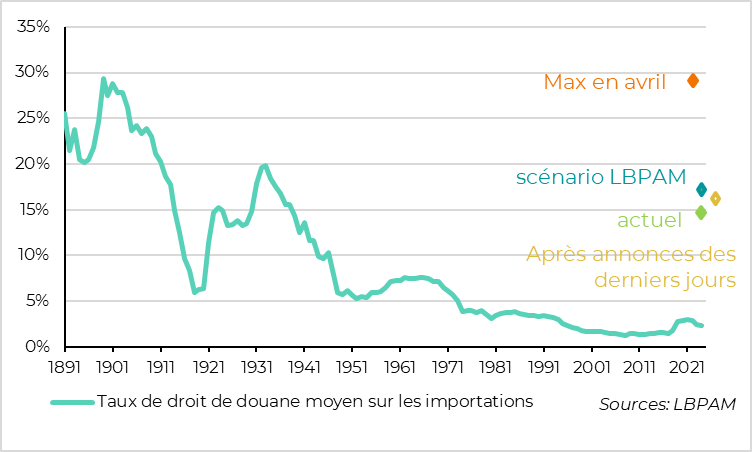

The unilateral tariff hikes announced by Trump since the weekend and the agreement with Vietnam lead to higher than expected tariffs with these targeted countries. But these countries are not the main exporters to the US, so if they were implemented, the average tariff on US imports would only rise by a further 1.5pt.

It should be remembered that the tariff increases already implemented represent a rise of over 10pt in the average tariff, and could reach 15pt if special goods (pharmaceuticals, semi-conductors, etc.) were taxed like cars at 25%. This is a historic shock which, in our view, should already cause the global economy to slow down markedly in the second half of the year, and at least temporarily reaccelerate US inflation.

If the recent tariff hikes were applied to all countries (i.e. a return to the reciprocal tariffs of early April), the shock would obviously be much greater.

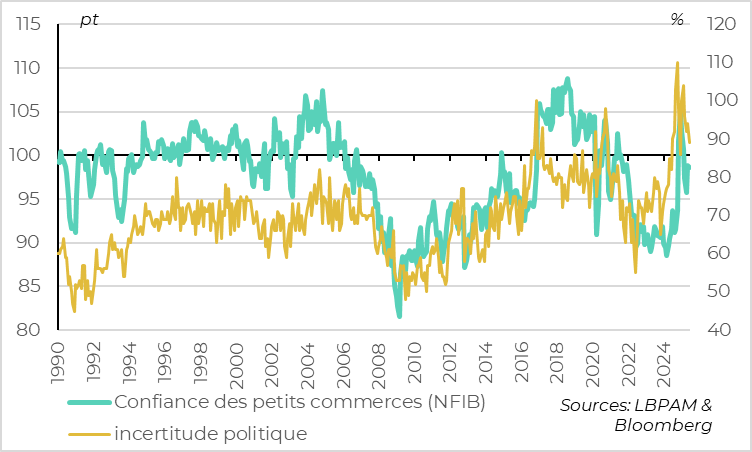

United States: uncertainty for SMEs eases but remains historically high

The NFIB survey indicates that optimism among US small businesses remains stable in June, just below its historical average (at 98.6pt) after rebounding in May.

Small business hiring and capex plans are stable at limited but positive levels, labor market indicators are consistent with a resilient job market, and indicators of financial conditions have stopped improving, but are not deteriorating markedly... All in all, there's nothing to challenge the idea that the US economy is slowing in a limited way until this summer.

On the uncertainty front, the small trades indicate that political uncertainty was still easing a little in June (before the new tariff announcements), but remained historically high, well below that of the first 100 days of Trump 2.0 but close to the highest levels reached during Trump 1.0.

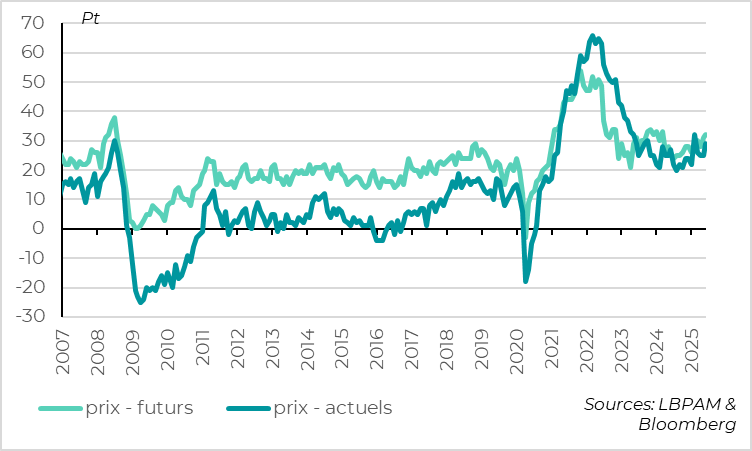

United States: small businesses point to future price rises

On the price front, small retailers increased their prices slightly more in June, but not abruptly. On the other hand, they indicate that they expect to increase their prices more sharply in the coming months. This suggests that the June inflation figure published next week may remain unchanged, but that inflation is likely to accelerate more sharply from the summer onwards.

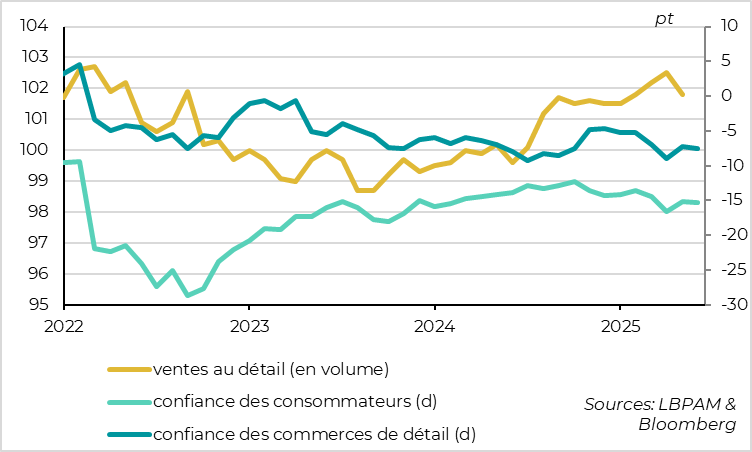

Euro zone: retail sales slow in May and confidence remains subdued

In the Eurozone, retail sales fell by 0.7%. But this follows 3 months of strong growth, so that the trend remains slightly upward for Q2.

This limited slowdown is consistent with the decline in household and business confidence since March, which only partially recovered from the shock of April. Limited confidence is likely to dampen the mid-year recovery in domestic demand, even if the trend remains upwards.

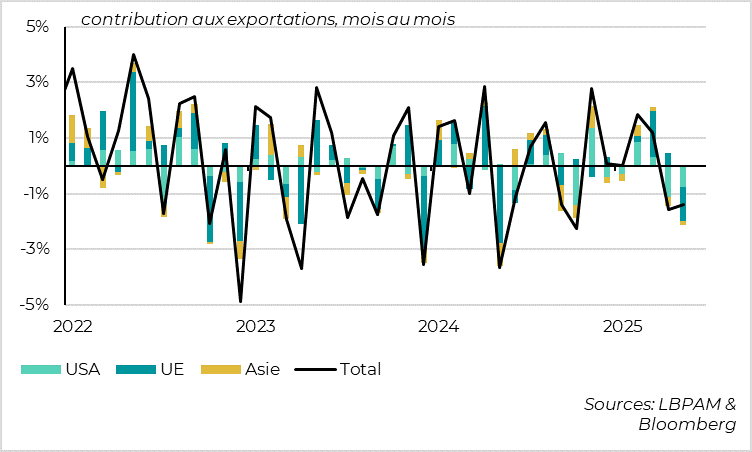

Germany: exports fall in Q2, especially to the US

German exports fell by 1.4% in May, following a 1.6% drop in April, so that they fell back quite sharply after their 2.6% rebound in Q1. This volatility in foreign trade stems primarily from exports to the United States, which fell by 10% compared to Q1, when they had risen by 5%.

This supports the idea that the advance in US demand in Q1 prior to the tariffs supported activity in the rest of the world at the start of the year, and will have a negative knock-on effect in Q2 and Q3, particularly for countries highly exposed to world trade such as Germany.

Germany: foreign trade expected to weigh negatively in mid-2025

Thus, trade in goods contributed 0.9pt of growth in Q1 in Germany, but should weigh on growth in the middle of the year, even if inventory variations should smooth out the shock on activity somewhat.

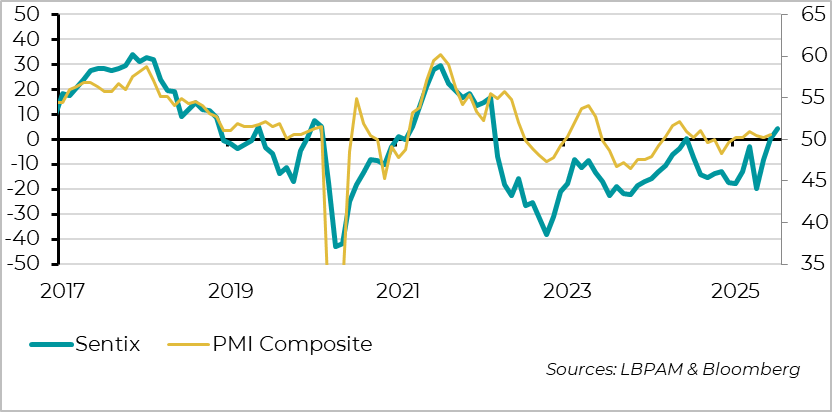

Euro zone: investor confidence continues to rebound in early July

But while growth in the Eurozone seems to be slowing slightly in the short term, the outlook remains positive and we anticipate a reacceleration from Q4 onwards, helped by the beginnings of German fiscal stimulus.

Investor confidence is moving in this direction, according to the Sentix survey, having risen again in early July after returning to positive territory in June and reaching its highest level since early 2022. This survey should be taken with a grain of salt, and we'll have to wait for the business and household surveys to get a clearer picture of the real economy in July. But it has historically been a good leading indicator of changes in economic trends. It is therefore an encouraging sign after the PMI stabilized slightly in the expansion zone in June.

Xavier Chapard

Strategist