Meanwhile, central banks continue to cut rates...

Link

Read Sebastian Xavier Chapard's market analysis for February 19, 2025.

Summary

►The markets are still digesting the weekend's announcements from the US authorities (unilateral negotiations with Russia on resolving the conflict in Ukraine and sharp criticism of European democracies), which probably mark a historic turning point for the Europe-US relationship. This is currently benefiting European equities (especially arms and banks) and weighing a little on bonds, via expectations of higher military spending and lower commodity prices. If the markets are heading in the right direction, we may well wonder whether they are not going too far, given that negotiations on a common European strategy are struggling to make headway, and the risk of tensions with the United States still looms large.

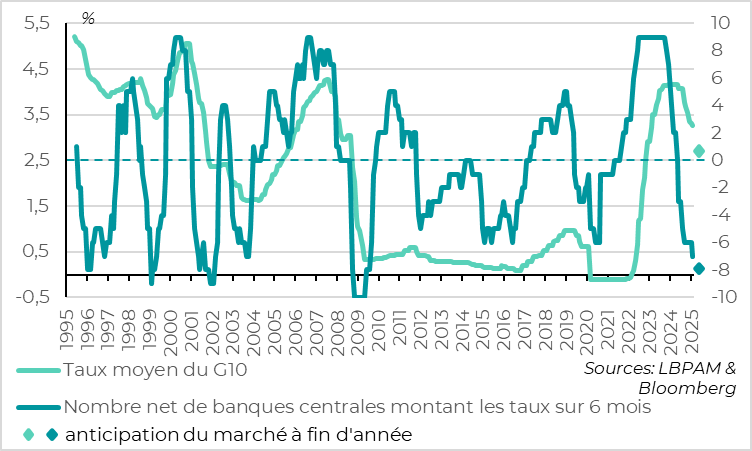

►In any case, the cycle of global monetary easing continues, with this week's first rate cut by the Reserve Bank of Australia (RBA) in this cycle. Apart from the Bank of Japan, which is the only major developed central bank to raise rates, only Norway has yet to cut rates. And all these central banks are set to cut rates again between now and the end of the year, which is good news for the economy and the markets this year.

►That said, rate cuts are likely to be measured, particularly for the paused Fed, but also for the Bank of England (BoE). After a series of better-than-expected data, the BoE is likely to stick to its “gradual and cautious” rate-cutting approach. UK GDP did not contract in Q4 (+0.1%), employment is holding up well despite the increase in charges and the minimum wage scheduled for April, and wage pressures remain too high, at +6.2% in the private sector. This does not call into question our scenario of a 25bp rate cut per quarter, with three additional cuts this year, especially as the Governor has already warned that he will look beyond the rebound in inflation forecast for the beginning of the year. But this reduces the chances of accelerated rate cuts.

►The BoJ's anachronistic rate hike strategy has not called into question the improvement in GDP at the end of 2024, and the positive outlook should allow it to raise rates further this year. Indeed, GDP growth is accelerating from 1.7% to 2.8% by the end of 2024, helped not only by volatile foreign trade, but also by resilient consumption and a recovery in business investment. And if we add rising prices, GDP in value terms finally exceeds the 600 trillion yen target set by former Prime Minister Abe in 2015. This is in line with a move away from the deflation that has plagued Japan since the 1990s.

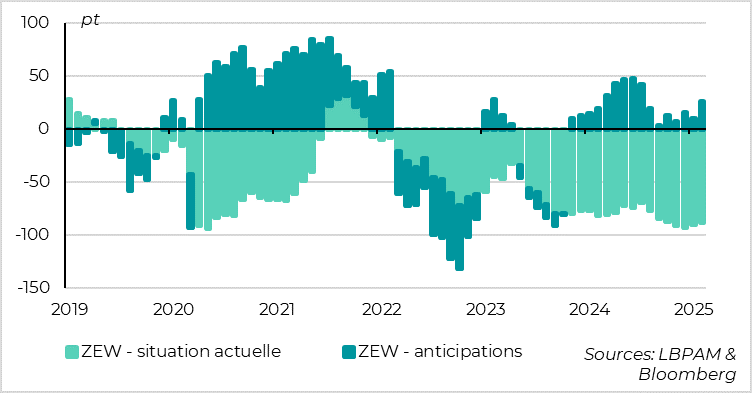

►In the Eurozone, investor confidence rebounded fairly sharply in February, from depressed levels. The rise in the German ZEW is the strongest in 2 years, less than a week before the federal election, thanks to an improved consumer outlook and the hope that a pro-business government capable of taking action will emerge from the elections. This is reassuring for the cycle, even if the German and European economies still face major challenges, especially if the threat of tariffs on Europe and automobiles materializes.

To go deeper

Central bank: cycle of across-the-board rate cuts continues

The Bank of Australia finally began cutting rates this week, by 25bp to 4.1%. This is the first rate cut since Covid, but it is not likely to be the last, even if the central bank remains very cautious in the face of geopolitical and economic uncertainties.

Among the central banks of the developed countries (the G10), apart from the Bank of Japan, which has a different cycle (the only one in a rate hike cycle thanks to its emergence from deflation, but which was the only one not to have raised rates in 2022), the only remaining central bank is the Norges Bank, which has not begun its rate cut cycle.

The market expects all these central banks to cut rates again by the end of the year. Even Norway and the Fed, whose pause could be long, but whose risk of reversion to rate hikes remains unlikely (barring a big surprise from D. Trump, of course).

The cycle of monetary easing after several years of very restrictive conditions is one of the main factors supporting our moderately optimistic scenario for the economy and markets, despite all the uncertainties and potential shocks.

That said, monetary easing is likely to remain gradual, particularly in the US but also, to some extent, in the UK.

Indeed, the latest English data show that the economy and employment did not deteriorate sharply at the turn of the year, which reduces the urgency of cutting rates while wage pressures remain too high. This should particularly reassure the two BoE members who voted for a 50bp rate cut rather than a 25bp rate cut in early February.

The Bank of England (BoE) is expected to stick to its “gradual and cautious” rate-cutting approach. This is in line with our scenario of 25bp rate cuts per quarter, with three additional cuts this year.

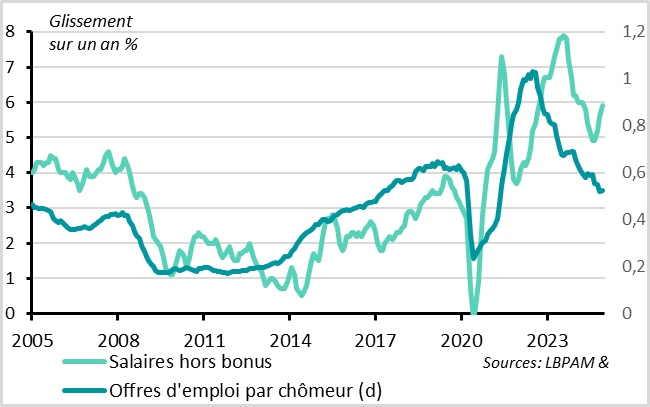

United Kingdom: wage pressures remain high despite easing tensions

Private-sector wage growth reached 6.2% year-on-year in Q4 2024, which should reinforce the BOE's view that it's too early to claim victory over inflation. This represents an acceleration on November's 5.9%, partly due to a bullish base effect, but also because short-term momentum is not slowing. That said, the BoE was expecting strong wage growth to persist in the short term (it was even forecasting 6.25% for Q4), and both labor market equilibrium indicators and surveys suggest a fairly marked slowdown in wages in the second half of the year to below 4%.

All in all, wage dynamics are still not slowing down, and remain well above the 3% level deemed compatible with the 2% inflation target. The outlook is favorable for rate cuts, albeit cautiously.

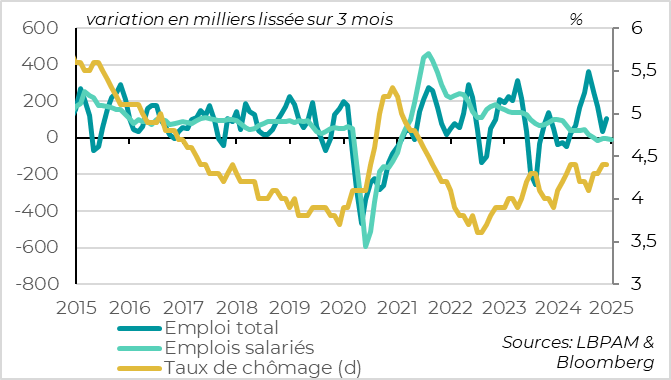

United Kingdom: employment slows but remains resilient at the turn of the year

Above all, the job market slowed but remained resilient at the turn of the year, which is reassuring given the forthcoming increase in employers' contributions and the minimum wage decided by the Labour government (to take effect in April).

The unemployment rate remained stable in December at 4.4%, below the 4.5% anticipated by consensus and the BoE. This reflects an increase in employment of 107 thousand in Q4, which is a slowdown on the previous 2 quarters but still clearly positive, in contrast to late 2023/early 2024.

Initial data for 2025 are mixed, but still suggest a resilient job market. Wage employment rose by 21 thousand in January, after falling by 10 thousand in the last quarter of 2024. The number of insured unemployed rose by 22 thousand in January, but was revised downwards for previous months, so that it fell by 50 thousand in Q4 and has been broadly stable since the summer. Finally, the number of job vacancies remains stable for the second month running after more than 2 years of continuous decline, which does not suggest a drop in demand for employees despite the approaching rise in costs.

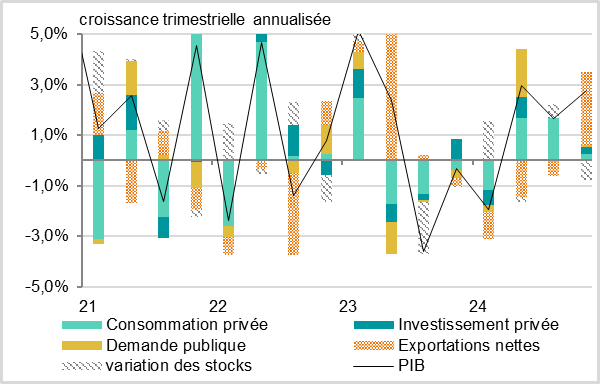

Japan: growth remains positive, validating the BoJ's rate hike strategy

Japanese growth is stronger than expected at the end of 2024, at an annualized 2.4% in Q4, after being revised upwards to 1.7% in Q3. This allows Japan to avoid a drop in GDP in 2024 (+0.1%) despite the drop in activity last winter. And if we add the rise in prices to the stability of real activity, yen-denominated GDP reaches 609 trillion in 2024, finally exceeding the 600 trillion target announced by former Prime Minister ABE 2015 (initially scheduled for 2020). This suggests that price rises are sustainable despite the BoJ's rate hikes, which validates its strategy and should enable it to raise rates further this year.

Admittedly, growth was driven mainly by foreign trade in Q4, which normalized after four negative quarters. But business investment is on the rise and consumption is holding up well after being boosted in mid-2024 by tax cuts, a sign that private domestic demand is solid.

Germany: investor confidence rises ahead of elections

The ZEW survey of German investors shows the strongest rise in confidence in 2 years in February, less than a week before the federal election. This is reassuring for the cycle, even if the German and European economies still face major challenges, limiting growth potential.

The ZEW indicator on the current situation improved marginally for the second month running, while remaining at a very low level (-88.5pt). Above all, the 6-month business outlook indicator rose from 10pt to 26pt, its highest level since last summer. This slight optimism reflects hopes of a more pro-business government (the CDU/CSU is proposing tax cuts, regulation and transfers) finally able to act, after 3 months without a government majority. What's more, the outlook for household spending is improving somewhat thanks to the ECB's rate cuts. The fact that D. Trump has not yet announced any tariff hikes on Europe and cars has also surely helped, at least if the rise in the equity market is anything to go by.

Even if this indicator of investor confidence should be taken with a grain of salt (compared with business confidence such as the PMI published on Friday), its rise from depressed levels nevertheless suggests that the economic cycle is moving in the right direction, which gives us hope that Germany will at least return to slightly positive growth after two years of stagnation.

Xavier Chapard

Head of Research