Middle East conflict puts markets under pressure

Link

- The tragic events unfolding in the Middle East clearly seem to have taken on greater weight in market sentiment. Tensions remain high in the region, with the risk of flare-ups and new outbreaks of violence on the rise. Nevertheless, the United States continues to play a major role in allowing more time for negotiations, in particular to free hostages held by Hamas, and also to bring humanitarian aid to civilians in Gaza. Thus, the ground intervention still planned by Israel is on hold for the time being. Faced with the unknown, the market remains on alert, with the price of oil, in particular, remaining close to its highs of recent days. Stock markets have fallen sharply again, and in the United States, the VIX, the so-called fear index, has risen sharply, but remains below the levels of the mini-banking crisis at the start of the year. The next few days will tell us whether the conflict remains contained and whether the markets can return to a calmer state. For the time being, we remain cautious in our asset allocation, favoring exposure to bonds.

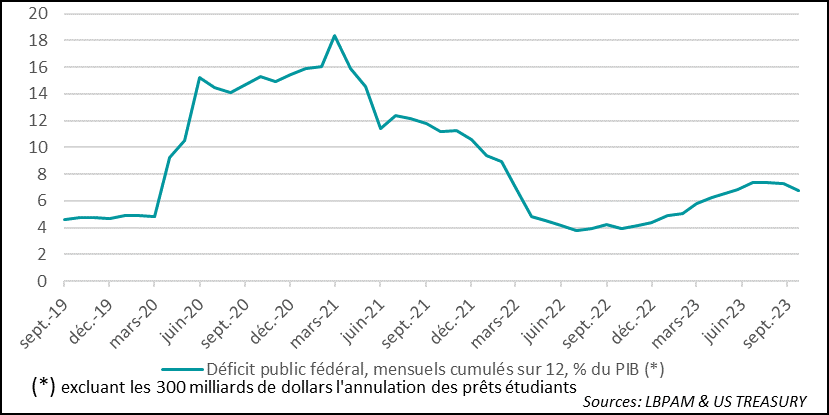

- At the same time, the fall in risky asset prices continues to be affected by the sharp rise in long-term interest rates, even though some investors have taken refuge in government bonds in the face of prevailing uncertainty. As we know, the rise in yields was strongest in the United States, reflecting the resilience of the American economy, but also explained by the deterioration in the public deficit and the avalanche of government bond issues. On the fiscal front, we have just received the final result for fiscal year 2023 (Oct. 22-Sept. 23), which clearly shows that the public deficit deteriorated sharply over the course of the year. We estimate that fiscal stimulus should represent just under 2 points of GDP in 2023. We believe, however, that this support is likely to wane, all the more so in a complicated political climate, with the Republican leader's position in the House of Representatives still vacant.

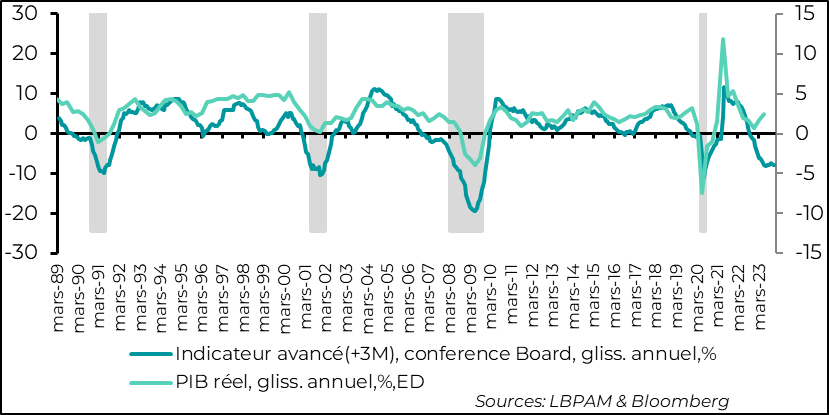

- In terms of economic dynamics, we know that US growth should be strong in 3Q23, close to 4% annualized or more, and driven by consumption. At the same time, historical leading indicators continue to point to mediocre growth in the coming quarters. The Conference Board's leading indicator, for example, has remained in very negative territory for several months, although it is no longer deteriorating.

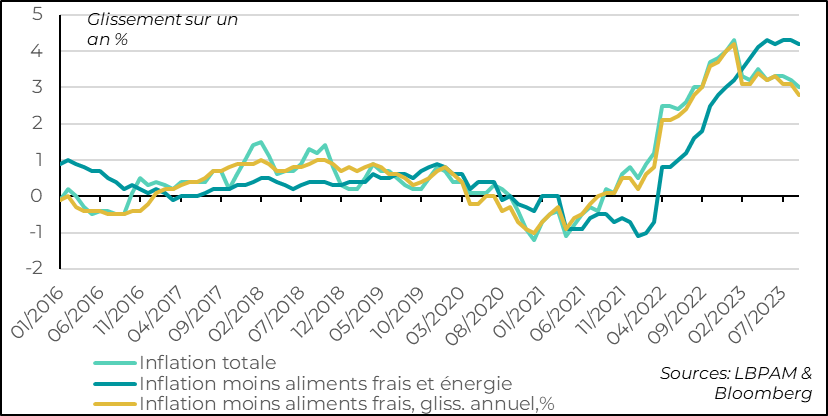

- In Japan, inflation figures showed that the process of decline is continuing apace. Inflation less fresh food, monitored by the Central Bank (BoJ), fell below 3% for the first time in 1 year, to 2.8% year-on-year. At the same time, inflation minus fresh food and energy prices decelerated at a slower pace, standing at 4.2% year-on-year. However, these figures are quite in line with the BoJ's expectations, so they should not change the institution's strategy. As Governor K. Ueda, the governor, the ultra-accommodative policy will be reviewed at the end of the year, particularly with regard to wage trends. In the meantime, the yen is again approaching 150 yen per dollar, which could trigger further intervention by the Japanese Treasury to support the currency.

The Middle East conflict continues to destabilize markets, with Islamist groups opening up other fronts. Missiles have reportedly been fired at Israel from Yemen, while a US base in Iraq has also been targeted by other groups, and tensions are still rising between Israel and Hezbollah in Lebanon. This anxiety-inducing climate is obviously affecting market sentiment.

One of the key variables reflecting the current situation is the trend in oil prices, which have risen sharply, approaching their highs for the year.

All this is reflected in a marked decline in risk-taking, affecting all markets.

One of the consequences is rising volatility. The VIX, which measures volatility on S&P500 options, has risen sharply over the past few days, but remains contained by historical standards. In fact, it remains below the level reached during the mini-banking crisis at the start of the year.

Safe-haven assets are also doing well, with gold gradually gaining ground since the start of the crisis to approach $2,000 an ounce.

Fig.1 Conflict: Sentiment has been hit hard, as evidenced by the rise in the VIX, while safe havens such as gold are gaining ground.

-Gold, price in dollars per ounce

-Vix, index, ED

Attempts by the United States to slow Israel's invasion of Gaza, by allowing time for negotiations to free hostages and bring in humanitarian aid, may prove to be a way of easing tensions in the very short term. In fact, this morning we saw some tensions ease on the markets with the fall in the price of oil and gold.

Nevertheless, it seems far too early to think that this conflict is behind us, especially as the Israeli army's ground operation has still not begun, with the risk of significant civilian casualties, which could create even more tension in Arab countries.

Beyond the conflict, markets were also kept on their toes by the sharp rise in long-term interest rates. Indeed, US 10-year yields are still close to 5% and have shown only a very limited decline.

The rise in long-term rates is partly due to the resilience of the US economy and to the fact that the Fed, while playing it safe, continues to emphasize the need for further tightening of monetary policy.

As Fed Chairman J. Powell pointed out last Thursday, while the very sharp rise in key rates and the lags in monetary policy action on the economy should prompt caution, the empirical evidence, with persistently strong demand and a very solid job market, suggests that monetary policy may not yet be restrictive enough to ensure that inflationary pressures subside to converge on the 2% target.

One of the factors behind the resilience of the US economy is persistent fiscal laxity. Thus, after the sharp decline following the extraordinary stimulus of 2020-2021, the public deficit has resumed its upward trend, providing further support to the economy. This, of course, translated into a sharp rise in government securities issuance, as the Fed gradually exits the market with its balance sheet reduction program.

The latest figures published on Friday for the 2023 fiscal year (October 2022 to September 2023) show how the deficit has deteriorated again in 2023. According to our estimates, which are close to those published by the IMF in its latest report, the stimulus provided to the economy by public finances would have been close to 2 points of GDP.

-Federal public deficit, monthly cumulative over 12.% of GDP (*)

-(*) excluding $300 billion student loan forgiveness

We believe that the coming period should be more sober, even if, in the background, we still have the plans adopted by the Biden administration (CHIPS and IRA) which, through subsidies (tax cuts) for the semiconductor and energy transition sectors (particularly in the automotive and renewable energy production sectors), continue to stimulate investment. We'll see later, when the companies present the bill, what the total budgetary cost of these subsidies will be.

Of course, not everything is rosy when it comes to the US economy. Certain sectors are suffering, especially those most sensitive to rising interest rates. Indeed, the leading indicators of the US economic cycle continue to give a rather negative message about the outlook, in contrast to the growth trend of recent quarters.

Fig.3 United States: The Conference Board's leading indicator remains poorly oriented, although it is no longer deteriorating and is still forecasting a worsening economic situation.

-Leading indicator (+3M), Conference Board, year-on-year, %

-Real GDP, year-on-year, %

In Japan, inflation statistics for September came in slightly above expectations, but confirmed the downward trend, in line with indications already given by inflation trends in Tokyo.

Total inflation fell to 3% year-on-year from 3.2% the previous month. The deceleration was largely due to lower energy prices. Inflation excluding fresh food, which is monitored by the BoJ, fell further, although less than expected by the market, to 2.8% from 3.1% in August. This is the first time it has fallen below 3% in 1 year.

At the same time, excluding fresh food and energy, core inflation stood at 4.1%, after 4.2% the previous month.

Fig.4 Japan: Inflation in September was in line with BoJ expectations, arguing in favor of maintaining ultra-accommodative policy

-Total inflation

-Inflation less fresh food and energy

-Inflation minus fresh food, year-on-year, %

These figures seem to be fairly in line with the central bank's expectations, and are unlikely to change BoJ Governor K. Ueda's views. Thus, the most likely outcome is that the very accommodative monetary strategy will be maintained until the end of the year, when it will be reviewed as indicated by the Governor. One of the determining variables for a change of course is the evolution of wages, which have recently shown a moderating trend. We believe, as do many in the market, that the exit from extreme accommodation will begin in early 2024.

The maintenance of this accommodating policy in the current tense environment is obviously translating into pressure on the yen. As a result, the Japanese currency is weakening again and approaching 150 yen per dollar, which could trigger further intervention by the Treasury to support it.