More key rate cuts expected before the end of the year

Link

Read Xavier Chapard's deciphering of the market on December 9, 2024

In Summary

►Unexpected geopolitical events are multiplying, with the fall of the Assad regime in Syria this weekend, following the coup attempt by the Korean president last week. These events have no immediate impact on the global economy, and therefore on the markets. But they do increase instability and the risk of conflicts spreading to the Middle East, as well as the risk of terrorism. Especially at a time when the United States is reluctant to be the world's policeman, as Trump reminded us in a post (“Syria is a disaster, but it's not our friend”), and Russia and Iran are weakened. It's always difficult to position the markets in the face of geopolitical risks, but we believe that hedging positions on the upside of oil or the dollar, for example, can limit the risks.

►Beyond that, the final session of central bank meetings begins this week, with the ECB in particular. A further rate cut of 25 bp to 3% is widely expected. We believe that the chances of a larger 25bp cut are limited, but that the ECB's communiqué will make it clearer that rate cuts should continue in early 2025 (removing the reference to a persistently restrictive policy and revising growth and inflation for 2025 downwards a little).

►In addition to the ECB, the Bank of Canada and the Swiss National Bank are also expected to cut rates, by at least 25bp and perhaps even 50bp. The Bank of Australia, on the other hand, is likely to remain one of the only major central banks to keep rates on hold until next year.

►The Fed enters a period of silence ahead of next week's meeting. The market is more confident that the Fed will cut rates by another 25bp after Friday's jobs reports, with the probability of a cut having risen from 70% to 85%. We expect a 25 bp cut to 4.25-4.50% next week, as rates remain restrictive and inflationary pressures do not rise again. But it is likely to slow its rate cuts next year, against a backdrop of still-above-target inflation and a still-solid economy. All the more so as Donald Trump has declared that he has no intention of replacing Jerome Powell on his return to the White House, which is positive for the central bank's independence in the medium term.

►The US labor market continued to moderate in November, but without a sharp deterioration. Job creation rebounded as expected, from 36 to 227 thousand, with the end of strikes and the impact of hurricanes. On the other hand, the unemployment rate rose from 4.1% to 4.2%, returning to its summer highs. Wages remain a little high, at 4% year-on-year versus 3.5% before Covid.

►This is positive for markets in the short term, as it leaves room for the Fed to remove further monetary restraint while activity remains buoyed by rising household incomes.

►Deflationary pressures remain high in China despite the support measures put in place since September, with inflation slowing to just 0.2% in November and producer prices continuing their sharp decline. This shows that more support is needed to sustain the economy beyond the rebound in activity at the turn of the year. Against this backdrop, markets will be keeping a close eye on the Central Economic Conference taking place this week in the presence of President Xi. But while this conference may give some indication as to the direction of public policy next year, it is not, historically, the occasion to announce specific new measures.

To go deeper

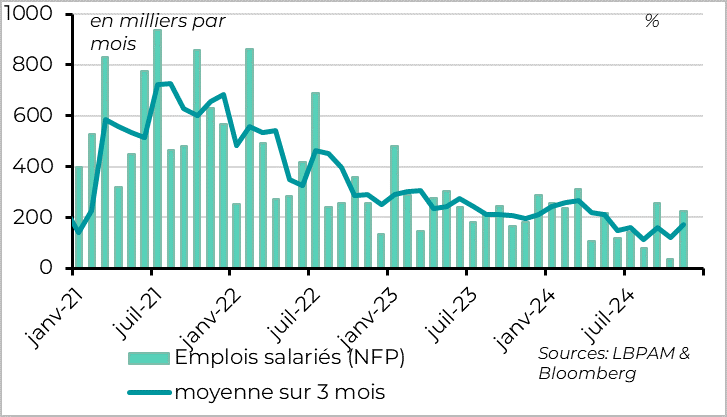

United States: job creation rebounds in November and remains positive

The US economy created 227,000 jobs according to the business survey, in line with expectations. This represents a moderate rebound from the 36,000 jobs created in October, when strikes and hurricanes weighed heavily. Manufacturing employment rose by 22,000 after three consecutive declines, thanks to the end of the strike at Boeing. Also, the number of workers reporting that they were unable to get to work due to weather conditions normalized to 56,000 in November, after jumping to over 500,000 in October.

Beyond the monthly volatility, employment growth is 173,000 over the last 3 months, a stable figure since the summer after the slowdown at the beginning of the year. The job market therefore seems to have stabilized close to its equilibrium level, according to this survey.

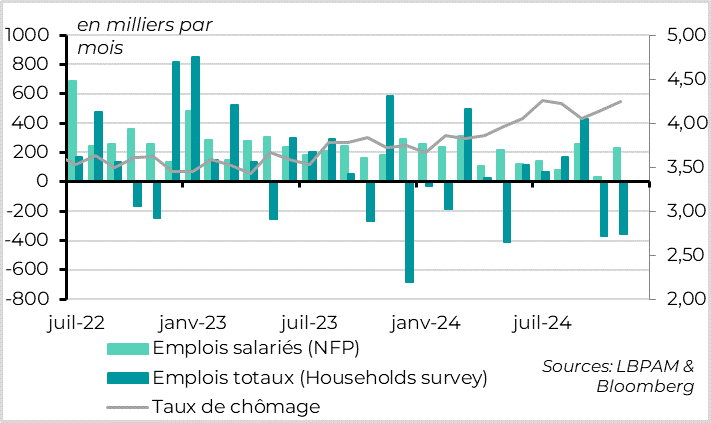

United States: but the unemployment rate climbs back to its summer highs

Cela

Cela

That said, the unemployment rate rose again in November, returning to its July high of 4.25%. This remains a historically low unemployment rate, in line with what the Fed considers to be the equilibrium rate, but suggests that the trend is towards a slowdown in the labor market.

The household survey, from which the unemployment rate is calculated, is weaker than the business survey. According to this survey, the number of people in work fell by 355,000 in November, following a drop of 368,000 in October. This pushes the unemployment rate up from 4.15% to 4.25%, despite the participation rate falling to a 6-month low. According to the survey, the employment rate in the US economy has been gradually declining over the past year, although it remains close to its pre-Covid level.

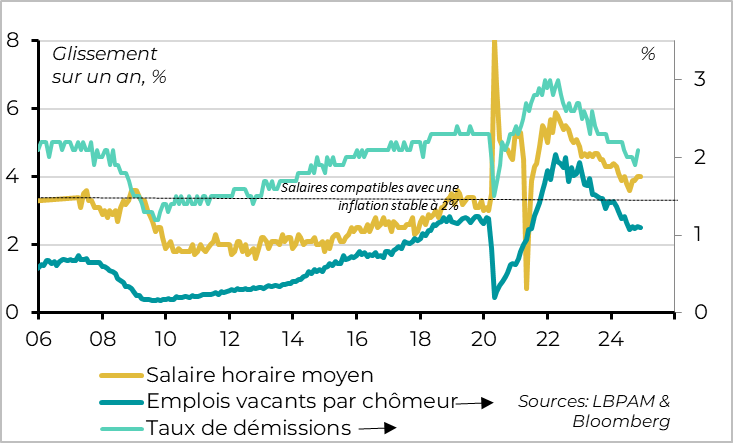

United States: wages remain dynamic, even a little too dynamic

Average hourly earnings rose by 4% year-on-year for the second consecutive month, and have been accelerating slightly for the past 3 months on a sequential basis. While wage costs are no longer generating high inflationary pressures, unlike in 2022-2023, they remain a little too high for the Fed. Wage growth of 4% is a little above its pre-Covid level and the level the Fed considers compatible with stable inflation of around 2%. Indeed, growth of 3.5% is usually seen as more compatible with the long-term inflation target (assuming productivity growth of 1.5%).

Measures of labour market tensions such as the number of vacancies per unemployed person or the resignation rate normalized at the start of the year and returned below their pre-Covid levels, suggesting that wage pressures are no longer so high. But they have recently stabilized at levels that still indicate a slightly higher-than-desired risk of wage and inflation persistence.

This is positive for short-term growth, as it supports household purchasing power. Indeed, growth in employment and wages, combined with stable hours worked, led to a 0.8% rise in wage income in November. This is encouraging for consumption, which remains the main driver of US growth.

But the persistence of somewhat high wages, combined with the strength of the economy, increases the risk that inflation will stop slowing and remain slightly above target. This is likely to be further demonstrated by the inflation figures for November published this week (core inflation is expected to reach 3.3% for the third consecutive month). In our view, this should prompt the Fed to slow the pace and scale of rate cuts next year, at least if the labor market continues to hold up well. All the more so as this slowdown would give the Fed time to consider the policies to be implemented by the new Trump administration.

Au total, nous pensons que la Fed va encore réduire ses taux de 25 pb la semaine prochaine mais qu’elle fera une pause en janvier et qu’elle baissera ses taux seulement 2 ou 3 fois l’année prochaine, au rythme d’une baisse par trimestre.

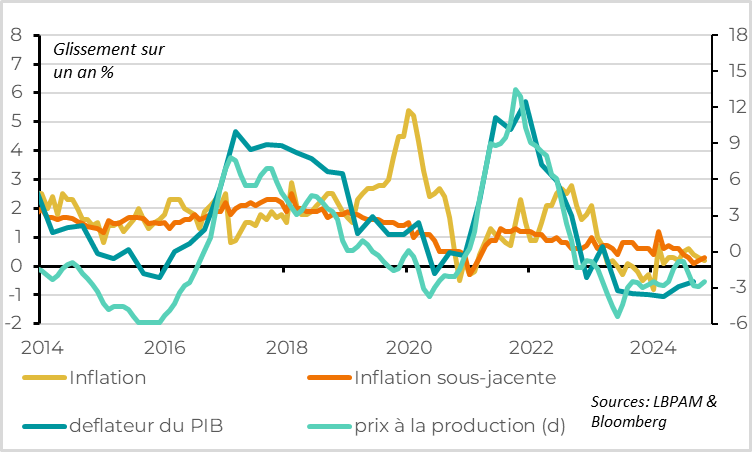

China: deflationary pressures remain high

Deflationary pressures remain high in China, despite the support measures put in place since September. This shows that more support is needed to sustain the economy beyond the rebound in activity at the turn of the year. Inflation slowed from 0.3% to just 0.2% in November, whereas it had been expected to rise. This reflects the slowdown in food inflation, offsetting less negative base effects on energy. Fundamentally, core inflation stagnated at 0.3%, a sign that domestic demand remains weak. Producer prices fell by 2.5% after 2.9%, continuing the sharp decline that began more than two years ago. While this is partly due to lower raw material prices, it also reflects the impact of overcapacity and lower construction prices.

Against this backdrop, markets will be keeping a close eye on the Central Economic Conference taking place this week in the presence of President Xi. But while this conference may give some indication as to the direction of public policy next year, it is not historically the occasion for announcing specific new measures. Beyond further central bank rate cuts, it is likely that we will have to wait until next March for the announcement of major new measures, especially on the fiscal front. This may seem a long time in the markets' time horizon.

Xavier Chapard

Strategist