More reassuring global economic prospects

Link

What should we take away from market news on November 25, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overviews

► Despite the end of the longest shutdown in history and NVIDIA’s strong earnings, markets have seen slight consolidation this week, mainly in U.S. risk assets. At this stage, we view this as a healthy pause following the robust performances in September and October, rather than a trend reversal. Uncertainty remains high, but the macroeconomic backdrop is still broadly supportive.

► Thanks to the solid performance of Italy’s public finances in recent months, supported by notable political stability, Moody’s has upgraded the country’s sovereign debt rating to Baa2. This is the first time in 23 years that the agency has taken such a decision. The move, partly anticipated, explains the moderate reaction of the Italian spread, measured by the difference between 10-year Italian and German government bond yields. This spread now stands slightly below that of France. We continue to believe that exposure to Southern European sovereign debt remains relevant.

► Preliminary S&P PMI surveys for November came in much stronger than expected across major economies. In the United States, the composite index (services and manufacturing) rose compared to the previous month and remains firmly in expansion territory. This rebound is mainly driven by renewed strength in services. According to the survey, the end of the shutdown and expectations of rate cuts by the Fed have significantly improved business sentiment.

► Statements by J. Williams, President of the New York Fed, during a conference in Chile on Friday, have reignited uncertainty around the central bank’s next moves. He expressed support for further rate cuts in the near term, arguing that monetary policy remains slightly restrictive. However, we believe most members will opt for caution and keep rates unchanged in December, even though the debate remains highly uncertain. We still anticipate additional cuts in early 2026, bringing the policy rate to just above 3%.

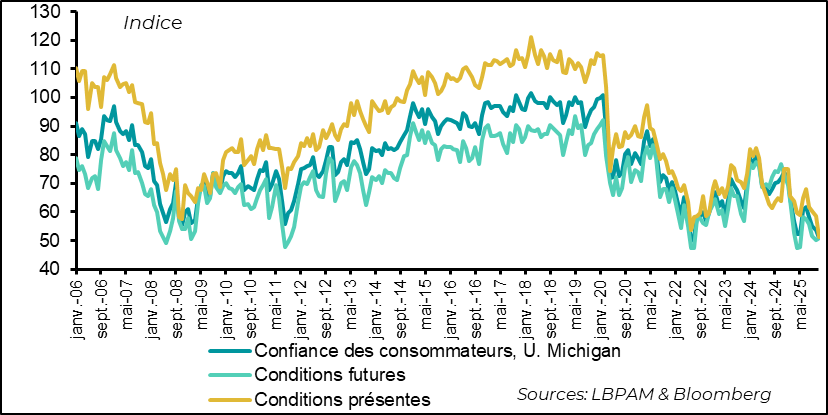

► Despite these positive signals from businesses, the University of Michigan’s final survey on consumer confidence still shows a very weak sentiment. However, these negative views on the economy and outlook are not reflected in household spending trends. In fact, consumption data prior to the suspension of official statistics continued to show resilience among consumers. That said, we expect household demand to slow in the final quarter of the year, particularly as the labor market becomes less supportive and inflation gradually accelerates due to tariff increases.

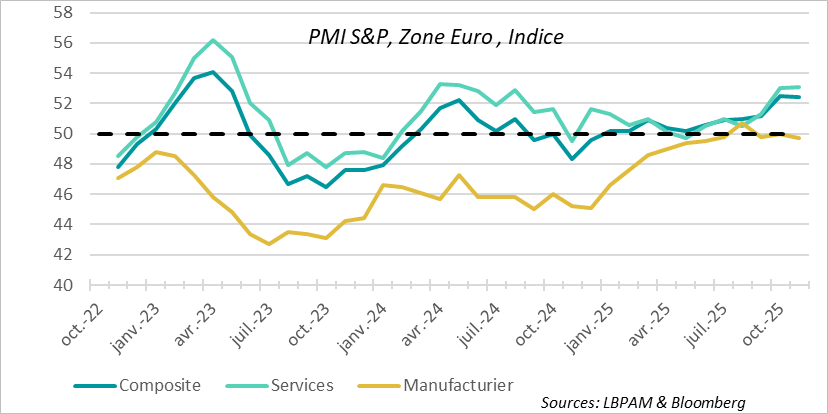

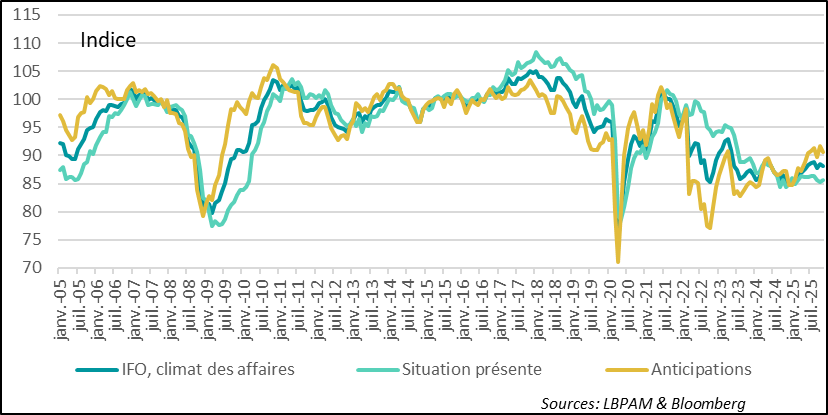

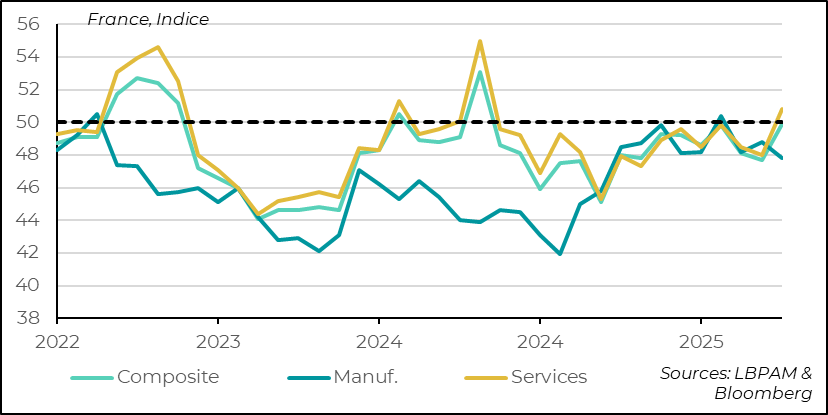

► In the euro area, the S&P PMI survey remains solid, with the composite index virtually unchanged at 52.4, still in expansion territory. A positive signal comes from France, where activity in services has rebounded and returned to growth, confirmed by INSEE’s business climate indicator. Conversely, Germany’s momentum is weakening in both industry and services, despite the implementation of the stimulus plan. The November IFO survey confirms this slowdown, with a slight decline in the composite index, mainly due to weaker expectations. We continue to anticipate a pickup in activity in 2026

Going Further

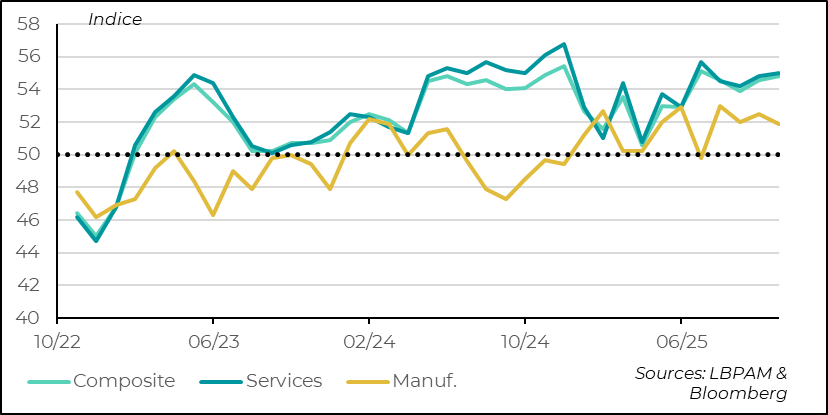

United States: November PMI indices show strong performance

Services continue to support U.S. growth

S&P’s composite PMI (covering services and manufacturing) for November exceeded expectations, driven by a sharp rebound in services. The sector index reached 55, its highest level in four months, signaling solid expansion. Companies notably reported a marked improvement in new orders during the month.

However, these strong figures contrast with hiring intentions that remain weak. Firms emphasize that rising costs continue to be a major obstacle to increasing payrolls, citing tariffs as one of the main sources of this pressure.

On the manufacturing side, activity slowed in November while remaining in expansion territory. This moderation reflects a decline in new orders, even as inventories continue to rise. Despite these unfavorable elements for future momentum, manufacturers’ optimism is improving, supported by heightened expectations of fiscal stimulus in 2026 and a more accommodative monetary policy.

Consumer confidence remains at a historically low level

The household survey also shows mixed signals.

On one hand, the unemployment rate unexpectedly rose from 4.3% to 4.4%. At 4.44%, it is close to rounding up to 4.5%, its highest level since the Covid period, and now exceeds the 4.2% threshold the Fed considers consistent with full employment. This suggests weaker labor demand relative to supply.

However, this increase is explained by the rebound in the participation rate, which climbed from 62.3% to 62.4%, offsetting the decline seen over the summer. Typically, more people returning to the labor market is a sign of strength. It is this rise in job seekers that explains the higher unemployment rate, while employment actually grew by 250,000 in September according to the household survey.

Wage data are also mixed: the monthly increase (+0.2%) fell short of expectations, but after revisions to previous months, annual growth reached 3.8%. More recent indicators confirm this ambivalence: continuing jobless claims hit a cyclical high in early November, while new claims remain stable at a low level.

Inflation expectations are falling but remain elevated

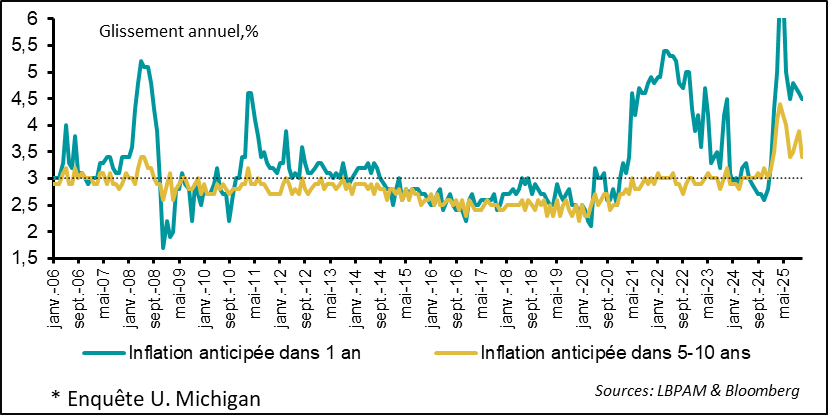

Price trends—and their impact on purchasing power—will be one of the main drivers of the expected slowdown in consumption. According to the University of Michigan survey, inflation expectations remain historically high, although they moderated in November.

Inflation remains a central topic of debate. We continue to believe that tariff increases will feed through to consumer prices in the coming months, even if this pass-through is proving much slower than anticipated. The average tariff observed on imports is still below the theoretical level estimated from the hikes announced by U.S. authorities. We nevertheless think the impact on inflation will be temporary, although the persistence of the tariff shock is difficult to assess.

Some members of the Fed’s monetary policy committee appear to take a relatively benign view of tariffs’ impact on inflation. This is suggested by J. Williams’ recent speech, in which he expressed readiness to cut rates further in the short term, arguing that monetary policy remains slightly restrictive.

However, the minutes of the latest Fed meeting reflected a much more cautious tone, which we believe is justified. Williams’ comments—given his proximity to J. Powell—add uncertainty to the decision expected on December 10. We remain in favor of caution and think the Fed could wait until early 2026 to resume monetary easing, especially as the lack of economic data complicates the assessment of conditions, notably in the labor market and price dynamics.

On the markets, the probability of a December rate cut is gaining ground again, helping to strengthen them after two weeks of adjustment. Is the Fed ‘put’ back?

Eurozone: european activity remains well-oriented despite underlying weaknesses

The Eurozone maintains robust activity… driven mainly by services

The Eurozone’s preliminary PMI for November was virtually unchanged, confirming its position in expansion territory. The composite index reached its highest level in nearly two years, driven by strong services activity, with the sector’s indicator hitting a peak not seen in 18 months. In contrast, manufacturing continues to struggle, with a slight decline in its overall index. However, this stagnation contrasts with the contraction observed over the previous two years.

An analysis of data for the Eurozone and its two largest economies suggests that peripheral countries—particularly Spain—remain the main drivers of European expansion.

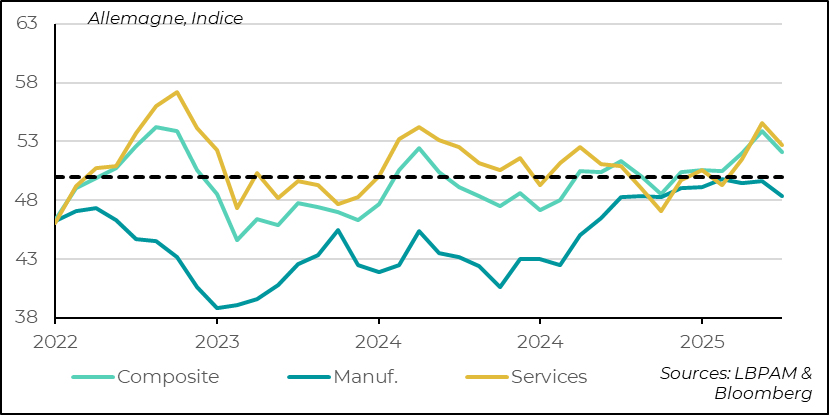

Germany: Activity softens slightly in November

The survey highlights a disappointing economic trend in Germany, which may seem surprising given the government’s massive stimulus plan. It is clear that additional efforts will be needed to restore business confidence and maximize the impact of current measures, whose most significant effects will only materialize in 2026. Meanwhile, German exporters continue to suffer from the negative consequences of U.S. protectionist measures.

The IFO also sends a mixed signal for Germany

The relatively negative message from the PMI was confirmed by the IFO survey, which also shows weakening confidence, particularly regarding outlook.

After numerous negative shocks, especially to its industrial base, Germany still has a long way to go before its economy regains momentum. This will likely be one of the major challenges for 2026 and for the government’s extraordinary stimulus plan.

In France, services rebound while manufacturing weakens

France’s PMI survey turned out more favorable than expected, thanks mainly to a strong rebound in the services sector. This improvement can be attributed to easing concerns over the political situation. However, with no budget yet for 2026, this upswing could prove short-lived.

Conversely, on the manufacturing side—as in Germany—activity deteriorated and remains in contraction territory.

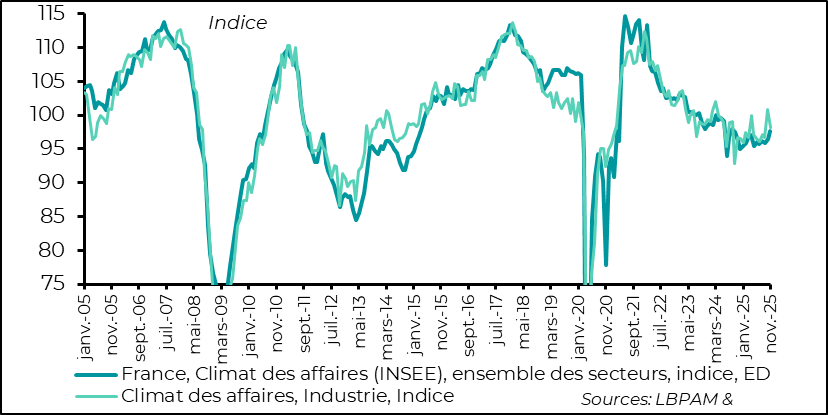

Business climate also improves according to INSEE… except in manufacturing

This trend was also confirmed by INSEE’s November business climate survey. The overall index continued to rise, while conditions in manufacturing deteriorated again.

It is clear that France’s economic situation remains fragile despite robust GDP growth in Q3 2025. Greater political stability and clarity on budgetary choices will be key to restoring confidence and giving fresh momentum to economic expansion.

Sebastian Paris Horvitz

Head of search