Nervous Markets Amid French Political Uncertainty

Link

-

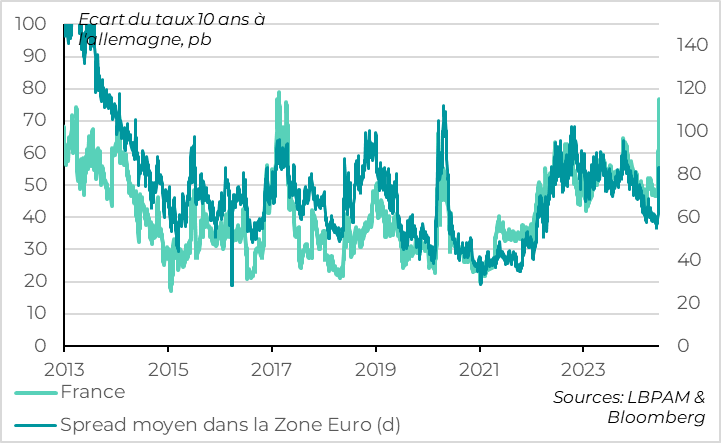

Over the past week, the interest rate spread between France and Germany widened by a total of 30 basis points. It has stabilized over the weekend above 75 basis points, close to its 2017 highs of 80 basis points. Although short-term uncertainties remain high, we believe that the risk of a significant market correction is limited. This is because all major parties wish to remain in the EU and Eurozone, and President Macron retains a veto right. This should support a medium-term rebound in European markets, particularly in equities and peripheral debt.

-

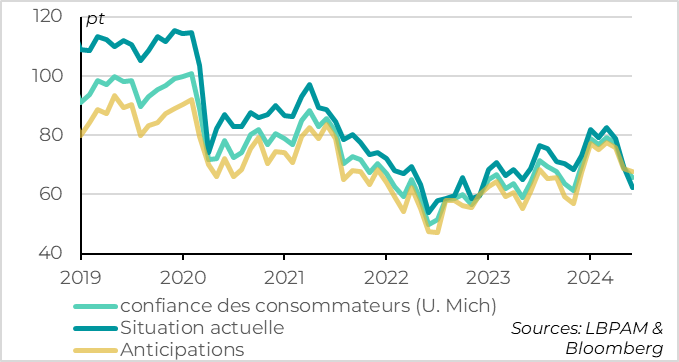

American household confidence continued to decline in June, suggesting weaker consumption compared to last year. Households indicate that inflation remains somewhat high, leading to a slight increase in inflation expectations in June. Although the Fed is not alarmed by the current level of inflation expectations, which remain generally anchored, the slightly elevated levels justify a cautious approach. The Fed is likely to wait for more signs of disinflation before lowering rates, despite favorable inflation figures in May.

-

American household confidence continued to decline in June, suggesting weaker consumption compared to last year. Households indicate that inflation remains somewhat high, leading to a slight increase in inflation expectations in June. Although the Fed is not alarmed by the current level of inflation expectations, which remain generally anchored, the slightly elevated levels justify a cautious approach. The Fed is likely to wait for more signs of disinflation before lowering rates, despite favorable inflation figures in May.

-

The Bank of Japan disappointed markets on Friday by not indicating an imminent rate hike and announcing that it will not reduce purchases until next month. However, it confirmed that it would start quantitative tightening in July and remains confident about exiting deflation, which we believe should allow for rate hikes in the coming months. This week, central banks in England, Switzerland, and Australia are also on the agenda.

Fig 1 France: uncertainties over the outcome of the legislative elections in France continue to weigh on the French market

10-year rate spread in Germany, bp

France

Average spread in the euro area

The interest rate spread between France and Germany widened throughout last week following the announcement of early elections and subsequent alliances for the first round. Overall, the French spread increased by 30 basis points, stabilizing above 75 basis points over the weekend, close to its 2017 highs of 80 basis points, just before the first round of the presidential elections.

Compared to 2017, the likelihood of parties representing extremes and lacking government experience taking control is higher, especially after the agreement between left-wing parties, which significantly reduces the probability of a central bloc victory. This raises concerns, particularly given France's severely degraded public finances and the need for budget consolidation.

However, unlike 2017, none of the coalitions advocate for a Frexit or Euro exit. Furthermore, the National Rally (RN) seems to be backtracking on some of its costliest proposals, while the left-wing coalition includes parties experienced in governance, limiting systemic risks.

Overall, in the coming month, it's hard not to think that market uncertainty will remain high, urging caution but not panic.

The stress on French debt is spreading to other French and European assets but in an orderly manner. Spreads on peripheral debts (Italy, Spain, etc.) have also widened but have only returned to their levels at the beginning of the year. The CAC 40 fell by 6.2% last week, underperforming the Eurostoxx (-4.2%) while global stocks remained largely stable. Volatility may remain high in the short term, but we still believe that the medium-term outlook for European markets remains positive, particularly for equities and peripheral country debt.

US Household Confidence Falls Again in June

Pt

Consumer Confidence (U.Mich)

Current situation

Expectations

According to preliminary results from the University of Michigan survey, American household confidence declined again in June, reaching its lowest point since late 2023. This decline is widespread, although more pronounced for the current situation indicator than for future expectations. Despite the survey's volatility, it suggests that the unemployment rate increase to 4% in May better reflects households' experiences than the dynamic job growth reported by businesses.

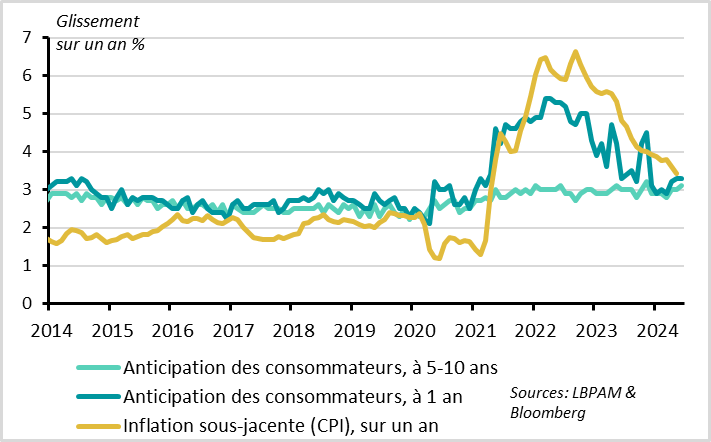

Fig.3 US Inflation Concerns Persist Despite Reasonable Expectations

Change over one year %

Consumer anticipation, 5-10 years

Consumer anticipation, 1 year

Core inflation (CPI), over one year

Household confidence is suffering from persistent inflation concerns. In early June, American household inflation expectations rose slightly and, while still generally anchored, remain somewhat high. The unexpected rise in June is noteworthy given the decline in realized inflation in May and lower gas prices, which typically result in lower expectations.

One-year inflation expectations are stable at 3.3% in early June, slightly above their historical average. They had returned to their average of 3% at the beginning of the year before rising slightly. Nonetheless, they remain well below their 2022 highs of over 5%. Long-term (5-10 years) inflation expectations increased slightly in June to 3.1%, within the normal fluctuation range for this indicator but at the high end of this range.

The Fed should not be alarmed by the level of inflation expectations, which remain generally anchored, especially in the long term. However, the slightly elevated level is another reason for the Fed to remain cautious in the short term and wait for more signs of disinflation before starting to lower rates.

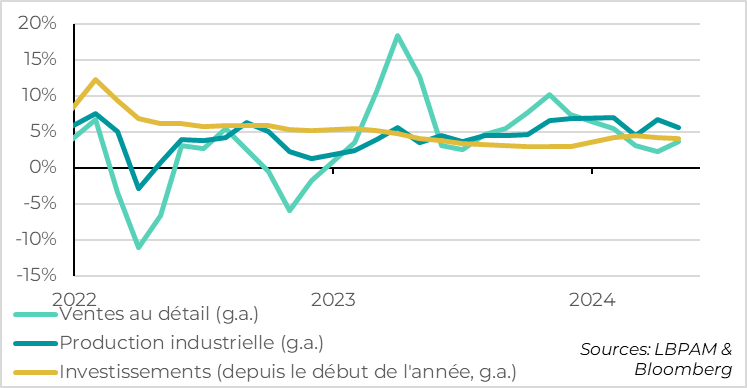

Fig.4 China: Activity Disappoints Again in May

Retail (g.a)

Industrial production (g.a)

Investment (year-to-date, g.a)

Chinese activity data for May disappoint again, suggesting a significant slowdown in Q2 growth after a solid start to the year. Recent public support announcements (for the real estate market and large investments) should allow authorities to achieve the 5% growth target this year. However, without more widespread support, especially directed towards consumption, the trend of economic slowdown is likely to continue beyond this year.

Industrial production growth slowed from 6.7% to 5.6% year-over-year in May, and investment growth slowed from 4.2% to 4.0% year-to-date, well below expectations. Investment remains weighed down by the real estate sector, where investment fell by more than 10% for the first time since the initial lockdown. While there are early signs of improvement in real estate sales, property prices continued to decline more sharply in May (-7.5% in the resale market, a 15-year low).

For once, consumption surprised on the upside in May after several months of significant slowdown. Retail sales rebounded from 2.3% to 3.7% year-over-year, and service activity from 3.5% to 4.8%. This suggests a less severe imbalance between demand and production than feared, although it remains significant. However, retail sales benefited in May from favorable base effects and extended holidays, which will not be the case in the coming months.

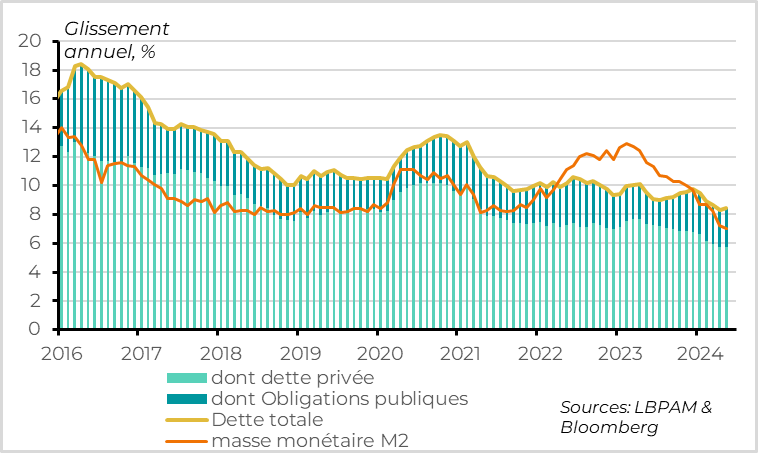

Fig.5 China: Credit Sustained by Public Issuances Amid Weak Private Demand

- including private debt

- including public bonds

- total debt

- money supply M2

Prospects for the private sector remain limited due to weak confidence and slowing credit growth. This underscores the importance of public support to stabilize short-term Chinese growth.

Credit to households and businesses slowed again in May, and M2 money supply hit a historic low of 7%. This is not a good sign for private sector activity in the coming months. However, total credit to the economy stabilized in May at 8.4% thanks to a rebound in public bond issuances, indicating that authorities will support growth further.

Despite weak private credit, authorities kept the key interest rate unchanged on Monday at 2.5%, likely to avoid additional downward pressure on the currency as the Fed maintains high rates. More substantial monetary easing measures, such as lowering key rates or reducing required reserves or injecting central bank liquidity, will likely be needed to support activity in the coming months.

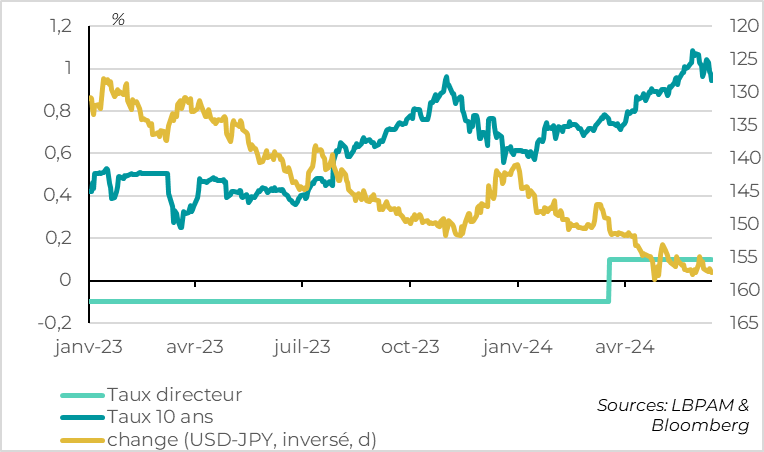

Fig.6 Japan: Bank of Japan Keeps Policy Unchanged in June

%

Key rate

10-year rate

Foreign exchange (USD-JPY, reversed, d)

As expected, the Bank of Japan (BoJ) kept its rates unchanged at 0.0/0.1% after exiting negative rates in March and announced it would start reducing its public bond portfolio.

This disappointed the market as the BoJ did not indicate an imminent rate hike (the market anticipates a one-in-three chance of a rate hike in July) and because the BoJ will not begin reducing purchases immediately. The BoJ stated that it would decide on its purchase reduction plan at its July meeting after consulting with financial actors.

Long-term rates fell below 0.95% after the BoJ meeting for the first time in a month, and the yen depreciated to 158 against the dollar, the level that prompted authorities to intervene in the foreign exchange market in late April.

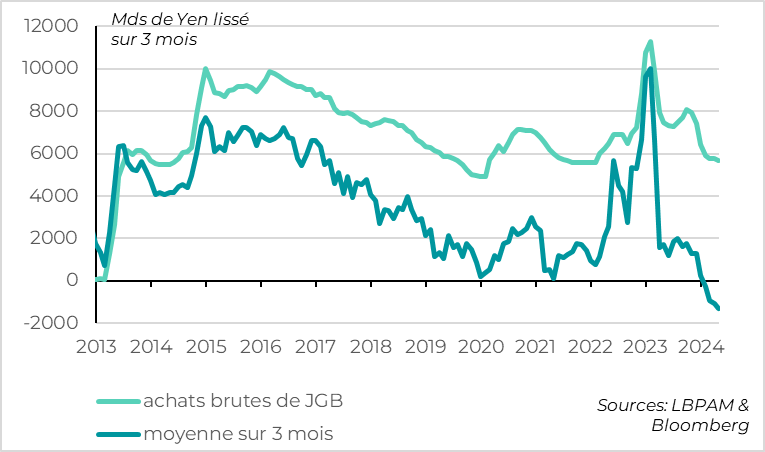

Fig.7 Japan: BoJ Prepares to Start Quantitative Tightening in July

MDS of Yen, smoothed over 3 months

JGB gross purchases

average over 3 months

Nevertheless, monetary policy is moving towards tightening, albeit slowly.

After exiting negative rates and yield curve control in March, the BoJ decided to start reducing purchases, though it takes its time defining the modalities of this withdrawal. While it continues to buy 6 trillion yen of bonds until the end of July, this is just enough to offset maturing bonds in its portfolio. This means it has not increased its balance sheet for a year and will start reducing it in late July.

Furthermore, the BoJ remains confident that core inflation will align with its target by mid-2025, for good reasons. While inflation was mainly driven by imported inflation in 2023, the BoJ estimates that future inflation will be more driven by rising inflation expectations and wages, which is more sustainable.

Overall, the prospects for quantitative tightening and rate hikes remain intact. The yen and Japanese long-term rates will continue to be guided by US rates in the short term, but we believe they should start rising in the second half of the year.