No Decoupling Between the USA and China, Only a Historic Trade War Remains

Link

Market Update for May 14, 2025: Insights from Xavier Chapard.

Key Takeaways

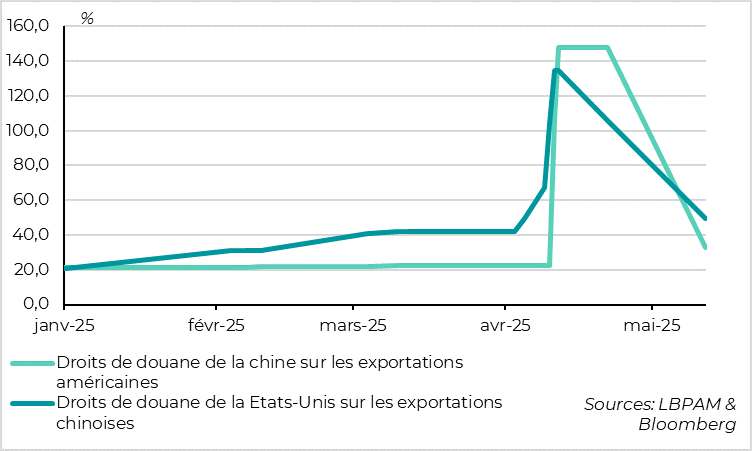

► Weekend trade negotiations between the United States and China led to a much larger-than-expected reduction in bilateral tariffs. For 90 days, "reciprocal" tariffs will drop from 145% to 30% for U.S. imports from China and from 125% to 10% for U.S. exports to China. We anticipated a reduction to around 60%, and Trump had mentioned 80% before the weekend

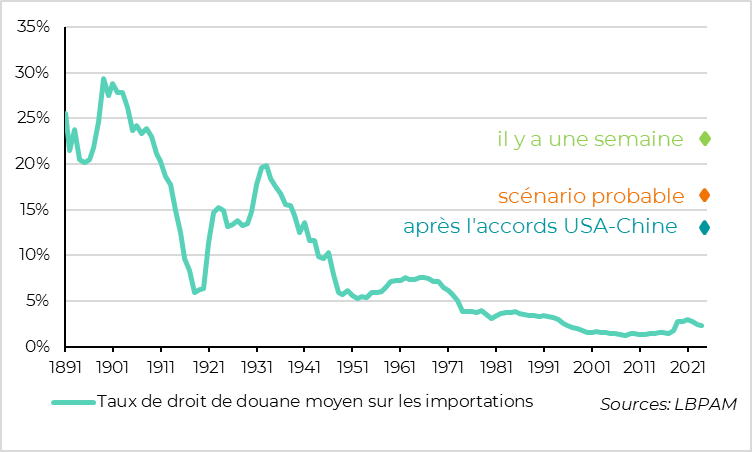

► These announcements are positive, indicating a general move towards de-escalation, with the peak of uncertainty likely behind us and a significant reduction in the risk of a global recession. However, the tariff and uncertainty shock remains substantial, with the average U.S. tariff potentially ending up at 13% instead of the 15% we anticipated, still much higher than the 2.5% at the beginning of the year. The scenario remains one of a global slowdown starting mid-year, particularly in the U.S., with a rise in U.S. inflation by the end of the year.

►Simultaneously, the trade agreement between the United States and the United Kingdom, the first in a series of bilateral agreements, suggests that significant tariffs, at least 10%, are here to stay. Uncertainty will also persist, given the reversals in U.S. policy and the temporary pause in additional "reciprocal" tariffs.

►The current situation has not yet deteriorated significantly, with confidence partially recovering after the April shock, supporting the market rebound. Confidence should continue to normalize while remaining limited due to the reduction in extreme political risks, but we still believe that U.S. activity and inflation data will deteriorate more significantly as summer approaches. In this context, markets may lack a clear trend in the coming weeks.

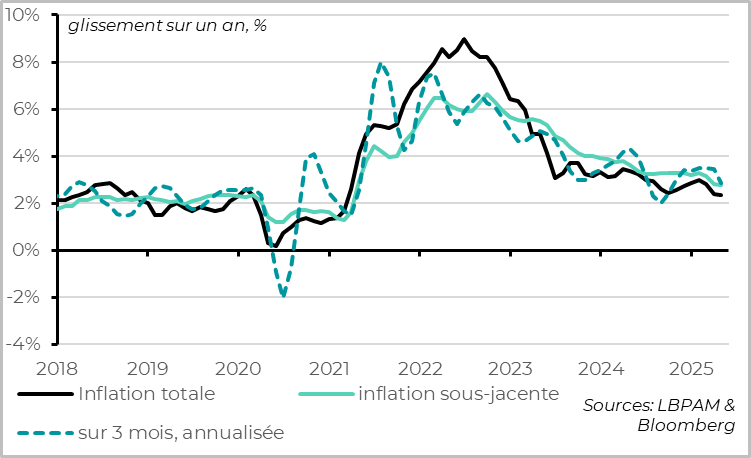

► U.S. inflation for April surprised slightly to the downside, with total inflation slowing from 2.4% to 2.3% and core inflation remaining stable at 2.8%. Besides the decline in energy and food inflation, the rise in goods prices was still limited in April, while service prices calmed with reduced travel demand. However, goods prices are expected to accelerate from May/June, two months after the tariff increase.

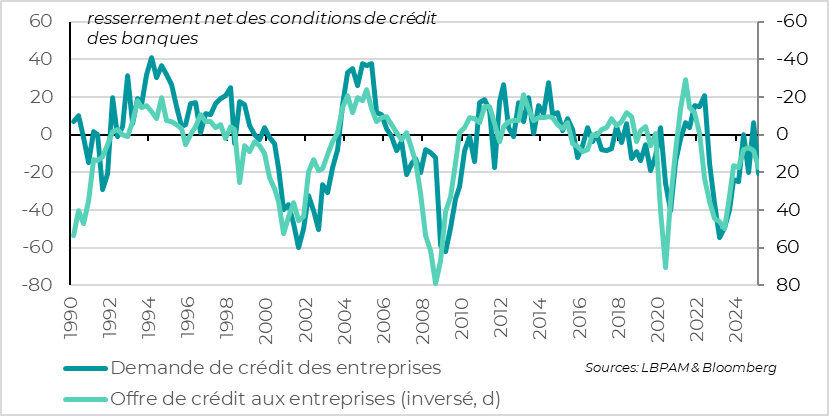

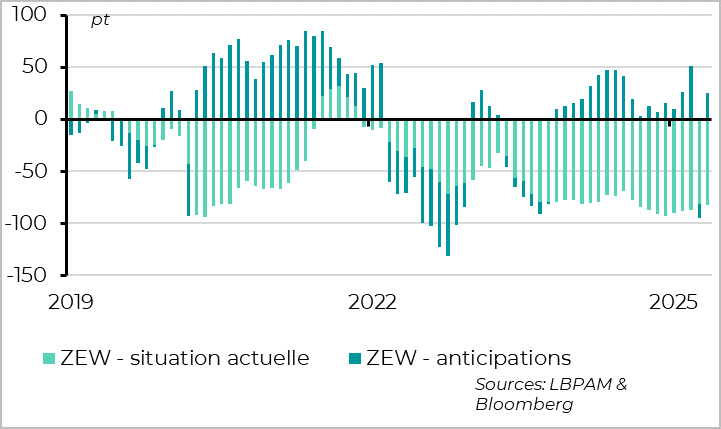

►German investor expectations in the ZEW survey reversed half of last month's decline in May, but they believe the current economic situation stopped improving this month and remains degraded. For the U.S., banks indicate that credit conditions for businesses deteriorated slightly in Q1, suggesting that the economy should slow down in the coming months.

► In the UK, the employment market is slowing more significantly this year, which should give the BoE confidence to continue its "gradual and cautious" rate cuts, despite the rebound in activity in Q1 and the rise in regulated prices. Wage growth excluding bonuses slowed from 5.9% to 5.6%, and the unemployment rate rose to 4.5% in Q1, while the number of employees fell by 33,000 in April.

To Go Further

USA-China: The Truce Massively Reduces Bilateral Tariffs for 3 Months

The de-escalation of "reciprocal" tariffs between the United States and China announced on Monday is much more significant than anticipated. For 90 days, the 34% "reciprocal" tariffs imposed by the United States on China are reduced to 10%, the same level as for other countries (also for a period of 90 days). These tariffs apply to almost two-thirds of Chinese exports to the United States. The tariffs imposed during the mid-April escalation (50% then an additional 41%) are completely suspended.

However, what remains unchanged are the 20% tariffs imposed by the United States on all imports from China in February and March as part of the fight against Fentanyl, to which the Chinese had not responded. Similarly, the overall tariffs on specific goods (25% on automobiles and steel and aluminum) remain in place for China. Symmetrically, Chinese authorities only impose a 10% increase in tariffs on imports from the United States out of the 125% reciprocal tariffs.

Overall, the increase in American tariffs on Chinese goods thus averages from 110% to 30%.

At the same time, the agreement signed between the United States and the United Kingdom is disappointing. The reciprocal tariffs of 10% on imports from the United Kingdom remain unchanged, suggesting that no country should obtain tariffs below 10%. Only tariffs on specific goods are reduced, particularly from 25% to 0% for steel and aluminum and from 25% to 10% for cars (below a quota). Overall, the average increase in tariffs on imports from the United Kingdom goes from 11% to 8.5%, which is still a massive increase compared to the 1.2% applied until the beginning of the year.

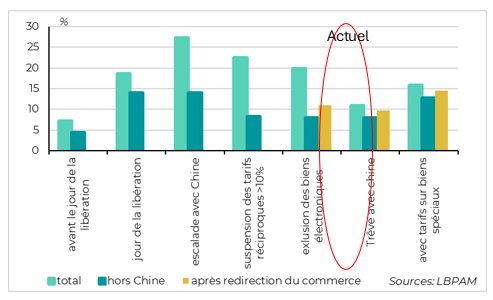

United States: The Average Tariff Increase is Less Significant Than Feared

Two particularly important uncertainties remain for the macro scenario:

- Will American tariffs on China remain at this new level? We already included in our central scenario a return of USA-China tariffs to 60%, but it now appears possible that they remain at 30%. The agreement lasts for 90 days. While it is reasonable to hope that this suspension will be extended, it is not guaranteed. Indeed, D. Trump posted last week that a tariff of 80% seemed fair to him, and he had further increased tariffs on China after a pause during his first term. However, a re-escalation as significant as that of April is unlikely.

- What will D. Trump do for specific goods that are not yet subject to tariff increases, primarily semiconductors and pharmaceuticals? We thought he would impose them globally at 25%, as is the case for other special goods (auto, steel, aluminum). It is hard to imagine that he will not impose them at all, given that these are the goods that were initially supposed to be specifically protected. But after the setbacks of the American administration and the signing of the first bilateral agreements, the possibility of more limited tariffs in rate and targeted geography has increased.

United States: But the Tariff Shock Remains Historic

Overall, the more significant-than-anticipated de-escalation between the United States and China is a pleasant surprise, reducing the risks of a global recession. But it is not likely to fundamentally change the macro scenario according to us, given the still massive increase in American tariffs and the upcoming impact of the April uncertainty shock. If the agreement is durable, it would reduce the average tariff shock we anticipate for this year from 15% to 13% in our central scenario, which remains a historic shock compared to the 2.5% in place at the beginning of the year.

This would reduce the shock on the American GDP by about 0.2 points for 2025-2026 (for a shock we estimate at 1.5 points) and would also slightly mitigate the re-acceleration of underlying American inflation in the second half of the year, which would reach 3.8% instead of 4% at the end of the year. Above all, it would reduce the risks related to our tariff scenario and strengthen the chances that the peak of uncertainty occurred in April, thus allowing slightly more favorable financial conditions. It is likely that other countries will obtain small tariff reductions, like the United Kingdom (maintaining 10% reciprocal tariffs but easing for automobiles and steel) and, above all, that specific tariffs on semiconductors and pharmaceuticals will be less significant than anticipated.

However, this does not challenge the marked slowdown in American growth that we foresee for the rest of the year, nor the fact that inflation will continue to rise and remain well above the target until the second half of next year. Uncertainty has also decreased since mid-April with the first setbacks of the American administration, but it remains significant, especially because reciprocal tariffs beyond 10% and additional tariffs on China are only suspended for 90 days and budget negotiations are still ongoing.

United States: Inflation Continues to Slow Slightly in April

Total and underlying inflation increased by 0.2% in April, slightly more than in March but less than the 0.3% expected. This allows for a year-on-year slowdown to 2.3% and 2.8%, the lowest since early 2021.

On one hand, this confirms that the acceleration of inflation at the beginning of the year was exaggerated and that the disinflationary dynamics continued before the trade war.

But on the other hand, this trend is exaggerated and should be challenged starting next month due to tariffs. The slowdown in inflation is exaggerated by the impact of negative tariffs on the demand for travel services, whose prices have been falling for 2 months, while the price of goods is just beginning to be impacted by tariff increases in April. Indeed, core goods inflation increased from -0.1% to 0.1% in April, turning positive for the first time since 2023 but remaining limited. If the usual 2-month lag between tariff imposition and goods prices holds, goods prices should accelerate more significantly in May and especially in June.

United States: Credit Conditions for Businesses Tighten at the Beginning of Q2

As in the eurozone, American banks indicate a deterioration in credit conditions in the first quarter. Banks are slightly tightening credit conditions for businesses, and credit demand is again decreasing for both businesses and households. As a leading indicator of the economic situation, this suggests that activity will indeed slow down more significantly in the coming months.

However, the survey of banks was conducted in early April, at the peak of trade uncertainty, and likely exaggerates the deterioration of banking credit conditions, which remain limited. Moreover, banking credit conditions are less important for the economic situation in the U.S. than in Europe because the economy is more financed through the market.

Germany: Confidence Rebounds in May After the April Shock, but Activity Remains Weak

In Europe, the ZEW survey of German investors recovers half of its April decline, reinforcing the idea that the uncertainty shock has passed. Thus, investor expectations for Germany's economic prospects rebounded to +25.2 in May after falling to 14 points in April, returning to its average level from last year. However, the indicator of the current economic situation in Germany fell for the first time this year and remains degraded at -82 points. This suggests that activity data may deteriorate in the short term following the political shocks from the United States in April, even though sentiment data is improving with reduced uncertainties.

In these conditions, surveys of businesses such as PMI or IFO will now be important to assess the extent of the impact of past shocks on the underlying state of the real economy.

Xavier Chapard

Strategist