Oil and the Euro have already forgotten the wars

Link

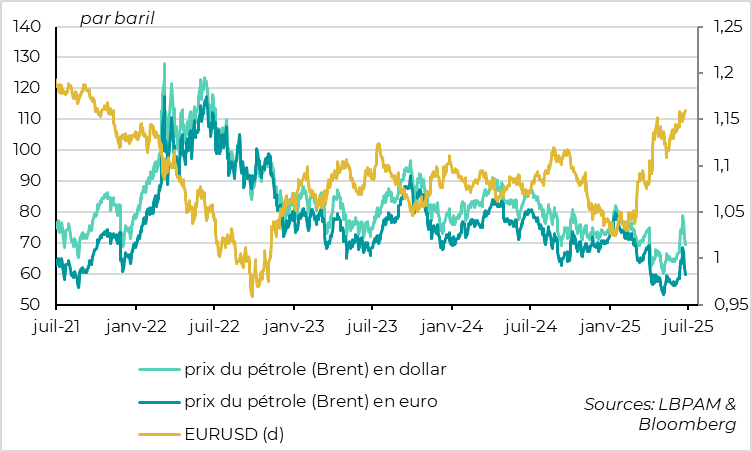

Despite concerns over the US strikes in the Middle East, a rapid de-escalation between Iran and Israel allowed markets to return to calm, with oil back below $70. This geopolitical détente, coupled with accommodative signals from the Fed, led to a fall in the dollar and a marked rebound in the euro.

Key Takeaways

► Despite fears over the weekend following the US bombings, we have seen a rapid and massive de-escalation of tensions in the Middle East. A limited retaliation by Iran, with no impact on energy installations, and American pressure have opened the door to a truce between Israel and Iran. After topping $80 a barrel at Monday's opening, oil has already fallen back to its pre-Israeli strike level, below $70 a barrel. While risks remain (compliance with the ceasefire, the actual state of Iran's nuclear facilities, etc.), this de-escalation is positive for the global economy.

► Diminishing geopolitical fears and inflationary risks, as well as surprisingly accommodating speeches by some Fed members, weighed on the dollar, which fell back to its lowest level since 2022 against a basket of currencies. After C. Waller this weekend, a second Fed governor in the person of Vice-Chairwoman M. Bowman opened the door to a rate cut as early as the July meeting. This comes as a surprise less than a week after the Fed meeting, which made it clear that the central bank wanted to wait for summer data before acting, suggesting stable rates at least until the October meeting. That said, these two members, appointed by D. Trump and probably campaigning to take over from Powell at the head of the Fed next spring, are far from representing the majority of Fed members. We continue to believe that the Fed will wait until at least the final quarter before cutting rates.

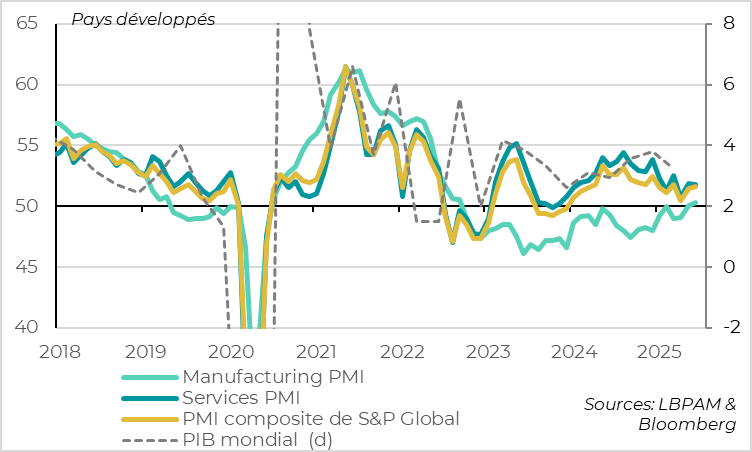

►Meanwhile, the first surveys for June, which have not had time to be impacted by the war in the Middle East, are mixed. They point to a still limited slowdown in the global economy as summer approaches.

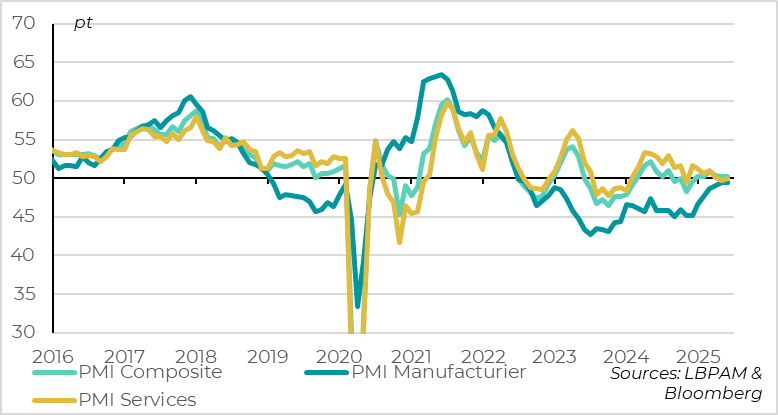

►Flash PMIs published by S&P Global were stable in June in the developed countries after May's partial rebound, at around 51.5pt. The manufacturing sector continues to improve slightly, with a PMI just above 50pt, suggesting that the anticipation of price rises continues to support industrial activity. In services, the PMI stagnated at an average level, indicating a gradual slowdown in domestic demand.

► In the United States, the overall S&P PMI remains solid, falling by just 0.2pt to 52.8pt. But the details of the survey are less reassuring, with regional Fed business surveys remaining more deteriorated than the PMI in June, and consumer confidence unexpectedly falling quite sharply, according to the Conference Board survey. All in all, this keeps uncertainty high as to the scale and timing of the US slowdown.

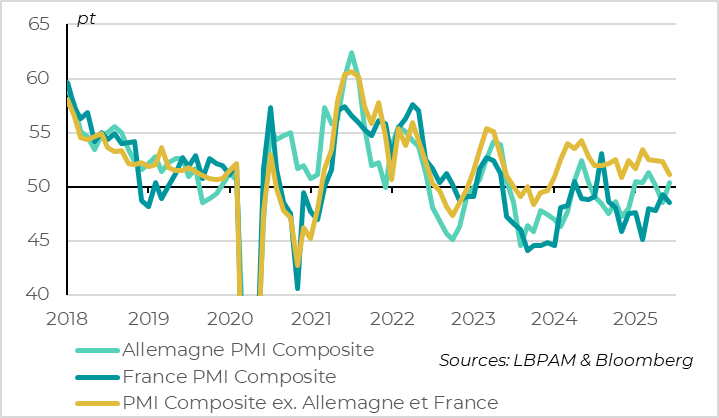

►For the Eurozone, the PMI remained stable at 50.2 points in June, indicating that trend growth remains positive but still sluggish. The emergence of the German PMI and services PMI from the contraction zone in June is reassuring, but the further sharp drop in the French PMI to just 48.5pt is a persistent drag.

To Go Further

Markets: Oil at pre-war levels in Iran and the euro-dollar at pre-war levels in Ukraine

Developed countries: PMI stable in June after rebounding in May

S&P's global composite PMI is stable in developed countries in June, according to preliminary estimates, at around 51.5. This confirms that global growth is resilient after the PMI's partial rebound in May from its low point in April, but also that global growth slowed in the first part of the year compared with last year.

In terms of sectors, the manufacturing PMI rises marginally after returning just above 50 points in May, after 2 years in contraction territory, indicating that the industrial cycle continues to benefit from the advance of goods demand and stockpiling ahead of tariff-related price rises. The services PMI remains stable at an average level, signalling resilient but lacklustre domestic demand.

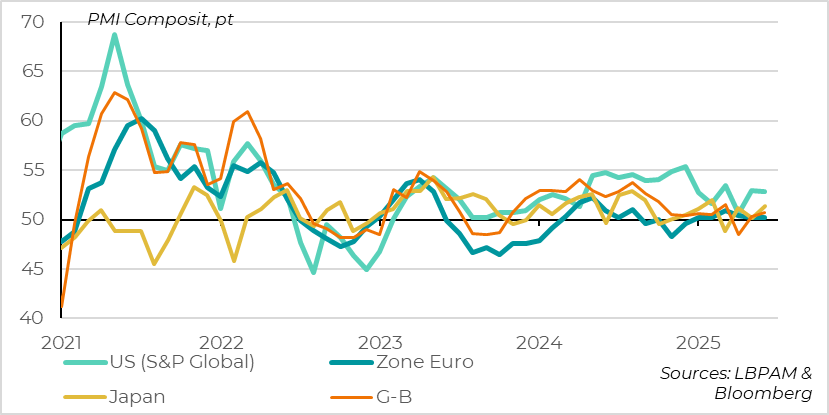

Developed countries: PMIs return to expansion zone

In geographical terms, PMIs were virtually stable in the USA and the Eurozone, but improved in the other main developed countries, which is reassuring for the solidity of the economic cycle.

In particular, in Japan and the UK, where domestic demand appears resilient, PMIs are moving back more clearly into the expansion zone. And in the UK, sales prices are easing after the rise in regulated prices and taxes in April, which should reassure the BoE that domestic pressures are easing. This reinforces our expectation of a rate cut at the next monetary policy meeting in early August.

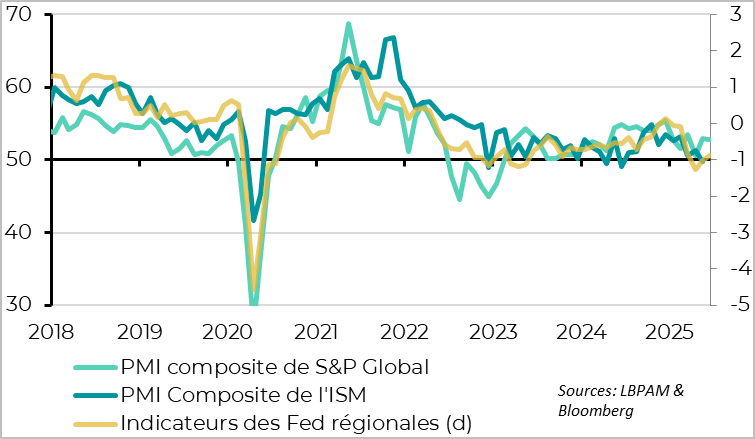

United States: business surveys have been mixed since April

The S&P Global US PMI confirms its May rebound, consolidating only marginally (-0.2pt) and remaining at a healthy 52.8pt. This suggests that growth is still slowing only slightly as we approach summer.

That said, a number of elements are less encouraging and maintain uncertainty as to the extent and timing of the slowdown expected in the US in the second half of the year.

Firstly, the detail of the overall S&P PMI is less robust than that of the global indicator. Indeed, the stability of the manufacturing PMI at 52 points comes from a sharp rise in inventories, suggesting that US companies are continuing to stockpile in the face of tariff uncertainty, and price indicators are still pointing to price rises ahead. In addition, the services PMI is slowing and business confidence for the coming months is down slightly, suggesting a trend slowdown in the economy.

Secondly, the regional Fed surveys for June show a more limited rebound in business confidence after the April shock, as in May and the May ISM. They improve slightly in June, but are consistent with a PMI barely above the 50pt mark.

United States: consumer confidence falls again

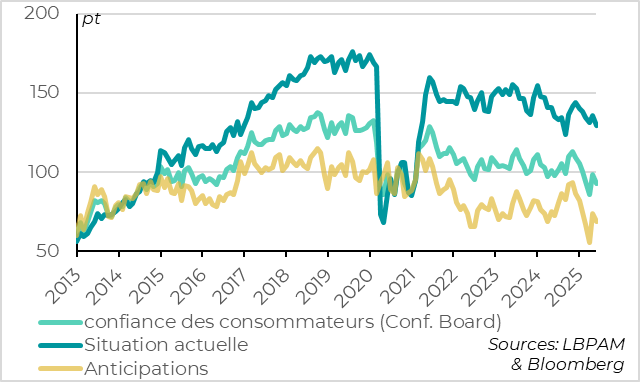

Finally, consumer confidence disappointed with an unexpectedly sharp drop in June, from 98.4 to 93 points, according to the Conference Board survey. It remains above its April level, but below its historical average.

This fall is partly due to household expectations, which in our view is not very revealing, as these expectations are highly volatile and probably distorted by extreme political polarization. But it is also due to the fall in the indicator of households' current situation, which nevertheless remains high, perhaps more indicative of the economic slowdown (as was the case in mid-2024).

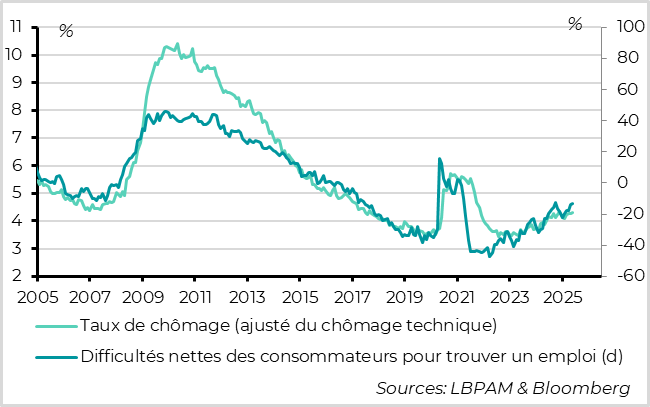

United States: households point to a slowdown in the job market this summer

The fall in household confidence in June was not due to inflationary fears, unlike at the start of the year, since household inflation expectations, although still high, fell for the second consecutive month in June.

The main reason for this is the slowdown in the job market. The unemployment rate is set to rise slightly in the coming months, although it is likely to remain historically low.

Euro zone: PMI stagnates just above 50 points

The Eurozone PMI remained stable in June at 50.2pt, a level that remains low but consistent with slightly positive growth.

This stability stems from the fact that the June rebound in the manufacturing PMI came to a halt, remaining just below 50 points (at 49.4), while the services PMI returned to stability after falling back below 50pt in May. This is reassuring, as it means that European domestic demand is holding up, even if the temporary support provided by US demand for goods in anticipation of tariffs is fading.

Euro zone: Business confidence picks up in Germany, but not in France

In geographical terms, within the eurozone, the PMI fell again in France and, like the Insee indicator, remained at a low level (48.5). By contrast, the German PMI rebounded and returned to the expansion zone in June, with an improvement in both industry and services. This improvement is confirmed by the IFO, which reached a 1-year high in June, at 88.4pt, thanks to the renewed optimism of German companies in all sectors.

These PMI data imply that PMIs for the rest of the zone fell fairly sharply in June, even though they remain 1 point above the eurozone PMI. The outperformance of the periphery is beginning to recede, but still persists.

Xavier Chapard

Strategist