Opening of Sino-American Negotiations: Beginning or Peak of De-escalation?

Link

Market Update for May 7, 2025: Insights by Xavier Chapard

Key Takeaways

► Markets were consolidating slightly at the beginning of the week after last week's rebound, awaiting the Fed's decision tonight and in a low-liquidity environment due to many markets being closed for holidays (in the UK, in Asia for Golden Week). However, they are recovering slightly this morning following the announcement of the opening of trade negotiations between the United States and China this weekend.

► These negotiations in Switzerland are taking place at a high level (with the Chinese Vice Premier and the US Treasury Secretary), even though the two presidents are not directly involved. This raises hopes for progress on de-escalation, even if it is not about discussing a long-term comprehensive trade agreement.

► Meanwhile, President Trump continues to send mixed signals. On one hand, he announces that negotiations are progressing well with several countries (including the UK and Canada). On the other hand, he indicates that he will unilaterally set the level of tariffs and the necessary concessions for partners wishing to negotiate.

►Overall, we believe that the peak of uncertainty has probably passed since the initial retreats of the administration, reducing extreme economic risks and the risk of a sharp market correction. However, we also believe that uncertainty will remain abnormally high for economic prospects and that the already imposed trade and confidence shock will lead to a significant slowdown in the global economy by mid-year. Given the market optimism following recent reassuring announcements, and the fact that the Fed is likely to remain on hold at least until summer, we remain cautious in our exposure to risky assets, particularly in the United States.

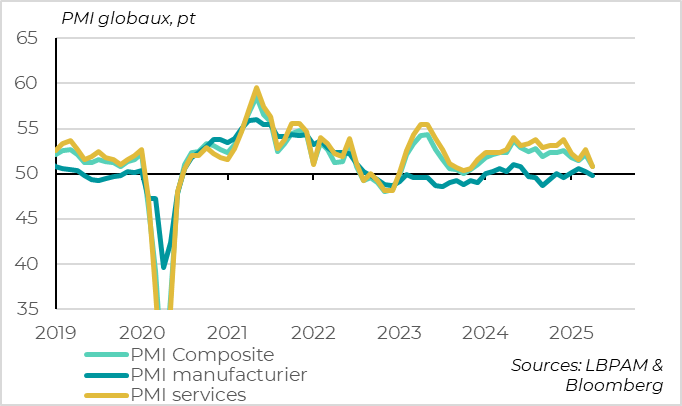

► The global composite PMI fell significantly and broadly in April while remaining in expansion territory at 50.8 points. This indicates a slowdown in global growth at the beginning of Q2, but not a collapse.

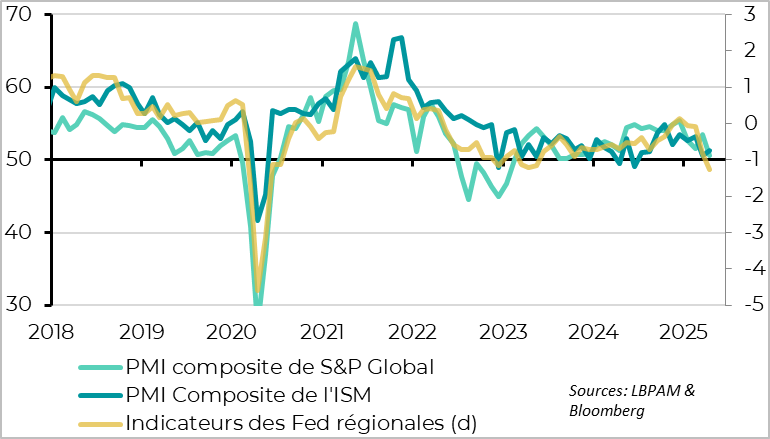

►In the United States, PMIs are mixed in April even though they generally indicate a slowdown. That said, the economic slowdown was exaggerated in Q1 (-0.3%) by the surge in imports in anticipation of tariffs, so the decline in imports could slightly delay the slowdown in growth in Q2.

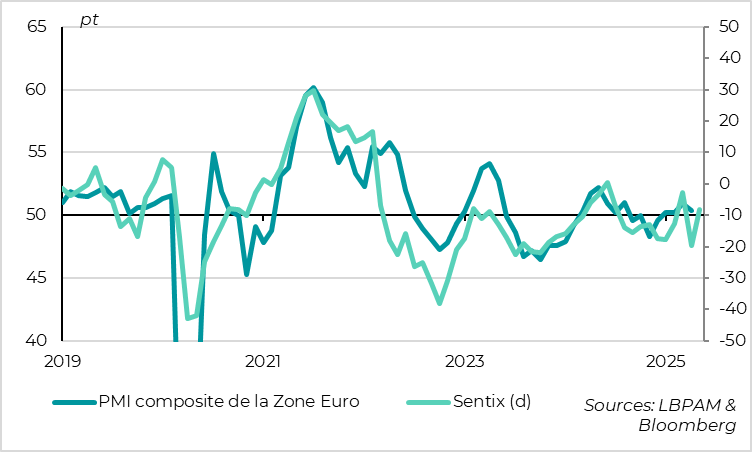

► In the eurozone, the final PMI was revised from 50.1 to 50.4 points, which is still a decline from March but suggests that growth is holding up at the beginning of Q2. The Sentix survey rebounded in May after its sharp decline in April, reducing the risks of a sharp slowdown in activity in the coming months. This supports our scenario of some resilience in the eurozone recovery, even if it is slightly delayed.

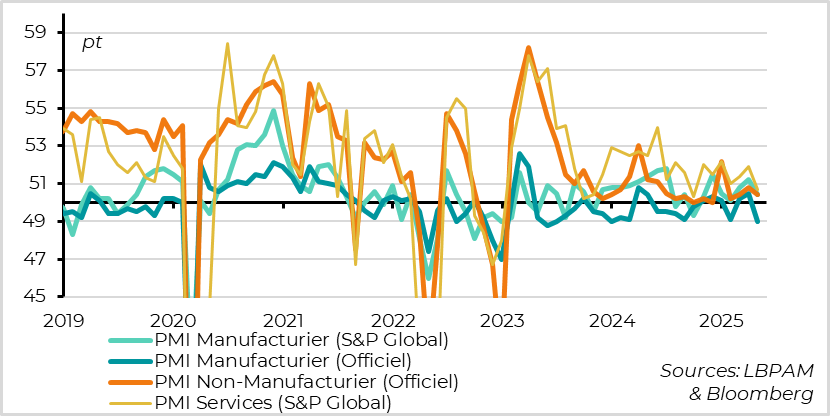

► Chinese PMIs fell more sharply than expected in April, suggesting a marked slowdown in growth after the acceleration at the end of 2024/beginning of 2025. This is prompting authorities to accelerate their support for the economy, with the central bank announcing this morning a cut in the refinancing rate and the reserve requirement ratio for banks. We still believe that the authorities are ready to do whatever it takes to support the economy in the face of massive external shocks, hence our anticipation of slightly higher Chinese growth than the consensus this year.

.

To Go Further

Global: PMI Declines Broadly but Not Abruptly in April

The global composite PMI fell from 52.1 to 50.8 points in April, indicating a significant slowdown in global growth at the beginning of Q2, but not a collapse. Indeed, the PMI is at its lowest since 2023 but remains above the 50-point threshold. However, business confidence has globally dropped to its lowest since the COVID shock in April, suggesting that the slowdown will continue in the coming months.

The decline is widespread across sectors and countries, although it is more pronounced for services than for manufacturing and for developed countries (especially the USA) than for emerging markets. This is somewhat surprising given that manufacturing and emerging markets are more directly exposed to the trade war. However, it shows that the confidence shock is very significant and that the primary victim of tariffs is indeed the US economy.

United States: Economic Indicators Point to Gradual Slowdown

In the United States, PMIs are mixed in April even though they generally indicate a significant slowdown compared to Q1. The ISM services unexpectedly increased from 50.8 to 51.8 while the services PMI fell by 3.4 points to 50.8. This reassured the markets, which focus more on the ISM even though both indicators are historically equally good at tracking the US economy. However, the ISM rebound follows a sharp decline in March, so it remains below its late 2024/early 2025 level. Regional Fed indicators, which incorporate more business expectations than the PMIs, which are purely coincident indicators, fell more sharply in April. This confirms the confidence shock.

Eurozone: Growth Slows but Holds at the Beginning of Q2

In the eurozone, the April PMI was revised from 50.1 to 50.4 points in the final release, suggesting good resilience of the economy even though business confidence is very degraded for the coming months. Indeed, the PMI is still down from March (50.9 points) but remains in line with the Q1 average, suggesting that growth is holding at the beginning of Q2. However, business confidence for the coming months has significantly dropped to its lowest in a year and a half.

The Sentix survey rebounded more than expected in May after its sharp decline in April. This suggests that the PMI should not fall sharply in May. The rebound in this investor survey is not surprising given the market rebound since mid-April and should be taken with caution, as it does not reflect what is actually happening in businesses. However, it has been a good leading indicator of the PMI recently, and it confirms that the massive confidence shock in April will not remain as significant after the initial retreats of the US administration (although we still believe that uncertainty will remain abnormally high).

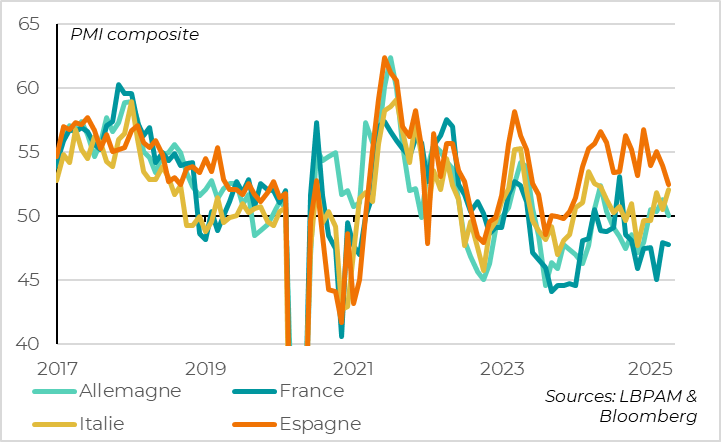

Eurozone: Peripheral Countries Continue to Outperform

In terms of countries, French and German PMIs fell slightly less than initially expected, with the German PMI narrowly avoiding falling below the 50-point mark (at 50.1 points). The Spanish PMI, however, fell more than expected, although it continues to outperform the rest of the zone (at 52.5). The good surprise comes from Italy, where the PMI rebounded to a one-year high (52.1 points), which is reassuring as Italy is highly exposed to the global and German industrial cycle. Overall, it seems that the periphery continues to drive the eurozone economy this year. This is one of the reasons why we prefer bonds from these countries over those from core countries and France.

China: Growth Slows More Sharply Than Expected at the Beginning of Q2

Conversely, Chinese PMIs disappointed in April, indicating a significant loss of momentum in both manufacturing and services at the beginning of Q2, after the growth rebound at the end of 2024/early 2025. Official PMIs indicated a more marked slowdown in manufacturing than in services, which was not surprising since tariffs on Chinese exports increased before those of other countries and authorities are supporting domestic demand. However, S&P Global PMIs indicate that activity in services is also slowing, with the services PMI falling from 51.9 to 50.7 points

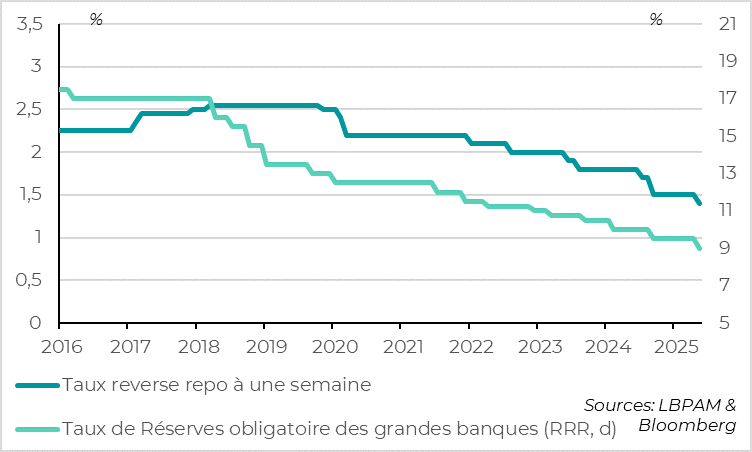

China: Authorities Prompted to Accelerate Monetary Easing This Morning

This is prompting Chinese authorities to accelerate their support for the economy (and their negotiations with the USA) after observing more resilient growth than expected in Q1 (at 5.4%). Thus, the central bank lowered its refinancing rate for banks by 10 basis points to 1.4% and the reserve requirement ratio by 50 basis points (to 9% for large banks) this morning for the first time since September. This rapid response confirms that the authorities are ready to significantly increase their support for the economy to counter the impact of the massive trade shock. Thus, our view is slightly more positive than the consensus on Chinese growth this year, despite the trade war.

Xavier Chapard

Strategist