Partial relief for the markets

Link

-

French and European assets rebounded slightly this morning following the results of the first round of the French parliamentary elections.

-

These results show that the scenario which would have greatly reduced the political risk (coalition around the center) has to be ruled out, but this scenario was unlikely. The scenario that the markets had already factored in, that of a parliament without a clear majority, is indeed the most likely. It justifies a persistent but limited risk premium. Above all, the least favorable scenario for the markets, that of an absolute majority for the left-wing alliance, has been all but ruled out. The scenario of a RN majority is still quite possible in our view, even if it is a little less likely after the left, and to a lesser extent the center, called on its candidates qualified third for triangular elections to withdraw.

-

In addition to the French election results, the markets are being supported by the stronger slowdown in underlying inflation in the USA, which increases the chances that the Fed will cut rates after the summer. Indeed, the Fed's inflation target rose by just 0.08% in May, slowing to 2.6% year-on-year. And inflation in services also slowed in May, although it remains high. This confirms that disinflation is continuing, even if we are still a long way from a return to the 2% target.

-

In addition to the French election results, the markets are being supported by the stronger slowdown in underlying inflation in the USA, which increases the chances that the Fed will cut rates after the summer. Indeed, the Fed's inflation target rose by just 0.08% in May, slowing to 2.6% year-on-year. And inflation in services also slowed in May, although it remains high. This confirms that disinflation is continuing, even if we are still a long way from a return to the 2% target.

-

On the activity front, US consumer spending remains resilient, even if it is slowing in trend. These data are in line with our scenario, which forecasts a marked but not abrupt slowdown in US growth this year. This scenario is positive for the Fed, which hopes to calm domestic pressures without triggering a recession.

-

China's June PMIs disappoint again, confirming the slowdown in growth in Q2. Without further support from the authorities, the risk of China missing its 5% growth target this year is increasing.

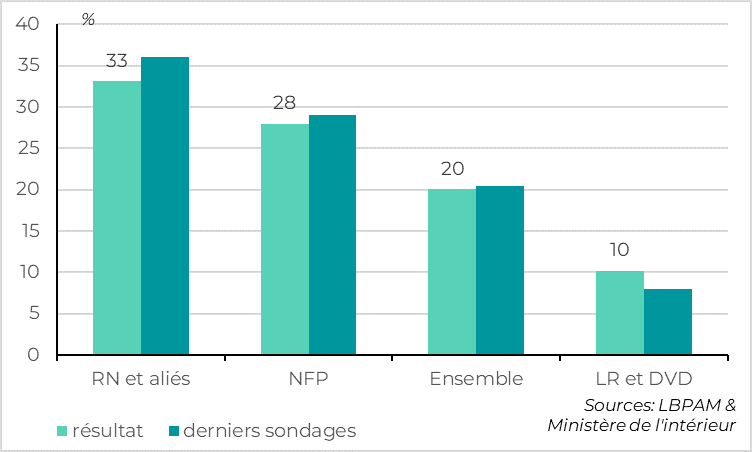

Fig 1 France: The results of the 1st round of legislative elections are in line with expectations

- RN and allies

- NFP

- Ensemble

- LR et DVD

The distribution of votes is close to what the latest polls predicted. At the margin, the RN and its allies obtained just a little fewer votes than expected, at 33% vs. more than 35% forecast.

The surprise came from the turnout, which was very high, at 66.7%. This makes withdrawal strategies crucial to the final result. The turnout is the highest since the 1990s, when it was less than 50% in 2022.

High turnout means a high number of MPs elected in the first round, and above all a high number of possible triangular contests. A total of 76 MPs have already been elected (including 37 RN and 32 Nouveau Front Populaire), compared with just 5 in 2022. Above all, there are some 300 possible triangular results (before withdrawals), compared with just 7 in 2022.

After the results, the Left Front and, less clearly, the presidential majority, issued instructions to block the RN. They are asking their candidates who qualified in triangular contests but came third to withdraw. This would reduce the chances of an absolute majority for the RN, if (1) these instructions are respected by the local candidates and (2) the citizens who voted for those who withdrew do indeed vote for the RN's opponent. For the first condition, we'll know by tomorrow evening (deadline for second-round candidacies). For the second condition, we'll have to wait for the vote next Sunday.

All in all, we can conclude from this first round of legislative elections that a majority around the center is impossible and, above all, that an absolute majority for the Nouveau Front Populaire is virtually impossible. An absolute RN majority is still possible, although less likely given the RN's slightly lower-than-expected result and the announcements of withdrawals. The most likely scenario is indeed that of a parliament without an absolute majority, which reduces the extreme risks but leaves France in a complicated political situation.

For the markets, the scenario that would have greatly reduced the political risk (coalition around the center) has to be ruled out, but this scenario was unlikely. The scenario that the markets had already factored in, that of a parliament without a clear majority, is indeed the most likely, which justifies a persistent but limited risk premium. Above all, the least favorable scenario for the markets, that of an absolute majority for the left-wing alliance, has been all but ruled out. That said, the scenario of a RN majority is still quite possible in our view, which could generate further volatility in the coming days.

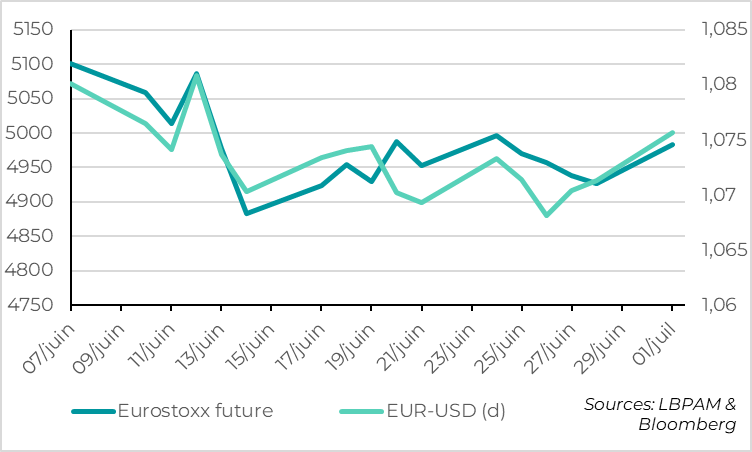

Fig.2 France: French and European assets rebound slightly this morning

- Eurostoxx future

- EUR-USD (d)

The markets greeted these results with a degree of relief, but without cancelling out the premium on French political risk that had built up following the announcement of the dissolution.

Before the markets opened this morning, the euro was up 0.4% against the dollar and the pound, and futures on European equity markets had rebounded by 1%. The spread between French and German 10-year debt, which stood at 80bp on Friday, should fall below 75bp if futures are to be believed. This would be the lowest spread in 2 weeks, but still well above its pre-European election level (less than 50bp).

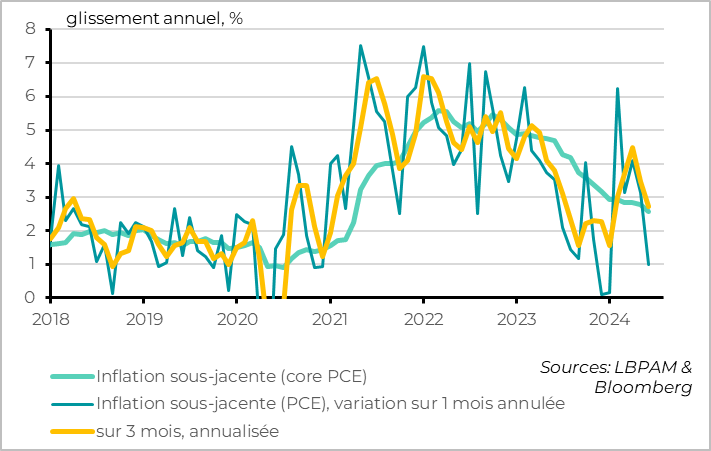

Fig.3 United States: Core inflation slows more than expected in May

- Underlying inflation (core PCE)

- Underlying inflation (PCE), cancelled 1-month change

- Over 3 months, annualized

In addition to the French election results, the markets are buoyed by the stronger slowdown in core inflation in the USA, which increases the chances that the Fed will cut rates after the summer.

The core PCE deflator, the Fed's inflation target, slowed even more than expected in May. It rose by just 0.08% over the month, its weakest monthly growth for 6 months. This allowed year-on-year inflation to slow from 2.8% to 2.6%. This is even less than suggested by the slowdown in consumer prices (CPI) and producer prices (PPI).

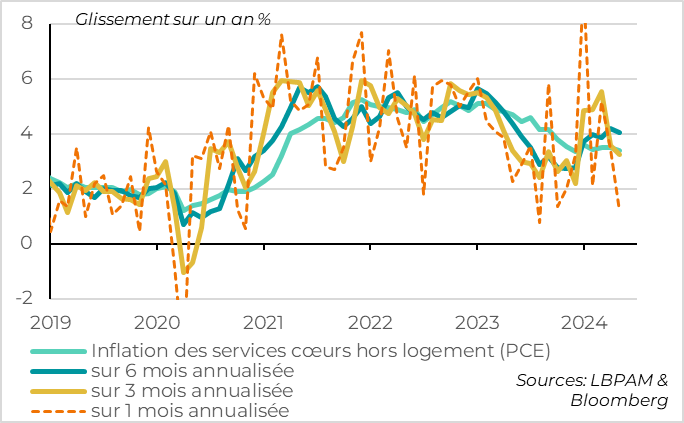

Fig.4 United States: Services inflation also slows, but remains too high

- Core services inflation excluding housing (PCE)

- Over 6 months annualized

- Over 3 months annualized

- Over 1 month annualized

The fall in core inflation still comes mainly from goods prices, but prices of services excluding housing also slowed in May after their Q1 rebound. This is reassuring for the Fed, as this measure of inflation reflects the evolution of domestic pressures, which are more sustainable. That said, inflation in services excluding housing is still too high, at 3.4%.

All in all, May's inflation figures are reassuring, as they confirm that the rise in inflation in Q1 did not indicate that the disinflationary trend was in doubt. Moreover, household inflation expectations fell slightly at the end of June, and are now at a level consistent with the Fed's short- and medium-term target. This reinforces our scenario that the Fed will be able to cut rates from September onwards.

But this is only a month of very favorable data, and inflation is still far from converging towards the 2% target. Against this backdrop, we will need confirmation of slowing inflation in the coming months to give the Fed sufficient confidence to start cutting rates. We still believe that disinflation will be slow and that the Fed will cut rates gradually (once a quarter in the coming quarters).

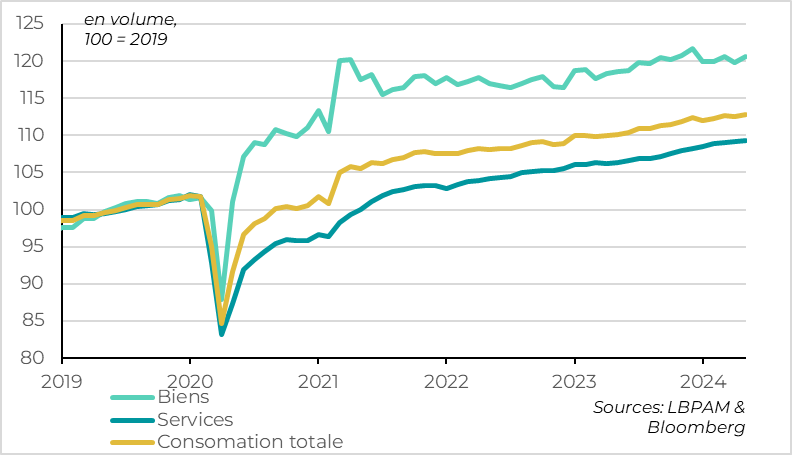

Fig.5 United States: Consumption, and therefore growth, slows gradually

- Property

- Services

- Total consumption

On the activity front, the latest US data indicate that consumption is still holding up, even if it is slowing in trend. Consumer spending in volume terms rebounded by 0.3% in May, after falling by 0.1% in April. This rebound stems from volatile demand for goods, while demand for services is gradually slowing but remains positive. Consumption was supported in May by household incomes, which rose by 0.5%. This enabled the savings rate to recover slightly to 3.9%, which is a high for the year but still half the pre-Covid level.

These data are in line with our scenario, which forecasts a marked but not abrupt slowdown in US growth this year. This scenario is positive for the Fed, which hopes to calm domestic pressures without triggering a recession.

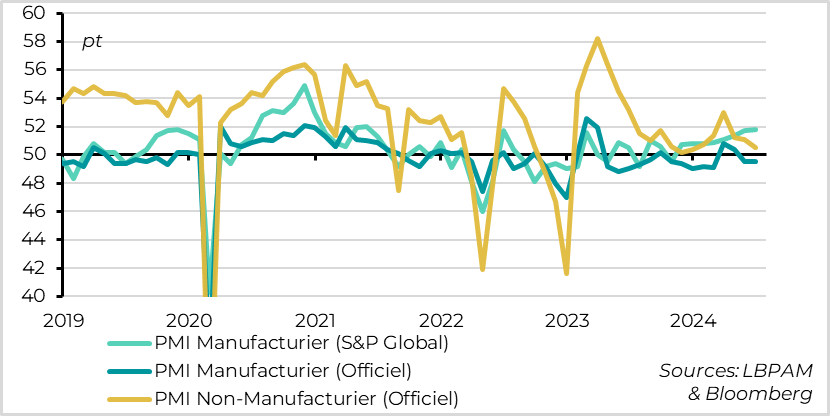

Fig.6 China: PMIs fall again in June

- PMI Manufacturier (S&P Global)

- Manufacturing PMI (Official)

- PMI Non-Manufacturing (Official)

China's official PMIs fell again in May, confirming the weakness of domestic demand and the economic slowdown in Q2 after the rebound in growth in Q1. Without further support from the authorities, the risk of growth failing to reach the 5% target increases, although this remains our scenario.

The official manufacturing PMI stagnated in the contraction zone, at 49.5pt. Above all, the non-manufacturing PMI falls again, from 51.1 to 50.5pt, a 6-month low. They confirm that activity is slowing down in Q2 after the rebound in growth in Q1, and suggest that growth will continue to decelerate this summer.

The Caixin Manufacturing PMI rose marginally in June, remaining in the expansion zone at 51.8pt. Given that this indicator covers a small number of private exporting companies, this suggests that exports remain well oriented. But this does not compensate for the signs of weakness in domestic demand that illustrate the drop in official PMIs.