No smooth sailing for central bankers

Link

- The environment in which central banks will have to operate in 2023 will evidently be more difficult than they had previously expected. Inflation falling slower than expected is likely to force central bankers to take a tougher stance than they thought. The possibility of bringing this inflationary episode to an end without having to slam the brakes on too hard seems to be somewhat contested in fact by much higher than expected prices on both sides of the Atlantic in January. The pressure on monetary policy may prove all the greater as growth, driven by demand that is holding up much better than expected, risks fuelling existing inflationary pressures.

- Calibrating the right mix for tightening monetary conditions will be no easy matter. Caution seemed to be the order of the day, with the talk veering towards more moderate rate hikes in the US and the ECB following a similar path to a more moderate pace, after a last sharp increase of 50 basis points (bp) in March. These approaches could be challenged. The bond market has been the quickest to adjust at this stage. The short end (2 years) of government bonds is now close to pre 2008-2009 financial crisis levels, while the long end (10 years) has nearly or completely erased the decline in rates at the beginning of the year. Stock markets are also beginning to suffer, but they continue to benefit from resilient economic growth. Faced with such uncertainties, we still advocate a certain dose of caution in asset allocation.

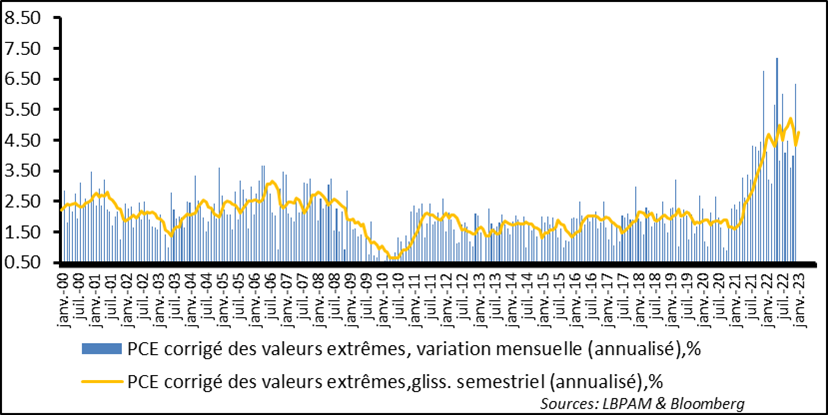

- On Friday, the personal consumption expenditures price index (the Fed's preferred inflation yardstick) disrupted the inflation forecast. It was already known that past inflation would be higher given the revisions to the index. The unpleasant surprise however came from the behaviour of core inflation, which rose by 4.7% year-on-year in January, compared with the expected 4.3%. The trend indicators developed by the Dallas Fed, which remove the most extreme price movements, show that inflation will continue to decline but rather slow down or even pick up pace in certain segments. This is a bad signal for the Fed, which has led the market to revise its assumptions further upwards on the path of key rates.

- China has tabled a document touted as a peace plan to end the war in Ukraine. More than a plan, in fact, the document is a statement of 12 principles that the Chinese authorities believe are essential if peace is to be restored. Thence, while adhering to most of the principles, European and American officials did not see it as a real proposal for resolving this war. In particular, China does not underscore the fact that Russia was the aggressor, violating the very principle of Ukraine's national sovereignty. In fact, China, which wanted to adopt a neutral position, seems to be moving closer and closer to the Kremlin. In a new vote at the UN at the end of last week concerning the war in Ukraine, China again abstained from condemning Russia for its invasion of Ukraine. The markets do not seem to be taking into account these growing tensions between East and West at this stage. If things do not change, such tensions will prove a major source of concern for the future.

The Fed's preferred Inflation yardstick, the personal consumption expenditures (PCE) price index, came in stronger than expected in January at 5.4%. The upward acceleration in core inflation over the month came as a surprise, with the core PCE (excluding energy and food) accelerating to 0.6% in monthly terms and to 4.7% year-on-year. While the peak of inflation has passed, this trend is at odds with what the Fed Chairman said about the past trend as a rapid disinflation so far.

The gauge developed by the Dallas Fed to measure the trend in PCE, removing the prices that are registering the most extreme increases and decreases, shows that inflation is no longer falling in January.

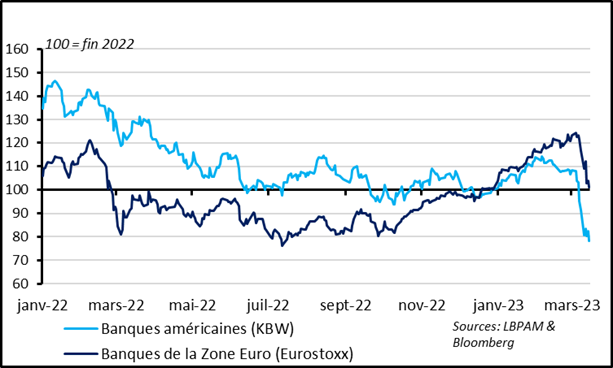

Figure 1 United States Core inflation is no longer decelerating in January

Looking at the trend over a shorter period, it turns out in fact that core inflation has even accelerated over one month as well as over six months. Although caution is called for, this trend seems to run counter to the idea of a rapid deceleration of inflation.

Figure 2 United States: Short-term trend of inflation is far less favourable than expected

In fact, this price development seems to show, all but self-evidently, that awakened by an overheating US economy, the inflation trend still seems far from being under control.

The improvement in financial conditions witnessed in recent months, of which Fed Chairman Jay Powell has been evasive, seems to have given a slight boost to business activity. Even the real estate sector, which has suffered the most from the rise in interest rates, seems to have benefited from the fall in interest rates since the beginning of the year. For example, the latest statistics on new home sales were surprisingly on the upside in January. The upturn may be short-lived of course, given the recent rapid upward adjustment in rates, which has already brought mortgage rates back to the level of the beginning of the year.

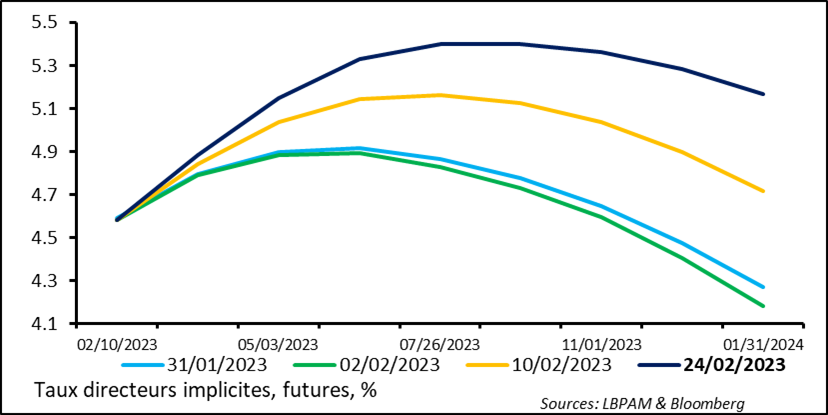

In view of these inflation figures and the rebound in business activity driven by services, the market has changed significantly its view of the trend in the Fed's prime rates. The idea of a rapid reversal of monetary policy this year, with rate cuts at the end of the year, has been almost completely erased. Furthermore, the market now believes that the terminal rate of prime rates could be far higher.

Figure 3 Fed: Expectation on the path of prime rates continue to move towards more monetary tightening

Conversely, the market has not yet shifted to a change in the pace of rate hikes, i.e. the Fed would continue to raise rates in steps of 25 bp.

Before the next meeting of the monetary policy committee, central bankers will have other statistics (on employment and inflation) at their disposal so as to be able to decide on the path they want to chart for monetary policy.

The employment statistics for the month of February will as of this week show the strength of the tensions that persist in the labour market. Given the low level of claims for unemployment benefits, it seems some redundancy plans notwithstanding, job creation remains sound, particularly in services, and wage pressures remain strong.

We continue to believe that the risks of more persistent inflation remain high. Our scenario of a more pronounced slowdown (moderate recession) in the US economy should help to ease these pressures, thanks to a tight monetary policy. If growth proves much more resilient, the risk of a deeper recession will increase, as a central bank will have to be much tighter in order to achieve its 2% inflation target.

This year continues to surprise us and may not mean smooth sailing for monetary authorities and the markets.

Kind regards,