Persistent clouds, but no storm

Link

-

The reaction of the markets to the results of the French elections was limited, as they had already factored in a scenario of no majority before the second round of parliamentary elections in France.

-

This configuration limits the systemic risks for the markets, which is positive for European assets not directly linked to French public policies. Neither side has the room for manoeuvre to implement radical budgetary measures, nor to adopt a confrontational stance with the European authorities.

-

That said, the absence of a clear majority - and even of a possible natural coalition - prolongs political uncertainty and leaves the budgetary outlook deteriorated. This should maintain a premium on French debt and the assets most closely linked to political risk in France.

-

There remains a slight potential for European assets to catch up, but realising this potential may take time at a time of increasing economic uncertainty. Indeed, since the end of July, economic surprises in the eurozone have joined US surprises in negative territory. At the start of July, investor confidence as measured by the Sentix fell sharply, after finally stabilising in June. The risks to our scenario of a limited recovery in Europe have become slightly negative again this summer.

-

In the US, after some fairly disappointing data in recent weeks, the NFIB survey of small businesses is somewhat reassuring. It suggests that the US economy is still resilient, even if it is slowing. SMEs also indicate that the disinflationary trend is continuing, but that it is still slow.

-

Jerome Powell adopted a fairly balanced stance during his bi-annual testimony to Congress yesterday. On the one hand, the rise in the unemployment rate in June and the net slowdown in inflation in May give the Fed more confidence to start cutting rates. On the other hand, the Fed is waiting for "other favourable data" before starting to cut rates. This is in line with our scenario, which calls for rates to remain stable in July before the Fed cuts rates for the first time in September.

-

Against this backdrop, the market will be keeping a close eye on US inflation data for June, due to be published tomorrow. They should confirm that inflation is resuming a slowing trend, but that this remains very gradual.

-

It should also be noted that the Q2 corporate earnings season begins in the United States at the end of this week. Earnings expectations are reasonable for Q2, but optimistic for subsequent quarters. Will micro fundamentals once again drive equities alongside macro developments? That remains to be seen.

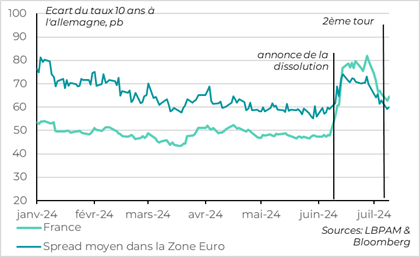

Fig 1 France: The risk premium on French debt stabilises at a high level

- France

- Average spread in the eurozone

The reaction of the markets to the results of the French election was limited, as they had already factored in a scenario of no majority before the second round of the French parliamentary elections. Indeed, there had been a large number of withdrawals to prevent the RN from achieving an absolute majority in the assembly. This was the outcome of the election, although the surprise was that the Nouveau Front Populaire came out on top rather than the RN.

The post-election configuration is therefore broadly in line with expectations and this limits the systemic risks for the markets. This is why we believe that the impact of French political risk on most European assets should gradually fade.

The fragmented Parliament does not provide the room for manoeuvre to implement the most extreme measures proposed on either the right or the left, or to adopt a confrontational stance with the European authorities. For France, the fact that the RN and LFI do not between them have a blocking majority somewhat reduces the risk of complete political deadlock. This makes the formation of a technical government or broad coalition possible in the long term, even if these solutions are difficult to envisage in the short term.

But at the same time, the absence of a clear majority - and even of a possible natural coalition - is prolonging political uncertainty and leaving the budgetary outlook deteriorated. This should maintain a premium on French debt and the assets most closely linked to political risk in France.

Most of the time, markets are quite comfortable with the absence of a majority, or even a government, in European countries, as this leads to broad coalitions and predictable economic policies. But in the case of France at the moment, it can be more complicated. Unlike most of its neighbours, France does not have a culture of building broad coalitions. And the position of the various blocs since the elections is not conducive to a simple resolution of the situation. This is a problem at a time when it needs to adjust its public finances (it is under the Excessive Deficit Procedure, with a deficit in excess of 5% of GDP). Finally, the current political situation is biased in favour of public deficits. If negotiations between the blocs on new spending are going to be complicated, what can be said about negotiations on spending cuts?

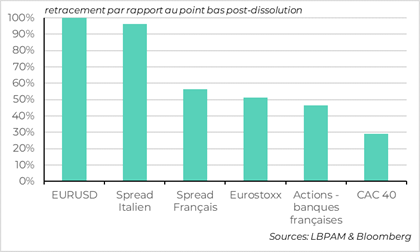

Fig.2 France: an uneven post-election rebound according to the markets

- EURUSD

- Italian spread

- French spread

- Eurostoxx

- Equities - French banks

- CAC40

All in all, we remain cautious on French government bonds and on players with close links to the government (French banks, etc.). These assets have already recovered half of their post-dissolution correction. The debts of peripheral countries and European companies, meanwhile, have already retraced all of their June decline, which is justified by the risk being relatively limited to France. We remain positive on these debts. For the European and French equity markets, the retracement has been more limited, which leaves some potential. That said, it may take time to realise this potential at a time of increasing economic uncertainty.

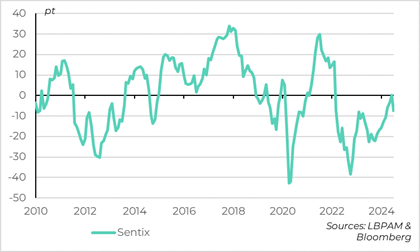

Fig.3 Euro zone: investor confidence falls sharply at the start of July

- Sentix

En effet, la confiance des investisseurs pour les perspectives économiques baisse nettement début juillet d’après la mesure du Sentix, ce qui renforce les incertitudes sur la conjoncture à court terme.

Le Sentix a nettement rebondi depuis fin 2023 et avait retrouvé un niveau neutre en juin pour la première fois depuis le début de la guerre en Ukraine. Mais il subit sa plus forte chute depuis 2022 en juillet, même si l’indicateur reste au-dessus de ses niveaux de 2022-2023. Il ne faut pas surréagir à cet indicateur de confiance, qui ne s’appuie que sur le sentiment des investisseurs et pour lequel l’enquête a été menée entre les deux tours des élections législatives françaises, au moment où l’incertitude politique était maximale. Mais cet indicateur a été par le passé un bon indicateur avancé des retournements de cycle et sa baisse va dans le sens des dernières données économiques pour la zone euro qui sont décevantes.

Nous continuons d’anticiper que la reprise en zone euro va continuer tout en restant limitée. Mais si les données économiques continuent de décevoir, cela augmentera rapidement le risque de nouvelle stagnation en zone euro.

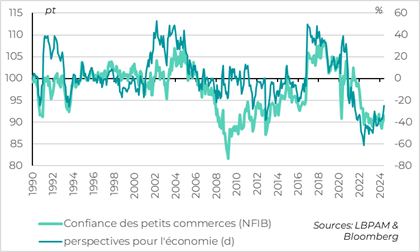

Fig.4 United States: confidence in small businesses stable but limited

- Small Business Confidence (NFIB)

- Outlook for the economy (d)

In the US, after some fairly disappointing data, the NFIB survey of small businesses suggests that the US economy is still resilient, even if it is slowing.

Confidence among US SMEs picked up slightly in June, returning to its level at the start of the year, driven by an economic outlook that has deteriorated slightly over the past two months, while hiring and investment prospects have stabilised over the past two months, after falling sharply at the start of the year. This suggests that the risk of an abrupt slowdown in the US economy remains limited. All the more so as small businesses expect credit conditions to stop tightening from now on, which is consistent with the Fed's monetary cycle.

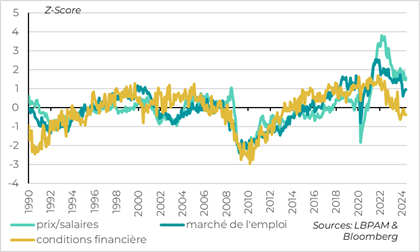

Fig.5 United States: pressure on prices and wages easing only slowly

- prices/salaries

- financial conditions

- job market

That said, SME confidence has remained in a fairly low fluctuation band for the past two years, due to uncertain sales prospects, restrictive financing conditions and inflation that is still too high. Although pressures on wages, prices and employment are easing compared with the last two years, they are still fairly high. For example, 21% of businesses still say that inflation is their main problem, which is the lowest share since 2021, but still a level not seen since the early 1980s. For the Fed, this suggests that the trend towards disinflation continues, but that it is still slow.

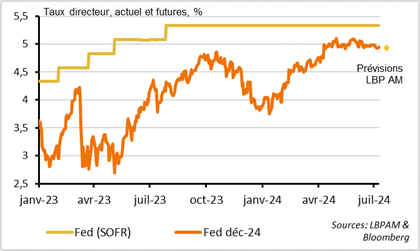

Fig.6 United States: the markets have converged towards our scenario of two Fed rate cuts this year

- Fed (SOFR)

- Fed Dec-24

Fed Chairman Jerome Powell adopted a fairly balanced stance during his bi-annual testimony to Congress yesterday. This suggests that a rate cut this month is unlikely, but that a September cut is on the cards, which is our scenario. The market is now expecting exactly two rate cuts between now and the end of the year, which seems reasonable to us.

Of course, the latest data - the sharper slowdown in inflation in May and the rise in the unemployment rate above 4% in June - brings the Fed closer to a rate cut. Powell noted that disinflation had finally made some further progress recently and that the labour market was "strong, but no longer overheated". As a result, "inflation is no longer the only risk we face", said Powell. So, while there is a risk to inflation if rates are cut too early or too much, there is also a risk to employment if they are cut too late or too little.

That said, Powell said that "other favourable data" on disinflation would reinforce the Fed's confidence that inflation was moving towards the 2% target on a sustainable basis. This implies that the Fed is not yet sufficiently confident in disinflation, which is the criterion it has set itself for starting to cut rates. He also pointed out that "the risks between the employment and inflation objectives are becoming better balanced", not that they are finally balanced. All in all, it seems that the Fed needs a little more time and some favourable data to start cutting rates.