Political uncertainties persist, but the economy is reassuring

Link

Read Xavier Chapard's market analysis for January 27, 2025.

Summary

►The first week of the new President Trump was marked by many declarations and signed decrees, but without the immediate implementation of the most extreme economic policies (which would have been immediate tariff hikes or a total freeze on immigration). That said, uncertainty about future US policies remains as high as before the inauguration, with in particular the threat of tariff hikes as early as the second quarter still present, depending on bilateral negotiations.

►This brought some relief to the markets and a slight deflation of the Trump trade, following the adage that you should buy the rumors but sell the facts, when they're fairly in line. As a result, equity markets hit new all-time highs and credit spreads reached their lowest levels of the year on both sides of the Atlantic. In addition, the dollar premium deflated somewhat (with the euro approaching 1.05 for the first time since early December), and the interest-rate differential between the US and Europe narrowed marginally.

►All in all, the first week of the new administration reinforces our view that the economic policies proposed by Trump during the campaign should be taken seriously but not to the letter. Our scenario thus incorporates targeted and moderate tariff hikes, the maintenance of a very accommodating fiscal policy but with little further easing, and a net drop in incoming migration flows compared with recent years but without any significant reduction in the stock of immigrants. This scenario would maintain a little more inflationary pressure and favor short-term growth over long-term growth for the USA, and reduce short-term growth a little in the rest of the world, without profoundly changing the overall scenario. If this is the case, European discounted assets are quite attractive, but the premium on US assets will not disappear quickly.

►That said, we remain convinced that it will be necessary to adjust our scenario and be very nimble in our asset management in order to adapt to the turbulence that will most likely be caused by the decisions of the new US administration.

►On the global economic front, the first PMI surveys for this year are reassuring, at least in the developed countries. Admittedly, the composite PMI for the developed countries fell in January to a 1-year low, but it remains in the zone where activity is exempt and, above all, the decline comes solely from the US services PMI, which was very high at the end of 2024. On the contrary, manufacturing PMIs and those of all other major developed zones rose, despite being downgraded and at risk in the face of uncertain US trade policy.

►For the Eurozone, the PMI rose slightly in January after its December rebound, and moved into the expansion zone for the first time in 6 months. This confirms that November's drop in confidence was exaggerated, and supports our scenario of a gradual recovery in growth over the course of this year.

►In country terms, French business confidence improved slightly in January, but remains downgraded, while in Germany it is back in the expansion zone for the first time since the first half of 2024. This is surprising in the run-up to the February elections, but reassuring after two years of slight decline in German GDP. Confidence remains solid, even if it is dipping a little in the rest of the Zone.

►China's official PMIs, on the other hand, were very disappointing in January after the rebound in activity at the end of 2024. The manufacturing PMI fell back into contraction and the non-manufacturing PMI was barely above 50pt. This confirms that the support measures taken at the end of the year had only a very temporary impact on achieving the 5% growth target for 2024. The Chinese economy still needs much more fiscal support to avoid a further slowdown, which is unlikely to be announced before March.

To go deeper

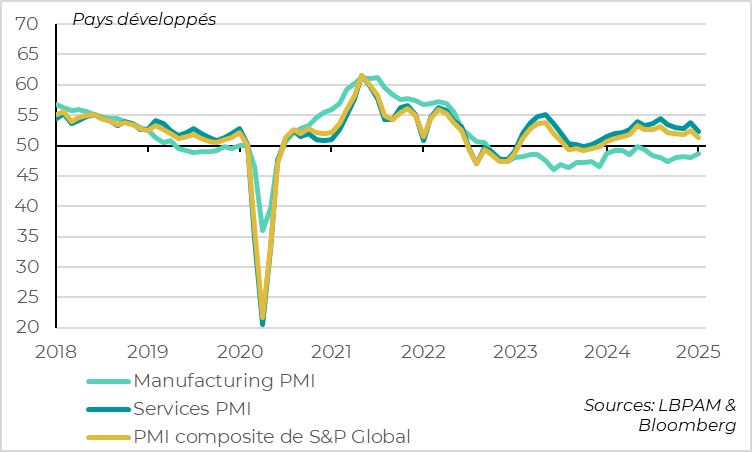

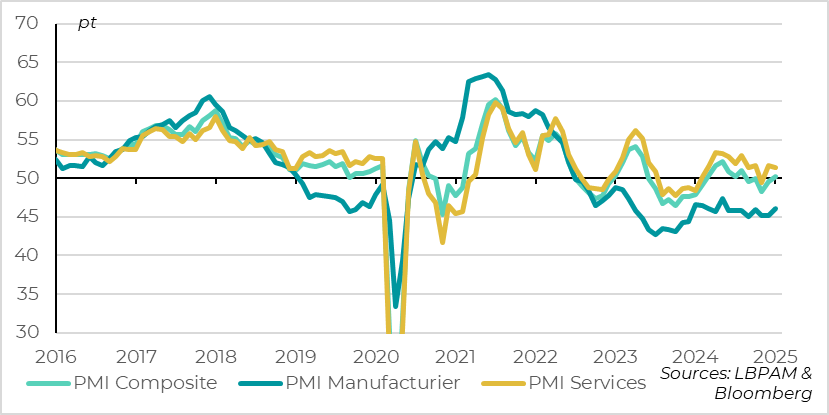

Developed countries: global PMI cancels out year-end rebound in early 2025 due to services, but manufacturing PMI continues to recover on trend

According to preliminary surveys, the PMI for developed countries fell in January, to a 1-year low, even though it remains in the business-free zone. But the detail is actually positive for the global economy.

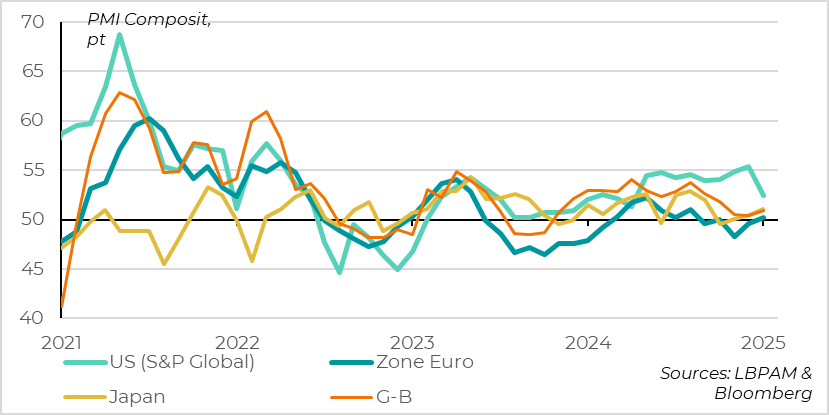

Developed countries: US PMI falls sharply from high levels, while those of other major zones rise in expansion zone

The decline is due solely to the sharp drop in the US services PMI (Cf. Inra), while PMIs are up in all other major developed zones. In fact, outside the US, the PMI is back above 50pt for the first time since the US election, according to our calculations.

In addition, manufacturing PMIs rose almost everywhere in January, and overall are at their highest level since last spring, even if they remain below 50pt. This is an encouraging sign, as manufacturing PMIs are less volatile on a month-to-month basis than those for services and industry, which is a particularly cyclical and globalized sector. And they should continue to improve over the coming months, if the sharp rise in manufacturers' confidence in production prospects in January is anything to go by. Indeed, the anticipation component of the manufacturing PMI survey reached its highest level since the start of the war in Ukraine in January. This is consistent with industrial activity being sustained by the strength of demand for goods at the turn of the year, and by the advance of imports ahead of possible tariffs.

All in all, despite the drop in the global composite PMI in January, we are reassured by the survey because (1) activity is improving outside the US, which was the sole driver of activity in developed countries at the end of 2024, and (2) the industrial sector finally seems to be improving a little, whereas it was still contracting in 2024.

United States: Services PMI consolidates as manufacturing PMI rises above 50pt

For once, and surprisingly given the distribution of economic policy risks, it's the USA that disappoints in the January PMIs.

The US PMI fell to 52.8pt, after hovering close to 55pt since last summer and reaching a 2-year high of 55.4 in December. This decline reflects lower confidence in services, for which the PMI fell from 56.8 to 52.8pt, its lowest level since last April. Domestic activity therefore seems to be slowing a little at the start of 2025, after having been very solid at the end of 2024.

That said, US companies in the sector remain confident about the outlook and continue to hire, suggesting that January's weakness may be exaggerated. What's more, the first available regional surveys show no overall loss of momentum. So we'll have to wait for the ISM survey before drawing any conclusions about US dynamism in early 2025.

In contrast to services, the US manufacturing PMI is back above 50 points for the first time in 6 months, at 50.1pt, which is reassuring for the global industrial cycle.

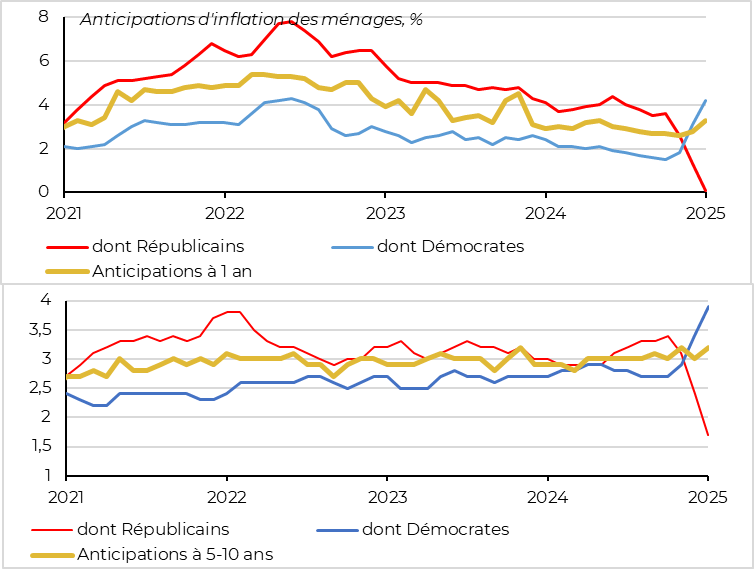

United States: household inflation expectations rise in January, with a strong bias towards political affiliation complicating the reading

On the US household front, the final survey from the University of Michigan confirms a slight drop in confidence in January after 6 months of increases (from 74 to 71.1pt), due to fears of renewed inflation following tariff hikes.

We are still taking this survey with a grain of salt, given the divergence in confidence between Republicans and Democrats. Indeed, the former remain the most confident since D. Trump's first term in office, as they anticipate that inflation will disappear this year. On the contrary, the latter have been the least confident since 2020, anticipating inflation to remain durably above target.

That said, the Fed is likely to be cautious in the face of rising inflation expectations in both the short term (at its highest since 2023) and the long term (which is at the upper limit of its historical fluctuation band at 3.2%). All the more so as PMI price indicators are still rising in January.

We therefore believe that, despite the drop in PMIs in January, the Fed will not cut rates this week, and will be very cautious about the timing and scale of possible future rate cuts. Our scenario remains a pause by the Fed over the next few months before two rate cuts in the middle and at the end of this year.

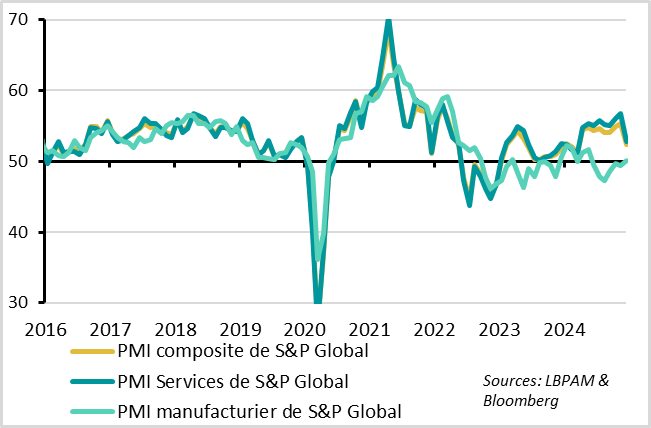

Eurozone: services PMI remains positive and manufacturing PMI improves slightly

For the Eurozone, the PMI rose slightly in January after its December rebound, and moved into the business expansion zone for the first time in 6 months. The PMI thus rises from 49.6 to 50.2pt, indicating a very slight revival of dynamism at the start of 2025. Above all, this suggests that the fall in confidence in November (to 48.3pt) after D. Trump's election was temporary, which will have a modest impact on growth. At least as long as threats of major tariffs are contained, which remains to be seen.

In terms of sectors, the services PMI remains stable at an average level (-0.2pt to 51.4), indicating that activity in services continues to pull activity a little. But the confidence boost in January came from the manufacturing PMI, which rose by 1pt to its highest level since the first half of 2024. That said, the manufacturing PMI remains at a very deteriorated level (46.1pt).

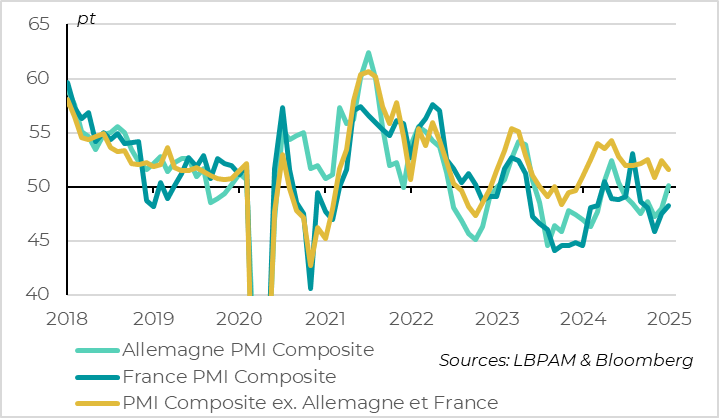

Euro zone: German PMI rebounds while French PMI increase is limited

In terms of countries, the French PMI rose slightly but remained weak (+0.8pt to 48.3pt), reflecting a slightly less deteriorated manufacturing sector at the start of 2025, while the services sector remains in contraction territory for the 5th consecutive month (i.e. since the end of the Olympic Games). Like the INSEE confidence indicator, the French PMI is consistent with marginally positive growth after the stagnation of late 2024.

Above all, the German PMI rebounds by more than 2 points to above the 50pt mark for the first time since the first half of 2024 (at 50.1), thanks to rising confidence in both industry and services. This is reassuring at a time of political uncertainty ahead of the federal elections in February, as it suggests that activity is stabilizing after a further fall in GDP at the end of 2024.

For once, the least positive news comes from the rest of the Eurozone, although it needs to be put into perspective. The PMI excluding France and Germany reversed part of its December rise in January, in both industry and services, even though it remains clearly in the expansion zone at 51.6pt. The periphery, and Spain in particular, looks set to continue outperforming the Zone's core countries, even if growth is beginning to normalize.

Xavier Chapard

Strategist