Post-election confidence improves in the United States but not in the rest of the world

Link

Check out our market analysis from November 13, 2024, by Xavier Chapard.

In summary

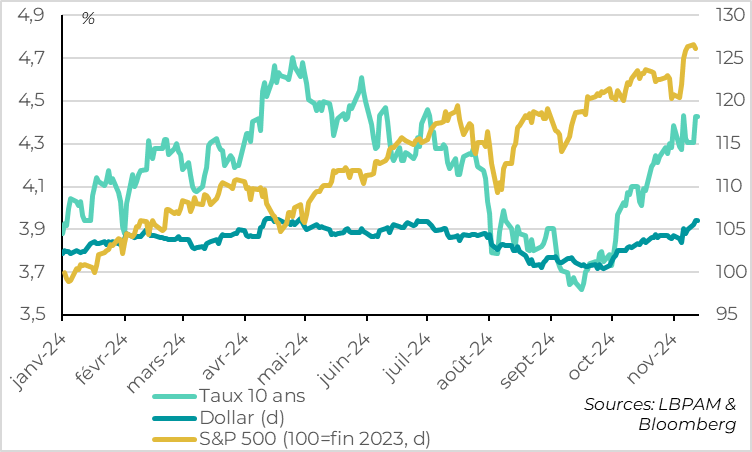

► Risk-taking on US assets continued with the anticipation of pro-business, pro-American but potentially inflationary policies (higher tariffs, lower taxes, reduced immigration, deregulation...). US equities hit new all-time highs on Monday, US credit spreads are near all-time lows, and the dollar is approaching 2-year highs. Long yields remain volatile, but are 15bp above their pre-election level of 4.4%. In contrast, non-US equities are down. These performances were broadly expected with the election of D. Trump and the likely red wave in Congress.

►With the political uncertainty in the USA dissipating, the focus is now on the nominations for the future Trump administration, which give an indication of what economic policies might actually be implemented. The first names put forward, fairly hard-line loyalists, suggest that the policies outlined during his campaign could be implemented to some extent, even if the scale and timing of the measures remain highly uncertain.

►Against this backdrop, it seems to us that long rates and the dollar have reached reasonable levels, although they could exaggerate their rise in the short term, if activity and inflation are higher than expected in the coming months. US equities are very expensive, but could still benefit from current momentum and the fact that investor positioning is not yet extreme. On the other hand, we feel that credit premiums in the US are now insufficient in the face of higher interest rates and the risk of volatility, and we prefer European public and corporate bonds.

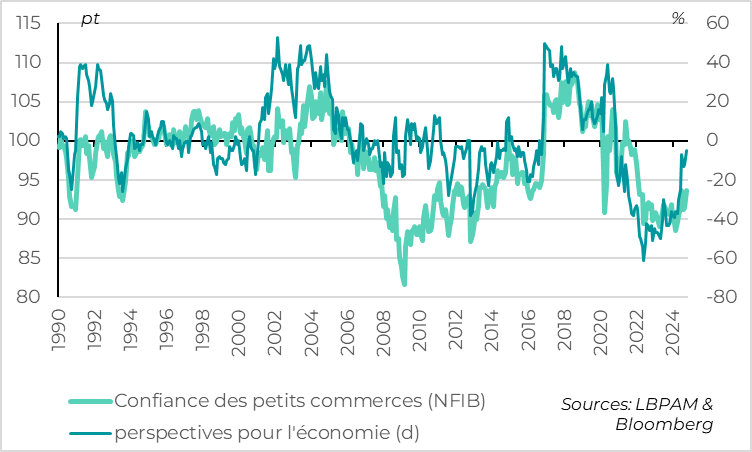

►Trump's election is seen as pro-business by US companies, as indicated by the rise in small business confidence in October according to NFIB. Rising household financial wealth could support growth in the short term, although the impact of Trump's policies on medium-term growth is uncertain.

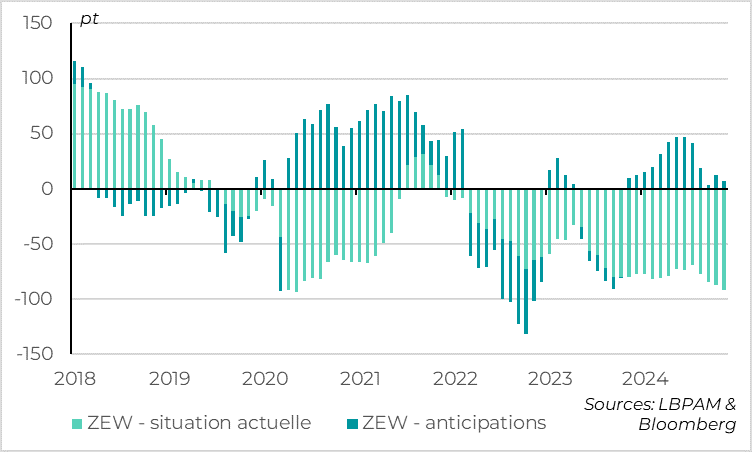

►On the contrary, German investor confidence unexpectedly fell in November, according to the ZEW indicator - after a slight improvement in October - probably due to domestic (early elections in February) and external (Trump's election) political uncertainties. Although we must remain cautious about this survey, it does suggest that European economic activity remains limited, despite the positive surprises of the past month.

►The stimulus plan announced by China at the end of last week is disappointing, as it focuses on resolving local government debt, but does not include specific measures to support consumption and the real estate sector. This suggests that the authorities want to wait for the impact of measures already taken and to see how US policies evolve before taking more significant fiscal measures. We expect Chinese growth to pick up temporarily in late 2024/early 2025. But, without further measures, it could slow down again in 2025, while the structural problems of the Chinese economy continue to weigh on the longer-term outlook.

►In the UK, employment fell slightly after the summer and tensions on the job market returned to more normal levels. The unemployment rate has thus risen to 4.3% and the job vacancy rate is back to its 2018 level. But wage deceleration remains very slow, with private wages still growing at 4.8% against a normal pace of around 3%. Combined with the less restrictive budget presented by the government, this validates the prudence of the BoE, which is expected to cut its key rates at a rate of 25bp per quarter over the coming quarters, slower than the ECB.

To go deeper

Market: Trump-related trades performed strongly

US equity markets hit new highs on Monday, before consolidating slightly yesterday. The S&P 500 and Dow Jones surpassed 6,000pt and 44,000pt respectively at the start of the week for the first time. The valuation of US equities is very high, having exceeded that of 2021 when economic policies were ultra-accommodating; historically, it has only been higher than during the bubble of the early 2000s. This limits the long-term outlook for U.S. equities, especially when compared to the much cheaper European equities. But equity valuation is not a decisive driver in the short term. Given the current strength of the markets and the fact that investor positioning is not (yet) extreme, we believe that US equities can still perform well in the coming weeks. This is particularly the case for smaller caps than the “Magnificent 7”.

On the contrary, the weakness of credit spreads in the US has prompted us to be more cautious about this asset class, especially compared with European credits, which still offer reasonable premiums. Indeed, the credit spread on investment-grade US companies is at its lowest level since 1998, while that on high-risk companies (High Yield) is close to its 2007 all-time low. This limits potential gains in an environment where interest rates are likely to remain high and economic policies could generate volatility.

The dollar and US long yields are close to levels we consider reasonable in a red wave scenario (just below 4.5% for 10-year yields and around 1.06 for the EURUSD). That said, the market could push rates and, above all, the dollar even higher in the short term, especially if the inflation figures published this afternoon surprise on the upside and further limit the Fed's room for manoeuvre in cutting rates. This leads us to remain neutral on these assets, preferring European bonds.

United States: SME confidence begins to recover before the elections

Especially as the return of “animal spirit” in US companies and rising household asset prices could boost US growth in the short term. All the more so as US banks indicated inQ3 that the credit cycle was gradually improving, even if corporate demand for credit remained limited.

Confidence among US small businesses rose from 91.5 to 93.7pt in October, according to the NFIB survey, equalling its highest level in 2.5 years, even though it is still historically limited. This reflects the improved economic outlook and the gradual easing of credit conditions. On the price front, US SMEs are reporting a slight slowdown in price and wage increases, although these remain fairly high.

The survey was conducted before the election result, as indicated by the rise in SME uncertainty to a new all-time high, although it probably incorporates the increase in the probability of Trump's victory observed in October. This suggests that the situation for US companies was good before Trump's election. From now on, the prospects of lower taxes and regulations should clearly support US SME confidence in the coming months, as was the case in 2016.

Germany: investor confidence falls sharply in October

On the contrary, the ZEW, the German investor survey, unexpectedly deteriorated in November after recovering slightly in October. After a fourth consecutive sharp fall, the indicator for the current state of the German economy is as bad as it was during the confinement of spring 2020. Above all, the outlook indicator reversed part of its October rebound, while remaining in positive territory. This survey marks the end of more than a month of positive economic surprises for the Eurozone.

We must remain cautious about this survey, as it does not reflect what companies are really experiencing (unlike the PMI and IFO), and therefore short-term activity. But it is a good indicator of a cycle turnaround, suggesting that the German economy is not about to rebound sharply. And this confidence survey suggests that political uncertainty is already having a negative impact on the economy. On the domestic front, Germany is facing early elections, probably on February 23, following the collapse of the coalition government last week. And on the external front, Trump's election increases the risk of tariffs on at least some German exports.

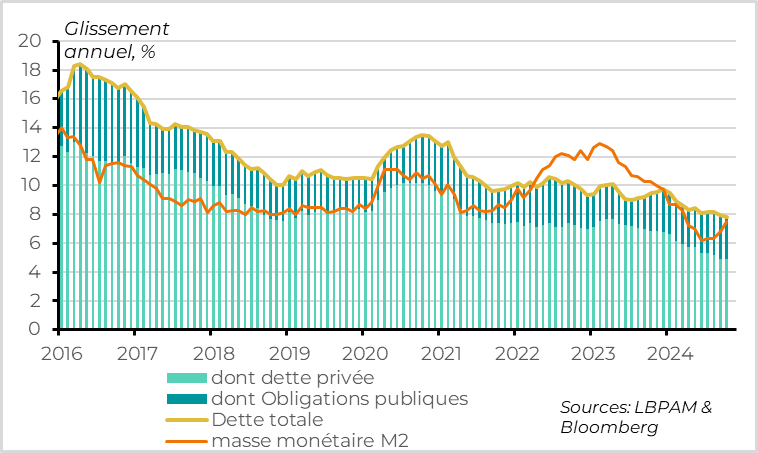

China: despite support from the authorities, the credit cycle remains weak due to private demand

The stimulus plan announced by China at the end of last week disappointed the markets.

It focused mainly on resolving local government debt, with programs worth over 10 trillion renminbi to restructure their debt. This is important for the economy in the short term, as it reduces the pressure on local governments, which are responsible for the majority of public spending and investment.

However, contrary to market expectations, the authorities did not announce any new fiscal measures to support consumption and the real estate sector. They did, however, indicate that they were preparing more substantial fiscal policies for next year, in addition to bank recapitalization.

This targeted approach suggests that the government hopes that the measures already announced are sufficient to get closer to the growth target of 5% for 2024. This is also our scenario, which anticipates a temporary re-acceleration in Chinese growth in late 2024/early 2025, close to the target. The latest figures for exports, housing sales and public spending all point in this direction.

But this implies that we'll probably have to wait until next year, and potentially until we have more details on US policies towards China, before the Chinese authorities announce additional stimulus measures for 2025. This could limit the rebound in confidence and markets, and increase the risk of a further Chinese slowdown during 2025.

Moreover, credit data for October indicate that the slight upturn in activity after the summer remains fragile. Indeed, while recent support measures enabled money supply growth to rebound slightly in October, credit growth continued to slow for the first time this year. This is due to persistent weakness in household and, above all, business demand.

Xavier Chapard

Strategist