Powell attempts to moderate market certainty about the end of rate hikes

Link

-

The return of risk appetite persisted at the end of the week in the United States, while elsewhere, notably in Europe, stock markets ended the week in the red. In Europe, the rebound in interest rates across the entire yield curve, following the sharp fall since the end of October and the beginning of the month, seems to have dampened the market's appetite for risk. In the United States, paradoxically, interest rates also gained considerable ground, particularly after statements by Fed Chairman Jerome Powell, who attempted to moderate the near-certainty that had taken hold in the market about the end of rate hikes. He declared that "if it becomes necessary to raise interest rates again, the Fed will not hesitate. We will continue to proceed cautiously, but balancing the risk of being misled by good monthly numbers [and doing nothing] against the risk of doing too much". But the ensuing rebound in long rates has not dampened risk-taking across the Atlantic.

-

This may be because some believe that the risk of a sharp slowdown in the US economy is very low, while inflation could decline rapidly anyway, opening the door to rate cuts. This scenario seems possible, but unlikely in our view. Thus, we believe that the economic slowdown will be quite significant compared to the current momentum, which will be the source of the decline in inflation and the eventual cut in key rates. This scenario is not favorable to riskier assets. That's why our allocation remains cautious, with a bias towards bonds, where we seek yield while reducing risk.

-

The difficult question to answer is how quickly the economic deceleration across the Atlantic will manifest itself in response to tighter financial conditions. We believe that, on the one hand, this year's unexpectedly strong fiscal stimulus (almost 2 points of GDP!) will not be there in 2024, and that, on the other hand, the consumer is likely to feel the effects of a less buoyant labor market and a slowdown in the dissaving momentum seen to date. Both forces will contribute to a significant slowdown in US growth.

-

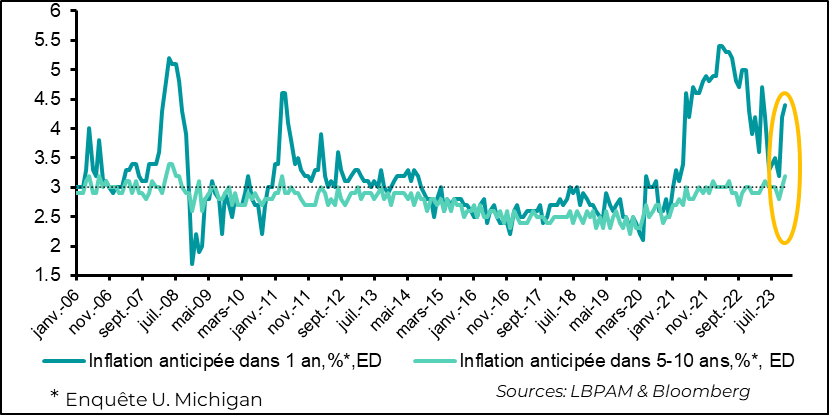

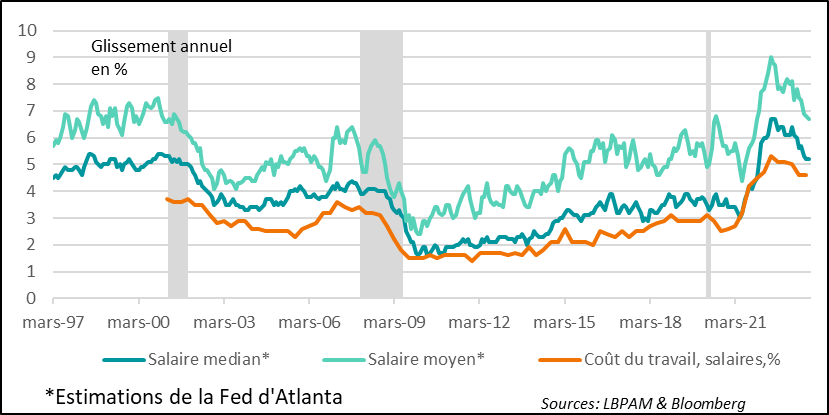

In this sense, the University of Michigan's consumer confidence survey surprised with a sharp drop in the index in the preliminary result for November. This was partly due to persistent fears about inflation. Long-term inflation expectations reached a 12-year high of 3.2% in November. Surprisingly, at the same time, energy prices were easing. This is not to exaggerate the message of this statistic, which can be quite volatile. Nevertheless, it does call for caution regarding the pace at which inflation is decelerating. In fact, we also had the Atlanta Fed's wage change statistics for October. Here, the lull is very slow, with a similar increase to the previous month at 5.2% year-on-year, well short of the level needed to bring inflation down to 2%. Tomorrow's US inflation figures will give us more information on the pace of price deceleration.

-

Among the factors that seem to have sustained risk appetite is also the confirmation of the meeting between Presidents Biden and Xi this week as part of the APEC (Asia-Pacific Economic Cooperation) conference being held in San Francisco. This is seen as a chance to ease the tensions that have intensified between the USA and China in recent months, and thus help reduce geopolitical and economic risks.

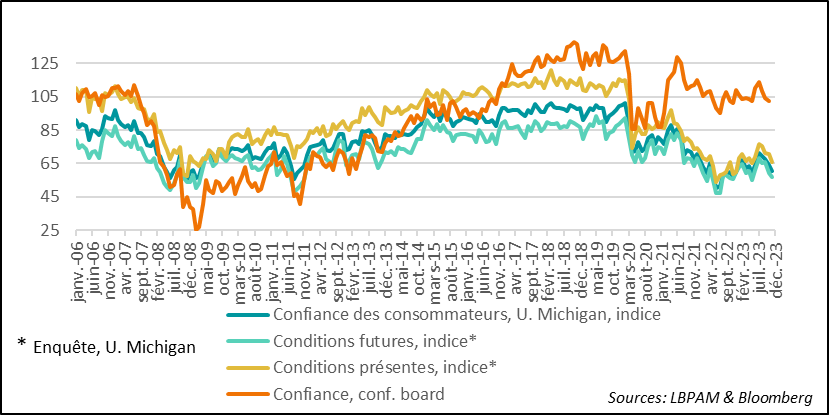

After the very strong contribution to GDP growth made by consumer spending in 3Q23, we might have expected consumer confidence to maintain its upward trend. This was not the case in November. Indeed, the University of Michigan's preliminary survey for November showed that the confidence index had fallen sharply. As we know, confidence indicators are not only volatile, they are not necessarily perfect proxies for consumer trends.

Nevertheless, this break in trend may point to emerging weaknesses in consumer sentiment. The rise in interest rates in recent times is certainly one of the factors which seems to have affected sentiment, with mortgage rates rising sharply, but also the increased cost of credit in the broadest sense, including consumer credit. In fact, difficulties are on the increase among lower-income households, as in the case of consumer credit for vehicle purchases, where the rate of low-income earners experiencing payment difficulties is at an all-time high.

Fig.1 United States: The upward trend in consumer confidence came to a screeching halt in November.

However, another factor once again seems to have played a major role in this drop in confidence: inflation. Both one-year and long-term inflation expectations rose sharply in early November. Both measures are quite volatile, but the long-term one is generally the more stable, and is the one the Fed monitors as a benchmark to ensure that expectations are well anchored.

In general, these movements are associated with sharp variations in energy prices, particularly gasoline. As it happens, despite the conflict in the Middle East, prices at the pump have maintained a downward trend since the beginning of October. So other factors seem to be at play. We'll see what tomorrow's price index tells us for October already, which should in fact show a strong moderation in total inflation due to the fall in energy prices. The focus will be on underlying inflation.

Waning confidence seems astonishing given the resilience of the US job market to date, even if October saw a sharper deceleration in job creation and a rise in the unemployment rate (3.9% vs. 3.8% previously).

In fact, the resilience of the job market has enabled strong wage increases. We saw this again with the recent agreements in the automotive industry, with increases of around 25% over the next 4 ½ years.

The Atlanta Fed has published its estimates of wage trends for October. These are much more reliable than those coming out of the employment report survey, which has a strong composition bias. Obviously, the increase is much slower than the peak reached in mid-2022, but the pace of wage growth is no longer decelerating. The year-on-year rise in median wages remained constant compared with the previous month, at 5.2%. This pace is not compatible with a rapid convergence towards 2% inflation, as the Fed would like.

Fig.3 United States: Wage growth, although down sharply from its mid-2022 peak, remains very high and is no longer decelerating.

Nous continuons de penser que la décélération de l’activité aux Etats-Unis devrait permettre de voir les tensions inflationnistes décliner au cours des trimestres précédents. Mais, comme J. Powell l’a indiqué, il faut rester prudents et conserver le risque que la Fed puisse faire davantage si l’économie américaine conserve sa robustesse, d’autant plus si la politique budgétaire ne devient pas plus prudente.