President Trump engages in a troubling escalation in Greenland

Link

What are the key takeaways from the market news on January 20, 2026? Sebastian Paris Horvitz provides some insights.

Overview

► The weekend was marked by a new escalation from President Trump regarding Greenland. He threatened Denmark and the European countries that supported it—England, Germany, Denmark, Finland, France, Norway, the Netherlands, and Sweden—with sanctions in the form of new tariff increases. Customs duties would increase by 10% from February 1 and by 25% from June 1, until an agreement is reached for the total acquisition of Greenland by the United States.

►The stunned reaction of Europeans was unanimous: avoid any escalation and prioritize negotiations with the United States. Nevertheless, comments from European leaders also converged on defending Greenland's independence within the Kingdom of Denmark, the European Union, and NATO, as well as rejecting American blackmail. On the other hand, despite the willingness to negotiate, the range of potential responses from Europe to US threats remains varied for the time being. President Macron has suggested activating the European Union's anti-coercion instrument, established in 2023, which allows the use of all commercial and financial levers to combat a country exerting pressure on Europe. However, many European leaders are taking a more moderate approach, focusing on constructive negotiation.

► It is clear that the outcome of this new crisis provoked by the United States is difficult to determine at this stage. Nevertheless, it is clear that it is generating a great deal of uncertainty and hampering economic expansion on both sides of the Atlantic. The risk of NATO breaking up after 77 years of existence would mark a new stage in the dismantling of the international system built after World War II, leading to new tensions on the horizon.

► On the markets, this situation has given new impetus to certain safe-haven assets, starting with gold, which reached a new all-time high ($4,700 per ounce). On the other hand, financial risks are leading to a rise in interest rates, particularly in the United States. At the same time, declining risk appetite is weighing on stock markets. In Europe, indices were down sharply yesterday, with the Euro Stoxx 50 falling 1.8%, while defense stocks rose. The coming days should provide greater clarity, particularly thanks to possible discussions in Davos between US and European leaders.

►In France, Prime Minister S. Lecornu appears to be moving toward using Article 49.3 to pass the 2026 budget. Maintaining the exceptional contribution from large companies at the 2025 level, when it was initially supposed to be reduced, should enable the bill to be passed, while maintaining the target of reducing the deficit to around 5% of GDP, as planned. Nevertheless, the political deadlock will continue to weigh on the country's economic strategy. Although the spread between French and German rates remains below the average for the last three months (66 basis points for 10-year rates, compared to an average of 70 bp), stress could increase from the summer onwards with the launch of the 2027 presidential campaign.

►From an economic data perspective, China has, as expected, achieved its GDP growth target for 2025, with growth of 5% compared to 2024. At the same time, December data shows that domestic momentum remains weak. Growth continues to be hampered by the construction sector (17.2% year-on-year). In addition, both investment and consumption (measured by retail sales) slowed further in December. On the other hand, industrial production is holding up, supported by relatively strong exports despite the sharp decline in sales to the United States. We continue to believe that the authorities will need to strengthen measures to support domestic demand, particularly consumption, in order to achieve their targets.

►Furthermore, from a structural perspective, the publication of China's birth rate for 2025, at 5.63 births per 1,000 inhabitants, its lowest level since the Communist Party came to power in 1949, is clearly not good news. The population has declined for the fourth consecutive year. China has one of the lowest fertility rates in the world, at around 1, well below the threshold of 2.1 needed to maintain a stable population. Overall, the incentives introduced in recent years to boost the birth rate appear to have failed. A declining population will remain a negative factor for the country's future growth.

Going Further

China: Growth target achieved, but domestic demand remains weak

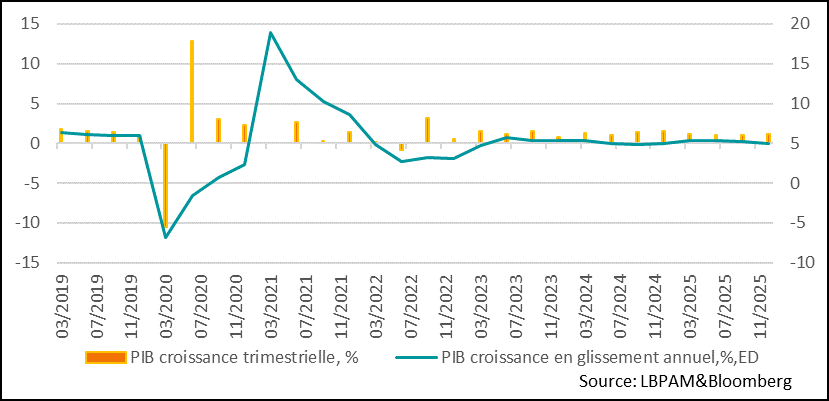

The 5% growth target has been achieved, driven by foreign trade

As expected, Chinese GDP growth reached 5% in 2025 compared to the previous year, exactly in line with the target set by the authorities. Growth continues to be driven largely by foreign trade, as shown by export data, which remains strong despite the sharp drop in exports to the United States, down 30% year-on-year in December 2025.

The dynamism of foreign trade is also supporting industrial production, which accelerated in December, growing by 5.2% year-on-year.

Domestic demand enters 2026 with weak momentum

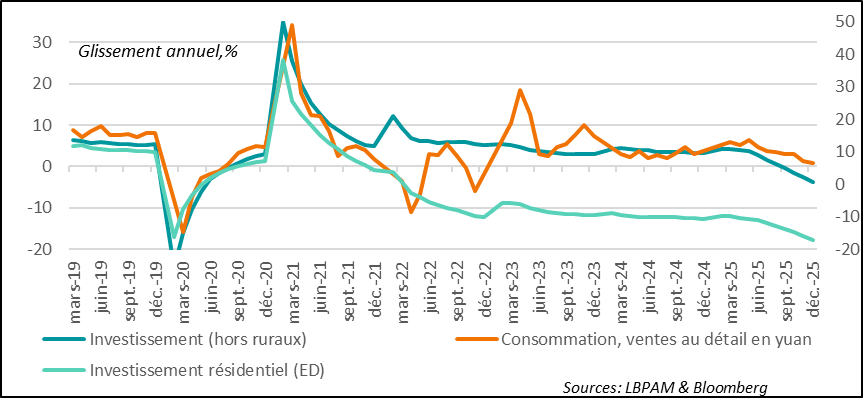

At the same time, domestic demand remains weak, as shown by consumption and investment figures for December.

Consumption, measured by retail sales growth, slowed in December to 0.9% year-on-year. It thus continues to lose momentum. It remains weighed down by a weak employment situation, while negative wealth effects continue to take their toll, with a further 0.7% decline in existing home prices in December.

The relaunch at the beginning of the year of the consumer subsidy program, which is more modest in terms of both funding and coverage (applying only to household appliances and a few electronic products, including smartphones), shows that consumption does not seem to be regaining momentum on its own.

Given this weakness in consumption, we expect more targeted support measures in the first half of the year, even though the authorities have not given any specific indications in this direction for the moment. Nevertheless, in order to maintain the 5% GDP growth target, supporting consumption in the first half of the year should better ensure that the target is met.

This is all the more important given that the real estate sector remains sluggish. Construction investment fell again in December, down 17.2% year-on-year. Here too, rumors continue to circulate about a possible support plan for real estate to stabilize the sector, but no major initiatives have been taken so far.

On the broader investment front, the news is also rather mediocre. Although efforts are continuing in certain strategic technology sectors, such as semiconductors, overall investment contracted by 3.8% in December year-on-year, much more than expected.

Overall, it is clear that Chinese growth, even if it meets its targets, remains extremely unbalanced. We are moving further and further away from one of the authorities' key objectives, which was precisely to rebalance the economy by promoting growth in domestic demand. In part, this should involve a change in social protection in China, which would boost consumer confidence and reduce their savings rate, and potentially help the birth rate in the process. But for now, the authorities still seem far from taking this path.

Sebastian Paris Horvitz

Director of Research