President Trump is fighting on all fronts to strengthen his power

Link

What are the key takeaways from the market news on January 13, 2026? Sebastian Paris Horvitz provides some insights.

Overview

► Following the intervention in Venezuela, President Trump has maintained his threatening rhetoric towards certain countries in recent days. One of his most insistent demands concerns his desire to annex Greenland. This has heightened tensions with European countries. President Trump seems to have definitively opted for a confrontational and transactional strategy both outside and inside the United States. Nevertheless, at this stage, the effects of these actions have not really affected market developments, except to support the price of gold and, to a lesser extent, the price of oil.

►The rise in gold prices received a further boost from anti-government protests in Iran, which led to severe repression by the authorities (more than 500 deaths and over 10,000 arrests, according to sources). Once again, the US president said he was ready to intervene to protect the protesters. Without announcing what type of intervention, the US threat caused gold to rise as a safe haven (reaching a historic high of $4,600 per ounce yesterday) and had an impact on oil prices. This was especially true as Trump announced a 25% tariff increase for any country trading with Iran. Despite the restrictions already imposed on the country, Iran produces more than 3 million barrels per day (just over 10% of OPEC production). Nevertheless, the announcement of possible talks with the United States seems to have calmed the rise in oil prices somewhat, which remain very low ($64 for Brent crude).

►At the same time, also in the United States, the government announced a series of measures aimed at addressing purchasing power issues, which remain one of the main sources of concern for American households. On the one hand, in order to combat the difficulty of accessing housing, the government has taken a series of measures, including the purchase of $200 billion in mortgage bonds (aimed at lowering the cost of real estate loans) by the government-sponsored agencies Freddie Mac and Fannie Mae. It has also asked Congress to ban institutional investors from buying homes in order to bring down prices and increase the availability of homes for sale to individuals. While these measures, if fully implemented in the short term, could have an impact on prices and financing costs, it is difficult to see how they could resolve the structural problems of access to housing in the medium term. These decisions seem primarily aimed at appeasing the electorate in order to correct the public's very negative perception of the country's economic management.

►In the same vein, Donald Trump has asked Congress to cap credit card interest rates at 10%. Today, the average rate is around 20%, but can exceed 40% depending on the borrower's credit rating. Such a measure was previously proposed by Bernie Sanders, the far-left Democratic senator. The effectiveness of such a restriction is not clear. While it would certainly be costly for banks, it would likely restrict access to this type of financing for people with the lowest credit ratings.

►Finally, the government has resumed its attacks on Fed Chairman J. Powell. Last weekend, he received a subpoena from the Department of Justice to testify, as he is being prosecuted for lying, according to the department, during his congressional hearing on the renovation of the Federal Reserve buildings in Washington. Powell responded with a video emphasizing that this was simply an attack on the institution's independence. The immediate effect was a rise in rates across the entire US sovereign curve. This reflects market concerns about a possible loss of independence if Powell were to be removed from office. Several statements were made by political leaders (both Democrats and Republicans) criticizing the lawsuit. In addition, a joint statement signed by the last three Fed chairpersons (A. Greenspan, B. Bernanke, J. Yellen) and several Treasury secretaries was published, warning the government about a possible loss of independence for the Fed. We are still awaiting the Supreme Court's decision on the President's ability to dismiss L. Cook, one of the Fed's governors.

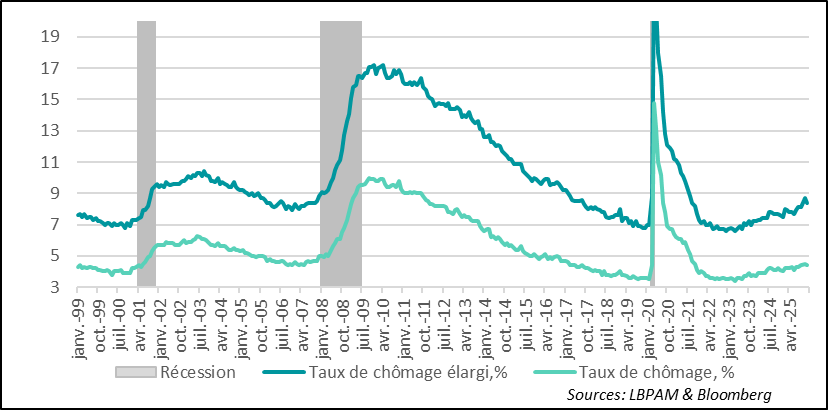

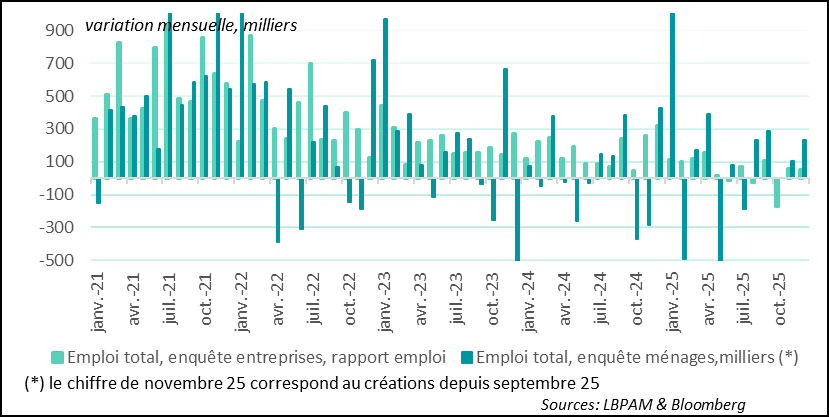

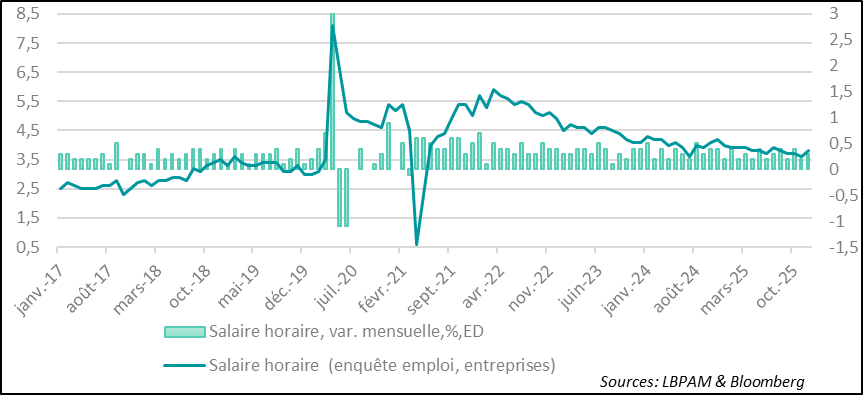

►Just before this avalanche of events and decisions, on the economic data front, we learned last Friday that the job market was doing better in December than the figures had shown the previous month. In particular, the unemployment rate fell back to 4.4%, after rising to 4.6% in November. At the same time, net job creation remained weak, with only 37,000 jobs added in the private sector. These figures seem to correct somewhat for last month's data, which was distorted by the government shutdown, but confirm that the labor market remains very sluggish, although there has been no collapse. The confidence shock caused by the government's measures seems to have paralyzed the labor market. At the same time, wages remain dynamic, growing at 3.8% year-on-year. We still believe that the fiscal stimulus at the beginning of the year could stimulate job creation somewhat. Finally, these figures make it almost certain that the Fed will keep its policy unchanged this month.

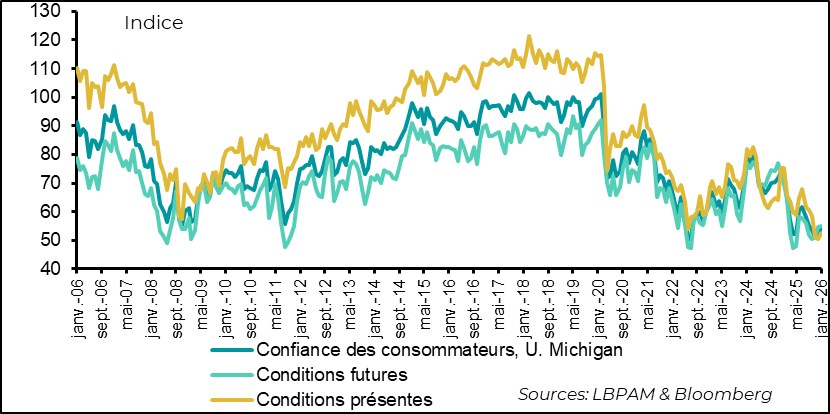

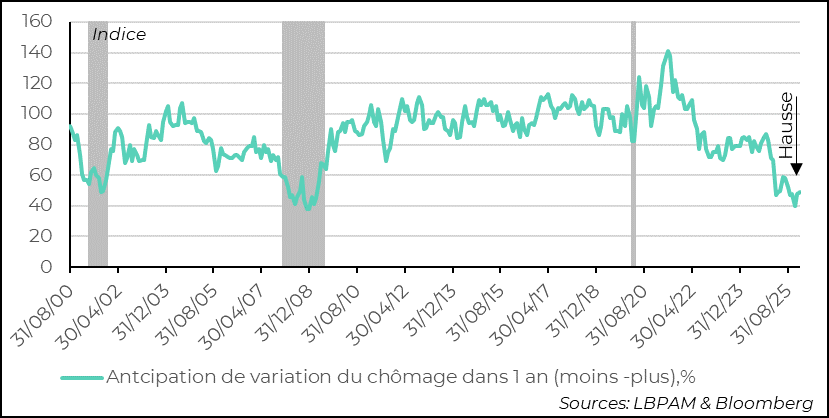

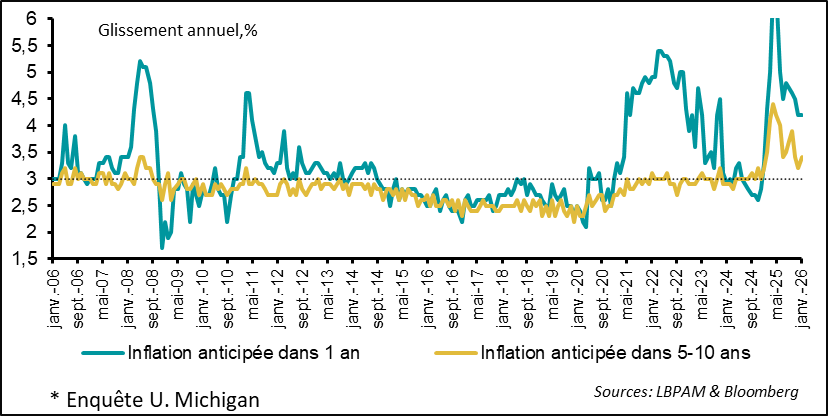

►A weaker employment situation compared to previous years continues to weigh on consumer confidence. The preliminary University of Michigan survey shows that the overall index remains close to historic lows, despite a slight rebound in December. Anxiety about future employment trends is one of the main sources of concern, not to mention continued high fears about inflation, even if these have moderated somewhat compared to a few months ago. At the same time, it is important to continue to emphasize that despite this decline in confidence, US consumers still seem to be holding up. We expect consumption to slow significantly in Q4 2025, but there is every reason to believe that it will remain solid.

Going further

United States: The job market is fragile, but not collapsing

The unemployment rate falls to 4.4%

As expected, the December employment report showed that the labor market remained sluggish. However, this report seems to correct the sharp deterioration in the market reflected in November's report, which was undoubtedly affected by the government shutdown. In particular, the unemployment rate, which had risen to 4.6%, fell back to 4.4%.

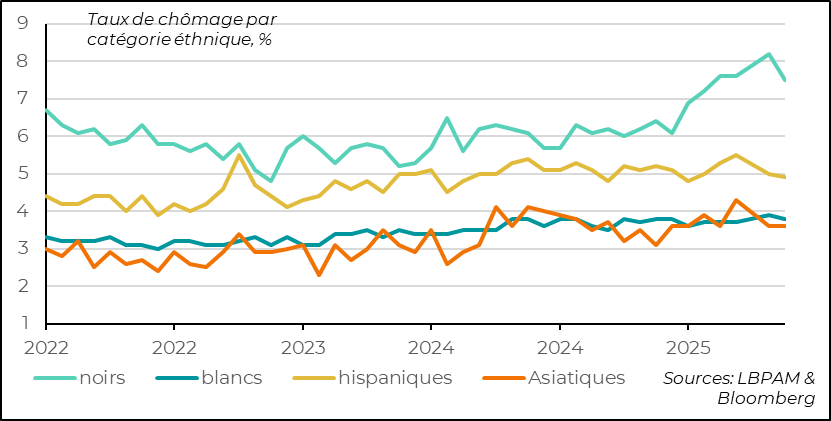

The deterioration in employment disproportionately affects certain categories

This reduction in the unemployment rate reflects, in particular, a correction of the rapid deterioration in the employment situation among certain categories of people highlighted in the November report. Unemployment had grown disproportionately among young people and Black people compared to the rest of the population. It is not easy to identify the reasons for this, even though these groups often hold more precarious jobs than the rest of the population. In December, the unemployment rate in these groups fell sharply, but continues to reflect a worse situation than in the rest of the population since the beginning of the year.

As has become common, surveys of businesses and households differ

Furthermore, net job creation figures from the business and household surveys differ. However, for several years now, it seems that the business survey has been closer to reality, after the usual annual revisions.

In any case, it is clear that the employment situation has deteriorated, with many sectors seeing employment stagnate or even decline over the past several months, as is the case in the manufacturing sector, which has been losing jobs since last May. In fact, job creation is still concentrated in two sectors: healthcare and leisure and hospitality. Last month, these two sectors created nearly 90,000 jobs. In any case, particularly in sectors that are more exposed to foreign trade due to protectionist policies, companies remain very cautious about hiring.

Wages are accelerating but remain moderate

Furthermore, proving that the labor market is not deteriorating sharply, the business survey shows that wages are still rising steadily, even accelerating last month to 3.8% year-on-year, which is still above inflation.

We still believe that the effects of the fiscal stimulus coming at the start of the year should support activity in the short term and that, if the economic shocks disappear as expected, the labor market should improve slightly.

Overall, the December employment report still shows signs of resilience in the labor market, with the unemployment rate falling to 4.4%. This resilience is consistent with a pause in the Fed's monetary easing this month.

United States: Consumer confidence remains low

Household confidence remains at historically low levels

The deterioration of the job market, though not a collapse, remains one of the main reasons for the persistence of historically low consumer confidence, at least according to the University of Michigan survey. Indeed, despite a very slight rebound in the preliminary overall index for January 2026, confidence remains stagnant, close to the lowest levels in the history of the survey.

Fears of a deteriorating job market weigh on confidence

As highlighted, fears that the labor market will deteriorate further in the coming year remain unusually high, reaching levels typically seen only during periods close to recession. This anxiety seems somewhat exaggerated and undoubtedly reflects the country's deep political divide and the government's highly aggressive policies, which are affecting many sectors, particularly public sector employment.

Inflation expectations remain high but are gradually easing

Another major concern for households is inflation trends. Expectations remain high, even though they have moderated compared to a few months ago. As we know, the decline in purchasing power was one of the key factors that contributed to Donald Trump's election as president. For the moment, there has been little progress on this front, which largely explains the latest measures proposed by the government to address the cost increases faced by households.

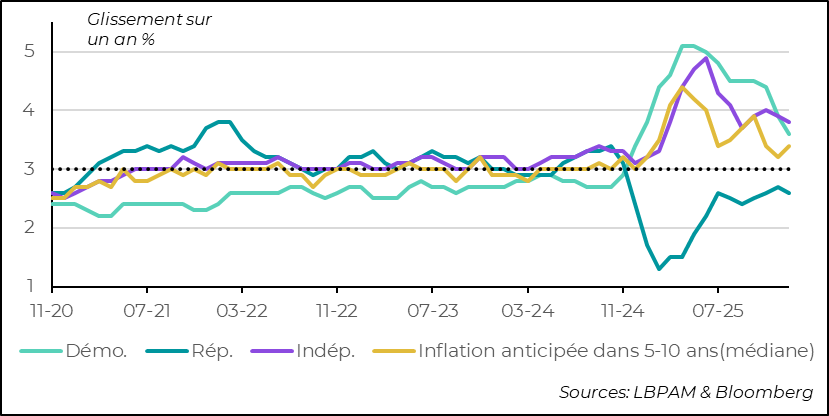

Inflation expectations based on political affiliation are gradually converging

It should also be noted that the divide in inflation expectations based on political affiliation remains historically high. Nevertheless, even though there are still significant differences, it seems that expectations are gradually converging. However, overall expectations remain well above the recent historical average.

It is very important to note that, despite these very low confidence figures, which are also reflected in President Trump's sharp decline in popularity, this has not prevented consumer appetite from remaining high in recent quarters. We expect consumption to slow in Q4 2025, but this should remain moderate.

Sebastian Paris Horvitz

Director of Research