Increased pressure on the Chinese authorities

Link

Market Analysis for October 14, 2024 by Sebastian PARIS HORVITZ.

In summary

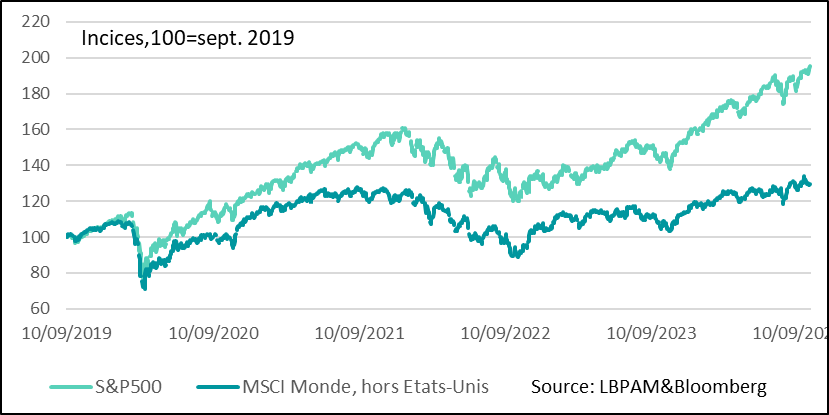

►The earnings season opens in the United States. Expectations are fairly reasonable, having been adjusted downwards in the recent period. Nevertheless, early results from US banks, led by JP Morgan, have exceeded expectations. This helped lift the US flagship index, the S&P500, to a new all-time high. With economic growth resilient and the Fed's communication rather supportive, risk appetite is holding up well across the Atlantic. As a result, US stock market outperformance relative to the rest of the world is growing...and valuations are tightening.

►This good performance came at a time when the additional impetus provided by China over the past week has weakened, with a sharp drop in Chinese stock market indices. Indeed, the authorities are unable to deliver a clear and comprehensive message on the fiscal measures that could be taken to support demand. In the next few weeks, Parliament is expected to adopt the spending measures to be included in the budget, which may or may not calm market anxiety.

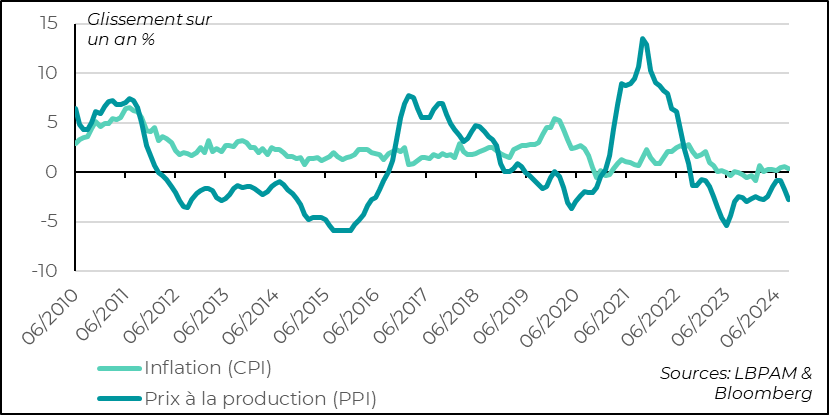

►Investor anxiety over the direction of China's economic policy was exacerbated by September's inflation figures, which confirmed that deflationary pressures are still very much present in the economy. Indeed, consumer prices rose by just 0.4% year-on-year, while producer prices fell by 2.8%. Both came in well below expectations.

►In the United States, core producer prices rose faster than expected. Past revisions have pushed core producer prices up to 2.8% year-on-year. With consumer price data and now producer price data for September, it is estimated that the core component of the consumption deflator (PCE), the indicator tracked by the Fed, probably accelerated in September at a monthly rate, but should decelerate slightly year-on-year to around 2.6%. Nevertheless, the slowdown in disinflationary momentum should justify a Fed rate cut of just 25 basis points in November.

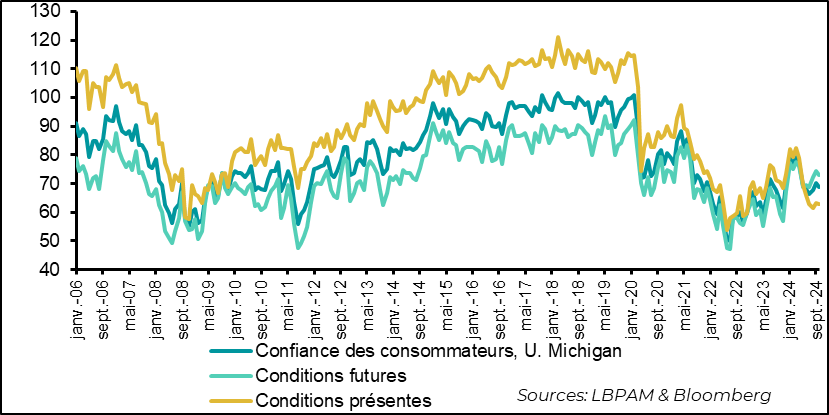

►As for US consumer confidence, the preliminary survey by the University of Michigan showed a relapse. It would appear that two factors were to blame. On the one hand, fears of accelerating inflation, and on the other, uncertainty over the outcome of the elections, which are just over three weeks away.

To go deeper

Despite the many uncertainties dominating the global economy, the start of the earnings season has given the US stock market fresh impetus. Driven by the financial sector, particularly banks, the S&P 500 reached a new all-time high. The resilience of US growth and the start of monetary loosening, with a Fed that has recently shown itself rather inclined to defend activity, meant that the US market remained dominant in the world.

Indeed, over the past 5 years, the US stock market has outperformed the other major markets even more. Of course, this outperformance is also massive in relation to emerging markets, despite China's very strong rebound in recent weeks.

Stock markets: US massively outperforms other major markets

The resilience of the US economy is a major contributor to this outperformance, as is the overwhelming dominance of US companies in the technology sector, all the more so with the recent craze for Artificial Intelligence (AI).

It's worth noting that in recent months, with expectations of a loosening of monetary policy and the Fed's rather aggressive move in its first rate cut (50 basis points), the rise in the US market has gone far beyond technology.

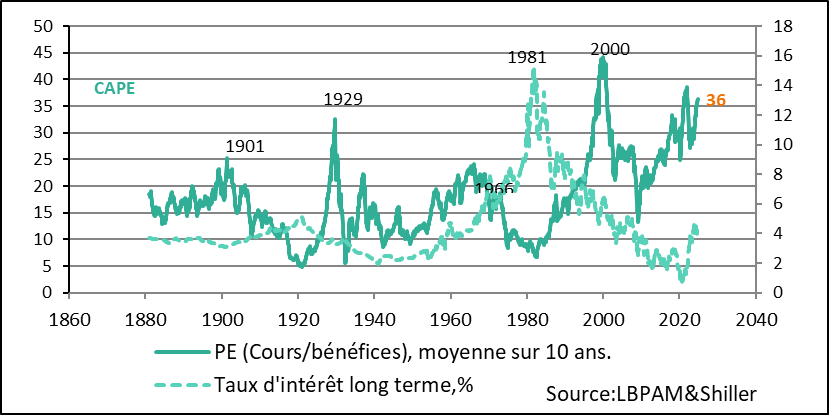

All in all, valuations have tightened again. We continue to see very demanding valuations for US stocks. Whether it's the very popular Shiller measure or the simple measure of the premium that equities offer over the “risk-free” asset (long-term US Treasuries), the same observation is made.

However, much of the good news is in the prices. History teaches us that, in the medium term, overpricing corrects itself. Nevertheless, in the short term, it is difficult to see a strong adjustment. In particular, we'll have to see whether the final stretch of the elections disrupts the buoyant wind that is sustaining the US stock market today.

United States: a very demanding valuation...but not necessarily capable of holding back the short-term wind of change

In recent weeks, one of the encouraging signs for the global economy as a whole has been the positive sentiment triggered by the Chinese authorities' salvo of financial easing measures.

Indeed, they were seen as the realization by China's leaders that much more needed to be done, to support domestic demand and counter deflationary pressures. Indeed, the ongoing adjustment of the real estate sector, aimed at reducing indebtedness in the Chinese economy, has clearly set in motion a deflationary dynamic. Demand remains depressed, with a powerful negative shock on the value of savings and very weakened confidence. Obviously, there are other factors that have affected the Chinese private sector's propensity to spend.

Unfortunately, the expected fiscal stimulus package to give some impetus to thrift has been slow in coming. A succession of announcements were made during the week, all of which remained vague and, above all, did not really offer a plan commensurate with the economy's needs, in order to rebound more clearly.

We'll have to wait until the end of the month for more details on this spending plan, with the budget discussions in Parliament. But this wait could put an abrupt end to the enthusiasm for Chinese equities. At this stage, we are still waiting for a favorable development, and are therefore maintaining a global exposure to emerging markets, which would benefit from growth support in China.

Adding to the pressure on the Chinese authorities, inflation figures for September were not exactly reassuring. Indeed, the trend in both consumer and producer prices continues to underline persistent deflationary pressures.

Consumer prices rose by just 0.4% year-on-year, while producer prices fell even more sharply, by 2.8%.

China: inflationary pressures are still very much with us, with price dynamics very depressed

The coming weeks will be crucial in testing the market's patience and, above all, the authorities' willingness, or otherwise, to restore the momentum of domestic demand. The challenge is to restore confidence, particularly among Chinese households, via a fiscal stimulus package of sufficient magnitude.

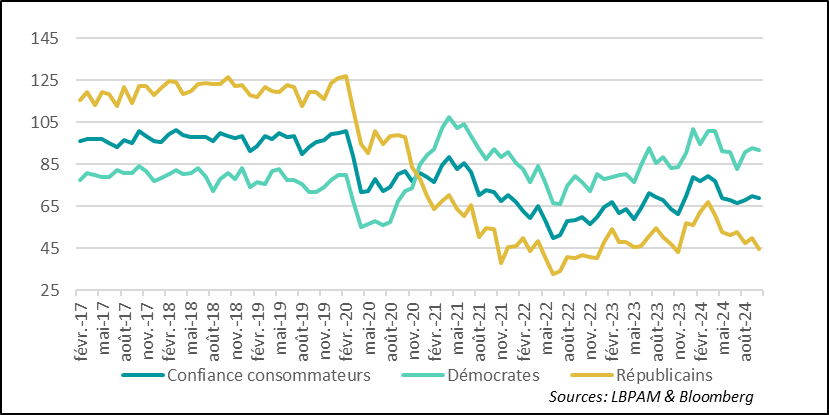

In the United States, the U. of Michigan's preliminary household confidence survey was rather disappointing. Indeed, after rather reassuring labor market figures, we thought that confidence would continue to rebound. In fact, what we saw was a decline: whether in terms of sentiment on current conditions or outlook, both indicators are pointing downwards.

USA: Confidence falls in October according to preliminary results of U. of Michigan survey

There appear to be two reasons for this decline. The first, and no surprise, is the electoral context. Indeed, political polarization remains quite extreme in the country. The perceptions of pro-Republican and pro-Democrat households are radically opposed. In particular, Republican sentiment fell again during the month. It's hard to see an improvement in this division before the elections...or even after.

USA: Democratic and Republican sentiment in confidence survey remains diametrically opposed

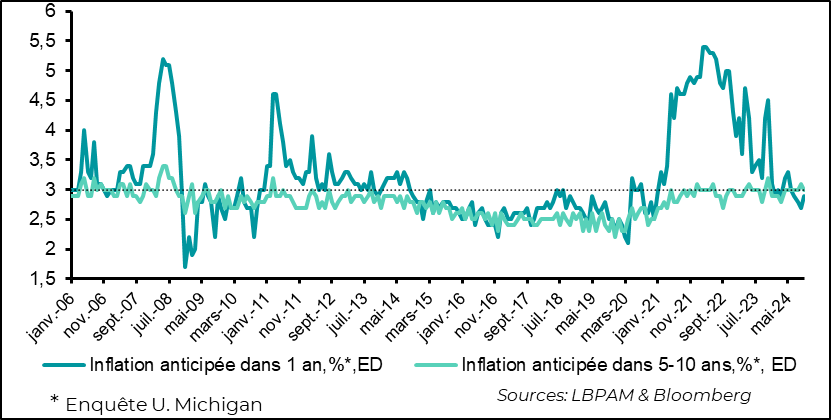

The second, and apparently stronger, factor was the rise in short-term inflation expectations. This is in response to the recent rise in energy prices and tensions on world markets, particularly given the situation in the Middle East.

This is not good news for the Fed, but this statistic is highly volatile and therefore unlikely to play a major role in the central bank's decision in early November. All the more so as medium-term expectations have fallen slightly, although they remain within the high range of the last 10 years.

United States: short-term inflation expectations pick up, notably due to higher energy prices

Sebastian PARIS HORVITZ

Head of Research