The “protected” sectors behind Trump

Link

Read Sebastian Paris Horvitz's market analysis for January 15, 2025.

Summary

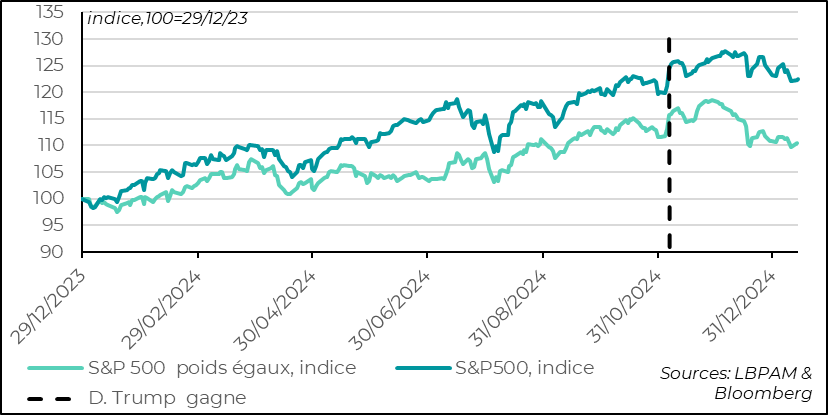

►The S&P500, the US stock market's flagship index, is now below the level reached after D. Trump's victory in the US presidential election. Much of this momentum is associated with rising long rates, which appear to have used up some of the post-election euphoria. The 50 basis point (bp) rise in ten-year yields has put the brakes on risk-taking. This rise is of course associated with the Fed's change of tone, which has become more cautious. Indeed, the robustness of the economy and the halt in the decline in inflation have greatly reduced expectations of monetary easing. In addition, uncertainties about D. Trump's future policies are also fuelling market anxiety.

►We'll know more about Trump's economic policy choices in a week's time, after his inauguration. Today, we will also see if there are any changes in price dynamics in the United States, with the publication of the CPI. We don't expect any marked moderation in core inflation. Yesterday, producer prices surprised somewhat to the downside, due in particular to food prices, but the few prices that are incorporated into the consumption deflator (PCE), the Fed's preferred inflation indicator, showed no significant signal of moderation. The Fed's current cautious stance is unlikely to change.

►Despite the US stock market's hesitancy over the past month, the results season should give the market some impetus, with good financial performances. What's more, in addition to the deregulation measures promised by D. Trump, the market should be further buoyed by the promise of a 15% corporate tax cut (from 21%). These factors continue to encourage us to maintain an overexposure to the US market, even if we have moderated it as a consequence of rising rates and demanding valuations.

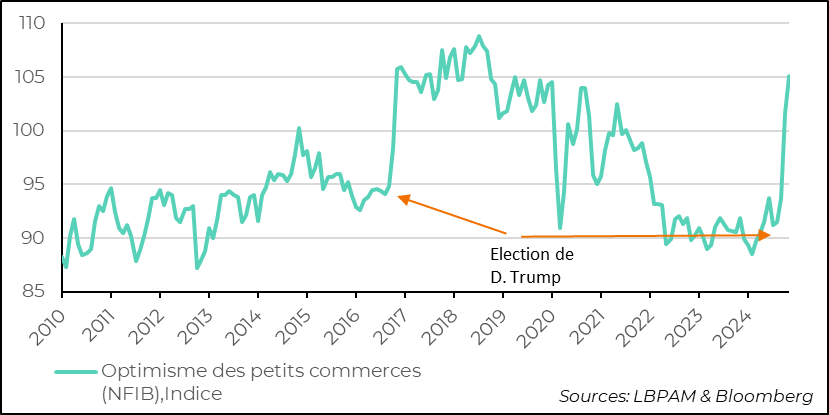

►This bet is also supported by the optimism that remains very much alive among US companies. This is particularly strong among small businesses. The survey of small businesses (NFIB), a sector that is rather protected from foreign trade, even if dependent on certain imports, showed that the optimism index rebounded strongly in December. Above all, hiring and investment intentions remain very positive. Obviously, too much optimism could lead to further overheating and prove counterproductive, as this would force the Fed to maintain a more restrictive policy.

►For most countries, the rise in oil prices at the start of the year is not good news. Since Christmas, the price of a barrel of Brent crude has risen by over 10% in dollar terms. The latest acceleration is due to the new sanctions against Russia, notably affecting tankers carrying Russian oil. It is difficult to determine the lasting impact of these sanctions. Nevertheless, the fact remains that we still have production overcapacity, in a world where demand for oil remains moderate. In any case, if the price of oil were to remain above $80, the impact on growth would be negative. For the euro zone, with the added impact of a weaker currency, GDP growth could be cut by 0.2 percentage points.

To go deeper

The euphoria that buoyed the US stock market after D. Trump's election in early November has cooled sharply, with the S&P losing all its gains to date. Indeed, the S&P500 is down nearly 4% on the day of the presidential election.

This pullback is largely associated with the sharp rise in long-term rates over the period. The 10-year rate on Treasuries has gained 50 bp since the election. This gain was the result of several factors. Firstly, the latest economic statistics indicate that the economy remains robust and that inflation, particularly in services, has stopped decelerating. This has prompted the market to reconsider its expectations of key rate cuts. Today, more than a single Fed rate cut is expected in 2025.

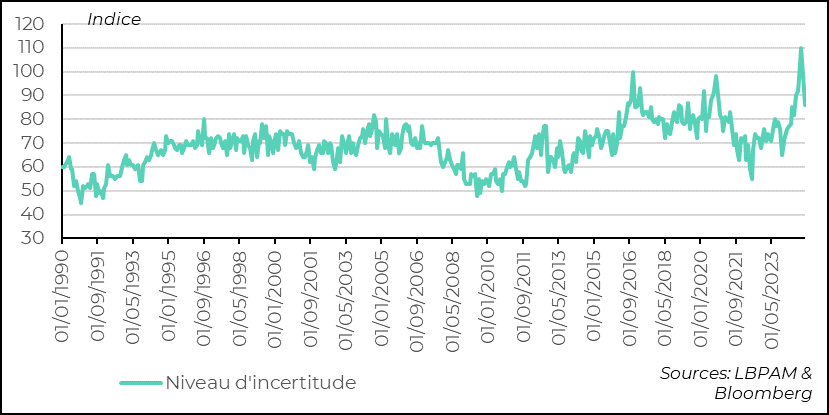

The second, just as important, is the uncertainty surrounding the economic policy choices to be made by the administration headed by D. Trump, and their consequences for the trajectory of the US economy. These uncertainties have led to term premiums on the US yield curve rising to levels not seen for over 10 years.

Against this backdrop of rising interest rates and a very high valuation for the US market, it seems only natural that the market should blow. What's more, while the major technology stocks are still holding up, this interest-rate movement and the uncertainties surrounding economic policy have had a greater impact on the more cyclical stocks. In fact, the S&P index, on an equal-weight basis, saw a far greater decline over the period.

United States: the S&P, and even more so the S&P Equal Weight, is now below its post-election level.

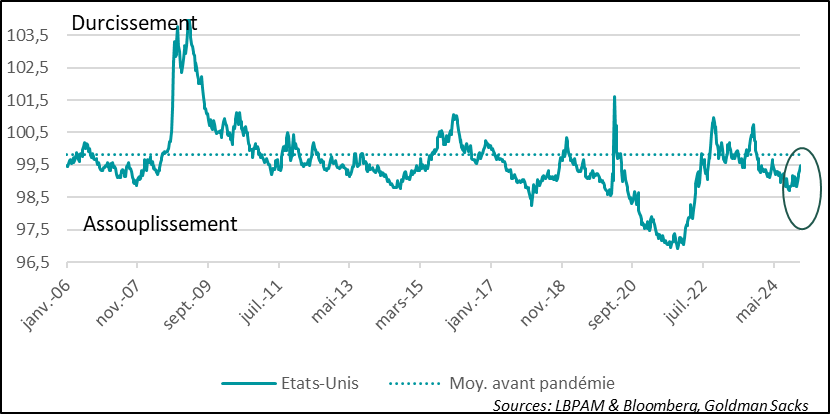

The rise in interest rates and fall in equity values have obviously led to a deterioration in financial conditions in the USA over this period. Nevertheless, they remain relatively accommodative compared with the last 10 years.

United States: financial conditions deteriorate at the start of the year

Certainly, these developments must factor into the decisions that will be made at the start of D. Trump's presidency. In recent days, messages of moderation on the protectionist measures promised during the campaign are being heard with insistence. If this were the case, it would surely ease market anxiety. Nevertheless, we'll have to wait another week for more certainty.

In any case, these latest market developments call for a degree of caution. This has led us to reduce our positive position on US stocks, but not to abandon it.

Indeed, our scenario is still based on a more “reasonable” approach to the protectionist policy that could be put in place. Also, the strong likelihood of corporate tax cuts (from 21% to 15%) and deregulation measures should remain positive for the US market. What's more, we are still expecting rather favorable earnings figures for the end of the year, which should also buoy the stock market in the short term.

Another factor is also important to consider. It's the optimism that D. Trump's election has triggered on the business side. This is a positive factor for growth.

The NFIB's December survey of small businesses once again showed the strength of the shot of optimism triggered by D. Trump's election. Indeed, the optimism index reached its highest level since 2019 and is very close to what we saw at the end of 2016 when D. Trump first took office.

United States: small businesses still reeling from the euphoria of D. Trump's election

The nervousness generated by the election period is fading fast, boosting business confidence.

United States: the sharp drop in the NFIB survey's indicator of political uncertainty shows the rapid appeasement that is taking place.

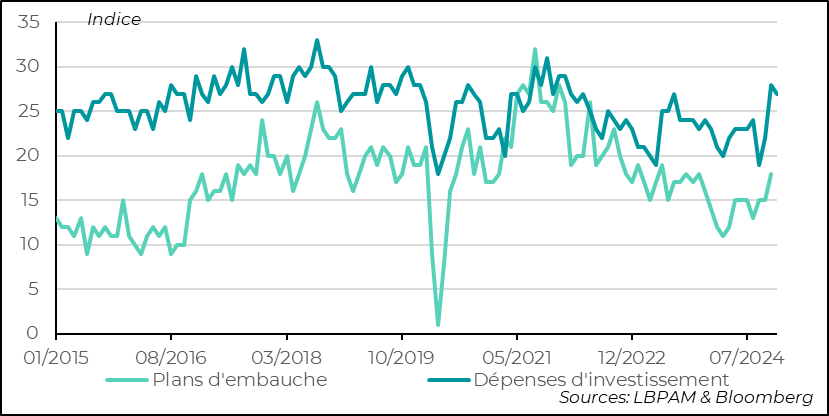

At the same time, hiring and investment prospects have rebounded sharply, although investment intentions dipped slightly over the month.

United States: significant rebound in hiring and investment intentions according to NFIB

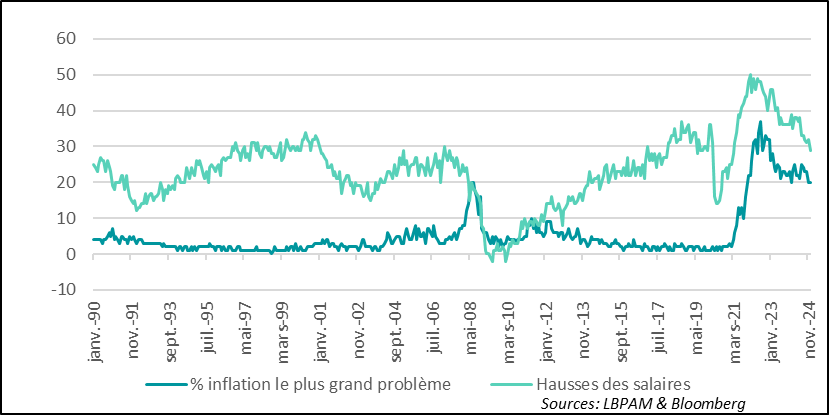

Also, a reassuring development on wage trends, which remain an important element in ensuring that the disinflation dynamic persists, and the continued moderation of increases. Nevertheless, there could be a contradiction between this deceleration in wages and the intentions of these companies to start hiring again in a job market that has certainly normalized but continues to have pockets of tension.

In this sense, for small businesses, inflation remains an important issue, albeit less problematic than it was two years ago.

United States: small retailers moderate wage increases but remain concerned about inflation, albeit to a lesser extent

The small-business sector can be considered relatively protected, and shopkeepers do not see the consequences of protectionist measures. Nevertheless, whether it's higher customs duties or migration restrictions, this sector could be quite clearly affected by overly aggressive measures.

That's why the first indications we'll get next week on the measures that will be taken will give us a better ability to anticipate how the US economy and the rest of the world will be affected. We'll need to see not only the scale of the measures, but also their sequence. We still think that tariffs on consumer products, which would directly affect household purchasing power, will be postponed or softened so as not to exacerbate inflationary pressures in the short term.

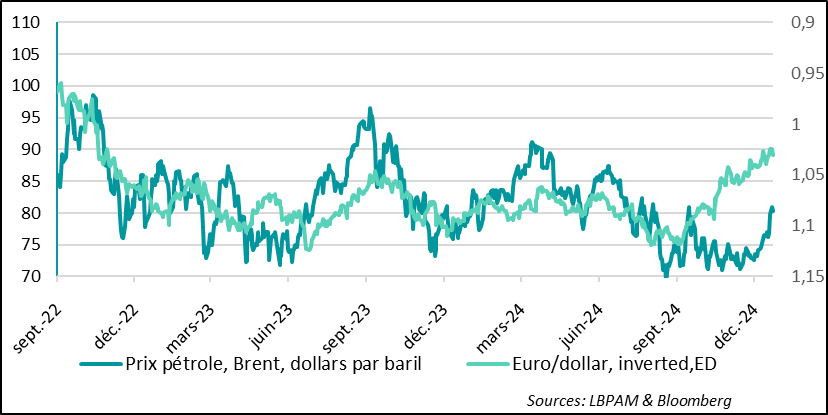

One of the bad news stories at the start of the year was the rise in oil prices. Indeed, the price of a barrel of Brent crude oil in dollars has already risen by almost 8% since the start of the year.

This price rise was recently exacerbated by new sanctions imposed on Russia by the United States, the United Kingdom and Europe. The US measures could severely restrict Russia's ability to export oil. These measures affect two major producers, Gazprom and Surgutneftegas. Above all, they affect the oil-transporting fleet, which is also sanctioned, notably by forcing two tanker insurers, Ingosstrakh and Alfastrakhovanie.

China and India in particular, which have become major importers of Russian oil, may have to limit their imports and turn to other exporters.

It is against this backdrop of uncertain oil supplies that prices have risen.

We'll have to wait and see whether these sanctions are effective. So far, Russia has proved highly effective in circumventing the restrictive measures.

Looking at the oil market as a whole, we are still in a situation of production overcapacity, in the face of demand that remains relatively moderate, notably due to China.

Indeed, it should be remembered that Saudi Arabia currently produces less than 9 million barrels a day, against a capacity of 12 million. It would therefore be capable of easily filling a production gap, preventing prices from soaring further.

Be that as it may, the recent rise in prices may prove not only bad news for household purchasing power, but also costly in terms of growth.

For example, for the euro zone, with an oil bill of around 2% of GDP, the recent rise, together with the fall in the euro, could cost nearly 0.2 percentage points of GDP growth in a full year if the rise were permanent.

Oil: recent sanctions against Russia have pushed up the price of oil. Bad news for Europe

Sebastian PARIS HORVITZ

Head of Research