Rates and oil rise despite signs of global slowdown

Link

- Markets are still digesting the message from central banks - higher rates for longer - and rising oil prices. US rates remain close to the 15-year highs they reached after last week's Fed meeting (2-year at 5.1% and 10-year at 4.45%). After a slight dip last week, oil prices start the week up near $94 per barrel, 20% above their Q2 level. This weighs on equities and supports the dollar (Eurostoxx and Euro-dollar are at their lowest since March), leading to a tightening of financial conditions.

- Central bank rhetoric and short-term oil shortages can still push rates and oil higher in the short term. But it seems to us that these trends are self-defeating in a context of slowing core inflation and growth. This week, core inflation, monitored by the Fed and ECB, is expected to fall sharply, below 4% in the US and below 5% in the Eurozone. This is still more than twice above target, but at least it confirms the slowing trend.

- On the growth front, advanced PMIs for September in developed countries were disappointing, suggesting that GDP will stagnate at the end of the summer. They are down in the USA (50.1pt) and Japan (51.8), although they remain slightly in the expansion zone. Above all, they remain clearly in the contraction zone in Europe.

- The Eurozone PMI recovered slightly in September, from 46.7 to 47.1pt, a level compatible with a 0.3% quarterly decline in GDP. The slight improvement is due to the stabilization of services in Germany and the resilience of southern European countries. But industrial activity continues to contract sharply (manufacturing PMI at 43.5pt) and the French PMI has fallen to its lowest level since the second containment (-2.5pt to 43.5). We believe that the Eurozone should avoid a recession thanks to a resilient labor market and rising real wages, but these figures and rising oil prices reinforce the downside risks.

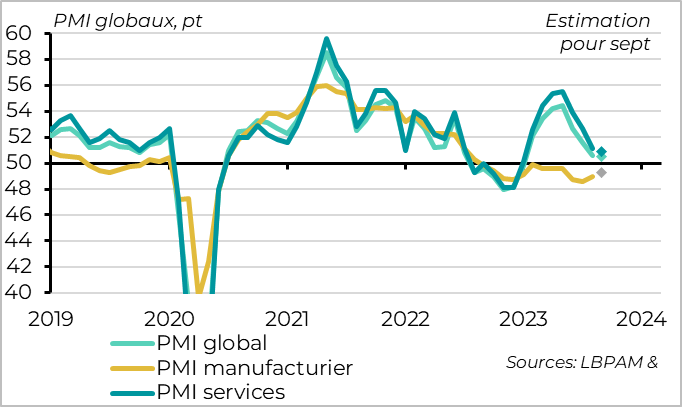

Fig.1 World: September PMIs point to stagnation in global growth

-Global PMI

-Manufacturing PMI

-Services PMI

The composite PMI for developed countries fell slightly in September, according to initial estimates, suggesting that GDP will stagnate at the end of the summer.

In sectoral terms, the manufacturing PMI improved marginally for the second month running, but remains clearly in contraction territory. And leading indicators such as the gap between new orders and inventories remain poorly oriented, outside the US. While the worst for the manufacturing sector is probably behind us, thanks to destocking and stabilization in China, a real rebound in activity is unlikely before next year. Moreover, the sectoral gap is still being bridged mainly by deceleration in the services sector, with the services PMI falling in September for the 6th month running and approaching the stagnation zone.

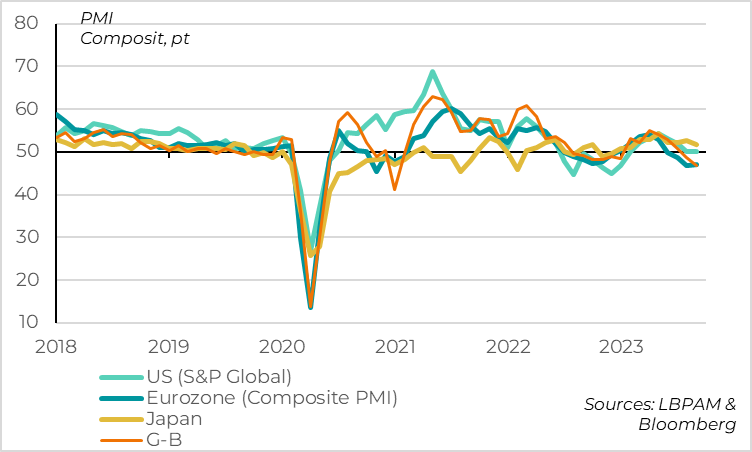

Fig.2 World: European PMIs continue to significantly underperform those of Japan and the United States

-US (S&P Global)

-Eurozone (composite PMI)

-Japan

-G-B

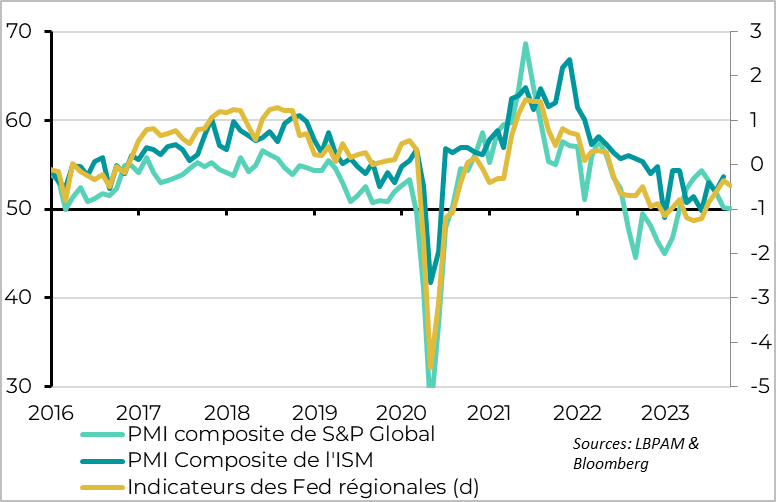

The geographical dispersion of PMIs remains significant.

It has narrowed slightly with the slight drop in US (50.2pt) and Japanese (51.8pt) composite PMIs, but the latter remain at levels compatible with expansion. Note that the US PMI is underperforming other economic indicators such as the ISM and regional Fed indicators, which remain compatible with growth close to potential this summer.

On the contrary, PMIs for Western Europe are stuck in the zone of clear contraction of activity. This is annoying, as PMIs are more reliable for tracking economic conditions in Europe than in the rest of the world.

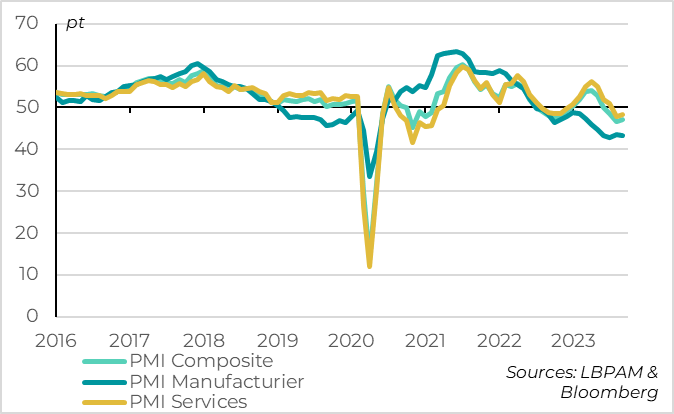

Fig.3 Euro zone: PMI rises slightly in September but remains in contraction zone

-Global PMI

-Manufacturing PMI

-Services PMI

Eurozone PMI recovers slightly in September, from 46.7 to 47.1pt, but remains clearly in the contraction zone after the sharp declines of the last three months. September's level is in fact the second lowest since the Covid shock. If the historical relationship between GDP growth and the PMI is valid, the PMI implies a contraction in GDP of around 0.3% quarter-on-quarter at the end of the summer.

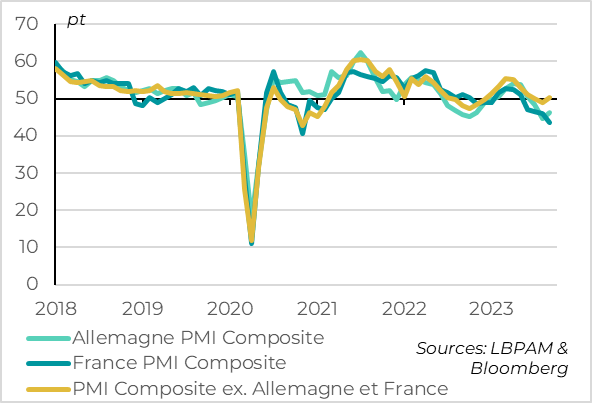

Fig.4 Euro zone: services stabilize in Germany and the periphery

-Germany PMI Composite

-France PMI Composite

-PMI Composite ex. Allemagne et France

The slightest deterioration in activity in the Eurozone is due to the stabilization of services activity in Germany and its resilience in the southern countries. On the contrary, industrial activity continues to contract sharply (manufacturing PMI at 43.5pt) and the French PMI falls to its lowest level since the second containment (-2.5pt to 43.5). Contrary to the stability of the INSEE survey at its long-term average in September, the French PMI suggests a fall in GDP for the first time since 2020.

Leading indicators remain poorly oriented. New orders fell for the first time since 2020 in September, and business confidence is at its lowest since the energy shock was reduced at the end of 2022. The only good news is that destocking was again massive in September, suggesting that the inventory cycle will no longer be a drag as the end of the year approaches.

At the same time, employment remains resilient and raw material prices are rebounding, increasing costs for companies less able to raise their selling prices. The increase in selling prices is the most limited since the start of the post-Covid reopening in September. While the absence of a price-wage loop is reassuring for the ECB, corporate margins are likely to come under pressure.

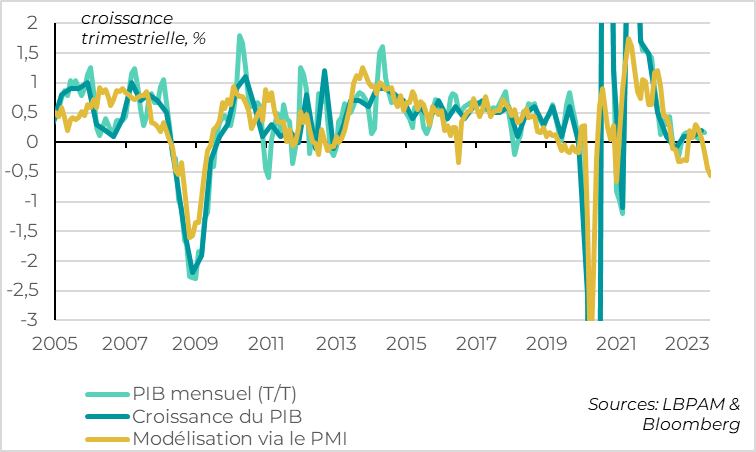

Fig.5 United Kingdom: PMI validates Bank of England's caution in September

-Monthly GDP (T/T)

-GDP growth

-Modeling via PMI

UK PMI falls sharply again in September, from 48.6 to 46.8pt, the lowest in almost 2 years. In fact, excluding periods of confinement, the UK PMI is at its lowest since the 2008-2009 financial crisis, and is consistent with a 0.4% decline in quarterly activity.

This weakness stems from the fall in the services PMI for the second consecutive month, which is now clearly in the contraction zone (at 47.2pt). This more than offsets the marginally less marked contraction in industrial activity (manufacturing PMI at 44.2pt). Leading indicators are mixed, with a sharp fall in orders, but resilient business confidence.

The good news for the Bank of England is that employment contracted again in September, suggesting weaker wage pressures ahead, and that both purchase and sales prices have been rising at a limited pace for the past two and a half years.

This seems to validate the BoE's cautious approach last week (which did not raise rates for the first time in 14 meetings) and leads us to anticipate that the UK's key rate has probably already reached its high point.

Fig.6 United States: S&P's global PMI remains neutral in September, but other indicators are still strong

-S&P Global composite PMI

-ISM composite PMI

-Regional Fed indicators (d)