Resurrecting the Fed's put option

Link

-

At least over the last two decades, certain market movements have been marked by what was once known as the Fed "put". In other words, by analogy with the purchase of a put on the options markets, the US central bank would always act (by easing its monetary policy) to prevent stock prices from falling too sharply. It would seem that the sharp rise in stock market prices over the past few days has been fuelled by this idea. This also explains the fall in interest rates on virtually all maturities. At the same time, it also seems that the market is correcting for the rapid fall in share prices over the last two months, and the massive rise in long rates over the period. Finally, it is not certain that the monetary authorities, given the still high level of inflation, even if it is falling, wanted the market to interpret their words with such "optimism".

-

We believe that we have indeed reached the end of the rate hike cycle, but this view is associated with a mediocre growth scenario for the coming quarters, on both sides of the Atlantic. It is this deceleration in activity that we believe will bring inflation back towards 2%, and loosen the grip of central banks. Consequently, we remain dubious about the possibility of a very strong rebound in stock market indices at this stage, given that the economic trajectory is likely to translate into deteriorating corporate earnings. In particular, given the valuations of equities across the Atlantic, we believe that earnings momentum over the coming quarters will not support them. That's why we're maintaining a yield-seeking bias towards bonds in our allocation, while remaining highly selective.

-

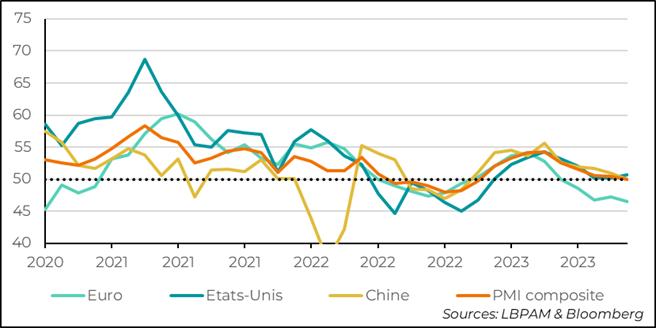

Our scenario of economic deceleration has to some extent been validated by the latest statistics on the state of activity worldwide. The global composite PMI constructed by JP. Morgan and S&P, which combines activity in the manufacturing and services sectors, came out weaker than expected. In both sectors, activity slowed markedly, with Europe continuing to show pronounced weakness.

-

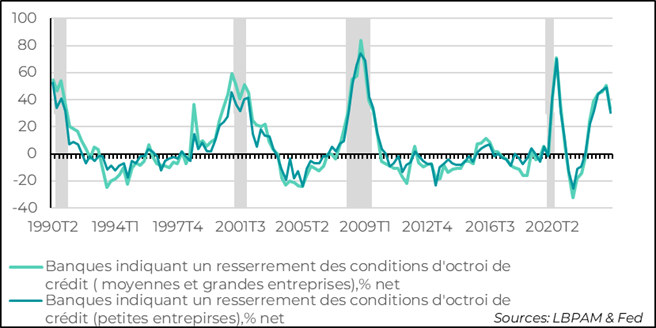

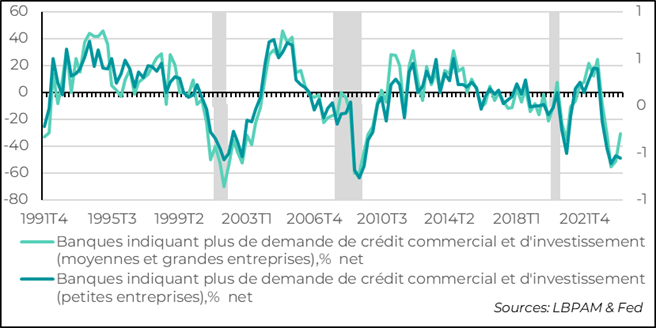

One of the key factors behind this deceleration remains the delayed effect of monetary tightening. Access to financing everywhere is becoming more difficult, as the savings once accumulated by consumers at the time of the Covid run out or remain unspent due to a more uncertain horizon. In the United States, the latest bank survey showed that access to credit remains difficult for both households and businesses. For the latter, conditions are still tightening, albeit to a lesser extent than in the previous quarter. In addition, demand for bank financing remains weak, particularly for small businesses, given the costs involved.

-

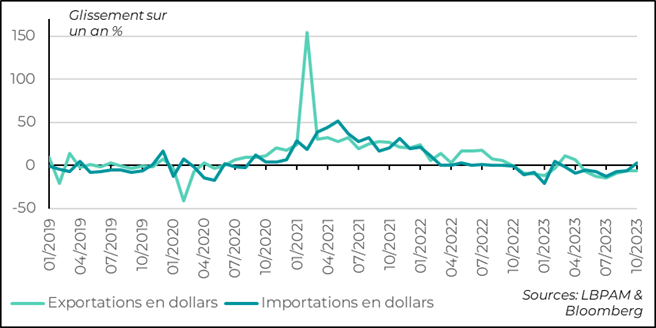

In Europe, corroborating the worsening business momentum reflected in the PMI surveys, particularly in industry, industrial production and industrial orders came out much weaker than expected in Germany. In China, the latest foreign trade figures also confirmed the dynamics that continue to underpin activity. Indeed, the recovery continues to be driven by the domestic economy, itself stimulated by public spending (notably through the state-owned industrial fabric). Imports continued their upward trend, rising for the first time in more than a year. At the same time, the downturn in global industrial activity is reflected in sluggish exports and persistently depressed demand.

As we enter the final quarter of the year, activity seems to have deteriorated. Indeed, with all the PMI surveys for the month of October now available, we can see that there has been a marked deceleration. The JP Morgan global composite PMI, with S&P, shows that activity is stagnating, with the index just shy of 50, the threshold separating expansion from contraction. In addition to the further weakening in industry already mentioned, the favorable trend in services that has prevailed in some countries so far seems to be losing strength rather quickly.

Fig.1 Global activity: The global composite indicator produced by JP Morgan and S&P, combining PMI surveys for industry and services, stagnated in October.

It's hard to see what would be the factor that could revitalize activity in a sustainable way at this stage. The only factor that might bring some relief is a more rapid easing in oil prices, despite current geopolitical tensions. However, in our view, this easing would be more a reflection of a loss of momentum in global demand, associated with the slowdown in global activity. Hence our expectation that growth will remain relatively mediocre over the next few quarters.

One of the key factors behind this slowdown is, of course, the delayed impact of monetary tightening on economic activity. The latest survey of US banks, which has just been published on credit conditions for the fourth quarter of the year, shows that these are still tightening, albeit at a slower pace than in the previous quarter.

With economic growth set to slow and monetary policy remaining restrictive, it is difficult to see banks easing credit conditions, particularly for businesses, in the near future.

In fact, given the rapid rise in the cost of credit, demand from companies remains weak, particularly among the smallest. Admittedly, some companies, especially the larger ones, have built up "woolly funds" when interest rates were low, but the pressure will gradually mount to find their way back to new financing, which will be much more expensive, and which will weigh on company finances, in addition to the difficulty of finding access to these new sources of liquidity.

Fig.3 United States: Given the cost of financing, demand for credit remains weak, particularly among small businesses.

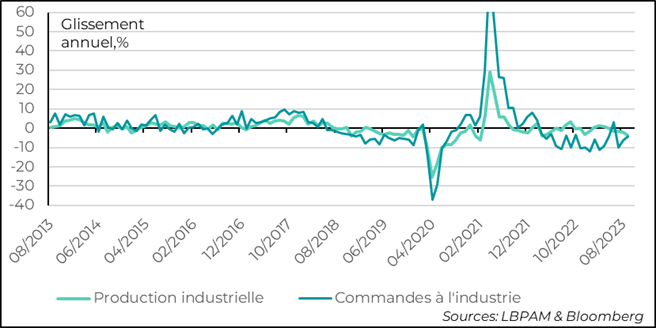

In Europe, PMI surveys confirmed the economy's poor momentum. Recent figures for German industry corroborated the worsening situation, already reflected in the decline in GDP in 3Q23. Industrial activity decelerated far more than expected in September, contracting by 3.7% year-on-year. In addition, industrial orders remained mediocre, rising by a much lower 0.2% than expected in September, with a total year-on-year decline of 4.3%.

Fig.4 Germany: German industry continues to suffer, with industrial activity contracting by 3.7% year-on-year in September

Chinese growth remains constrained by the slump in the real estate sector. Nevertheless, the economy is still maintaining a pace of activity that seems to satisfy the authorities, even if they have decided to give an extra boost with more public spending in the coming quarters (just under 1 point of GDP). This growth is supported in particular by the State's industrial apparatus. This was well reflected in the first year-on-year growth in Chinese imports in October for over a year, rising by 3%, following a 6.3% contraction the previous month.

On the other hand, the deteriorating state of global industrial activity, with demand at half-mast, continued to weigh on Chinese exports, which contracted by a much larger-than-expected 6.4% year-on-year.

So, at this stage, it's clear that the strength of Chinese growth will remain highly dependent on the authorities' willingness to give activity a boost or not, especially as the real estate sector remains weighed down. We are still expecting growth to slow in 2024 compared with 2023, falling short of the government's 5% target.

Fig.5 China: Growth driven by demand from Chinese industry (notably the state-owned industrial apparatus), reflected in rising imports