Rising geopolitical tensions

Link

Check out our market analysis from November 20, 2024, by Sebastian PARIS HORVITZ.

In summary

► Following J. Biden's authorization of Ukraine's use of American long-range missiles, President Putin has modified Russia's doctrine on the use of nuclear force. The new doctrine states that if a non-nuclear-weapon state attacks Russia on its territory, supported by a nuclear-weapon state, it too will be treated as such. So, after learning that Ukraine had carried out an attack on Russian territory using missiles supplied by the USA, fear gripped the markets. Safe havens rallied, while European equities once again suffered.

►This episode reminds us, if need be, that we are still living in a situation of major geopolitical and military tensions, and that Europe remains one of the theaters of these tensions. Hence the reaction of investors to these fears. D. Trump's arrival in power on the other side of the Atlantic will not necessarily be a source of appeasement. Nevertheless, at this stage, it seems to us that these tensions call for caution rather than panic. It is reasonable to hope for a calming down, which will leave room for considerations on the economic and financial environment on the markets.

►At the same time, tensions with Russia coincided with Gazprom's suspension of gas deliveries to Austria. Austria was one of the last countries still receiving a small amount of Russian gas (Hungary and Slovenia are the only countries still heavily dependent). Austria should be able to find alternative sources. However, this comes at a time when gas stocks in Europe are falling much faster than expected. As a result, gas prices have risen. It is now at its highest for the year, at 46 euros per Kwh. This is not good news, but it is not likely to derail growth, and Europe's gas supply is not at risk.

►In the United States, the announcements of D. Trump's appointments to the key posts in his future government continue. Numerous divisive figures have been announced, notably for cabinet posts in the Departments of Justice and Defense. For the key position of Treasury Secretary, the President-elect has yet to make a decision. In any case, we'll have to wait until early next year, when the new Senate convenes, to see whether D. Trump's choices will be accepted by the Republican senators, who have the majority in the upper chamber. These decisions may or may not signal “moderation” in the policies that the new president might implement.

►In the meantime, while taking geopolitical tensions into account, markets should continue to move under the influence of economic data and, for the United States, on the optimism generated by D. Trump's promises. Not to mention continued monetary easing in the short term. Admittedly, many expectations are already priced into US stocks, resulting in very demanding valuations. This is a handicap in the medium term, but should support risk-taking in the short term.

►For once, the latest economic data from the USA painted a less encouraging picture. The sector most sensitive to interest rates, real estate, showed signs of weakness in October. Housing starts and building permits were both down in October. However, like many statistics in October, they were severely affected by weather conditions. In fact, it was in the south, the region hit by the hurricanes, that the declines were steepest. At the same time, in line with past interest rate cuts, homebuilder confidence recovered in November. The risk for the sector is that rates will remain relatively higher than anticipated in the months ahead.

To go deeper

Tensions escalated in the war between Ukraine and Russia after the latter threatened to use nuclear weapons. These tensions have obviously reawakened fears in the markets, favoring safe-haven assets, particularly in Europe.

At the same time, these tensions coincided with Gazprom's decision to stop supplying gas to Austria, following a court ruling against the Russian company.

Austria continued to receive gas from Russia, but its dependence has been drastically reduced in recent years. Only Hungary and Slovenia remain highly dependent on Russian gas.

Nevertheless, Austria should be able to increase its gas supplies from other sources without too much difficulty.

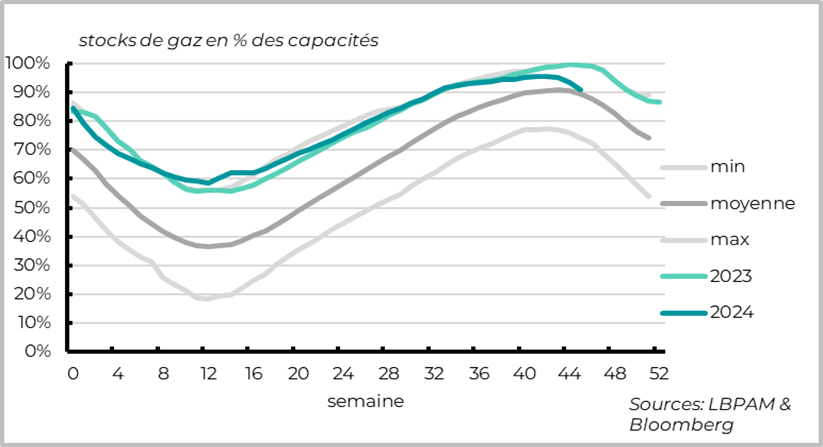

Nevertheless, Gazprom's decision to stop supplying Austria comes at a time when Europe's gas stocks are falling faster than expected. This contrasts with the situation we have been experiencing for some time, when stocks were very high compared with the historical average. Lower-than-usual temperatures before the onset of winter seem to have increased gas consumption more than expected. As a result, inventories are already back towards the historical average.

Gas: Inventories in Europe have fallen faster than expected even before the onset of winter

Nonetheless, today there are no real fears that Europe will be able to find the necessary supplies should gas requirements turn out to be greater than expected.

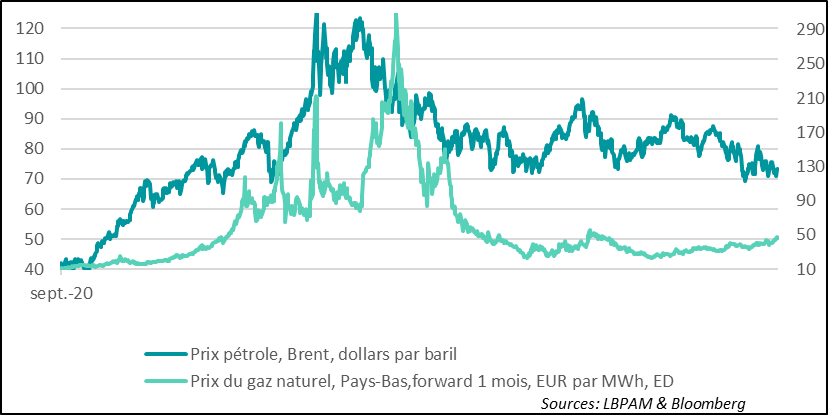

Nevertheless, all these factors taken together have caused tension on the market, and the price of gas has risen, accelerating since the beginning of November. As a result, the price per Mwh hit 46 euros, the highest level of the year.

This is not good news, but we don't think it will derail growth in the region, although it could have a slight impact on final energy prices.

At the same time, given the state of the global gas market, it seems to us that these tensions should dissipate, although geopolitical tensions could still weigh on prices.

Gas: Gas prices have risen recently, but the state of the market suggests that this increase will be contained.

In the United States, the markets consolidated slightly after the euphoria generated by the election of D. Trump. Nevertheless, the enthusiasm for risky assets is likely to remain in the face of the President-elect's promises.

The economic situation and corporate earnings should also continue to drive market performance in the months ahead. Today, Nvidia's results should surely stir the market, in particular to reassess whether investors' high expectations for the deployment of Artificial Intelligence are still justified.

At the same time, the market will remain highly sensitive to developments in the economy, especially as an important consideration on the upside, notably risk appetite, also depends on bets on further Fed monetary easing.

As we have seen so far, and as Fed Chairman J. Powell recently reiterated, the US economy remains very robust. This is surely a message of caution about the path monetary policy will take in the year ahead.

This has already been taken on board by the market, with fewer key rate cuts in 2025, hence the importance of D. Trump's promises as a support factor for the market.

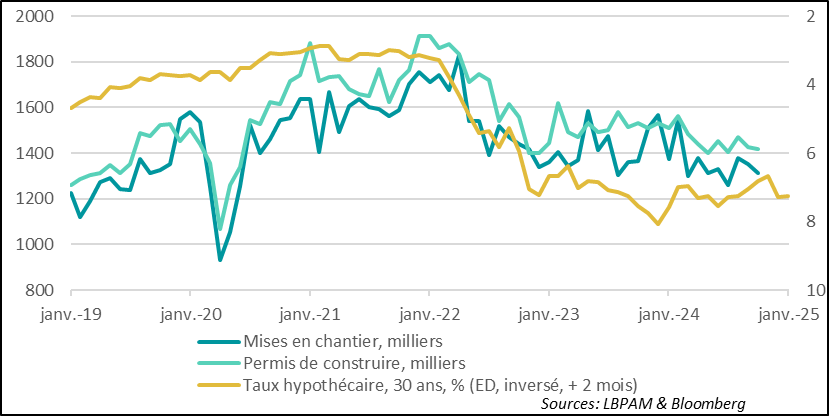

At the same time, pockets of weakness remain in the economy. Not least in the real estate sector. Over the last two quarters, residential construction has made a negative contribution to GDP growth. Nevertheless, expectations of interest-rate cuts, albeit on a smaller scale, should be seen as a support factor for the sector.

However, statistics for October were not very positive for the sector. Both housing starts and building permits fell over the month.

But this poor performance is not due to the recent rise in mortgage rates. In fact, the market tends to react with a slight delay to changes in financial conditions.

Weather conditions were the main factor affecting activity, particularly the hurricanes that hit the south of the country, where construction activity is the highest in the country. In the south, housing starts fell by 8% over the month.

This should be corrected in the coming months, especially as reconstruction work begins to repair the damage caused by the storms.

United States: Construction activity hit hard by weather conditions in October, particularly hurricanes in the south of the country

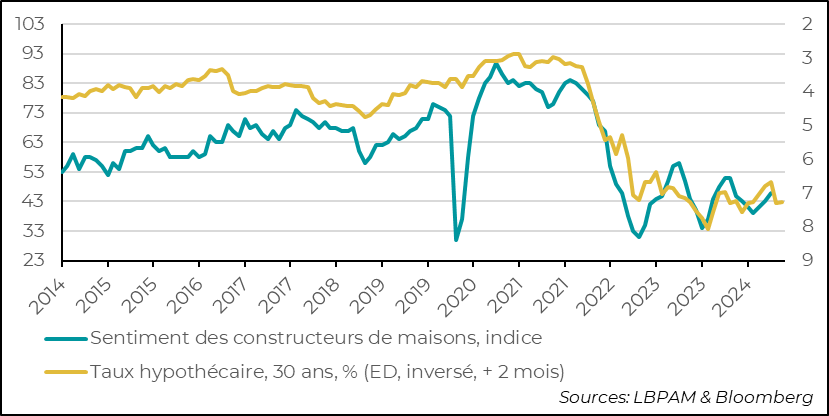

In fact, interest-rate sensitivity is most apparent in homebuilder optimism. Indeed, the NAHB index rebounded nicely in November, even if it remains relatively weak compared with its historical level.

However, it should be noted that this rebound could be short-lived, if mortgage rates remain as high as they are today.

The market has taken on board the scenario of a Fed that could do far less than was expected just a few months ago. There are also concerns about the budgetary costs and possible inflationary pressures that could result from the new government's policies in 2025. This could well prove to be a barrier to a strong rebound in construction in the quarters ahead.

United States: NAHB homebuilder optimism indicator rebounds in November

Sebastian PARIS HORVITZ

Research Director