Rising oil prices further complicate prospects

Link

- The price of oil exceeds 90 dollars per barrel for the first time in almost a year. It has risen by $15 per barrel since the start of the 3rd quarter, and more for Europe and Asia due to the appreciation of the dollar. And there are bad reasons for this rise, since it is not improved demand but reduced supply that is driving this movement.

- Saudi Arabia and Russia have announced a three-month extension of their production cuts of 1 Mbl/d and 0.3 Mbl/d respectively. This means that global oil production will be cut by around 1% until the end of the year. We expect the price of oil to ease a little on the back of limited growth in China and stagnation in the Eurozone, as the period of high seasonal consumption comes to an end and US production starts to rise again. But the tense inventory situation and Saudi Arabia's strong commitment to defending prices should not allow oil to move clearly back below USD 80/bl in our central scenario, and increase the risk of a bullish shock.

- We're still a long way from the energy shock of 2022, particularly in the Eurozone, where gas and electricity prices remain much more contained than last year. That said, the disinflationary effect of falling energy prices will fade by the end of the year and, if the rise in oil prices persists, energy inflation will again make a slightly positive contribution to inflation in 2024. This will slow the pace of inflation normalization and act as a further brake on growth in the Eurozone.

- For central banks, the rise in oil prices complicates matters, although as things stand we still think the Fed and ECB should give themselves time and keep their rates unchanged until the end of the year. In theory, the central bank should not react to a rise in commodity prices and let the economy adjust, with a little more inflation and a little less growth for a year. That said, it must ensure that second-round effects on non-energy prices remain limited, and that inflation expectations do not become unanchored. In the current inflationary context, this may put pressure on the ECB, as inflation expectations are somewhat high. For example, household inflation expectations rose slightly in July to 2.4% over a 3-year horizon, which is below the 3% reached last year but above the 2% reached before the inflation shock. Market expectations are also slightly elevated, having risen over the summer. At 2.6%, the 5-year 5-year swap is close to its 2008 highs. It seems to us, however, that the clear deterioration in the Eurozone's economic outlook warrants caution on the part of the ECB.

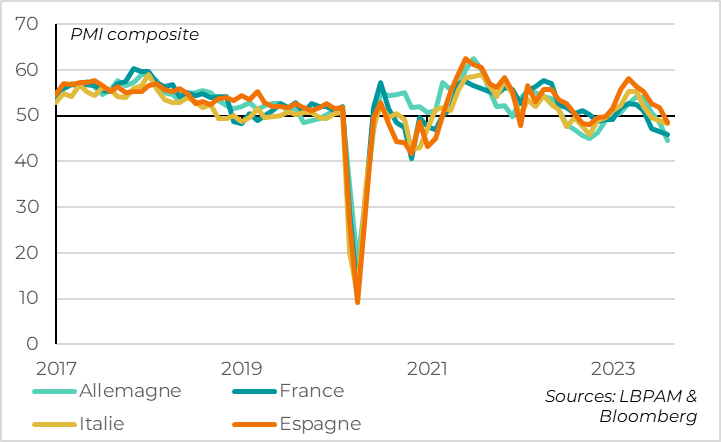

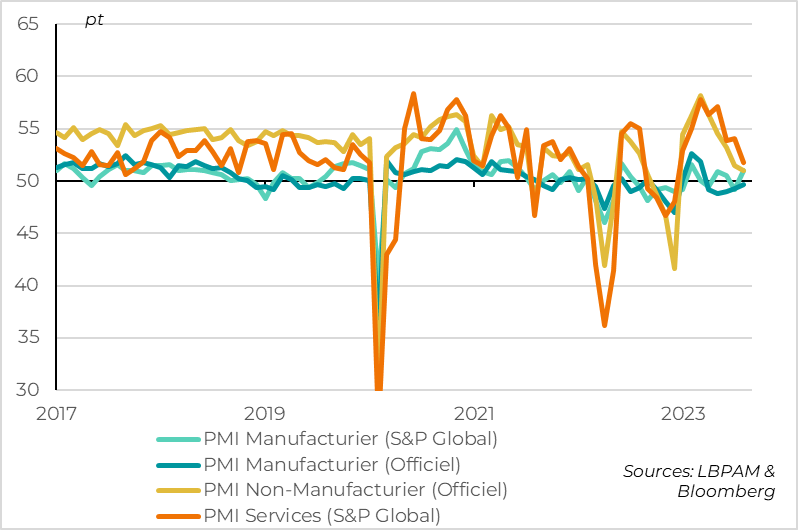

- Indeed, the Eurozone's composite PMI for August was revised down to 46.7pt, its lowest level since 2020, which is historically associated with a fall in GDP. In addition to the great weakness of the German and, to a lesser extent, French economies, PMIs fell sharply in Italy and Spain, as activity in the services sector contracted. This suggests that the strong rebound in tourism that helped southern European countries in the first part of the year is beginning to run out of steam. At the same time, the weakness of Chinese demand is not encouraging for northern countries. Caixin's Chinese services PMI fell in August from 54.1pt to 51.8pt, its lowest level since the end of the Covid-Zero policy.

- We continue to expect Chinese growth to stabilize at a limited level, thanks to increasing support from the authorities, especially for real estate. In Europe, we expect stagnation but no real recession in the coming quarters, thanks to rising real wages and high household savings. But we must recognize that the downside risks to our scenario are increasing.

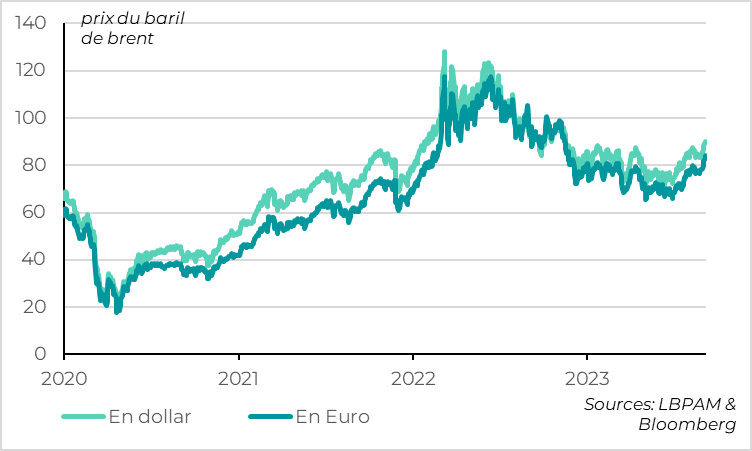

Fig.1 Oil: the price of oil rises above 90 USD/bl for the first time in almost a year.

Since yesterday, the price of oil has exceeded $90 per barrel for the first time in almost a year. This represents an increase of $15 per barrel from the June low. And the recent rise is even greater outside the United States, as the dollar has appreciated by almost 5% since mid-July against a basket of currencies, returning to 6-month highs.

The reasons for this rise are the wrong ones, since it is reduced supply rather than improved demand that is driving this movement. This implies an even more negative economic impact, particularly outside the USA.

Indeed, the rise was mainly due to the reduction in supply prospects following the announcement by Saudi Arabia and Russia to extend their production cut by 3 months to the end of the year. By extending its unilateral production cut of 1 million barrels per day begun in July, Saudi Arabia will produce around 9 Mbl/d for six months, compared with 11 Mbl/d a year ago. Russian oil production, which finally fell in June, is expected to remain down by 300,000 b/d until the end of the year.

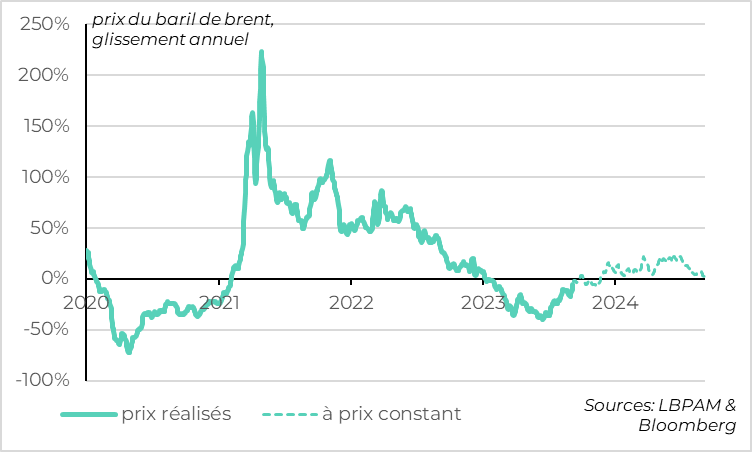

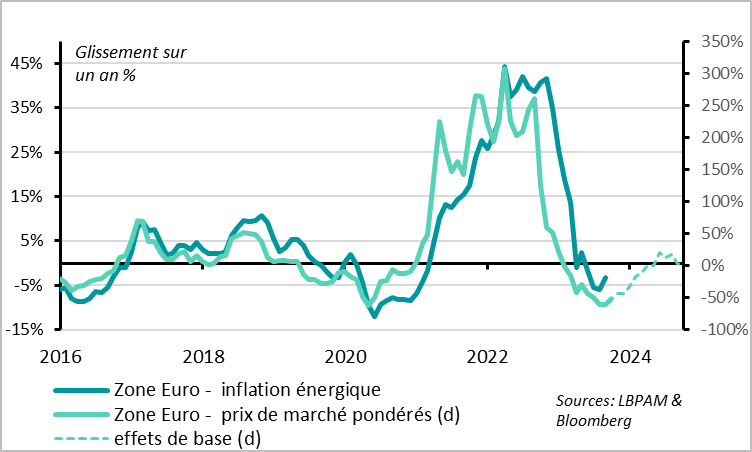

Fig.2 Oil: if prices remain at current levels, oil will make a positive contribution to inflation from the end of the year.

After having been the main driver of inflation in late 2021/early 2022, at the start of the current inflationary cycle, the fall in oil prices since mid-2022 has reduced inflation since the beginning of the year. But this disinflationary impact peaked in the summer and was expected to fade until the end of the year. This is why we believe that US inflation at 3% in June was the low point for the year. But if the recent rise in oil prices is sustainable, its contribution to inflation will turn positive again by the end of the year, limiting the slowdown in inflation in 2024. However, this contribution would remain much more limited than in 2021-2022.

For the Eurozone, for example, we estimate that a permanent rise in oil prices of $15 per barrel would increase inflation in the Eurozone by around 0.5% in one year via the rise in energy inflation, and by 0.2% in the second year via second-round effects. At the same time, this price rise would reduce growth by around 0.25%.

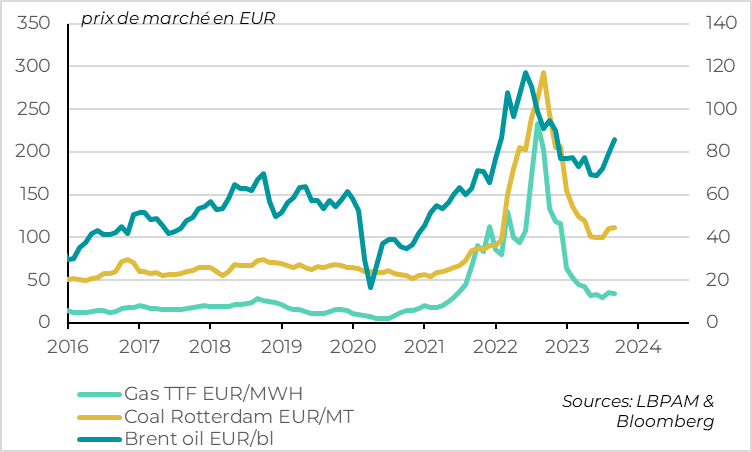

Fig.3 Eurozone: Non-oil energy prices only stabilized this summer, limiting energy risk.

Apart from oil, prices for other energies have stopped falling since the start of the summer, but have not rebounded significantly. This is particularly the case for natural gas, whose price has stabilized at around 30-49 EUR/MWh for the past 3 months, i.e. twice its "normal" pre-2021 price, but well below the 200+ seen last year. And we believe that while prices are unlikely to remain under pressure in the medium term, the risk of a sharp rise this winter is limited thanks to the high level of stocks before the start of winter and the structural reduction in demand since last year's shock (of the order of 15%).

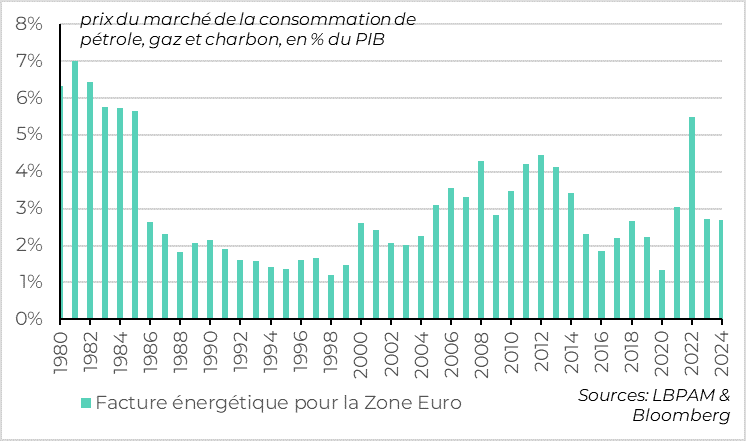

Fig.4 Euro zone: At constant prices, the current rise in oil prices is incomparable with the shock of 2022.

Fig.5 Eurozone: And energy inflation is set to return only slightly to positive territory in 2024.

The fact that gas prices have not soared despite the rise in oil prices is crucial for the Eurozone, because the gas import bill (50% of the oil import bill) has been more volatile than the oil import bill over the past 3 years, and because gas prices have a direct impact on the price of all electricity in the European Union.

So, even if energy prices were to remain at their current levels, the Eurozone's energy import bill would be stable in 2024 at half its 2022 level. And the contribution of energy inflation to overall inflation will be only marginally positive, according to our calculations.

Fig.6 China: While manufacturing PMIs are showing signs of stabilization, the sharp fall in services PMIs does not point to a real rebound in growth.

Fig.6 Eurozone: PMI falls further than expected in August as southern countries join northern ones in contraction zone.