Risks to the global economy diminish, despite political uncertainties

Link

Market Analysis for October 21, 2024 by Xavier Chapard.

In summary

►The market rallied again last week, supported by the scenario of a soft landing for the global economy. In addition to the acceleration of ECB rate cuts, downside risks to the global economy receded with US consumer spending figures still very solid and the first signs of stabilization in Chinese growth. Oil prices have fallen back below $75 a barrel, despite continuing high tensions in the Middle East.

►That said, political uncertainties remain high. Of course, this is mainly due to the US elections in early November, which remain undecided. But between now and then, the French and UK budget negotiations, the Japanese elections and announcements from China's People's Congress could create volatility. Not to mention geopolitical uncertainties. Against this backdrop, this week's IMF and World Bank meetings seem less important for setting the global political outlook than in the past.

►Chinese GDP did slow in Q3, from 4.7% to 4.6%, reinforcing our view that Chinese growth will struggle to reach the authorities' 5% target this year. That said, activity rebounded a little in September, and economic policies continued to be eased more rapidly than expected over the past month (with a 25bp cut in the mortgage rate this morning).

►This makes it possible to anticipate a cyclical rebound in growth at the turn of the year, and limits the risk that an accident in China could impact global dynamics. That said, the long-term outlook for the Chinese economy remains limited due to structural weaknesses, as evidenced by still significant deflationary pressures and the ongoing real estate adjustment.

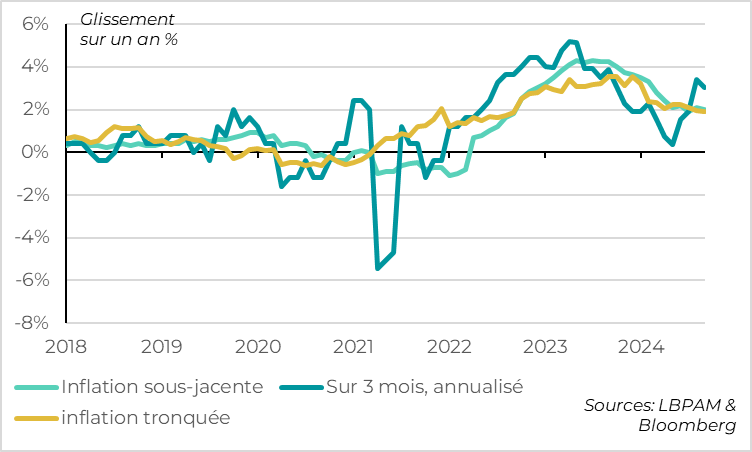

►Unlike China and the other major central banks, the Bank of Japan is likely to continue tightening monetary policy gradually. If inflation slowed from 3% to 2.5% in September, this was due to lower household energy bills. Core inflation is actually rising, and remains above the 2% target at 2.1%. Above all, wage dynamics remain buoyant, and the main trade union is reportedly still calling for wage increases of 5% next year. This reinforces confidence that Japan is out of deflation and can raise rates, which remain well below their equilibrium level. We believe that the BoJ could raise rates to 0.5% in December, a level that the market is only anticipating for the middle of next year.

►This week, in addition to numerous corporate results, we'll be keeping a close eye on the publication of October's advanced PMIs on Thursday, as they will help to gauge growth momentum in the Eurozone after a difficult summer. In the US, the publication of the Fed's Beige Book on Wednesday will be important for Fed members. This compendium of qualitative judgements suggested a less robust economy than the last summer's activity data indicated, which surely helped push the Fed to be more accommodating. This is important at a time when our expectation of a 25bp Fed rate cut in November has become the market's central scenario, but the risk of the Fed waiting until December to cut rates is increasing.

To go deeper

China: growth slows again in Q3, as expected

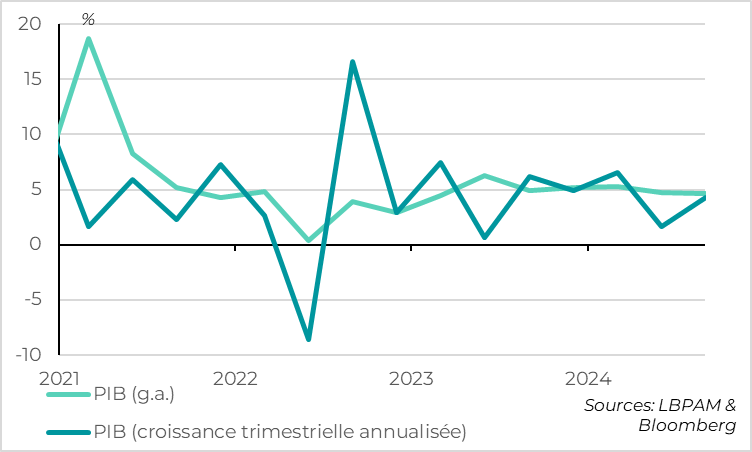

Chinese GDP slowed from 4.7% to 4.6% inQ3, confirming that reaching the 5% growth target this year will be difficult.

Growth was slightly weaker than expected in Q3 (consensus was for 4.5%), but this follows weaker growth than initially estimated in previous quarters. Indeed, China's GDP grew by 0.9% in Q3, after being revised downwards from 0.7% to 0.5% in Q2.

Overall, growth since the start of the year has fallen below the authorities' target, at 4.8% after 5.0% in the1st half. Even with the fairly sharp rebound in growth we expect over the coming months, we expect Chinese growth to fall slightly short of the target this year.

China: business picks up slightly in September

That said, September activity data point to a slight rebound in activity at the end of the third quarter, helped by initial support measures from the authorities.

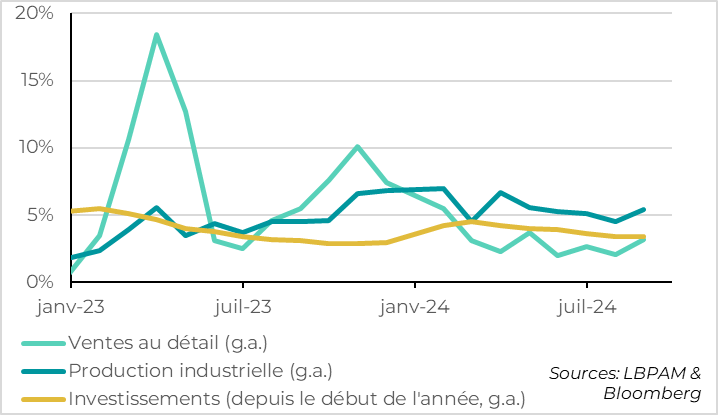

Industrial production rebounded strongly in September, from 4.5% to 5.4% year-on-year. It benefited from recent policy measures to support the recovery in automobiles, household appliances and business equipment, offsetting weaker foreign demand. Activity in the service sector also picked up slightly, rising from 4.6% to 5.1%.

On the demand side, retail sales picked up slightly in September, rising by 3.2% after 2.1% in August. This remains weak, but is still their strongest rise for 4 months. Investment is also accelerating slightly, to 3.4% year-to-date, driven by a recovery in infrastructure investment (i.e. government support), while industrial investment remains resilient. On the other hand, real estate investment continues to contract by over 10% year-on-year.

China: authorities step up credit support

Combined with the increased stimulus provided by the authorities since mid-September, this should lead to a rebound in activity over the coming months.

Following the cuts in the central bank's regulated rates and reserve requirement, Chinese banks lowered benchmark lending rates more sharply than expected this morning. The one-year benchmark lending rate, used for pricing corporate loans, fell by 15bp to 3.1%. The five-year benchmark lending rate, used for pricing home loans, fell by 25bp to 3.6%.

These rates, set by the major public banks, are considered de facto key rates that are passed on to the real economy, reflecting the authorities' support for economic growth. That said, the easing of financial conditions is a necessary but not sufficient element to support domestic activity in a deflationary context of household and local government deleveraging. It must be complemented by fiscal measures to boost demand directly, hence the importance of the measures to be announced by the People's Congress in the next few days.

China: Deflationary pressures remain high

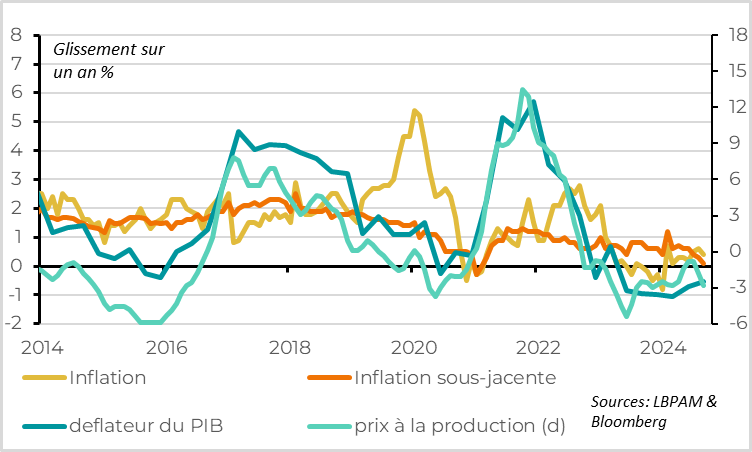

China's structural problems are still very much with us, as evidenced by the persistence of deflationary pressures. Falling prices reflect the shortfall between demand and supply, but also reinforce it by increasing the real cost of debt and the wait-and-see attitude.

Indeed, the GDP deflator (i.e. the price level in GDP) fell inQ3 for the sixth consecutive quarter, by 0.6% year-on-year. And unlike activity, there was no improvement over the quarter. Core inflation slowed in September to just 0.1%, its lowest level outside the confinements, and producer prices fell by 2.8%.

China: real estate market still showing no signs of stabilization

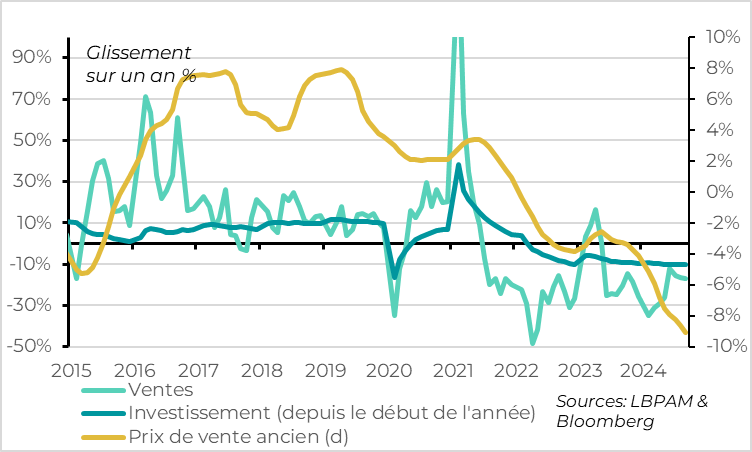

The real estate sector continues to contract sharply, demonstrating that the authorities need to do more if they are to stabilize the sector, as announced by the Politburo in September.

Property prices fall further in September. According to official statistics, prices of new homes in cities fell by 0.7% over the month and 5.7% over the year, while prices of older homes dropped by 0.9% over the month and 9% over the year.

Combined with the continuing fall in sales, this is putting further pressure on developers' finances, and not encouraging them to launch new projects. Against this backdrop, real estate investment continued to decline, falling by more than 10% in September.

Japan: core inflation remains above target

Xavier Chapard

Strategist