Second attempt at a budget in France with a new Prime Minister

Link

Sebastian PARIS HORVITZ decrypts the market on December 16, 2024.

In summary

►F. Bayrou has been appointed Prime Minister by E. Macron. The President must believe that F. Bayrou will be able to build a sufficient majority to avoid censure and pass a budget for 2025. In the meantime, the government has had a special law discussed in the Finance Committee to enable the State to collect taxes and raise debt, and thus meet its commitments. This law must now be submitted to the Senate before being voted on by the Assembly. Nevertheless, this legislation is totally inadequate to give real budgetary direction to public finances.

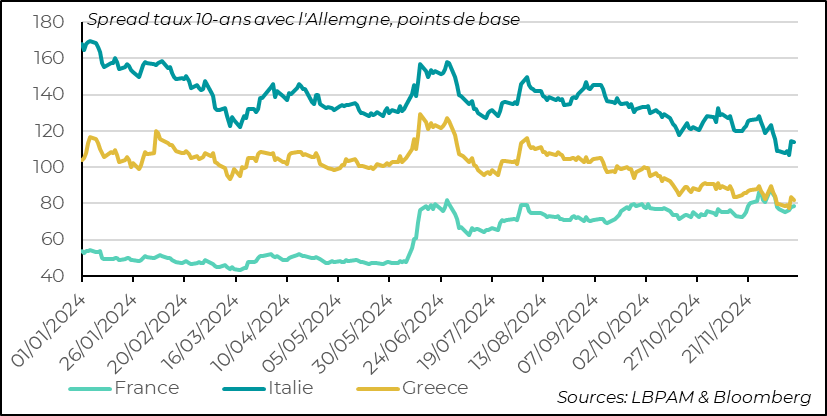

►Against this backdrop, Moody's decided to downgrade France's credit rating to AA3. This brings Moody's into line with S&P and Fitch in terms of ratings. Nevertheless, Moody's maintains the outlook for French debt as stable. For Moody's, the probability is now very low that the next government will commit to a substantial fiscal adjustment in the medium term. At this stage, we expect the interest-rate differential between France and Germany to remain high, close to the current level, so for a 10-year maturity the rate should remain between 75-80 basis points (bp).

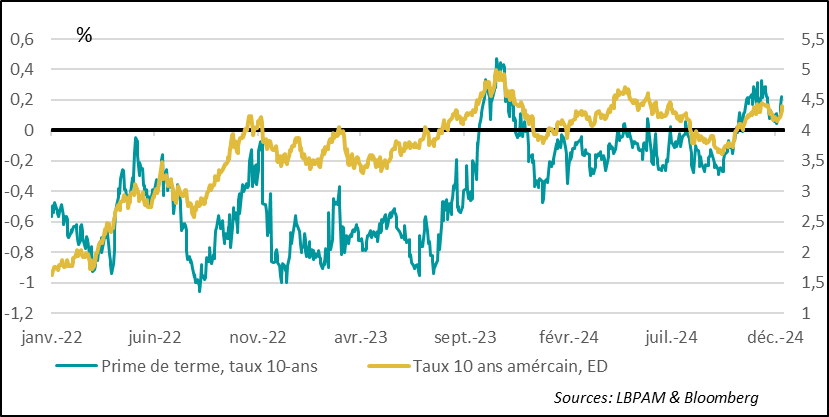

►At the same time, long-term interest rates have tightened over the past week. In the US, they rose by almost 20bp, while in Germany they gained almost 15bp. This upward movement was driven by the US. In part, this can be explained by the resilience of the US economy, the downward resistance of inflation and the uncertainties surrounding the Fed's monetary policy path. Thus, the main factor contributing to the rise in long rates was the rise in the term premium. With the fiscal slippage in the US continuing as the year draws to a close, upward pressure could persist.

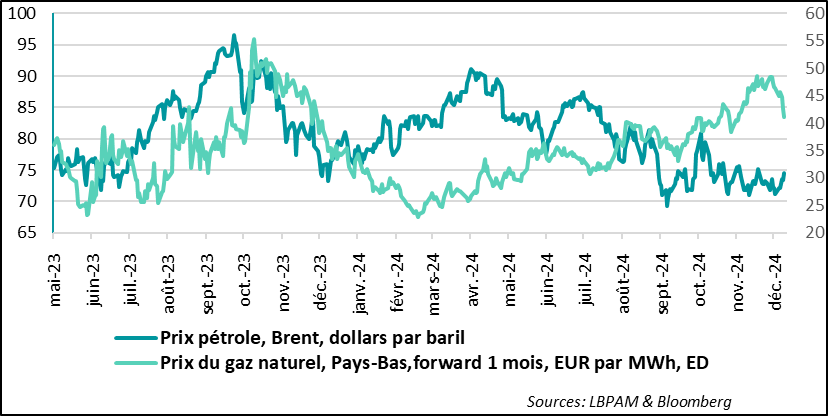

►On the energy market, we had good news for Europe, with the fall in gas prices almost completely wiping out November's sharp rise. In part, this corresponds to the dissipation of the fears that had arisen over supplies to the region, following stock declines. However, gas prices remain higher than at the end of last year. In the opposite direction, oil prices have resumed their upward trajectory, approaching $75 a barrel for Brent. This rise reflects fears about possible sanctions against Russia by European countries and the United States, as well as sanctions against Iran.

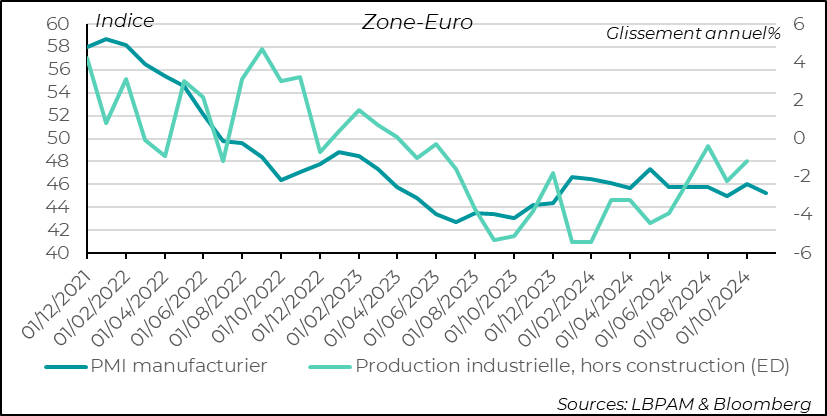

►On the economic front, we had the statistics on industrial production for the Eurozone as a whole for the month of October. Unsurprisingly, the year-on-year contraction continued, but overall it was slightly more moderate than expected, falling by 1.2%. Germany remains one of the biggest contributors to this decline. As we know, the PMI industrial survey figures for November do not augur well. We expect industry to continue to lag behind the economic recovery in 2025.

►In China, after a two-day meeting, the authorities once again reiterated their intentions to do more to stimulate the economy and also protect the real estate sector. But, once again, little in the way of concrete action was forthcoming. This risks disappointing investors once again. All the more so as economic data came out weaker than expected in November, particularly as regards consumer spending. Indeed, retail sales slowed, breaking the signs of recovery seen the previous month. On the other hand, industrial activity remained solid, reflecting the strength of the export sector. The latter should benefit in the short term from US imports, given the risk of tariff hikes. By contrast, the real estate sector continues to suffer.

To go deeper

France has a new Prime Minister. F. Bayrou has been given the tough task of forming a new government. His first task is to pass a budget for 2025. Obviously, the political balance hasn't changed, and given the fragmentation of the Assembly, building a majority won't be easy. Above all, the context remains that of the need for budgetary adjustments to enable France to reduce its public deficit in order to meet its commitments under the excessive deficit procedure in which it finds itself.

Moody's has already announced that it is lowering France's rating by one notch to AA3. This puts Moody's rating on a par with the other agencies, S&P and Fitch. Moody's decision is based on a political diagnosis: the low probability that France will be able to offer a credible path for reducing its public deficit beyond the coming year.

For 2025, the outgoing government has already submitted a special bill to enable the State to continue collecting taxes and issuing debt. It does not include any tax measures, and therefore remains within the framework of the 2024 Finance Act. Nevertheless, the Assembly's Finance Committee has adopted it, adding measures including inflation indexation of the income tax scale to prevent a large number of households from becoming taxable. However, it seems that there are doubts about the constitutionality of such a measure. It has to be said that this special law has rarely been used.

The Senate must now review the text and forward it to the Assembly for a vote.

The budget impasse and Moody's downgrading of France's credit rating should not have a major impact on the risk premium France has been carrying since the dissolution of the Assembly.

Indeed, France's yield differential with Germany for a 10-year bond, at under 80 bp, is already very wide compared with the ratings of other countries on the periphery of the Eurozone. Nevertheless, market overreaction cannot be ruled out if the fiscal impasse continues. For our part, we remain cautious on French debt as part of our position on Eurozone sovereign debt.

Euro zone: France retains a substantial premium on its public debt vis-à-vis Germany, but it is not increasing and is following the trends of other peripheral countries.

In fact, over and above movements in spreads within the Eurozone, the week saw a sharp rise in long-term rates in most major countries, starting with the United States. In the US, the 10-year yield rose by almost 20bp. It also contributed significantly to the rise in rates in other countries.

In our view, this increase largely reflects the continuing resilience of the US economy, the downward resistance of inflation and, consequently, the uncertainties surrounding the future path of the Fed's monetary policy.

This is reflected in the evolution of the term premium, which reflects the premium demanded by investors to hold US debt over a long maturity. For example, on a 10-year bond, the New York Fed's estimate of this premium rose quite sharply over the week, by just under 15bp. Inflation expectations have also risen slightly.

United States: Rise in long-term interest rates

We were expecting long-term interest rates to fall at the end of the year on both sides of the Atlantic, particularly in Europe given the economic situation and flows. Nonetheless, we felt that the fall in interest rates since Trump's election had been exaggerated, and were expecting a correction.

We believe that long rates are likely to come under more upward pressure in the months ahead, particularly in the United States. In particular, the recent drift in public finances since the close of the previous fiscal year should push the US government to increase issuance and put pressure on the market, unless unexpected corrective measures are taken very quickly by the new administration from mid-January.

One factor that could have an impact on short-term rates is changes in energy prices. Up until now, oil prices have been on a downward trend, reflecting depressed demand, particularly from China. However, over the past week, oil prices have tightened, approaching $75 per barrel (Brent). At the same time, they remain lower than at the end of last year.

This rise, in a market that remains rather oversupplied, was due to speculation about possible new sanctions against Russia, but also Iran, on the part of the Americans and European countries. At this stage, we expect prices to remain close to current levels. In this sense, it is important to stress that one of the objectives of the Trump Administration is to keep oil prices low.

At the same time, on the energy front, Europe has received some good news in the form of a sharp drop in gas prices. Indeed, prices almost wiped out all the upside seen in November, due to fears about supplies to the region following the fall in European gas stocks. Now that these fears have subsided, prices have fallen back. However, they remain much higher than at the end of last year. As we know, this is a sensitive factor for household purchasing power.

Energy: Oil prices react to fears of new sanctions against Russia and Iran, while Europe benefits from a correction in gas prices

PMI surveys showed that activity in Europe, and particularly in the Eurozone, deteriorated in November. In particular, industrial activity continued to contract. Statistics on the state of industry in October underline the malaise in the Eurozone sector.

Indeed, year-on-year, production continues to decline, even if it was merely stagnant over the month.

The survey results for November, which were rather mediocre, may well show a further deterioration. Although industrial weakness is fairly widespread, Germany continues to make a significant contribution to this poor performance. Nevertheless, political uncertainty in France could also weigh on industry in the months ahead.

Euro Zone: Industrial production in the Euro Zone remains sluggish

These figures are a reminder of the importance of the ECB continuing to ease monetary policy and improve credit conditions in the European economy to support activity.

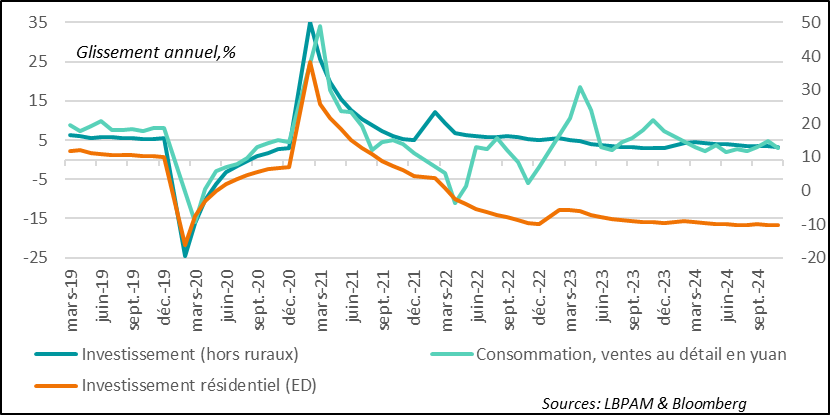

In China, the two-day meeting of the body that dictates economic guidelines for the year ahead did little to change the uncertainty surrounding the specific measures the authorities intend to take to support demand. Indeed, the same rhetoric on the need for a more proactive fiscal policy was maintained, notably by targeting the real estate market. But no concrete action was revealed.

The assumption continues to be that decisions are on hold until the Chinese government has a clearer vision of what D. Trump intends to do.

This contrasts with our reading of the state of the economy, based on the latest rather disappointing economic statistics. In fact, November's retail sales statistics fell well short of expectations. Year-on-year, they decelerated to 3%, compared with 5% expected and 4.8% the previous month. Compared with the previous year, consumption is still struggling to take off. In part, this can be attributed to a lack of consumer confidence. This underlines the urgent need for the authorities to act if they are to achieve their growth targets.

Also, the real estate sector, despite support measures in the form of more attractive financing conditions, remains stagnant. Residential investment is still falling, and house prices are also declining.

Only industry continues to show strength. It seems to continue to benefit from sustained demand from abroad. This momentum is likely to persist, particularly if, as is expected, US importers step up their imports from China in the face of the risk of higher tariffs.

China: Domestic demand weakens in November, while the real estate sector continues to falter. Only industry benefits from external demand

Sebastian PARIS HORVITZ

Head of research