Services continue to drive growth

Link

Find the first market analysis of the year 2025, signed by Sebastian Paris Horvitz.

Summary

►Donald Trump, approaching his inauguration as President of the United States, has already begun to stoke tensions with threatening messages. On Monday, after a publication in the press, he forcefully denied the possibility of a softening of his protectionist policies. Yesterday, he attacked Canada, Mexico and Panama, threatening to impose tariffs, even suggesting that these countries should become part of the United States. In fact, he proposed that the Gulf of Mexico be renamed the Gulf of America. As in his first term, we must once again be prepared for comments that can be highly destabilizing. The markets will not remain unaffected by these volatile comments.

►In addition to volatility, other fears remain very present: the potential inflationary effects of protectionist policies and fiscal laxity, as well as uncertainty over monetary policy. In this sense, one of the most powerful dynamics over the past 1 month has been the almost uninterrupted rise in long-term rates, particularly on both sides of the Atlantic. We believe that yields in the USA and Europe are becoming attractive, in the context of our scenario. However, we do not rule out the possibility of further upward pressure in the very short term. Hence our selective and cautious exposure to sovereign debt at this stage.

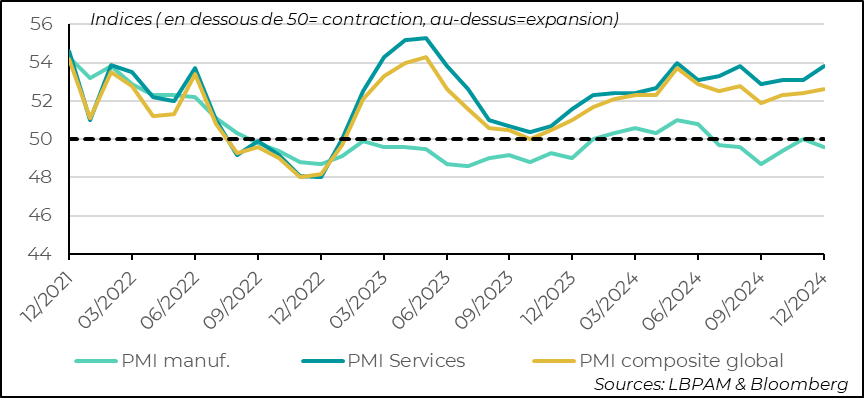

►As expected, the release of PMI indicators, most recently the services indicator, showed that global growth continues to be driven by this sector. In fact, in almost all regions, services activity rebounded in December. Thus, despite the stagnation of activity in industry, overall activity, as measured by the composite indicator (industry and services) recovered.

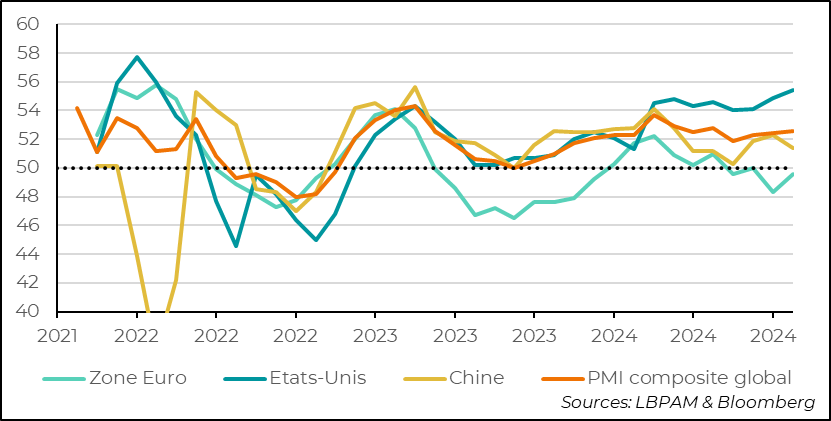

►However, differences in dynamism between countries and regions remain significant. The United States continues to outperform the rest of the world. Nevertheless, and this is good news for the eurozone, activity in the services sector has rebounded, erasing the worrying trend in this sector in November.

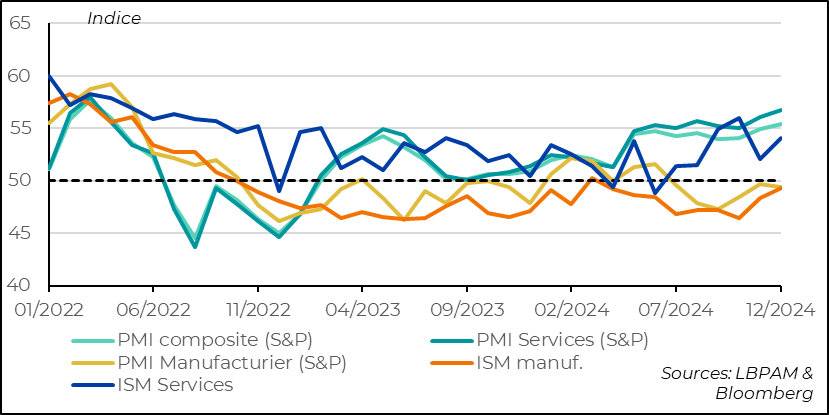

► In the United States, both the S&P PMI and ISM surveys showed an upturn in activity in December. However, both the ISM services index and the ISM manufacturing index indicated that hiring was losing momentum. However, this is not translating into an upsurge in layoffs: jobless claims have continued to fall in recent weeks.

►In the Eurozone, inflation figures for December have been published: inflation rose slightly over the month to 2.4%, compared with 2.2% in November. Higher energy prices made the biggest contribution. This base effect should dissipate over the coming months. In our view, the trend towards disinflation continues. Core inflation remained stable at 2.7%. We still expect inflation to converge at 2% in 2025, enabling the ECB to continue cutting key interest rates.

► Finally, the ECB has published households' expectations of future inflation: over the course of the month, they have become tighter. 3-year inflation expectations rebounded to 2.4%. At this stage, this should not be a cause for major concern for the central bank.

To go deeper

PMI surveys on services activity for December once again showed that global growth continues to be driven by this sector. Not only is JP Morgan's global indicator, based on S&P's PMI surveys, clearly in expansion territory; more importantly, activity in virtually all major countries has gained ground. This contrasts with the situation in industry.

As a result, the overall services indicator is back at its highest level since August. A level only reached in the spring of 2023. This enables the composite indicator (industry and services) to continue its recovery from last October's weakening.

S&P Global PMI: near-universal rebound in services activity in December reassures global business climate

Nevertheless, regional differences persist. The USA continues to display the greatest robustness, with S&P's composite PMI indicator reaching its highest level since 2022.

The Eurozone also continues to lag behind, although the rebound in services is breaking last month's poor momentum. This indicator paints the picture of a region where growth is stagnating, still weighed down by industry.

S&P Global PMI: regional differences in activity remain significant, with the US still in the lead, while activity stagnates in the Eurozone

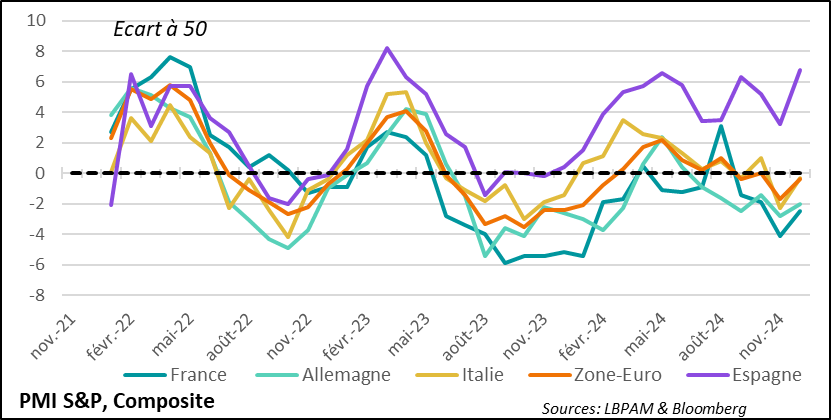

At the same time, the situation within the eurozone is highly contrasted. Peripheral countries, such as Spain, continue to enjoy a more favorable dynamic. Germany and France, on the other hand, continue to lag behind.

Eurozone: services activity rebounds across the board in December, but contrasts between countries remain significant

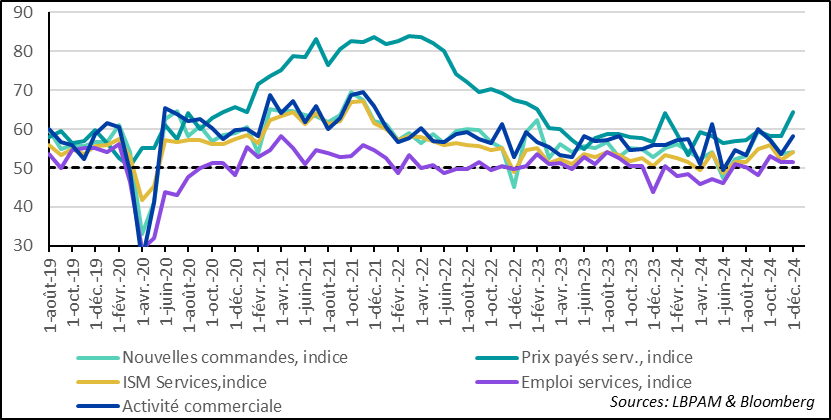

In the U.S., the PMI services survey from the Institute for Supply Management (ISM) confirmed the S&P survey, with a rebound in activity in December.

United States: ISM and S&P services PMI surveys show a rebound in services activity in December

For the ISM survey, the underlying indices point to a marked rebound in business activity (production), which is partly behind the improvement in the synthetic index.

Comments from companies often suggest that this rebound is partly linked to expectations regarding the effects of the implementation of customs barriers.

For its part, the employment indicator was weaker, but still in expansion territory, indicating a slightly more wait-and-see attitude towards hiring. The cost indicator (prices paid) also gained considerable ground. This indicator is worth keeping an eye on, even if at this stage it is unlikely to reflect any sharp rises in selling prices or inflation.

United States: ISM services survey reflects an improvement in business activity (production), driving the rebound in activity in December

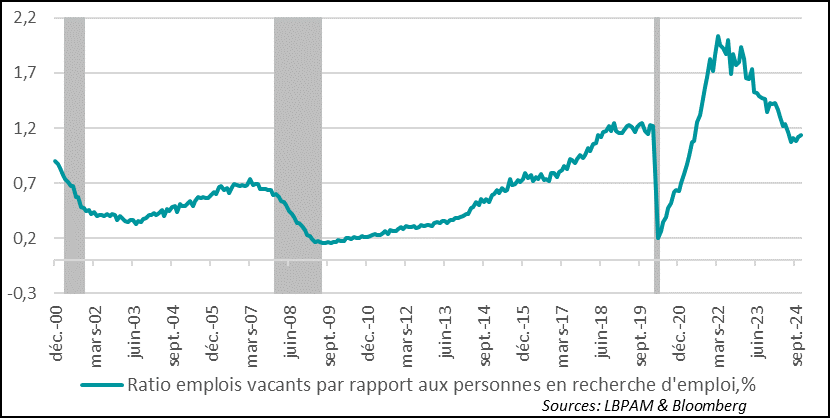

The rather positive message on the economic situation across the Atlantic from the PMI surveys was also reflected in an upturn in job vacancies. As a result, the ratio of job vacancies to job seekers, an indicator of tensions on the labor market, has risen. This might suggest that tensions on the job market are still present. Nevertheless, this indicator has seen a significant decline over the past two years, and is now close to its pre-Covid crisis level.

United States: job vacancies rebound in November according to JOLTS survey, job market remains buoyant

Obviously, the Fed keeps a close eye on this type of statistic, but we'll have to wait for the possible impact on wages to really worry about it. In any case, the Fed is cautious about the trajectory of future rate cuts. More reassuringly, the number of people leaving their jobs to look for new ones has fallen, according to the survey.

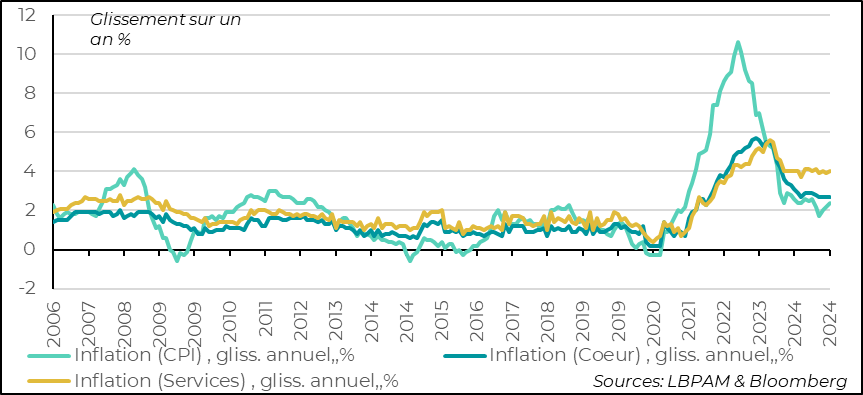

In the Eurozone, inflation estimates for December were published. As expected, inflation accelerated to 2.4% year-on-year, compared with 2.2% the previous month. Energy prices accounted for most of this acceleration. Core inflation remained stable at 2.7%.

This acceleration confirms the ECB's cautious tone. But looking at the figures, we still believe that the momentum of inflation deceleration remains relatively intact.

In order to be fully reassured about the disinflation dynamic, the essential element for the months ahead would be a decline in services inflation. At this stage, inflation is stagnating, and we can't see any real deceleration in the last 1 year.

A decline in service prices is partly due to a decline in wages. After the strong indexation effects in 2024, we believe - as shown by the ECB's estimates - that wage growth should begin a marked deceleration in 2025. All the more so as growth remains weak in the region. In our view, this deceleration should result in inflation converging towards 2% during the year. This would allow monetary easing to continue.

Eurozone: inflation accelerates in December to 2.4%, mainly due to energy prices

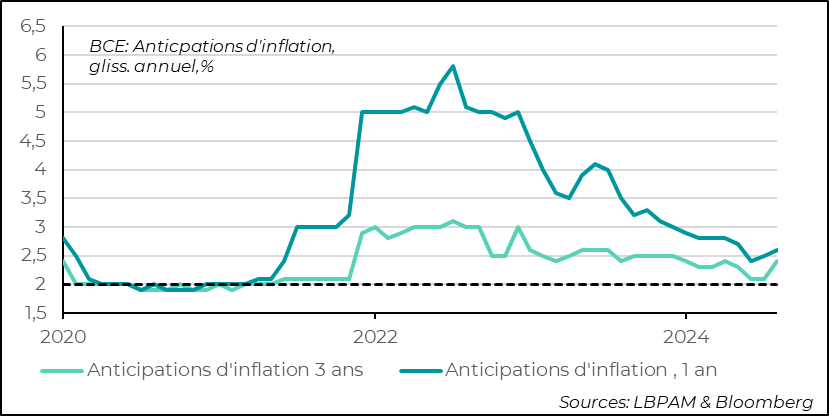

This more favorable disinflation dynamic is very important for keeping expectations well anchored. Today, both economists' forecasts and market expectations point to convergence towards inflation close to the ECB target as the dominant scenario.

In this sense, the rise in 3-year household inflation expectations in the ECB survey is not a good signal. But it would be premature to see this as a major fear for inflation convergence towards 2% in the eurozone.

Eurozone: household inflation expectations in ECB survey rise again

Sebastian PARIS HORVITZ

Head of Research