Slowly melting inflation

Link

- New tensions emerged on sovereign bonds, pushing interest rates towards the highs seen in recent weeks. The resilience of US growth continues to be one of the main contributing factors, while medium-term inflation expectations remain relatively stable. On both sides of the Atlantic, the market seems to have taken on board the idea that restrictive monetary policies will persist for some time to come. Nevertheless, differences in growth dynamics, with a more robust US economy, continue to affect investment flows, which is clearly reflected in the dollar's renewed strength since mid-July. In the short term, this strength could persist, complicating monetary policy in many countries. At the same time, we continue to believe that the coming quarter should show signs of a slowdown in US activity, contributing to greater stability on the currency markets. We are maintaining a very cautious view in our asset allocation as we move through this uncertain period, especially as early autumn tends to be a turbulent time for the markets.

- As we all know, US growth data have been very robust for several months now, particularly on the consumer front. On the supply side, the message has been more mixed, although the rebound in ISM services has been surprisingly solid. The latest small business survey for August, while not a major leading indicator, paints a picture of very moderate activity, with the optimism indicator down, but above all remaining at relatively low levels. More significant in the current period are the indicators on inflation and, above all, wage pressures. We can see that inflation continues to weigh on activity and that, although wage pressures are easing, they remain high. The US inflation figures to be announced today will tell us more about the underlying dynamics, bearing in mind that higher energy prices will push up overall inflation.

- In Europe, the survey of market operators in Germany (ZEW) confirmed the negative sentiment regarding the economic situation, given the very unfavorable economic data of recent months. The index of opinion on the current situation reached its lowest level since August 2020. At the same time, the outlook index is stabilizing. Tomorrow's message from the ECB will be decisive in shaping expectations. If the ECB is too tough, it will only worsen negative sentiment about growth momentum in the Eurozone in the short term. We still believe, as does the market, that the ECB will leave its key rates stable, while insisting on the need to maintain a rigorous policy. Nevertheless, given the deterioration in economic conditions, which the ECB is likely to acknowledge in its forecasts, we believe that, as Mrs Lagarde has already indicated, "humility" will prompt central bankers to adopt a more cautious stance.

- As we all know, central bankers are navigating in a highly uncertain environment with regard to inflationary pressures, particularly in Europe. For the time being, the decline in inflation has been very gradual, and remains at very high levels. Weaker current growth should help to accelerate the deceleration of inflation, in our view. But, as we can see in the UK, this momentum may prove slow. In particular, despite a deterioration in the labor market, with job losses now contributing to the rise in the unemployment rate to 4.3% in July (+0.8 points year-on-year), wage growth is still accelerating (8.5% year-on-year). This should prompt the BoE to raise its key rate once again, to 5.50%. We believe that doing so in September would be wiser than waiting. But, like other central bankers, caution in the face of worsening economic conditions could lead them to be more patient.

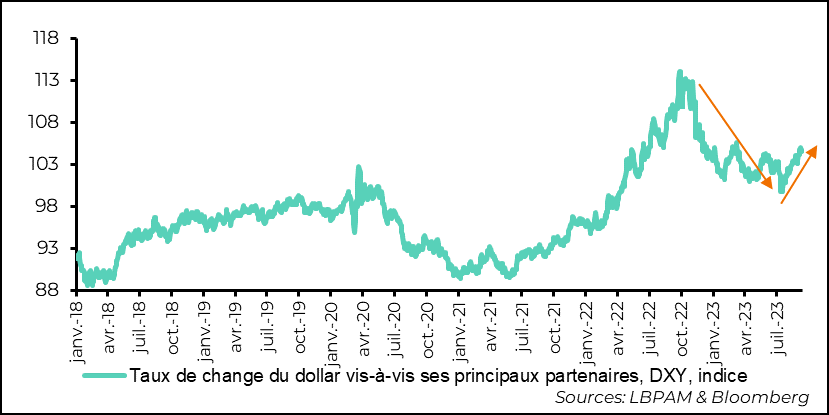

The summer was marked by very significant upward movements in interest rates, particularly long-term rates. In part, this movement, more pronounced in the United States, was driven by a more favorable economic climate across the Atlantic than in other developed countries. One of the collateral effects was a change in the direction of the dollar. The dollar's depreciation, which had brought it to a low point in mid-July, has since reversed, pushing the exchange rate against its main trading partners up by almost 5%. Statements by the Chinese and Japanese authorities earlier this week, warning market operators of the depreciation of their currencies, seem to have calmed this momentum.

Fig.1 Dollar: Improved performance of the US economy supported the greenback as interest rates rose

-Exchange rate of the dollar against its main partners, DXY, index

Nevertheless, in the very short term, growth momentum should remain more favorable in the US. What's more, the Fed's message is likely to remain fairly tough on inflation, signaling that it's too early to let down its guard. This should keep the entire yield curve under pressure.

Any disappointment over US growth or faster disinflation could undermine the dollar's strength, but at this stage it's hard to see the greenback weakening very much. Central banks' decisions over the coming week will give us an important indication of the dollar's momentum, as will the US inflation figures to be published today, particularly concerning core inflation. Nevertheless, as we all know, a dollar that is too strong will only complicate monetary policy management in many countries.

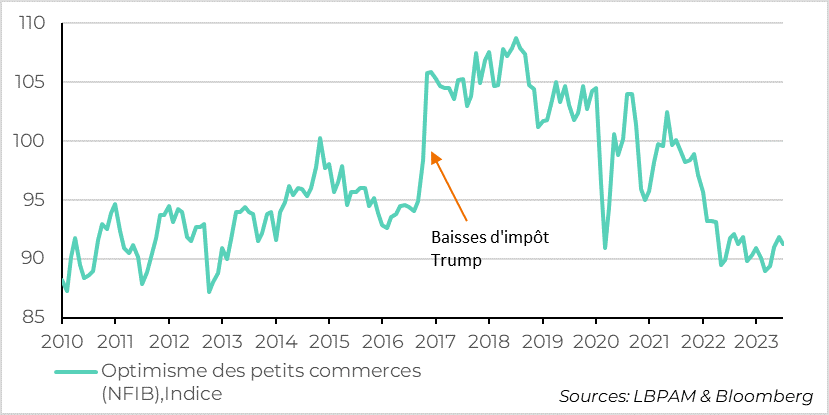

It's all very well to try and keep an eye on where the US economy is heading. It's true that the latest economic statistics have been very favourable. Consumption, in particular, has been very solid over the past two months, still supported by a robust labor market, and the services activity survey for August surprised by its robustness. Data from the August NFIB survey, while not a major indicator of the US economy, nevertheless reflects some of the more mixed messages on the economic situation, such as those given by the Fed's Beige Book. In fact, optimism among small retailers eased in August, halting the upward trend seen since May.

Fig.2 United States: Optimism among small retailers remains at low levels and is even deteriorating.

-Trump tax cut

-Small Business Optimism, (NFIB), Index

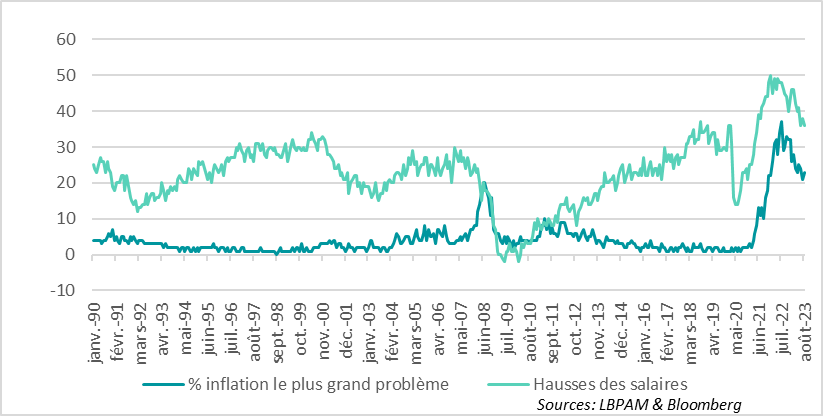

In more detail, some of the variables that have been interesting to monitor in recent times, with the surge in inflation, have been those derived from this survey. The sector continues to see inflation as a major concern. Although the level of concern has fallen, it remains historically high. This may prove to be a brake on the sector's expansion.

In addition, the survey clearly reveals that wage pressures, even if they appear to be easing, remain high, which should weigh on costs in the sector.

Fig.3 United States: Persistently high inflation and rising wages weigh on morale in the small retail sector

-% inflation the biggest problem

-Wage increases

We remain convinced that the next few months should give us a very important indication of the dynamics of the US economy. Above all, we continue to believe that monetary tightening is likely to be a greater drag on growth than is currently expected.

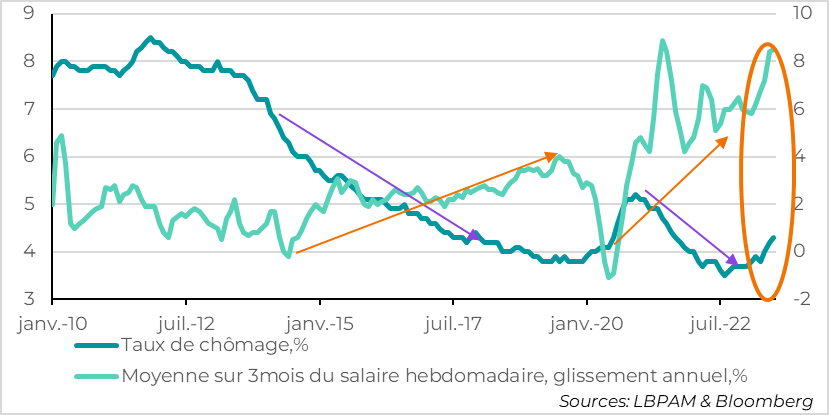

The difficult task facing central banks remains extremely complex in the current economic climate. In Europe, in particular, while growth seems to be responding well to monetary tightening by easing, signs on inflation remain mixed. This has prompted central bankers to remain far more worried than in the United States, for example. In the UK, for example, there are signs of a slowdown in activity, but inflation is still reluctant to show any marked signs of deceleration.

The latest UK employment statistics for July clearly demonstrate this. The unemployment rate has risen to 4.3% (+0.8 points over the last year), essentially due to a contraction in employment, but at the same time wages continue to accelerate year-on-year. Average weekly earnings have risen to 8.5%, a historically high rate, just below the record set in spring 2021.

Fig.4 United Kingdom: The labor market is weakening, with job losses and rising unemployment, but wages are still rising at a brisk pace

-Unemployment rate, %

-3-month average weekly earnings, year-on-year, %

Obviously, this is not good news for the BoE. Nevertheless, it knows that the deterioration in the labor market should have an impact, albeit delayed, on wages. The challenge is to prevent a wage-price spiral from taking hold, making inflation harder to control. We're certainly not there yet. But the BoE is likely to take out insurance against this risk, and once again raise its key rate to 5.5%. Will it risk being patient and taking a break in September? That is the question. We think they should act now.