Still no rise in US inflation?

Link

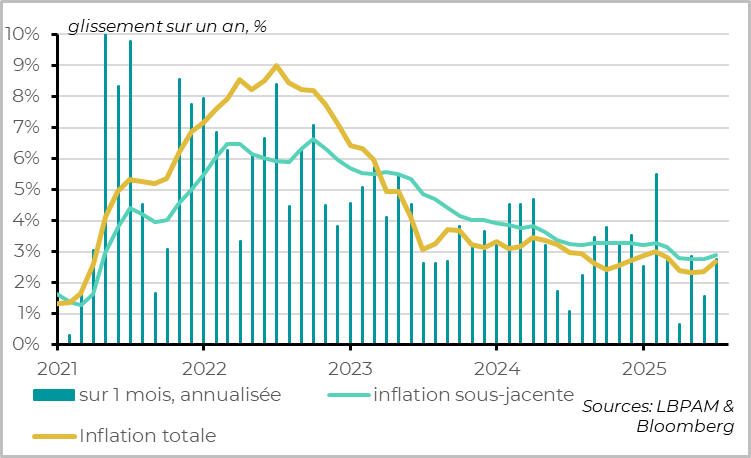

US core inflation is slowing for the fifth consecutive month, but the decline is less marked than before. Price rises linked to tariffs are beginning to be felt, particularly on non-automotive goods. The Fed remains cautious, awaiting data from the coming months before considering a rate cut. In China, growth is slowing despite a good start to the year, while in Europe, confidence is improving, except in France where the austerity plan could rekindle political tensions.

Key Takeaways

► US core inflation surprised on the downside for the fifth consecutive month, accelerating less than expected to +0.2% over the month and 2.9% year-on-year. That said, this surprise is less significant than in the previous 3 months. And it is due above all to the continuing decline in car prices, which is difficult to sustain, and in travel prices, which reflects weak demand.

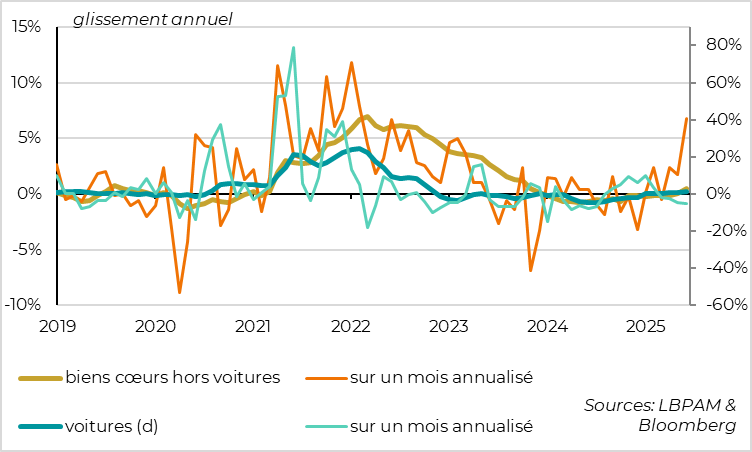

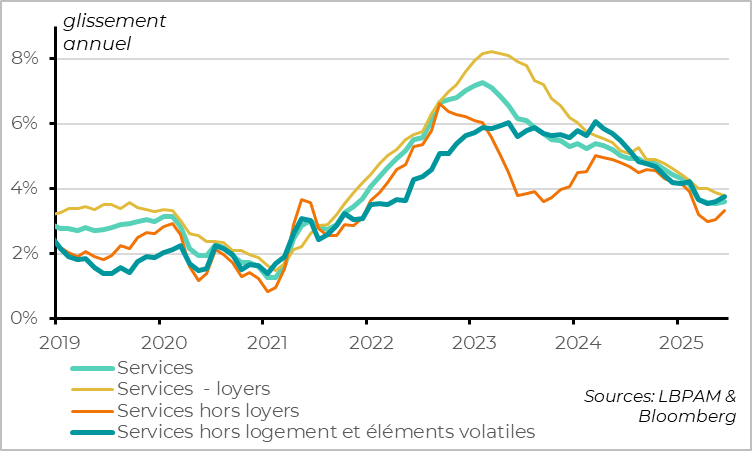

► In fact, the impact of customs duties is beginning to be felt, with a notable rise in the price of goods excluding cars in June (+0.55%). And inflation in services excluding housing is no longer slowing, although it remains a little too high at over 3.5%. This reflects a limited but real stagflationary shock. In these conditions, we continue to anticipate a sharper rise in inflation in the months ahead and a slowdown in the US economy in the second half of the year.

►The good news is that the absence of a generalized acceleration in prices strengthens the chances that the price shock linked to tariffs will be temporary, allowing the Fed to lower rates eventually. The bad news is that inflation is likely to accelerate more sharply in the second half of the year, weighing on activity.

►For the Fed, June's inflation figure doesn't change much. As long as employment holds up, it will at least wait for the July and August inflation figures, which should better reveal the extent to which the tariffs already imposed are being passed on to inflation. Especially as the tariff shock is likely to increase further from August onwards, even if only a small part of D. Trump's new tariff hike threats are finally implemented. A rate cut before September or October seems highly unlikely to us, and we think the Fed will wait until December before cutting rates.

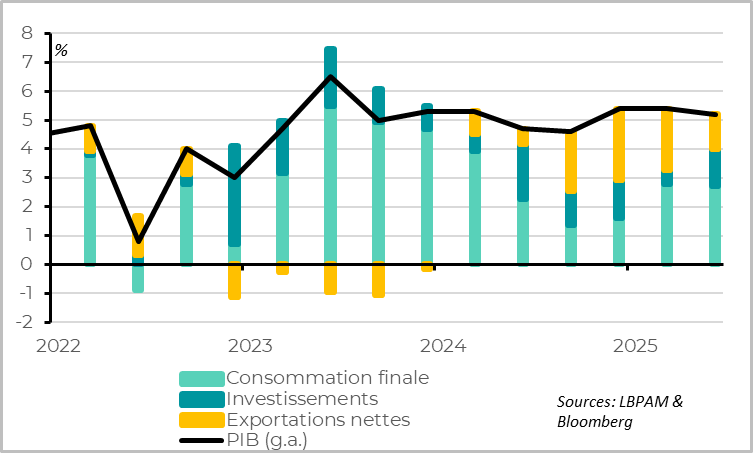

► Meanwhile, Chinese growth held up well in the first part of the year, coming in at 5.2% in Q2 after 5.4% in Q1. That said, growth was still driven by exports, which should be less buoyant in the second half of the year. And domestic demand (consumption and investment) slowed markedly in June, weighed down by a further deterioration in the property market. Against this backdrop, we anticipate a slowdown in the second half of the year, which will remain limited only if the authorities do more in terms of monetary and fiscal stimulus.

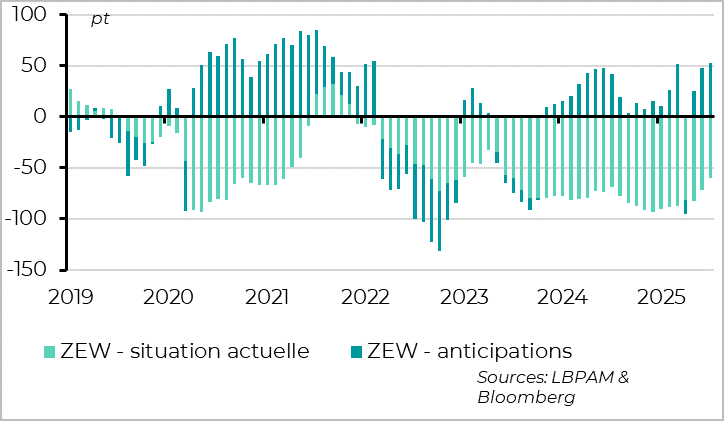

► In the Eurozone, German investor confidence continued to rise in July according to the ZEW survey, reaching its highest level since the start of the war in Ukraine. This suggests that the recovery momentum remains in place, despite the likely slowdown in growth this summer due to the trade war.

► In France, the markets showed little reaction to the Prime Minister's announcement of a plan worth over 40 billion euros to reduce the deficit from 5.4% to 4.6% of GDP next year. While this austerity plan of almost 1.5% of GDP is necessary, it will weigh on growth next year and, above all, risks reigniting political tensions this summer, as the details of the budget approach parliament for negotiation in September. Despite a yield spread on 10-year bonds versus Germany that remains close to 70bp, we remain cautious on French debt, preferring the debt of southern European countries.

To Go Further

United States: underlying inflation still fails to accelerate significantly in June

U.S. core inflation remained subdued in June, a sign that core inflation remains contained despite rate hikes over the past 3 months. Prices rose by 0.2% in June, after 0.1% in May, against expectations of 0.3%. Goods prices accelerated only slightly (from 0 to 0.2%) and services prices remained contained (+0.3% over the month).

That said, the downward surprise is marginal. Core prices actually rose by 0.23%, or 2.8% annualized, against consensus expectations of 0.25%. Year-on-year, core inflation rose for the first time in 6 months, from 2.8% to 2.9%, remaining significantly above the Fed's target.

On the other hand, total inflation is accelerating due to gasoline prices (+1% over the month), while food inflation remains high (at 3% year-on-year), which is not good news for the Republican base, which is very sensitive to these prices.

United States: the impact of tariffs begins to show, gradually

Above all, the impact of customs duty hikes began to materialize in June, but this was masked by the continuing fall in car prices.

Core goods prices accelerated only slightly, from 0 to +0.2% over the month (and 0.6% year-on-year). However, this increase is undermined by the continuing sharp fall in car prices (-0.5% over the month, +1.1% year-on-year), which can be explained by the sharp slowdown in car sales, but which seems unsustainable given the rise in dealer rates and prices.

Excluding cars, the price of goods actually accelerated sharply in June, from 0.15% in May to 0.55%, the biggest rise since early 2022. This pushes core goods inflation (excluding cars) back into positive territory year-on-year for the first time in a year and a half (+0.5%).

If car prices stop falling, as we expected, the intensification of the delayed diffusion of tariff-related cost increases should push goods inflation sharply upwards this summer.

United States: services inflation remains steady, but is not slowing down significantly

Inflation in services remains contained, at 0.25% over the month and 3.6% over the year. This is a significant difference from the inflationary shock of 2021-2022, when rising goods prices were accompanied by rising service prices. This clearly reduces the risk of tariff-related inflation becoming persistent.

But this is no surprise, and partly reflects the weakening of US domestic demand. Inflation in the services sector, for example, is benefiting from the fall in travel demand, as shown by the continuing sharp decline in hotel and air ticket prices (-3.5% year-on-year). Excluding these volatile elements and rents, inflation in services accelerated slightly in June after three months of limited increases, and stabilized above 3.5% on trend.

This is not a positive sign, but rather confirms the stagflationary nature of the tariff shock.

China: growth remains resilient in Q2

China's GDP slowed less than expected in Q2 and remains fairly high, at 5.2% year-on-year after 5.4% in the previous two quarters. On a sequential basis, growth slowed by only 5% to an annualized quarterly rate of 4.5%, according to the authorities, which is positive given the trade shocks and uncertainties of Q2.

With average growth of 5.3% in H1, Chinese growth should be close to the authorities' target (around 5%), even if it slows sharply in H2, at least as long as it doesn't collapse.

China: exports remain a driving force in 1st half despite trade war

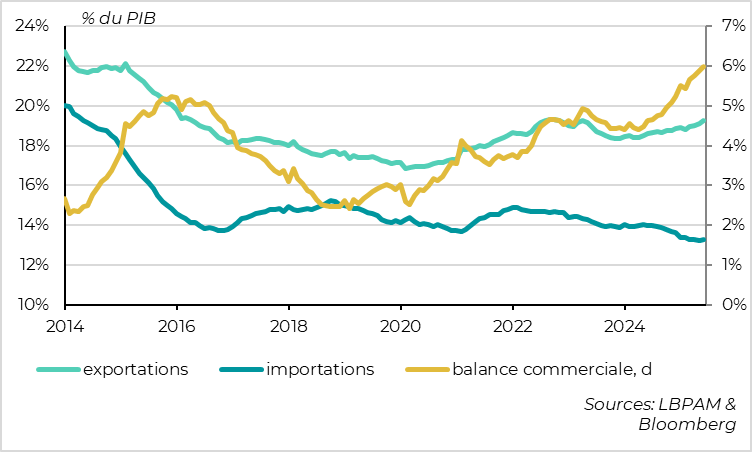

Chinese growth remained driven by external demand, with net exports continuing to grow in Q2 and still contributing a quarter of growth by mid-2025. In June, export growth stabilized at 5.8% year-on-year, thanks to a partial rebound in exports to the USA (-16% after -34% in May) following the truce announced in mid-May.

However, the slowdown in world trade and less favorable base effects are likely to reduce this contribution significantly in the second half of the year.

China: domestic demand slows fairly sharply in June and remains limited

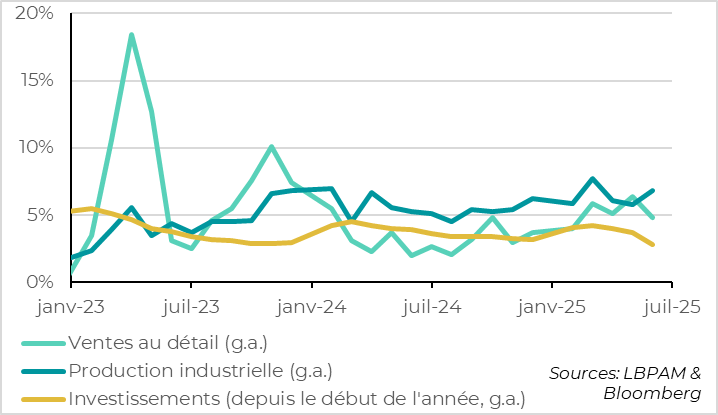

Domestic demand was less buoyant in June and therefore needs further support in the second half of the year to avoid an abrupt slowdown in growth.

After accelerating in May, retail sales slowed sharply in June, from 6.4% to 4.8%. They even fell over the month for the first time in over a year. This is due to the backlash from the end of certain capital goods exchange programs set up by the authorities, which shows that consumption trends remain fairly weak when fiscal support is less important.

Investment also slowed sharply in June, growing by just 2.8% over the first half of the year, the slowest pace since the start of the Covid. This weakness is exaggerated by the fall in prices (investment being measured in value terms), but is real and fairly widespread. Public investment (infrastructure) is slowing down slightly after a rebound at the turn of the year, and industrial investment is beginning to lose steam despite the resilience of industrial production (+6.8% in June), probably due to worsening export prospects and still low business confidence. These slowdowns are not enough to offset the more significant contraction in real estate investment (-11.2% in the first half after -10.6% last year).

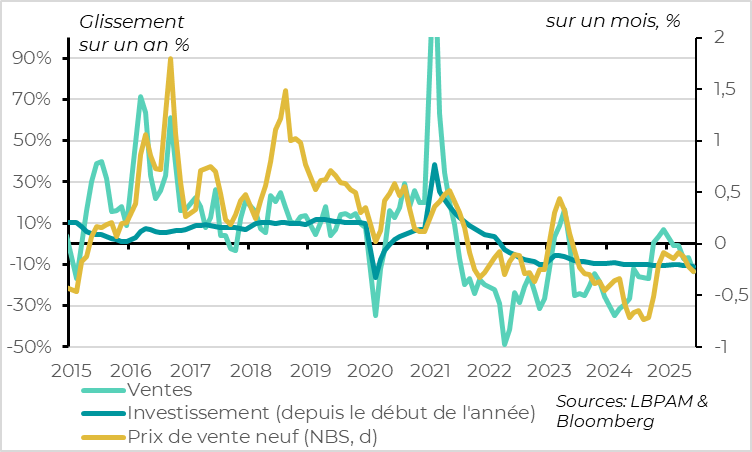

China: real estate sector deteriorates again in Q2

The real estate sector deteriorated sharply again in mid-2025, after signs of stabilization at the turn of the year, despite the authorities' stated intention to bring stability. Indeed, real estate sales are contracting again, and property prices have been falling a little faster since May.

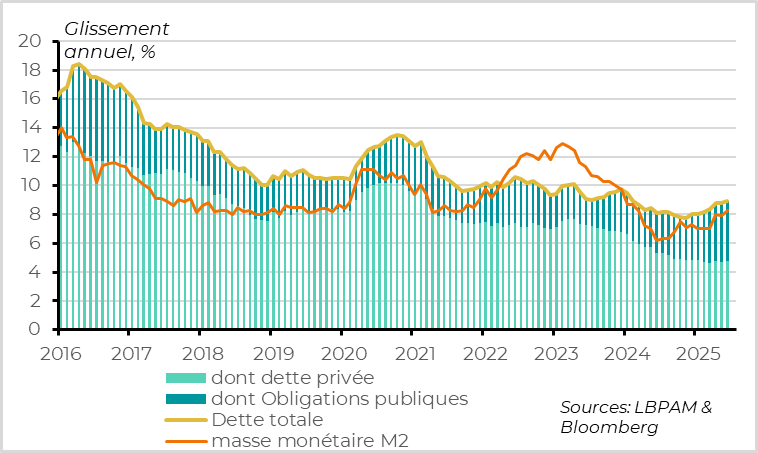

China: but monetary and fiscal support from the authorities should limit the slowdown in H2

That said, the authorities' support remains significant and should be passed on to the economy in the coming months, limiting the extent of the slowdown in the second half of the year. Thus, M2 money supply and total financing of the economy picked up a little in Q2, reaching their strongest growth in 1.5 years in June (at 8.3% and 8.9% respectively). This is due to the acceleration in public bond issuance (central and local), while bank lending has only stabilized. Still, this should support domestic demand over the coming months.

Germany: investor confidence continues to rebound in July

In the eurozone, German investors remain optimistic despite a still stagnant Q2. According to the ZEW survey, the current situation of the German economy is clearly improving, even if it remains deteriorated, reaching a 2-year high of -59.5pt. Above all, the economic outlook improved again in July after two sharp rises, and is now positive, at its highest level since the start of the war in Ukraine (at 52.7pt).

Of course, this investor survey should be treated with caution, as it does not reflect what is happening in the real economy, unlike the business and household surveys, and because investor confidence is probably boosted by the high risk appetite on the markets. The situation could change markedly if EU tariffs really are raised to 30% on August 1.

But it's still an encouraging sign for Germany and the Eurozone, suggesting that domestic support (notably ECB rate cuts and massive fiscal easing to come) is helping to offset trade fears. All the more so as German investors remain negative on the outlook for the US economy and cautious on the outlook for the Chinese economy.

Xavier Chapard

Strategist