Strong US employment limits the Fed's room for manoeuvre

Link

Market Analysis for October 7, 2024 by Xavier Chapard.

In summary

►US employment was much stronger than expected in September, implying that the Fed will almost certainly reduce the size of its rate cuts from 50bp in September to 25bp at its next meetings, as we anticipated. While the market (and the Fed) debated the probabilities between a soft landing and a recession scenario, the no-landing scenario, in which inflationary pressures remain too high, is back on the radar.

►All US employment measures were much stronger than expected. Job creation accelerated to 254 thousand, the unemployment rate unexpectedly fell to 4.1% and wages accelerated to 4%. These measures, which had been deteriorating rapidly over the summer, are now, in September, stronger than the levels the Fed considers compatible with an inflation rate durably stabilized at 2%.

►One should never overreact to a single monthly data point, and October's jobs reports could be weaker due to temporary elements (weather and strikes). And it doesn't change our central scenario of a gradual slowdown in the US job market between now and the end of the year. But this data does break the momentum of rapid deterioration in the job market indicated by this summer's employment reports. This clearly reduces the risks of an abrupt slowdown in the labor market in the short term, and increases the chances of a reacceleration in the US economy next year. This validates the reduction in our probability of recession within the next year, which we have lowered from 25% to 20% (the historical average being 15%).

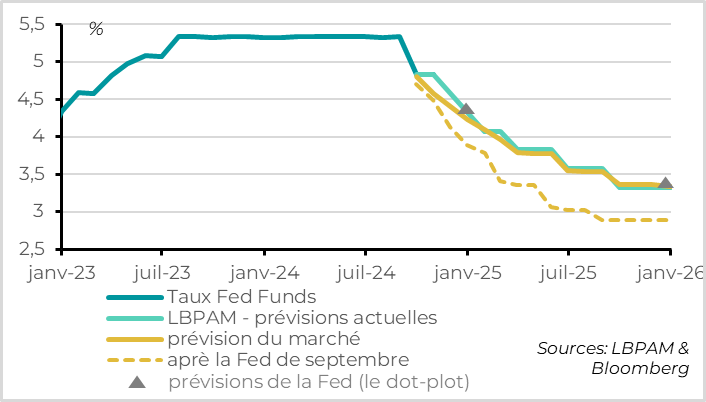

►We continue to expect the Fed to cut rates by 25bp in November and December, in order to “recalibrate” its monetary policy towards a less restrictive level. The market has aligned itself with our interest rate expectations following the jobs reports. This leads us to be neutral on bonds.

►But uncertainty about the extent of next year's rate cuts is growing. Our scenario calls for 4 Fed rate cuts between now and the end of next summer, for a terminal rate of 3.3%. Up until now, risks have been on the downside of this scenario, and the market had priced in rates falling below 3% after the Fed's September meeting. But job reports show that the risk of more persistent wage and inflationary pressures and a persistently tight labor market are still present. This could force the Fed to keep rates higher for longer, a risk that the market had totally dismissed since the summer.

►While the Fed may be less aggressive in its rate cuts, the ECB is likely to be a little more aggressive than it anticipated in September. This is what Banque de France Governor Villeroy de Galhau suggested at the weekend, paving the way for a rate cut as early as October. The slightest divergence between the Fed and the ECB pushed the EURUSD back below 1.10 this morning for the first time in 2 months. We continue to believe that a sustainable rebound in the euro is not just around the corner.

►Tensions in the Middle East pushed Brent crude up over $7 a barrel last week, to $78. While the markets had removed almost all geopolitical premium from the oil price, it is now back, even if it remains stable over the weekend. At this stage, it doesn't seem likely to change the global economic cycle, but it does create a new risk for the future.

To go deeper

United States: employment accelerates to 6-month high in September

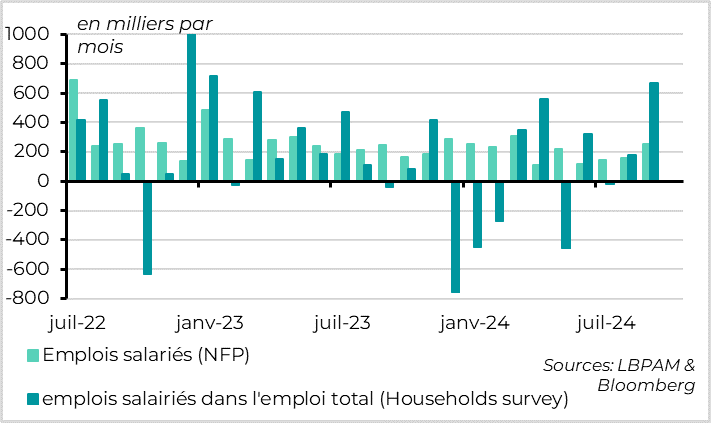

Job creation in the USA accelerated sharply to 254,000 in September. At a 6-month high, they exceeded expectations by more than 100 thousand, and are above the level deemed necessary to keep the US job market stable. Moreover, the detailed job reports confirm the strength of job demand.

Indeed, unlike in previous months, job creations have been revised sharply upwards for the last two months, by 72 thousand. Over three months, job creation averaged 185,000, indicating only a very gradual slowdown. And the surprise comes from private employment, which rose by 223 thousand in September.

On the other hand, the household survey confirms the rise in employment, with an increase of 430 thousand jobs in September. This is reassuring, as this survey had been indicating a weaker job market than the business survey for a year. The ADP survey also shows more private job creation in September than in the summer, although not as high as in the other two surveys (+143 thousand).

United States: unemployment rate cancels out summer rise

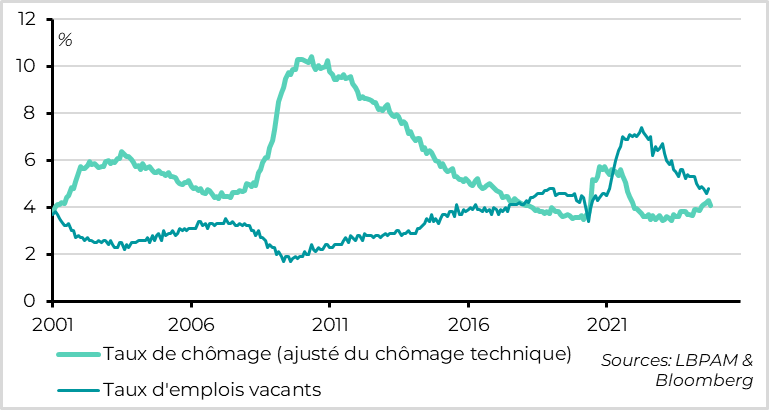

The unemployment rate fell unexpectedly in September, from 4.2% to 4.1% (or 4.05% without rounding). This is its lowest level for 4 months, having risen rapidly to 4.3% in July. This leaves some margin in relation to the 4.4% that Fed members were forecasting in September for the end of the year.

And unemployment is falling for good reason, thanks to job creation, while the participation rate and short-time working remained stable in September.

Add to this the rise in the job vacancy rate in August, and it seems that the US job market is stabilizing after having rapidly rebalanced over the past year. The vacancy rate per unemployed person has returned to its pre-Covid level, but remains historically high, above 1. This gives the image of a labor market that is no longer overheating, but remains very solid.

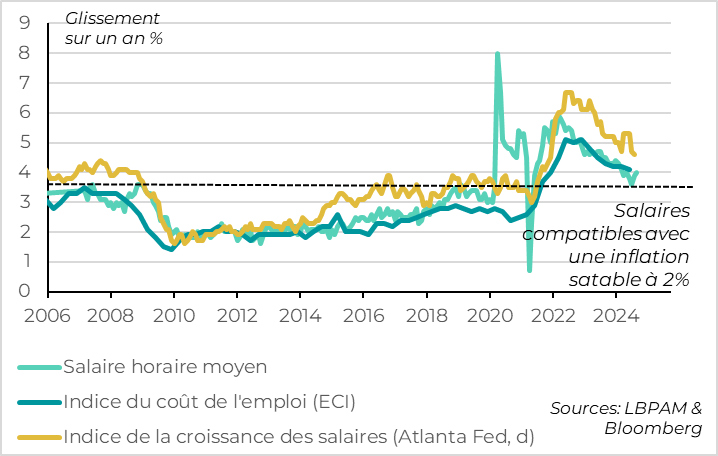

United States: Hourly wages accelerate slightly

Finally, hourly wages surprised on the upside for the second month running, rising by 0.4% in September after 0.5% in August. As a result, annual hourly wage growth accelerated from 3.9% to 4.0%, a 4-month high.

As always, this measure of average hourly earnings should be taken with a grain of salt, as it is impacted by significant compositional effects and by the fall in hours worked in September. We'll have to wait for the Atlanta Fed's calculated wage data in two weeks' time to get a clearer picture of the dynamics of wage pressures. But this initial data suggests that the slowdown is not as marked as it was before the summer.

Wage resilience is good news for household purchasing power, but it's something the Fed will have to keep a close eye on, as wage growth is once again slightly above the level the Fed considers compatible with stable inflation at 2%.

United States: The total PMI (industry and services) shows a stagnation of activity in the zone, but with wide disparities.

Although September's jobs reports are very solid, all is not perfect, and the central scenario remains that of a gradual slowdown in the US job market.

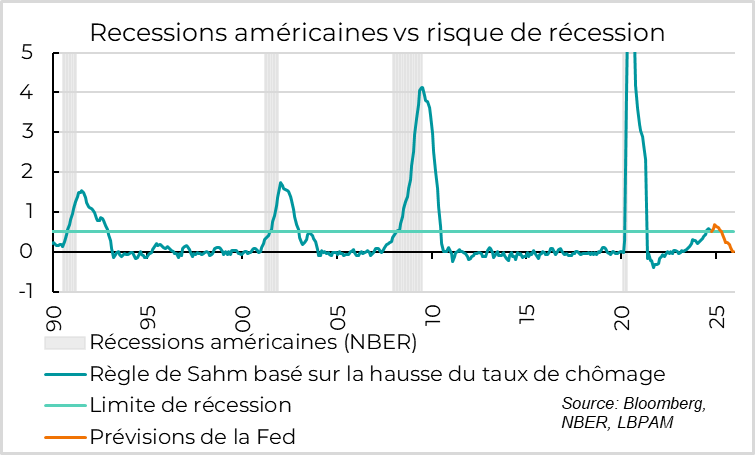

The Sahm rule, which states that the risk of recession is high when the smoothed unemployment rate rises by more than 0.5% from its recent low point, remains activated for the third consecutive month, albeit just at the limit in September. And households indicate that the labor market is easing quite rapidly again in September, according to the Conference Board survey.

Also, temporary employment continues to fall and the number of hours worked remains on a downward trajectory, which are historically signs of a slowing labor market. And on the wages front, the resignation rate is at its lowest in almost 10 years, suggesting that wages will continue to slow.

All in all, September's US employment figures do not change the scenario of a gradual slowdown in the job market, which has returned to equilibrium, but they do sharply reduce the risk of an abrupt slowdown in the US in the short term. And it increases the chances that the US economy will accelerate more sharply than expected next year, when the summer's easing of financial conditions and possible additional fiscal support will be transmitted to the economy.

United States: The market aligns with our Fed rate cut scenario

After the jobs reports, the chances of the Fed cutting rates by another 50bp in November are virtually nil. The market has aligned itself with our scenario of a 25bp rate cut in November and December, whereas it was anticipating a 75bp rate cut before the jobs reports.

The market may even start to wonder whether the Fed will continue to cut rates at each of the next meetings, starting with the one in November. Especially if the inflation figures released this week surprise on the upside again, and the Fed minutes show that a majority of Fed members are more cautious than Powell about future rate cuts.

That said, we believe that the Fed rate is still sufficiently high (i.e. restrictive) and that disinflation is sufficiently marked at the end of 2024 for the Fed to continue cutting rates as indicated in the dot-plot between now and the end of the year.

On the other hand, the risk on our Fed rate scenario for next year is becoming more balanced, whereas it was clearly tilted to the downside recently. We still expect the Fed to cut rates to around 3.25/3.5% by the middle of next year, which is now also the market's scenario. But if faster disinflation next year and a further weakening of the labor market to favor a lower terminal rate, a stabilization or even re-acceleration of the labor market and a halt to disinflation next year could force the Fed to keep rates higher for longer. This risk had disappeared from the market radar, but must now be taken into account once again.

Xavier Chapard

Strategist