Summer answers

Link

Que retenir de l'actualité de marché du 23 juillet 2025 ? Réponses avec le décryptage de Sebastian Paris Horvitz.

Summary

► Unfortunately, discussions about J. Powell's future continue. This despite the US President's declarations to let the Fed Chairman serve out the remainder of his term next spring. J. Powell's premature departure would surely have a detrimental effect on the markets, particularly bond markets. Indeed, the main risk would be that his replacement at the head of the institution would be reluctant to assert his independence and “align” himself with the views of the US government, thus casting doubt on the respect of his mandate, in particular with regard to price stability.

►Summer is unlikely to provide a definitive answer to the saga surrounding the future of the Fed Chairman, or to the questions surrounding the effects of US protectionist policies. Nevertheless, we should have more clarity on the level of tariffs the US will apply to the rest of the world. We've just learned that Japan will have to endure a 15% tariff, while for the Philippines it will be 19%, slightly above the 20% affecting Vietnam. For many smaller countries, the rate should be between 10% and 15% by August 1. Negotiations with the EU and China still need to be finalized, followed by specific tariffs on pharmaceuticals and semi-conductors.

► All in all, even if we can expect a lull after August 1, bringing some relief to investors, the fact remains that we should be landing at much higher tariff levels than at present, when the 10% “rule” prevailed for many countries. This will be negative for growth worldwide, and more inflationary in the US.

►In fact, we believe that the inflation figures for July and August in the US should shed more light on the response of consumer prices to price rises. We remain convinced that these effects will be present in the months to come, even if their scale and durability remain difficult to anticipate.

► US employment figures will also tell us whether the weakening we are already seeing in certain segments, notably with job creation in the private sector slowing rapidly, is spreading. This could downgrade our assessment of the country's economic growth in 2H25.

►At the same time, the summer could see the dollar finally stabilize, after its marked depreciation since the start of the year, or continue to fall. We know that this depreciation of the greenback exacerbates the inflationary effect of tariffs, but makes American exports more competitive. Above all, it has partly supported the rebound of large caps on US stock exchanges with strong exposure to the rest of the world, by boosting their earnings in dollars. Obviously, a further appreciation of the euro will not be good news for the Eurozone.

►As early as this week, we'll have preliminary indications from S&P's activity surveys for most of the world's major economies. In the US, we prefer to wait until early August for the verdict of the ISM indices. We already know that some sectors are doing better, such as steel, where activity is rebounding thanks to the tariffs... But metal prices are rising. Nevertheless, the general trend given by the statistics already available is still that of a deceleration in the US economy. This is what the Conference Board's leading indicator for June shows for the months ahead.

► In the Eurozone, these activity indicators will tell us just how fragile the European economy is. For the time being, everything suggests that growth will remain sluggish this summer. At the same time, monetary easing is an important factor in economic recovery. Despite the uncertainties, this should gradually translate into credit stimulation. The ECB's bank survey for 2Q25 gives a mixed message. It does, however, show that lending conditions are improving and that credit demand is picking up, albeit at a very slow pace.

To go deeper

While the final implementation of US tariffs appears to be nearing completion, their effects are yet to be felt. Despite many uncertainties, the impact of these historic US protectionist measures will be negative for the global economy.

One of the most paradoxical movements since President Trump took office has been the fall in the dollar, particularly in the context of trade barriers. Indeed, we would have expected an appreciation in the greenback, especially as a divergence has naturally set in on the path followed by central banks, with the Fed putting a halt to its easing trajectory, at least for the time being.

Admittedly, the dollar was relatively high before D. Trump came to power, which could have pushed it towards gradual depreciation. Also, protective movements on the capital markets may also have induced a depreciation, which we'll call technical. But we believe that part of the reason for the dollar's downward movement is a break with the strong belief in American exceptionalism.

It seems to us that American protectionist measures, and the breakdown of the multilateral structures that have been in place for decades, could continue to affect the US currency in the medium term.

At the same time, the United States retains an essential asset. This is its leadership in technological developments, notably AI. An important factor for tomorrow's growth. Will Europe, or China in particular, be able to challenge this advantage in the years to come? This is one of the big questions for the future, along with that of military security.

In the short term, the dollar remains weak. This should exacerbate the inflationary effect of US protectionist measures. At the same time, it gives US exporters a competitive edge. This is particularly true in Europe, where currencies have appreciated against the dollar by over 10% since the start of the year.

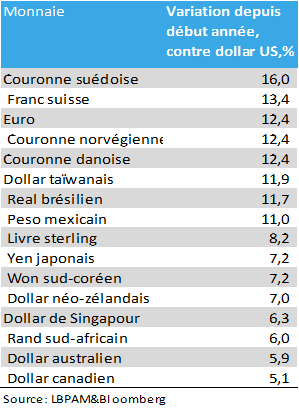

Dollar: European currencies have appreciated the most against the dollar since the start of the year

As a result, the dollar's depreciation, particularly in markets that are important to US large-cap companies, has boosted dollar-denominated corporate earnings. This is particularly true of large-cap technology companies.

In euro terms, the main US stock market indices are still in the red, whereas in dollar terms, they have been rising since the beginning of the year. This is largely thanks to the big tech stocks.

For Europe, this depreciation of the dollar is certainly bringing us lower raw material costs, particularly for energy, but this is weighing on the competitiveness of European companies and obviously on the euro-denominated earnings of large companies, which are generally very exposed to the United States.

We expect the dollar to remain stable over the coming months, but we cannot ignore the fear of further depreciation of the greenback, especially if the US economy were to weaken more than we expect.

Over the next two weeks, we'll have plenty of important economic data on growth dynamics in the USA. All indications are that the economy is still resilient, but that the deceleration trend is still present, despite sectoral differences. In industry, in particular, we saw an increase in steel production in June, following the introduction of protectionist measures. At the same time, this should translate into higher prices for all companies using this raw material in their production lines.

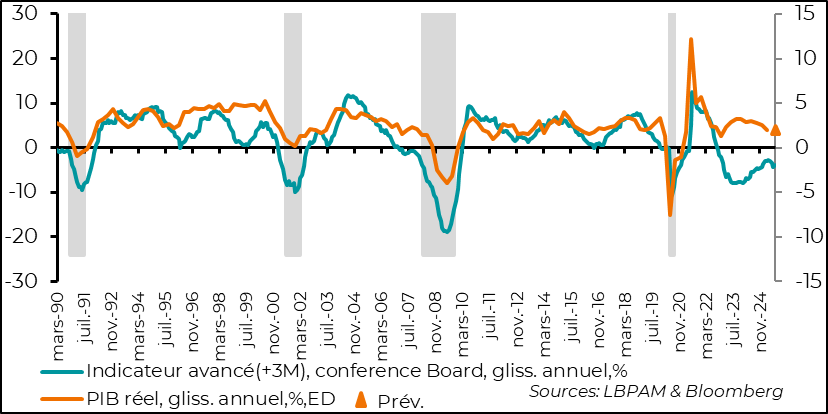

The Conference Board's leading indicator for June, taking into account a wide range of cyclical variables, including the rise in US equities, gave a message of continued deceleration in activity over the coming months.

Thus, despite the expected rebound in GDP for 2Q25 compared with 1Q25, due in particular to the sharp drop in imports responding to the rise in 1Q25 in anticipation of tariff increases, the trend would be for demand to lose momentum.

United States: the Conference Board's leading indicator suggests that economic growth is set to slow slightly in the months ahead.

In the Eurozone, one of the important ingredients for the recovery we anticipate towards the end of 2025 is the contribution monetary easing should make to supporting a credit rebound in the European economy.

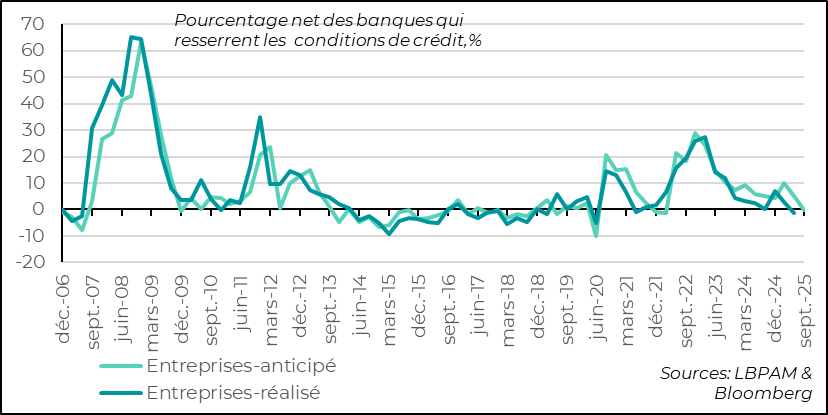

In this sense, the trends described in the ECB's survey on credit conditions are important. For 2Q25, the survey reveals a slight improvement in the situation, but it still remains fragile, particularly on the corporate side.

Banks' lending conditions for businesses improved slightly over the quarter. However, they do not see much change for the future. The banks emphasize that they are nonetheless very selective when it comes to choosing credit applications, paying close attention to the uncertainties brought about by the economic situation, particularly for exporting companies. Nevertheless, strong competitive conditions are also prompting them to relax the constraints imposed on companies.

Euro zone: banks ease credit conditions slightly for businesses in 2Q25

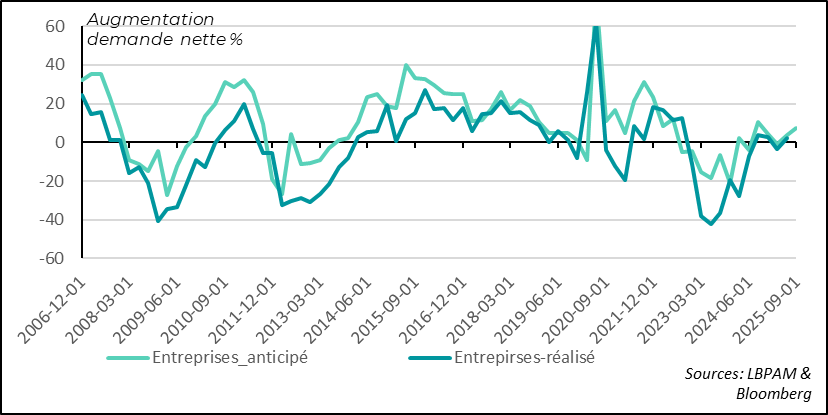

On the demand side, we saw a slight recovery in 2Q25, after the air pocket of 1Q25 in the face of the many uncertainties on the horizon. At the same time, the trend seems to be for a continuation of this rebound in 3Q25, which bodes well for the future.

Euro zone: despite uncertainties, corporate credit demand rebounds in 2Q25

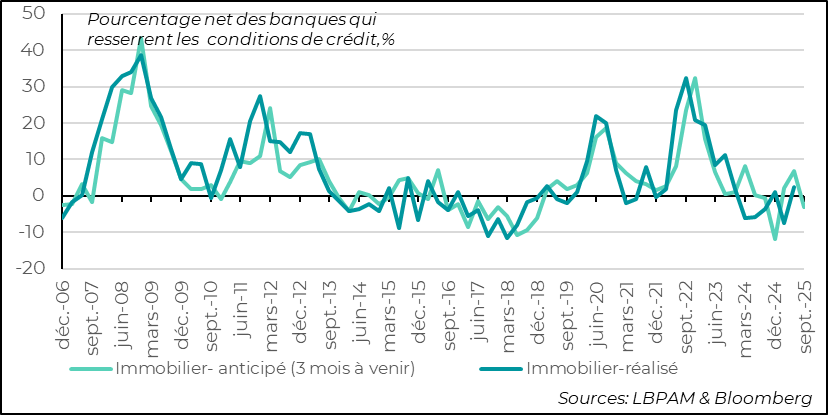

On the household side, in particular, mortgage lending conditions were tightened slightly in 2Q25, reversing the previous trend. However, for the coming quarter, banks are anticipating a further easing, which would obviously be positive for consolidating the recovery in activity.

Eurozone: banks slightly tightened mortgage terms for households in 2Q25, but outlook should improve

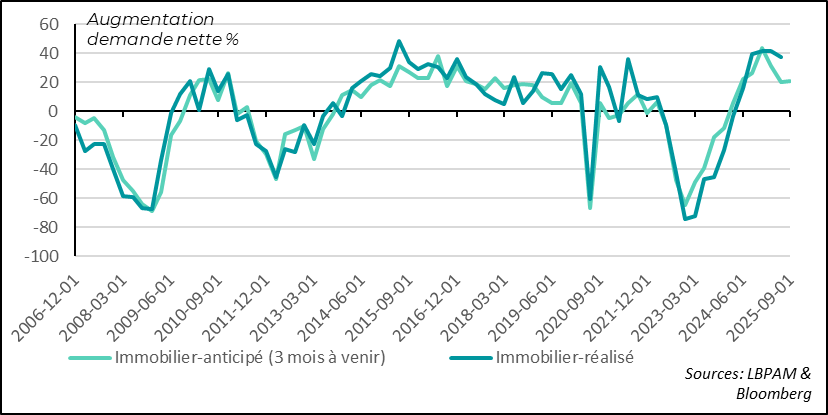

At the same time, and this remains reassuring, demand for mortgages remains robust, even if the zone's banks are anticipating a slight decline in demand over the coming quarter. Nonetheless, the expansionary momentum continues, which is always a positive sign for the future, and should satisfy the ECB as it implements its more accommodating policy for the economy.

Eurozone: household demand for mortgages remains strong, although banks expect it to ease slightly in 3Q25

Sebastian PARIS HORVITZ

Head of research