Summer sets fire to rates

Link

- LThe summer was marked by extraordinary forest fires in Europe and North America. For the experts, these phenomena can be partly explained by global warming and the associated drought. We can only hope that these disasters will increase pressure on governments to speed up the energy transition and thus reduce the factors accentuating global warming.

- At the same time, on the markets, long-term interest rates took a beating. In the United States, 10-year government bond yields have risen by more than 50 basis points since mid-July, reaching a high of 4.28% not seen since 20008. In the Eurozone, the rise was more modest, with an increase of just over 20 basis points over the same period. These increases, particularly in the United States, can be largely explained by 3 factors. Firstly, the greater resilience of the US economy. Secondly, inflation is slowing down. And finally, a greater-than-expected need for government securities to finance public deficits, destabilizing the balance between supply and demand for government securities. These reasons have led the market to conclude that real rates (i.e. inflation-adjusted rates) are likely to remain higher than previously thought. These higher rates have done some damage to riskier assets, notably equities, which have seen their flawless advance since the start of the year halted. We are still maintaining a relatively cautious allocation, maintaining a slight under-exposure to equities and seeking to benefit from the high carry offered by the bond world, while remaining highly selective. In these times, which still seem to us to be fraught with uncertainty, we are maintaining a relatively large position of well-interest-bearing cash.

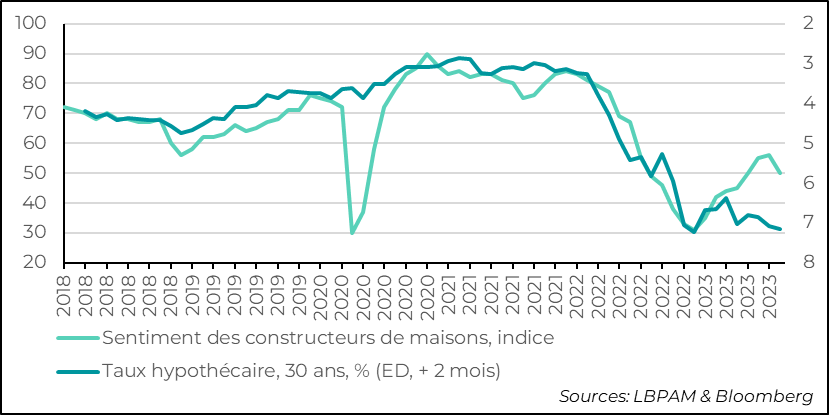

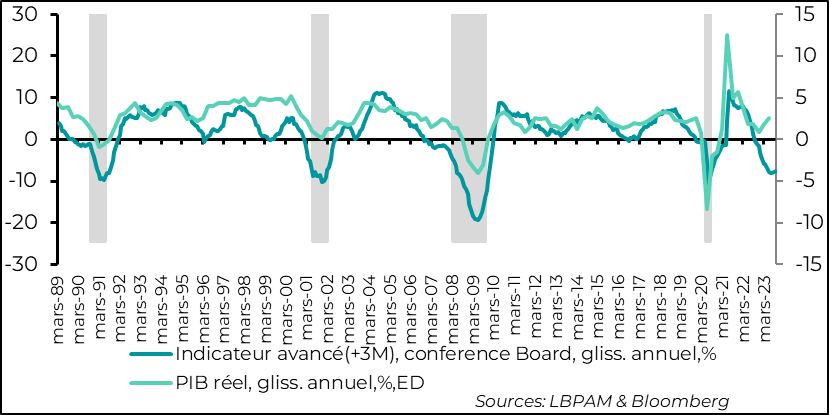

- The economic trajectory of the various regions remains uncertain, as does the pace of disinflation. In the United States, the latest economic statistics show that the economy remains resilient. In fact, consumer spending once again showed impressive strength in July, with a sharp rise in retail sales. The robustness of the job market seems to have a lot to do with this. Even with a deceleration in consumption in August and September, we should still see a strong contribution to GDP growth in 3Q21. Investment also seems to be holding up well, even though we seem to be seeing a turnaround in the real estate market, which has been rebounding since the start of the year, despite already high mortgage rates. The latest rise in mortgage rates, to over 7% for 30-year mortgages, seems to have broken the momentum. Indeed, confidence among homebuilders fell sharply in August, while building permit applications slumped. All in all, despite slightly more favorable statistics, the Conference Board's leading indicator continues to point to a possible entry into recession for the US economy. We are maintaining our forecast that the US economy could contract, albeit moderately, over the next six to nine months, under the weight of the financial constraints imposed by monetary tightening.

- On the inflation front, core inflation continued to decelerate in July, rising to 4.7% year-on-year from 4.8% the previous month. Total year-on-year inflation rebounded to 3.2%, compared with 3% the previous month, due, as expected, to the strong attenuation of the effect of higher energy prices. All in all, inflation is indeed decelerating, but with pressures on the labor market persisting, disinflation is likely to be very slow. In fact, this is the Fed's diagnosis, as we read in the minutes of the last Economic Policy Committee meeting. For most members of the committee, a further rate hike is still possible, but above all, most believe that high rates should be maintained for some time to come.

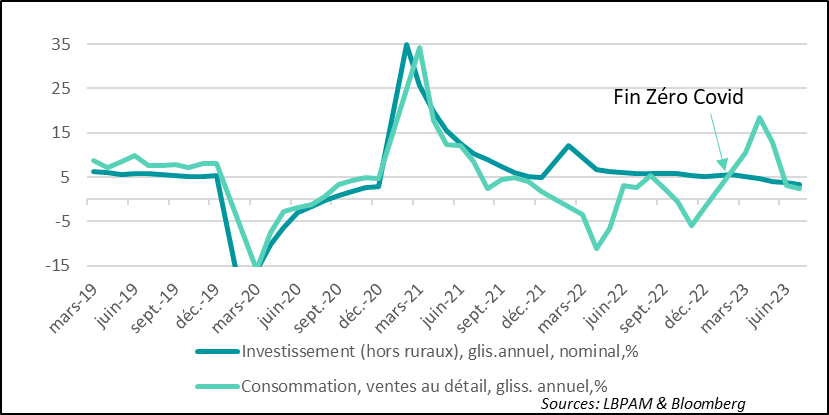

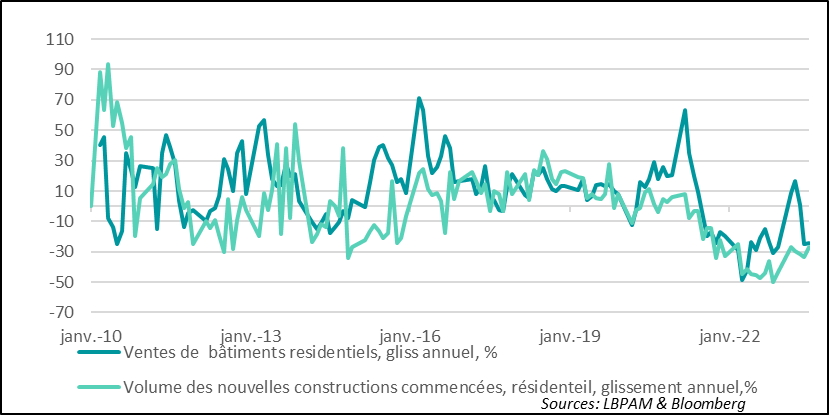

- In China, economic data continued to disappoint. The loss of momentum after the rebound associated with the end of the zero-covid policy is becoming evident. Whether it's statistics on consumption or investment, all point to weakening growth momentum. What's more, the difficulties in the real estate sector continue, with Country Garden one of the leading property developers unable to service part of its debt. Faced with this situation, the central bank has again eased monetary policy, and the Politburo has insisted on the need to sustain growth. The government is urging the provinces to invest and seems keen to support consumption, but so far there are no tangible results. In fact, the confidence of foreign investors, which seemed to be gradually improving, has been dampened once again by the slowness and small scale of the policy to support the economy. We continue to believe that the authorities will support the economy, but the risk is that the extent of this support will be much less than anticipated.

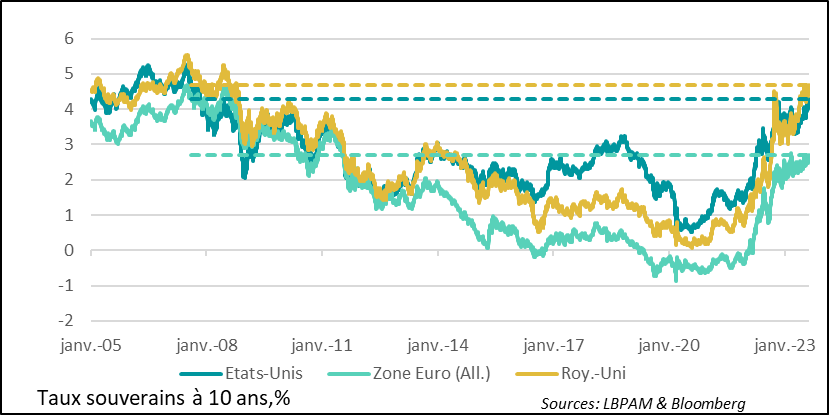

Long-term interest rates have risen sharply over the past month, particularly in the United States. In the US, the resilience of the economy and investors' anticipation that high real interest rates would persist for longer than previously expected seem to explain this rise. In addition, Fitch's downgrading of US public debt on the grounds that large public deficits were still to come contributed to this dynamic.

In Europe, it was the persistence of inflation that pushed rates up, particularly in the UK.

Overall, 10-year yields in the United States and the United Kingdom have returned to their highest levels since 2008. In the Eurozone, they are back to 2011 levels, i.e. just before deflationary pressures took hold in the region.

Fig.1 Long-term interest rates: Long-term interest rates in the major countries at their highest level for over 10 years.

Sovereign 10-year rates, %.

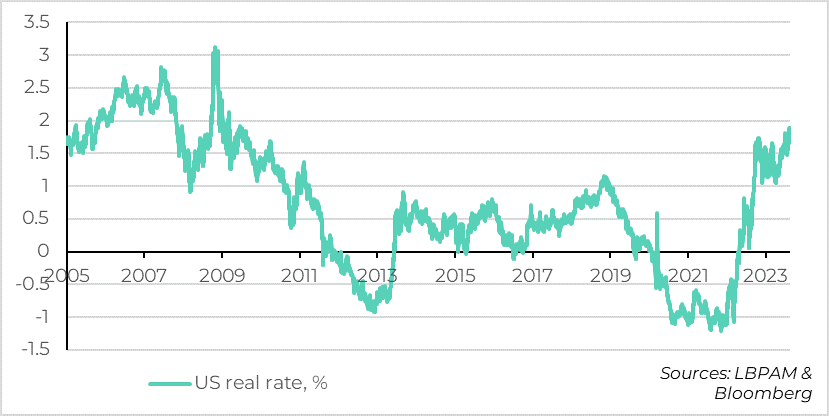

In the USA, real interest rates, i.e. nominal rates adjusted for inflation expectations, have surged. The market now thinks it likely that, in order to contain inflationary pressures in the future, real rates will have to remain higher than previously anticipated. In addition to the resilience shown by the US economy today, the US government's financing needs are also likely to force the Fed to keep the real equilibrium rate - i.e. the rate that enables growth to be maintained without triggering inflationary pressures - higher than in the past, or at least compared with the last ten years.

We can only note a break in the dynamic of constant decline in the real rate that we have seen over the last few decades. It is surely too early to conclude whether this is a genuine structural change, or whether it is the cyclical consequence of the very particular situation we are facing today.

Fig.2 Long-term interest rates: Most of the recent rise in US interest rates is due to the rise in real interest rates.

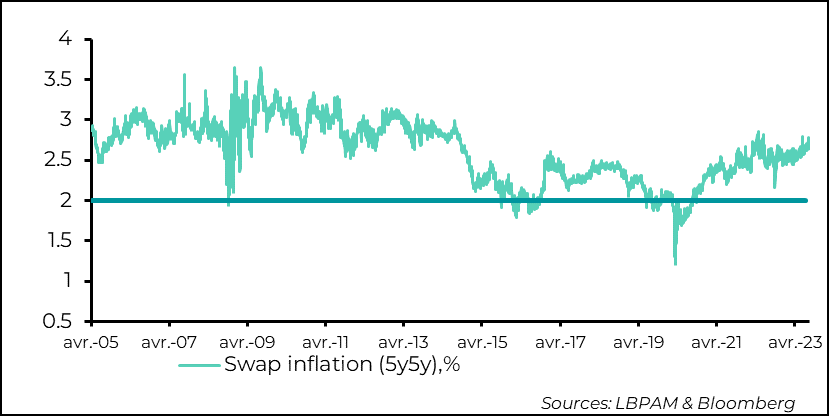

What's important for the Fed is that the bond market continues to believe that monetary policy will contain inflationary pressures and maintain price stability. Indeed, inflation expectations measured on the market remain fairly well anchored, compared with historical levels and the central bank's medium-term inflation target of 2%.

Fig.3 Long-term rates: US inflation expectations remain in a narrow range

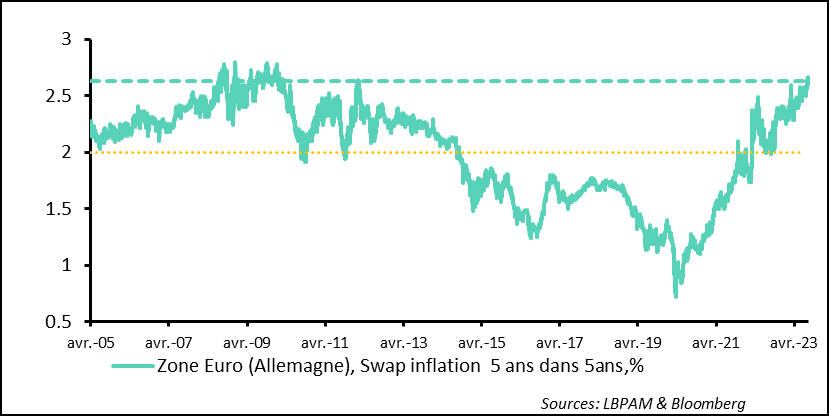

It is important to note that inflation expectations in the Eurozone have continued to rise over the recent period. We are now in the high range of the last 20 years. This must be a source of concern for the ECB.

However, it is likely that the weakening growth seen in the zone will also begin to manifest itself in a deceleration of price rises. But this will probably require an easing of the labor market, which remains very tight, with the unemployment rate for the zone as a whole remaining historically low.

Fig.4 Long-term rates: In the Eurozone, inflation expectations are back to the high levels of 2008-2009, complicating the ECB's strategy.

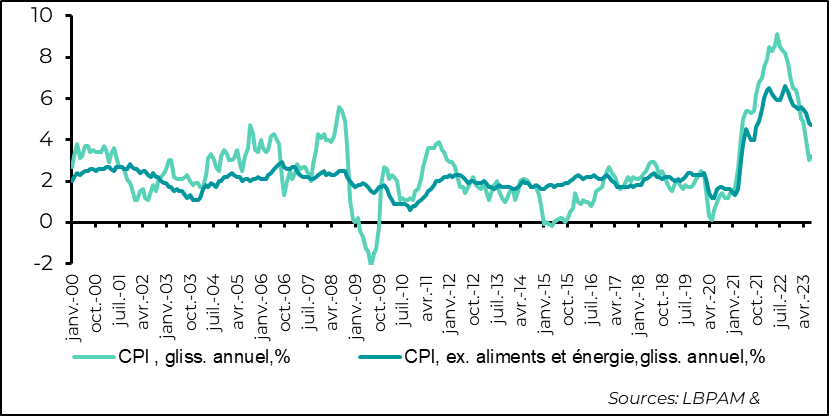

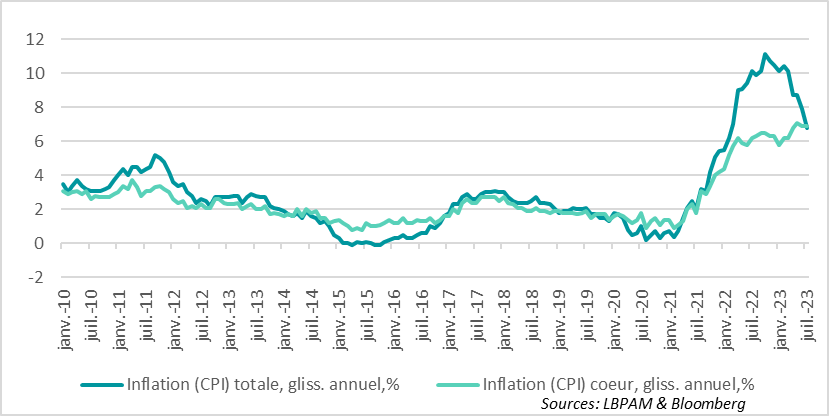

For both the Fed and the market, the disinflation dynamic remains one of the key factors in determining the stance to be taken by monetary policy in the quarters ahead. In this respect, the continued deceleration of US inflation in July was reassuring.

In particular, core inflation continued its downward trend, falling to 4.7% year-on-year from 4.8% the previous month. On the other hand, as expected, total inflation rose to 3.2%, after 3% the previous month. This is essentially due to the fact that the very favorable effects of certain base effects, notably linked to the fall in energy prices, are fading and should become much less favorable in the months ahead, especially as oil prices have recently risen again.

Fig.5 United States : Inflation continues to decelerate, but very favorable base effects, linked in particular to lower energy prices, should fade away

CPI, annual sliding, % -

CPI, ex. food & energy, annual sliding, %

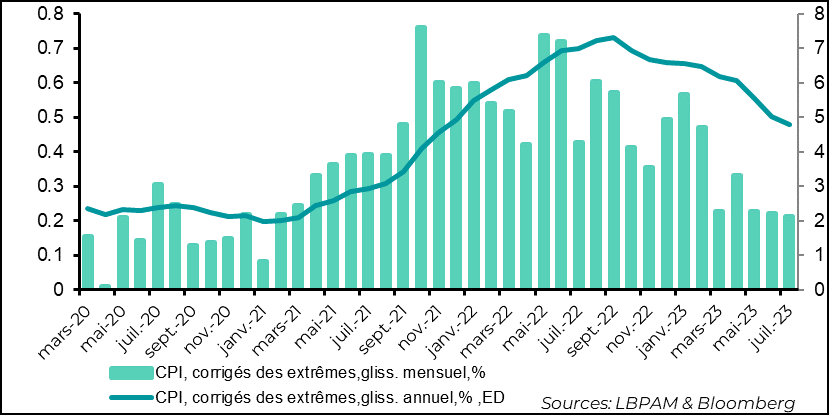

The underlying measures are also improving. The statistic produced by the Cleveland Fed, which consists in removing from the index the prices of goods or services that have experienced the most extreme variations, both upwards and downwards (16% is symmetrically removed from the index), has also continued to decline. In fact, over the last three months, monthly inflation has moderated.

Fig.6 United States : Underlying measures of inflation also improve.

CPI, adjusted for extremes, monthly sliding, %.

CPI, adjusted for extremes, slippage, annual %, ED

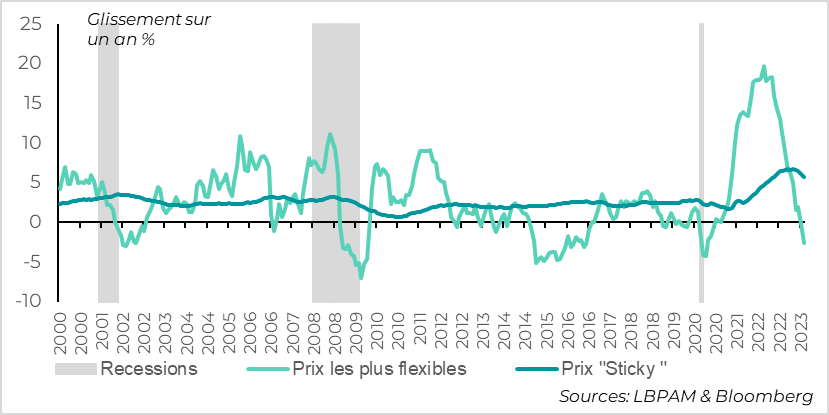

Other measures that remain highly instructive for trying to read the evolution of inflation are those of the Atlanta Fed, which differentiate between prices that are generally rather viscous, i.e. only changing very slowly. Here again, we see moderation. Nevertheless, the strongest deceleration in inflation is due to the most flexible prices, which obviously include energy prices.

Fig.7 United States : The prices slowest to adjust are also beginning to fall, but at a much slower pace than the most flexible prices.

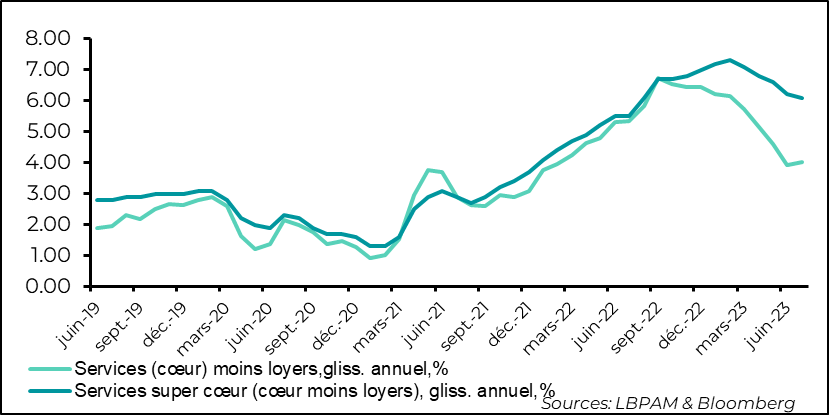

Nonetheless, the statistic that the Fed seems to be following most closely today, i.e. price rises in services, is a priori more sensitive to persistent tensions on the labour market. Although decelerating, it remains very high, even when adjusted for rents, which have a considerable weight in the price index.

Fig.8 United States : The deceleration in services prices is here and now...but it will be slow.

Services (core) less rents, slipp. annual % change

Super core services (core minus rents), gliss. Annual, % change

All in all, inflation is indeed decelerating in the United States, but with the labor market still very tight, we expect this deceleration to be slow. What's more, certain base effects, which until now have been very favorable, should start to fade. This is very clear for energy prices. In this sense, the Fed is likely to keep a rather cautious tone on its monetary policy, insisting that it is necessary to maintain a still restrictive policy for some time to come.

Nevertheless, we continue to believe that rate hikes are over, even if the risk of a further hike cannot be ruled out, especially as the US economy remains highly resilient, thanks in particular to consumer spending.

In the UK, headline inflation did fall in July, thanks to lower energy prices, but underlying inflation is struggling to get back on track. This partly explains the bond market's reaction in pushing interest rates even higher. In our view, it is likely that the BoE will need to raise key interest rates once or twice more, but not more than that, so as not to risk a far too sharp deterioration in the economy.

Inflation (CPI) total, year-on-year, % (CPI core, year-on-year, %)

Inflation (CPI core, year-on-year %)

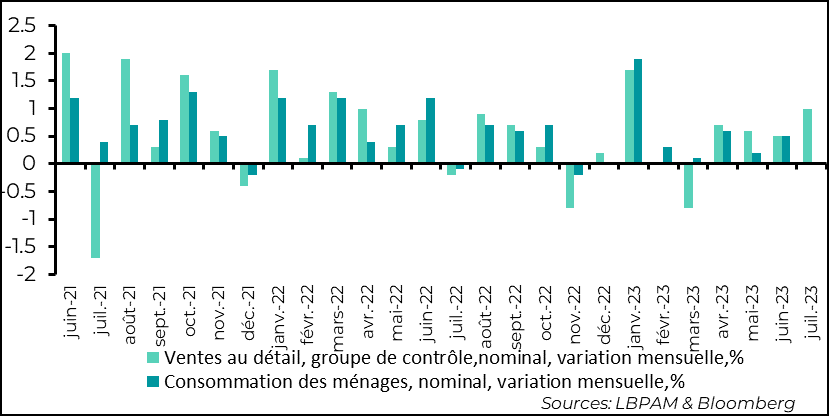

The momentum of the US economy has been surprising since the start of the year. Retail sales for the month of July once again beat all expectations with a much stronger-than-expected rise of 1% over the month. The control group, i.e. my retail sales segments which are used to estimate household consumption in GDP, also rose by 1%, so with inflation moderating over the month, we have growth in real terms of 0.8% over the month, the strongest after the extraordinary rise in January. There will surely be a "correction" to expect in September, but the contribution of consumption should be very strong to GDP growth in 3Q23.

Fig.10 United States : Retail sales rise sharply in July, underscoring robust consumer spending

This robustness in consumption is due to the continuing strength of the labor market and the effect of the deceleration in inflation, which is outpacing wage inflation and thus giving households purchasing power.

At the same time, this robustness must worry the Fed, for if demand remains solid, disinflation is likely to be far too slow. This is why the central bank is likely to maintain its tough stance in the months ahead.

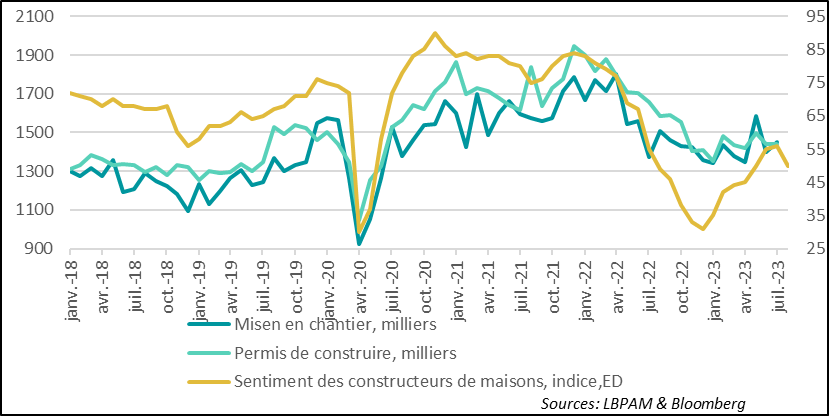

One sector where rising interest rates seem to be having an impact is real estate. Indeed, the latest statistics show that the momentum of recovery in the construction sector seen since the beginning of the year seems to be fading. In August, the Home Builders' Confidence Index (NHAB) fell quite sharply after rising steadily since the start of the year, when interest rates had eased.

Fig.11 United States : Construction could be hit again after surprising resilience since the start of the year

Housing starts, thousands

Building permits, thousands

Homebuilder sentiment, index, ED

In fact, rising interest rates have pushed mortgage rates to new highs, with rates on 30-year mortgages well over 7%.

Fig.12 United States : Rising mortgage rates appear to be putting a damper on construction

Homebuilder sentiment,

30-year mortgage rate index, % (ED +2 months)

Despite good economic statistics, the Conference Board's leading indicator continues to predict that a recession remains highly likely over the next 12 months. Nevertheless, the decline in this indicator is moderating, reflecting in part good demand-related statistics, while supply-side activity statistics are less robust. In addition, the persistence of an inverted yield curve plays an important role in the very low level of this indicator.

Fig.13 United States : The Conference Board's leading indicator continues to forecast a recession 12 months ahead.

Leading indicator (+3M), Conference Board, gliss. Annual, %

Real GDP, gliss. Year-on-year, %, ED

The Chinese economy continues to deteriorate. In particular, the impetus given to consumption by the end of the Zero-Covid policy is rapidly running out of steam.

Retail sales for July came in well below expectations, dropping to just 2.5% year-on-year from 3.1% the previous month, but above all well below the 4% expected by consensus. At the same time, investment also gradually eased, falling to 3.4% year-on-year from 3.8% the previous month.

Fig.14 China: The recovery is clearly running out of steam.

Investment (excl. rural, slipp. Annual, nominal, %

Consumption, retail sales, annual, % (excl. rural)

Above all, the real estate market, which was one of the pillars of the country's growth, remains sick and is not really in a position to take off. News of the financial difficulties of Country Garden, a major property developer, which was unable to pay a coupon on a bond it had issued, shows the extent of the malaise.

Fig.15 China: The real estate sector remains ailing

Sales of residential buildings, year-on-year, %

Volume of new residential construction starts, year-on-year, %

The authorities continue to make announcements to underline their intention to stimulate growth. But so far, the measures and announcements are far from bearing fruit.

Although the central bank has eased monetary policy, this does not seem to have stimulated demand for credit.

The government is pushing the provinces to invest and is trying to support the financial market by mobilizing public asset managers. But once again, this seems timid and far from restoring confidence.

We expect more action to be taken, given the extent of the economy's loss of dynamism. Obviously, the authorities' decision to stop publishing youth unemployment statistics was not the best way to move towards transparency and restore confidence. Nevertheless, it perhaps underlines the awareness of the urgent need to act quickly in the face of an economic downturn that seems not to have been well anticipated by the authorities.