Tensions over US employment dissipate very slowly

Link

- The market continues to be dominated by a wind of optimism, based in particular on the possibility of an easing of monetary conditions by the major central banks. Nevertheless, as we recently pointed out, the sharp rise in stock markets since the start of the year puts the market at risk of possible corrections, as much of the good news is, in our view, priced in. At the same time, we continue to believe that the resilience of growth, the continuation of disinflation - albeit slow compared to the eagerness of some - and indeed the loosening of the monetary vise (expected in late spring), should remain a support to the market.

- The US employment report for February, as always eagerly awaited, delivered a mixed message, although it was dominated by signs of moderation in labor market tensions. Rather good news for the Fed.

- Although job creation was well above expectations, at 275,000, the sharp downward revisions of the previous two months (-165,000) mitigated against this. Also, the unemployment rate rose again, to 3.9%, still historically low, but the highest since January 2022. Wage increases also slowed markedly over the month (0.1% vs. 0.5% the previous month), although year-on-year they fell back slightly to 4.3%.

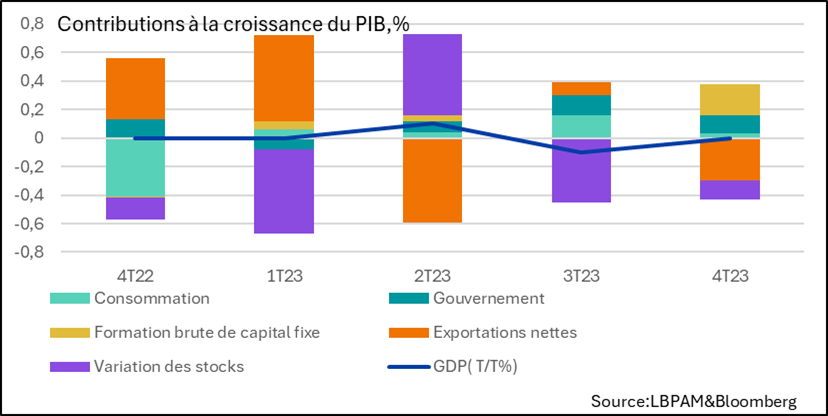

- In the Eurozone, we knew that GDP had stagnated in 4Q23, but we didn't have all the details on the contributions to growth of the various demand items. We thus confirmed that on the domestic demand side, consumption had remained sluggish, while public spending maintained a solid contribution. The good news for the future was the marked positive contribution of investment. We are still expecting weak growth figures for 1H24, but with a gradual upward trend in economic conditions.

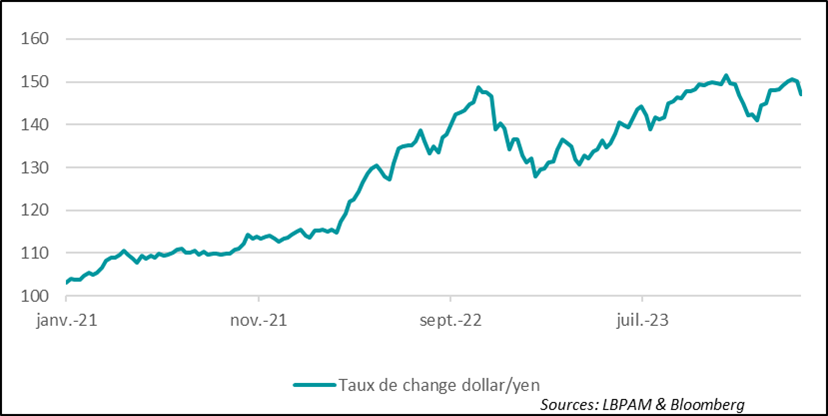

- In Japan, speculation continues to mount that the Bank of Japan (BoJ) may abandon its ultra-accommodative monetary policy at its meeting on March 19. As a result, the yen is strengthening sharply, adversely affecting the stock market.

- Preliminary results from Portugal's parliamentary elections appear to put the center-right party (AD) in the lead, leaving behind the Socialist Party, in power since 2015. The most striking fact is the rise of the far-right populist party (Chega, created in 2019), which is said to have more than tripled its number of seats. So, at this stage, only a coalition could govern the country. But the nature of such a coalition is difficult to define, especially given Chega's considerable weight. As a result, it is difficult to outline a possible government program.

It's undeniable that part of the solid performance of stock market indices, some of which are breaking all-time records at the start of this year, is based on the anticipation of key rate cuts by central banks, notably the Fed and the ECB.

These expectations are supported by the speeches of central bankers who, as last week in statements by J. Powell to the US Congress or by C. Lagarde after the ECB's monetary policy meeting, suggested that rate cuts were imminent. Ms. Lagarde even hinted that a rate cut in June would be possible if the data were in line with the institution's economic projections, particularly concerning wage trends.

Last Friday, in the United States, we had the employment report for February. It gave a mixed message, even if the balance tipped towards a moderation of tensions on the labor market.

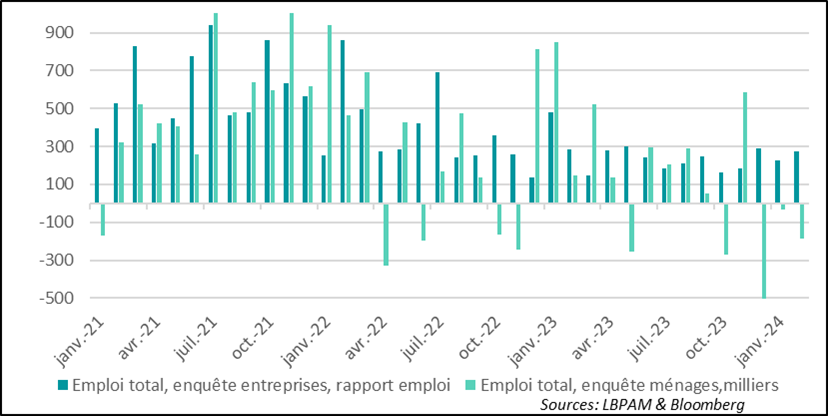

The first message of the report, according to the business survey, is a rather robust picture of the job market, with 275 thousand jobs created, well above expectations, and the "natural" level of entrants to the labor market. Nevertheless, the number of job creations was revised sharply downwards over the previous two months, by 165 thousand, moderating the message of strong job creations in February.

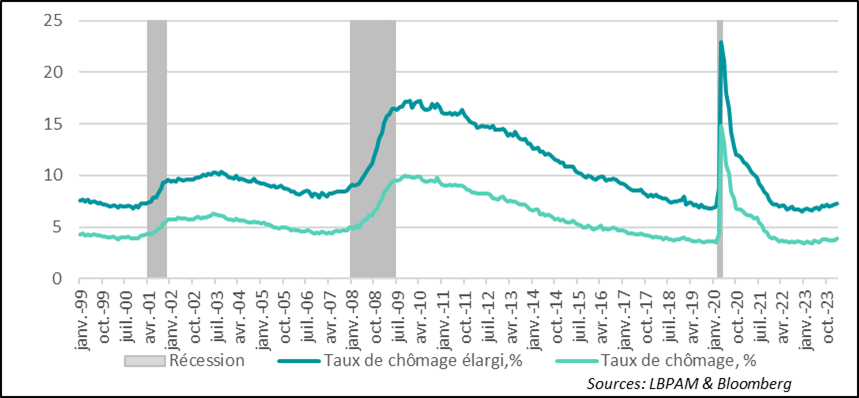

In addition, the household survey saw the unemployment rate rise to 3.9%, the highest level since January 2022. This suggests that the dynamism of the labor market is waning.

Fig.1 United States: Unemployment rises to 3.9% in February, the highest level since January 2022

At the same time, we continue to see somewhat contradictory messages between the household and business surveys. Indeed, the latter continues to give a much more favourable message. We could certainly see further downward revisions in job creation next month. Nevertheless, it is always difficult to determine which survey gives the "true" picture of month-on-month job creation. Nevertheless, this is the third consecutive month that the household survey has revealed job destruction.

Fig.2 United States: Business and household surveys give different messages on employment dynamics

There is a tendency to think that these figures, though mixed, point rather to less dynamism on the labor market.

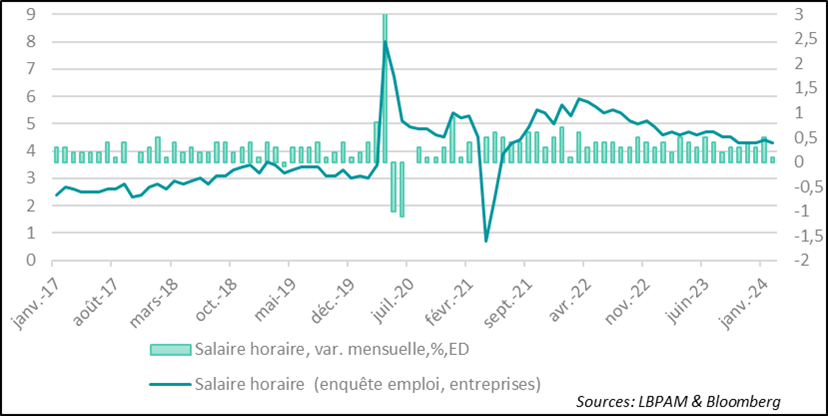

This seems to be reflected in weak wage gains over the month, with an increase of 0.1%, the lowest since March 2022. Of course, we cannot extract a trend from this point, especially as year-on-year wage growth remains high at 4.3%, well above the level that would be compatible with inflation close to 2%.

Fig.3 United States: Wages slow down over the month, but it's too early to draw any trends

If confirmed, this trend towards wage deceleration would be seen as very favourable by the Fed and could cement a possible rate cut in June. Nevertheless, central bankers will probably wait for more solid statistics on wages than those from the employment report, which suffer from a strong composition effect. Next week, we'll have more reliable statistics from the Atlanta Fed, which will tell us whether the downward trend in wages is indeed continuing.

Fig.4 United States: We'll have to wait and see whether the Atlanta Fed's more reliable statistics

What is certain is that the Fed will remain cautious and patient about policy and is unlikely to rush into anything unless there is much more news of an economic slowdown than we are seeing today. We continue to expect the start of rate cuts in June, but we believe that the extent of the cuts will be moderate in 2024 due to persistent inflationary pressures in certain segments of the US economy.

The inflation data to be published this week will also help determine the Fed's decision in the months ahead.

Growth in the Eurozone has been stagnant for over a year. In 4Q23, we knew that growth had been flat, even if there were major differences across the region, with Germany in particular contributing to the drag on the zone's economic expansion.

We now have regional details on the contribution of the various demand items to GDP growth in 4Q23. Unsurprisingly, we can see that consumption remained weak throughout the zone at the end of the year. Public spending also remained a source of support. Nevertheless, the good news for the future is that investment seems to have held up much better, which could prove an important support for a return to more solid growth in the quarters ahead.

For the time being, we continue to anticipate a very gradual return to more solid expansion, which would really gain momentum towards the end of 2024.

Fig.5 Eurozone: Investment resilient in 4Q23

Speculation continues to grow that the BoJ may be moving away from its ultra-accommodative policy. Several members of the Monetary Policy Committee have recently suggested that they are more confident about the end of the deflationary period. In addition, recent wage data, in line with the bank's expectations, and more favorable economic trends (upward revision of GDP in 4Q23), could validate this decision.

This speculation is particularly evident in the yen's new appreciation trend since the end of February. Of course, we've seen this type of movement before, and we must be cautious. But it's true that the BoJ could quickly validate its exit at a time when the Japanese economy seems to be holding up, the global economy is proving resilient and, above all, inflation seems to be persistently holding above 2%. We put the probability of exit at just over 50% for the March 19 meeting.

Fig.6 Japan: Speculation about a possible exit from the BoJ's ultra-accommodative monetary policy on March 19 is reflected above all in the yen's appreciation