The acceleration of ECB rate cuts is confirmed

Link

Market Analysis for October 2, 2024 by Xavier Chapard.

In summary

► Tensions in the Middle East have escalated further with Iran’s retaliation against Israel and the entry of Israeli troops into Lebanon. That said, the market reaction remains contained, with oil rising by “only” 4% this week to $75 per barrel.

►Eurozone inflation in September slowed as expected, with overall inflation falling below the 2% target for the first time in three years, despite the persistence of core inflation. The details of the figures are rather encouraging as they show a more marked sequential slowdown in core inflation, particularly in service prices in September.

► Inflation is below the ECB’s forecasts and should converge towards the target faster than the ECB anticipates next year. Adding the downside risks to European growth, the conditions for the ECB to cut rates faster than anticipated in September are in place. This is what Lagarde suggested by saying: “We will take into account our greater confidence [in disinflation] in October.” We believe the ECB will cut rates by 25 basis points in October and December.

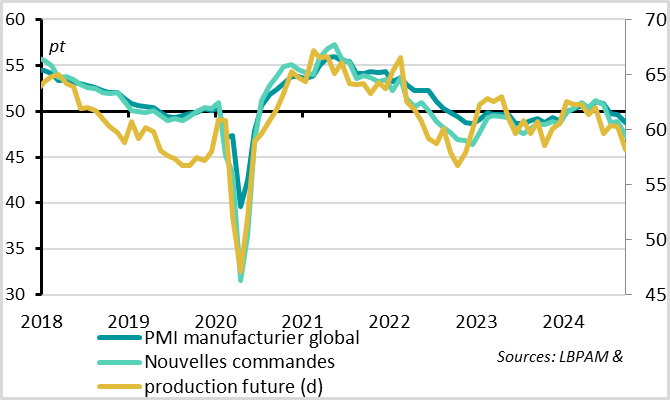

►The industrial cycle continues to deteriorate significantly in September according to PMI indicators, which have fallen again overall to only 48.8 points, a one-year low. Leading indicators remain poorly oriented. The unexpected weakening of the industrial cycle this summer poses downside risks to our stable global growth scenario. However, we still anticipate a medium-term recovery in the industry thanks to the increase in household purchasing power, the easing of monetary conditions, and support measures in China.

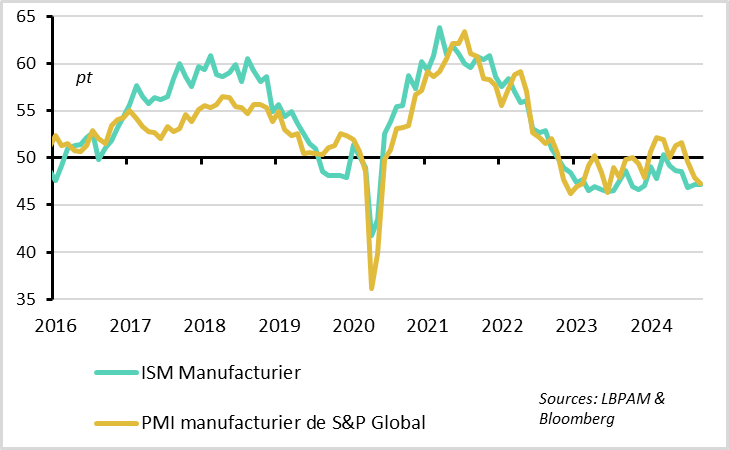

►For the industry, there is no American exceptionalism. The ISM manufacturing index stagnated at 47.2 points in September, clearly in contraction territory, and the S&P Global PMI indicator confirms this weakness.

► All eyes are now on the U.S. employment reports on Friday, which will be the penultimate reports before the Fed’s November decision. We believe it would take a significant deterioration in the data (job creation below 100,000 or an unemployment rate rising to 4.4%) to push the Fed to cut rates by 50 basis points again rather than moving to 25 basis point cuts. This is suggested by Jerome Powell’s latest statements, indicating that 25 basis point cuts (and not 50 basis points) at the November and December meetings are the Fed’s central scenario for now.

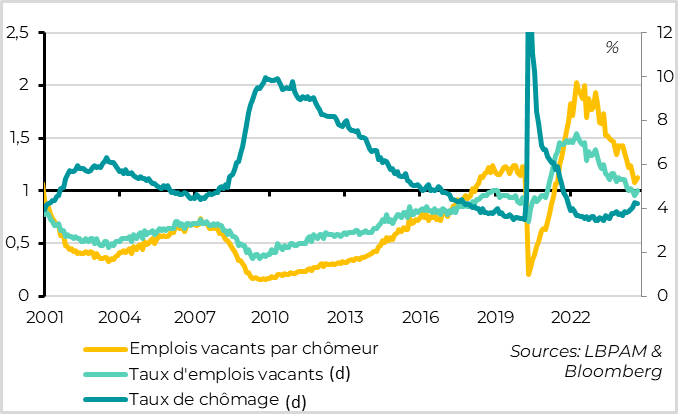

►The data on job flows in the U.S. for August (the JOLTS survey) are rather reassuring for the Fed. They indicate that the U.S. labor market is slowing in trend, but still gradually and limitedly. The number of job vacancies remains high at over 8 million, although it is now more in line with the number of unemployed. Hiring and quits are slowing, suggesting less intense wage pressures, but the number of layoffs remains very low.

►Tension on French debt has only marginally decreased after Michel Barnier’s general policy speech yesterday. The budget outlook is deteriorated with a deficit exceeding 6% of GDP this year and a return to the 3% limit only expected in 2029 (at the earliest). Uncertainties remain high for the coming days, as the survival of the government is not guaranteed, especially when it presents specific measures to cut spending and increase taxes, and as the season for France’s rating revisions begins.

To go deeper

Eurozone: Inflation falls below 2% for the first time in 3 year

Eurozone inflation in September slowed as expected, with overall inflation falling below the 2% target for the first time in three years, despite the persistence of core inflation. The details of the figures are rather encouraging, which should strengthen the ECB's confidence in disinflation.

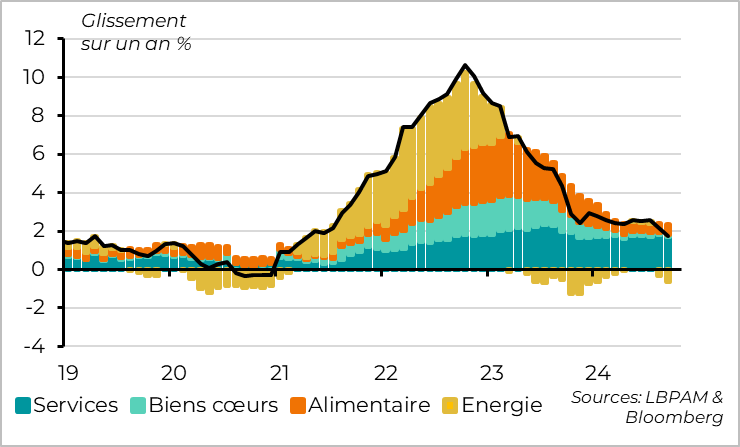

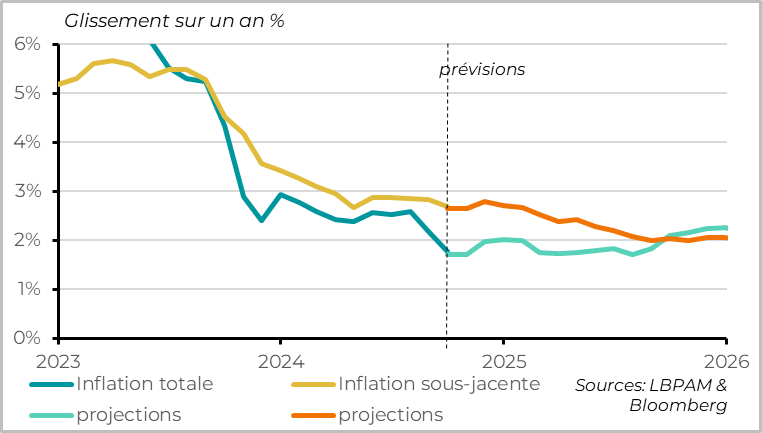

Overall inflation fell to 1.8% in September, dropping below 2% for the first time since 2021. This is due to a sharp decline in energy prices, especially compared to September 2023. Core inflation only slowed slightly, from 2.8% to 2.7%, which is still well above the target. This persistence is still driven by inflation in services, which is a concern for the ECB as it is the most durable part and best reflects domestic pressures. At 4%, service inflation reversed its August increase, which was accentuated by the Olympic effect in France, but it is still not on a downward trajectory.

That said, the details of the inflation figures suggest that inflationary pressures are indeed slowing, even if gradually.

Eurozone: Core inflation remains high but slows sequentiall

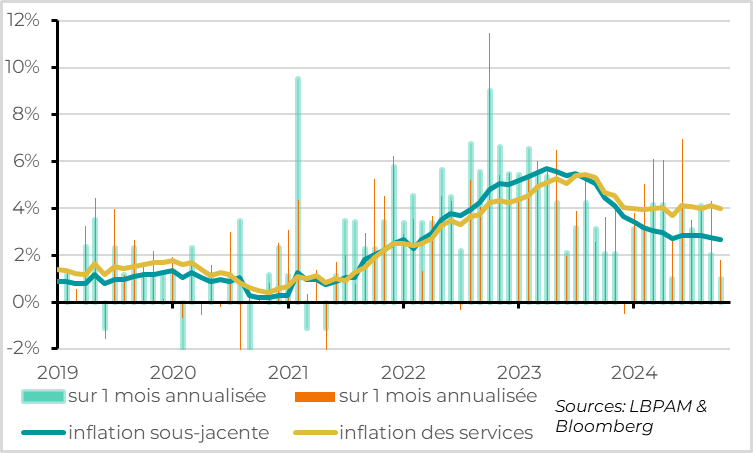

Core inflation (i.e., excluding energy and food) actually slowed by 0.15% over the month, to 2.68%. This is slightly below expectations.

More importantly, the rise in prices slowed more markedly on a sequential basis in September, even in services. Core prices increased by only 0.1% in September, the smallest increase in 10 months. This reflects the stagnation of industrial goods prices for the second consecutive month, but especially the sharp slowdown in the rise of service prices (+0.15% over the month).

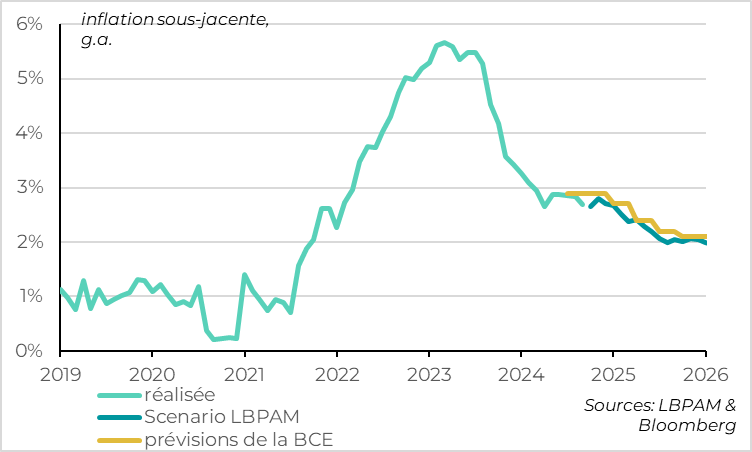

Eurozone: Core inflation lower than ECB forecasts

And September inflation is well below ECB forecasts. Both overall and core inflation are 0.1 percentage points below ECB forecasts for the third quarter, even though the central bank already had July and August data for its forecasts. This suggests a significant downside surprise for September. Overall inflation below 2% was not expected by the ECB until mid-2026. And core inflation is 0.3% below the ECB's forecast for the fourth quarter

Eurozone: A sustainable return to the inflation target is in sight

Overall, we expect overall inflation to remain below or close to 2% over the next year and core inflation to return close to the 2% target by mid-2025, which the ECB only expects by the end of 2025/early 2026. The ECB could revise its forecasts downwards in December, which could prompt it to cut rates a bit faster than it anticipated during its September meeting.

The latest speeches by ECB members suggest that the ECB could cut rates at its October meeting, as we expect. Indeed, Christine Lagarde, speaking before the European Parliament on Monday, said that the economic recovery was facing headwinds and that disinflation had accelerated over the past two months. In an even clearer message, she said: "We will take into account our greater confidence in October." Even Oli Rehn, the Governor of the Bank of Finland, said there were grounds for cutting rates in October.

World: The global industrial cycle deteriorates significantly this summer

The industrial cycle continues to deteriorate significantly in September according to PMI indicators. The weakening of the industrial cycle raises questions at a time when it was supposed to recover, increasing downside risks for the global cycle even though we still anticipate a medium-term recovery.

The global manufacturing PMI fell sharply again in September, from 49.6 to 48.8 points. At a one-year low, the global industrial cycle indicator has been in contraction territory for the third consecutive month. Leading indicators do not suggest an imminent improvement. Indeed, new orders (at 47.3) and business confidence in the outlook (at 58.2) are both at their lowest since the monetary and energy shock of 2022.

The new weakness in the industrial cycle since the summer is a negative surprise as industrial activity was expected to recover in 2024 after two years of weakness, thanks to the recovery in demand for goods and the end of inventory adjustments. This may be due to the delayed impact of the monetary tightening cycle, which weighs on investment, and the weakness of the Chinese economy.

We continue to anticipate an improvement in the industrial cycle in the medium term thanks to the increase in household purchasing power and the easing of monetary conditions, which should allow a recovery in durable goods consumption and business investment. And the latest support measures announced by China reduce downside risks. But in the short term, the data suggests that risks remain on the downside.

United States: Inflation in services is more difficult to reduce, even excluding the effect of housing

And for the industry, there is no American exceptionalism. The ISM manufacturing index stagnated at 47.2 points in September, clearly in contraction territory. And it is joined by the S&P Global PMI indicator, which was slightly less degraded until now. The production component of the ISM stabilizes close to 50 points, but the new orders and employment indicators remain in strong contraction territory. The only good news in this survey is that inventories are falling sharply, which is consistent with the resilience of goods demand indicators this summer (retail sales, industrial orders).

United States: The labor market slows gradually and limitedly

The data on job flows in the United States for August (the JOLTS survey) continue to show that the U.S. labor market is slowing in trend, but gradually and limitedly. Hiring is slowing, but the number of layoffs remains very low.

The number of job vacancies reversed its July decline in August, rising back above 8 million. The job vacancy rate remains above its pre-Covid level, at 4.8%, and the number of job vacancies per unemployed person stabilizes at 1.1. This measure of labor market tightness, closely watched by the Fed, has therefore fallen below its pre-Covid level but remains high, roughly at its 2018 level when the labor market was strong without overheating.

The number of quits, which is a good leading measure of wage pressures, continues to decline in August, falling below 2% for the first time since 2015. This points to a less dynamic labor market and supports the Fed's analysis that wage pressures should no longer push inflation higher. But at the same time, layoffs remain historically low, which does not suggest a reversal in the labor market.

Xavier Chapard

Strategist